Saudi Arabia, a long-standing oil powerhouse, is making history by wholeheartedly embracing crypto. This transition, far from insignificant, marks a significant evolution in the global financial landscape.

Finance News

The crypto arena is on the verge of a revolution. According to Bloomberg analysts, the first Ethereum Spot ETFs could make their debut in the U.S. market as early as next week.

While major international banks and other financial institutions have been embracing blockchain technology and cryptocurrencies for several months, HSBC had been content to observe, or even ignore them. But the saying goes, 'better late than never.' Thus, the $3 trillion asset banking giant has decided to make up for lost time. An alliance with the blockchain payment processor FC Pay has been established. The goal is to allow HSBC customers to pay their bills with cryptocurrencies like Shiba Inu, XRP, and more.

It has been several months since the ECB unveiled its digital euro project, an announcement that continues to reverberate in the financial markets. A recent statement by Christine Lagarde, President of the ECB, has garnered particular attention from the crypto community. According to the ECB President, the digital euro (to be distinguished from a cryptocurrency) will not be anonymous. This revelation raises deep questions about privacy protection, and many analysts are also pondering the potential implications of this digital euro project on cryptocurrencies.

Two years ago, Bitcoin lost any chance of flourishing among Chinese cryptocurrency traders. The Chinese Communist Party didn't seem ready for decentralization, opting for a totalitarian CBDC (Central Bank Digital Currency) rather than an emancipatory BTC (Bitcoin). However, in recent times, the Xi Jinping government has seemingly changed its perception of the flagship cryptocurrency. This decision by a Shanghai court to grant Bitcoin the status of “unique and non-reproducible currency” attests to this change of heart.

LINK, the cryptocurrency of Chainlink, is gaining more attention. Recent developments around the asset seem to have strengthened its appeal, pushing investors to take positions in the crypto.

From Bitcoin's meteoric rise, now surpassing Visa in transaction volume, to Binance's bold prediction about the demise of stablecoins in Europe, the news has been as varied as it has been impactful. Citigroup has also made a splashy entry into the crypto world, while the Ethereum ecosystem faces turbulence with the rejection of its Shanghai upgrade. And the FTX case, nearing its resolution, marks a pivotal moment for millions of investors. Dive with us into this weekly roundup to stay informed about the significant events of the past week.

The dominance of Bitcoin (BTC) in the crypto ecosystem has recently reached a yearly high, piquing the curiosity of investors and experts. Why this sudden resurgence? And what are the implications for altcoins?

The Fed has maintained its benchmark interest rate unchanged at 5.50% after eleven increases since March 2022.

In recent days, the Fed and CBDC have drawn significant attention from the crypto community. Fifty pro-crypto Republican lawmakers have just introduced a bill aimed at countering the CBDC. These elected officials raise valid concerns about financial privacy and individual freedom.

The dynamics of the crypto market are often influenced by major transactions. Recently, an investor who participated in Ethereum's 2014 ICO caused quite a stir by transferring a colossal amount of ETH to Kraken. Should we be concerned?

Bitcoin is poised to deliver a performance that could leave the audience in awe. In these times of economic turbulence, the star of Bitcoin shines with a newfound brilliance, promising a golden dawn that would surprise even the most optimistic among us. Behind the scenes of this grand stage are significant movements, signaling an unexpected and historic surge.

The world of crypto is catching its breath: Bitcoin (BTC) has surged to $27,400, marking a 10% increase over the past week. Additionally, the open interest on BTC also saw a 10% rise in just 3 hours yesterday. However, this situation is evoking familiar sentiments among investors, reminiscent of the temporary surge on August 29th, following Grayscale's victory over the SEC. Are we witnessing a similar scenario?

In a world where bitcoin fever continues to gain momentum, a new chapter looks set to open, promising far-reaching upheavals in the global financial landscape. A veritable tidal wave seems to be in the making, orchestrated by asset management titans who control colossal fortunes. These giants, armed with their trillions, are ready to invest massively in bitcoin. Such an incursion could well redefine the financial paradigms we know today. But what if a significant fraction of this financial windfall were to make its way into the crypto market?

Tokenization of real-world assets is already a reality. The days of procrastination are over. The Australia and New Zealand Banking Group (ANZ), one of Australia's four largest banks, has just completed its first transfer of tokenized assets. For the crypto ecosystem, this is a victory worth celebrating. Made possible by Chainlink's cross-chain interoperability protocol, this initiative officially ushers in the era of fusion between the crypto world and that of traditional finance.

While the United States, through the SEC and CFTC, grapples with regulatory challenges in the cryptocurrency market, Germany is forging ahead. Currently, numerous German banks have already stepped into the exciting world of cryptocurrencies, and some local financial institutions believe it's time to embark on this adventure. This includes the Stuttgart Stock Exchange, which plans to launch crypto staking next year.

Visa, the payment services giant, is making cryptocurrencies and the underlying blockchain technology a cornerstone of its growth strategy. In recent months, the company has been actively involved in this direction, with numerous initiatives related to cryptocurrencies. While Visa's previous crypto-related activities showcased its enthusiasm for blockchain, they didn't reveal much about the company's long-term plans. In a recent media statement, Visa clarified its stance on this matter, asserting that Solana's blockchain is the most relevant in the market to ensure its expansion in the crypto industry. In this article, we will delve into why Visa is banking on Solana's blockchain.

The co-founder of the payment company Lightspark, focused on the Bitcoin Lightning Network, has recently spoken about the archaic state of the international payment system. On September 12, 2023, during an appearance on CNBC, David Marcus discussed the potential of the Bitcoin network and expressed his commitment to turning it into a global payment system.

Renowned for being tamper-proof and completely transparent, Bitcoin is often touted as a perfect 'trustless' network. But can we truly say that we trust no one but ourselves when we use Bitcoin? This is the question posed by Pierre Schweitzer during the Surfin Bitcoin 2023 event in Biarritz.

What is the cumulative inflation since 2010? What is the extent of purchasing power loss?

Will the ECB stop raising its key interest rate soon? Some governors hope so.

All eyes are on bitcoin (BTC). Prices are not showing positive signs, and investors are becoming increasingly concerned. But while some are desperately hoping for a rise, their wish is unlikely to come true. According to Jamie Coutts, the downtrend has not said its last word.

Cardano suffered a decline of around -37% this summer 2023. Let's take a look at the prospects for the ADA price.

Bitcoin dropped by around -3% on Monday, September 11. Let's take a look at the prospects for the $BTC price.

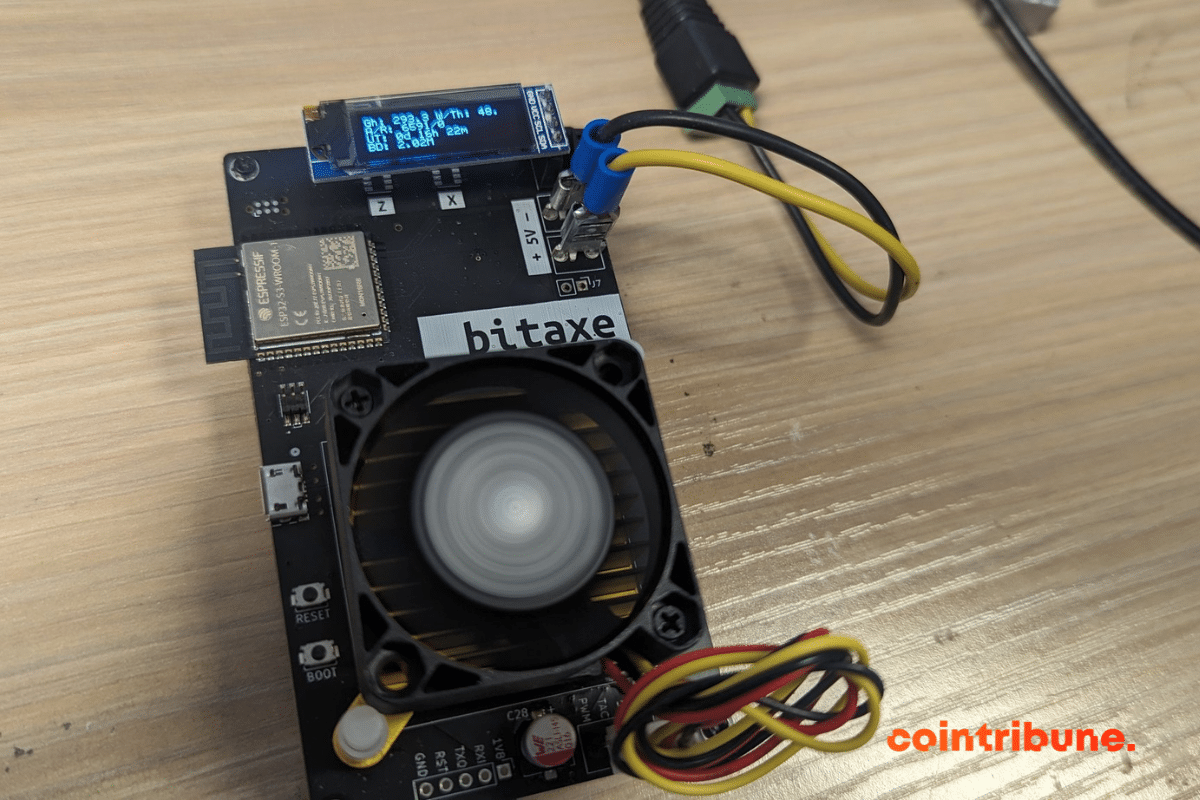

Is the decentralization of the Bitcoin network about to improve thanks to minimalist miners such as Nerdminer and Bitaxe?

In the vast crypto universe, every week brings its share of revelations and surprises. As enthusiasts and investors alike scrutinize the evolution of Bitcoin, the crypto giant has a week full of developments in store for us. Without further ado, let's dive into the fascinating world of Bitcoin, exploring the five major alerts that are on everyone's lips.

China is one of the United States' fiercest competitors for global hegemony. At least in economic terms. To achieve this, the country seems to be pursuing a strategy of limiting or even reducing its investments in the United States. Saudi Arabia, which has just joined the BRICS, also seems to be doing the same, further confirming its plans to leave the dollar behind.

Renowned investor Warren Buffett doesn't like cryptocurrencies, bitcoin (BTC) included. And he's not hiding it. On several occasions, the billionaire has explained why, in his opinion, this asset is not worth investing your money in. Yet there is evidence that the businessman has missed an opportunity to increase his fortune.

Recently, no fewer than 6 countries joined the BRICS in what is now known as BRICS+. Although the organization has rejected the membership applications of some countries, it seems to be calling on others to join. Such is the case of Indonesia.

The first domino of the bull run has fallen. U.S. companies will soon be able to account for their Bitcoin holdings at their fair value.