"Blockchain technology is revolutionizing various industries such as finance, supply chain management, and healthcare. Its decentralized and transparent nature ensures security, efficiency, and immutability of data. With the potential to eliminate intermediaries and provide trust in transactions, blockchain is poised to transform the way we do business."

Tech News

One of the quirks of Bitcoin is the occasional validation of empty transaction blocks. Explanation.

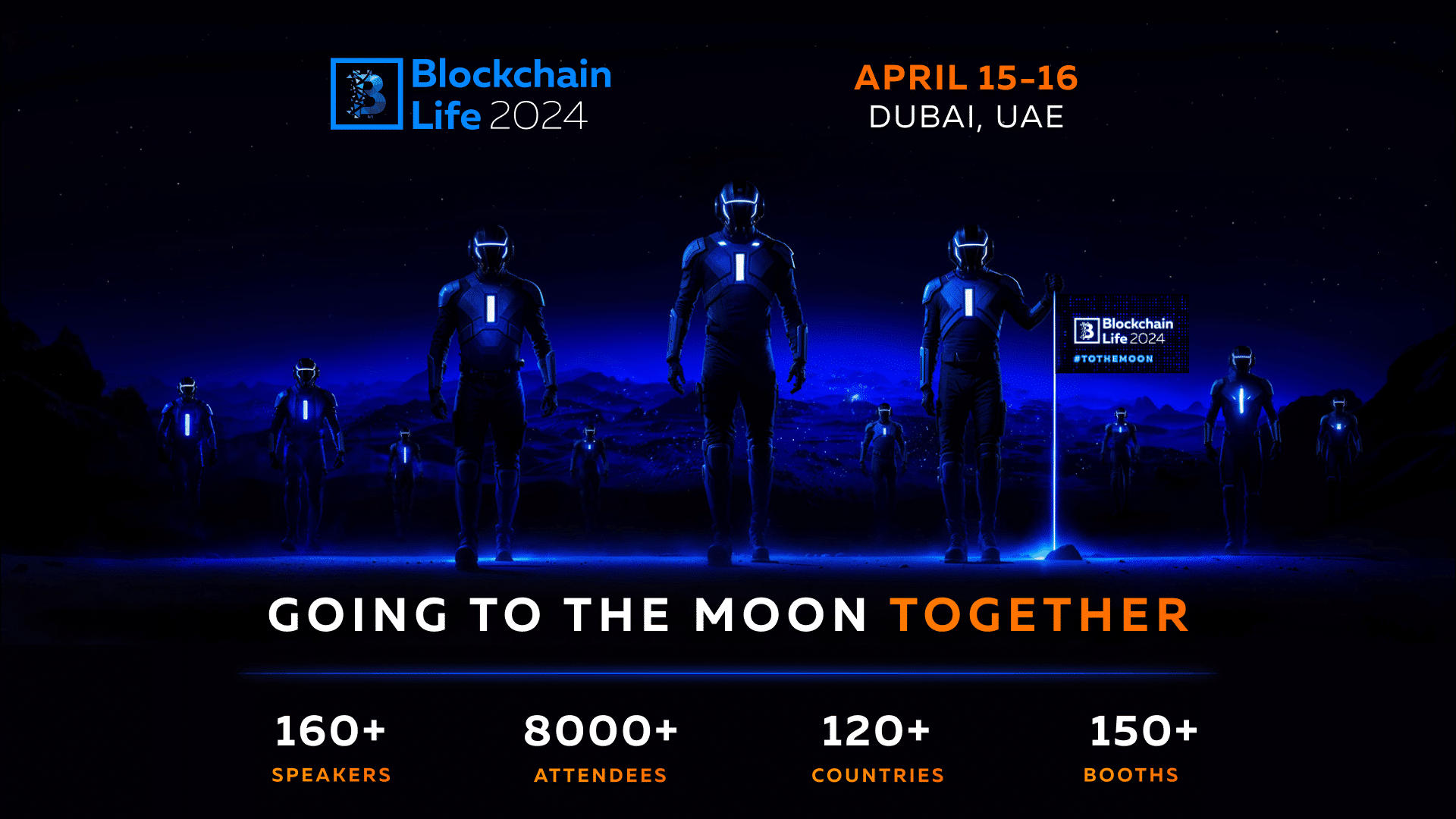

Blockchain Life 2024 will bring together over 8,000 crypto leaders and 1000+ of international companies at the event of the year in Dubai.

"While the historic regulation on AI will soon be adopted, the EU is preparing to establish the European Office for Artificial Intelligence."

The social network Republike continues to rise since the opening of its alpha version among a few informed users. The platform stands out from traditional social networks thanks to its revolutionary Pay-to-Own model. Republike aims to be a hub for healthy exchanges, original and diverse content, and unparalleled authenticity. The platform is about to reach a crucial milestone in its development process and invites all enthusiasts to join the adventure before it's too late.

Meeting with Etienne de Sainte-Marie and Julien Gerardot, the founders of Republike, this platform revolutionizing social networks.

Dive into the heart of the clever concept of Chinder, an innovative app that allows you to swipe cryptocurrencies like Tinder

Bitcoin recently exceeded 500 EH/s. That is, 500 trillion trillion hashes per second. Putting things into perspective.

The WHO has published on January 18th a report with over 40 recommendations to ensure ethical and safe use of AI.

Vitalik Buterin questions the classification of Validiums on Ethereum: are they true layer 2 (L2) solutions or not?

Leading up to the 2024 elections, OpenAI is committed to combating the misuse of AI and promoting transparency.

Bitcoin is as decentralized as its least decentralized gear. The pools, along with ASIC manufacturers, are a weak link.

Major luxury and sportswear brands are investing in NFTs. Explore how they are transforming the digital fashion landscape.

The new Saga 2 version of Solana promises similar features to the initial version but at a more affordable price.

Bitfinex thwarted a $15 billion XRP attack, preventing a major cryptocurrency theft from its vault.

The artistic and intellectual production of man must take precedence above all? French publishers are taking a stand.

The Bitcoin Halving, scheduled for mid-April, promises to change everything. It is expected to significantly impact the price of BTC, with many analysts associating the block reward halving with a potential bull run. However, major upheavals are also to be expected on the side of Bitcoin miners after the halving. The average cost of mining will be revised upward during this period, putting several companies at risk.

The crypto trader REKT proposes 5 distinct steps of the Bitcoin halving.

Here are some statistics on the bitcoin mining harvest in 2023. The ordinals and other entries have rounded the end of the month.

"Polygon has announced the transition to phase 2 of its zkEVM network, marking an important milestone towards the planned full activation in March 2023."

OpenAI announced its intention to enable creators of generative AI to monetize their custom systems on the GPT Store.

Fox Corp partners with the Polygon blockchain and launches "Verify", a revolutionary open-source protocol to authenticate the origin of media content and fight against misinformation. Explanations.

Yesterday, the United States Securities and Exchange Commission released information stating that Bitcoin ETFs had been approved. However, according to recent news, this announcement turns out to be false, even though it was disseminated on the official X account of the financial watchdog. Two hypotheses emerge: either the SEC’s account…

Here is a selection of figures putting the year 2023 into perspective for bitcoin. Fifteen years already...

With AI tools like ChatGPT, scammers can now scam you on dating sites and social networks.

As the hashrate has soared by 102% in 2023 and the halving is approaching, bitcoin miners continue to strengthen their operations.

Crypto: The Solana blockchain asserts its position with over 2,500 active developers monthly, representing a growth of 50%.

According to recent news, the Bitcoin blockchain has been the subject of a transaction that raises questions. An individual whose identity is not known is said to have injected $66,000 to encrypt data on the blockchain that supports the flagship cryptocurrency.

The Ethereum crypto platform continues to perform. This time, it is the total value locked (TVL) of layer 2 blockchains linked to it that has caught the attention of the crypto community. It is currently valued at just over $21 billion. An all-time high.

The payment giant Visa is considering enhancing its customer relationship through the launch of a Web3 loyalty rewards system.