Exactly one week ago, financial giant BlackRock filed for registration of the iShares Ethereum Trust, the proposed ethereum (ETH) cash ETF. The news caught the attention of crypto analysts as it suggested the upcoming filing of an Ethereum ETF application with the SEC. That has now been done.

Finance News

The SEC has lost and will continue to lose lawsuits, celebrates Ripple's lawyer.

Despite the cheers, the fact is that inflation continues to erode Americans' savings. Much more than what official figures suggest.

Yesterday pinned, today fearless. PayPal has just thrown down the gauntlet to the authorities by asserting its determination to pursue its blockchain innovations. Let's analyze this statement that sounds like a declaration of war.

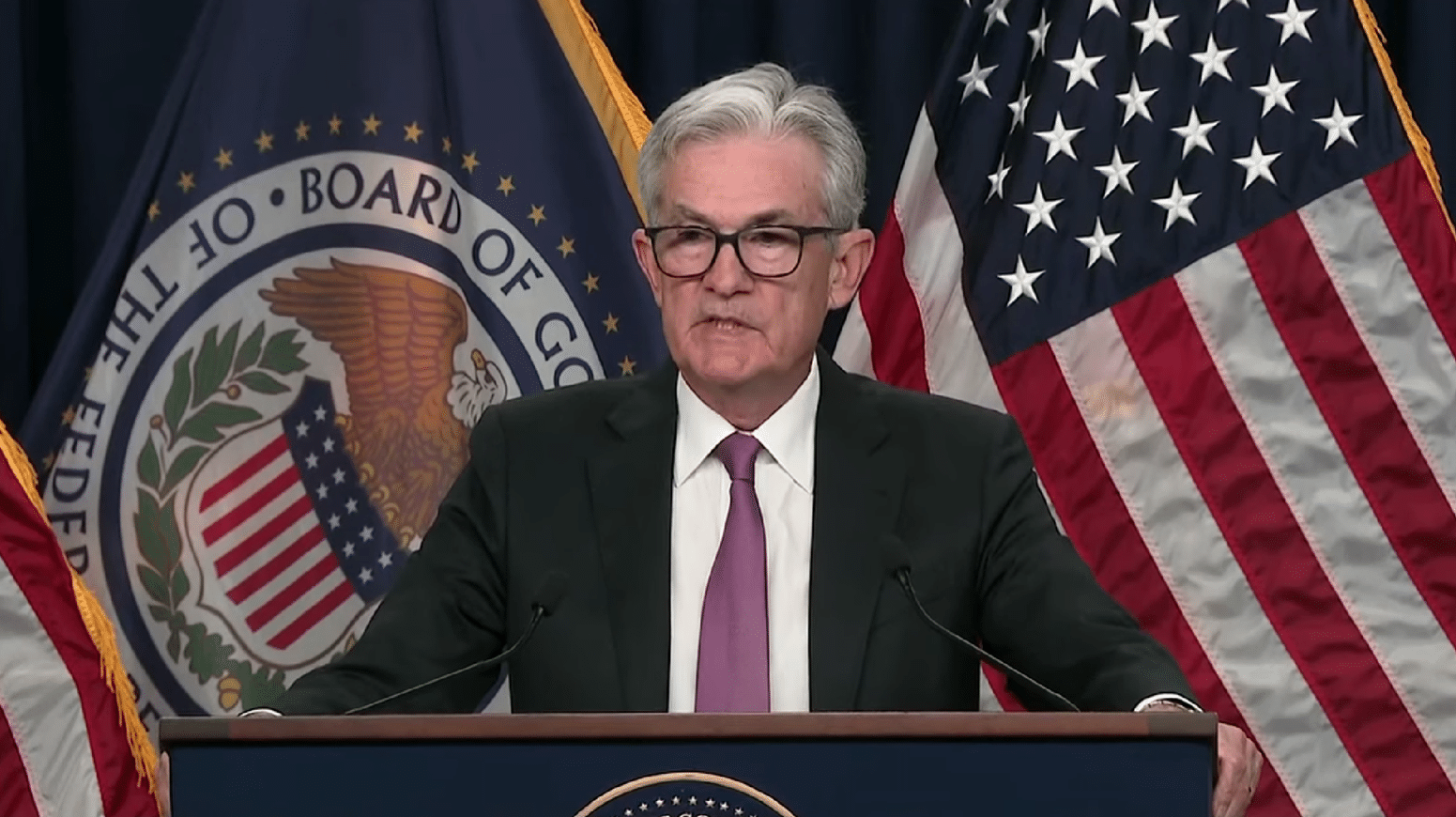

The long-awaited moment has finally arrived: today the U.S. government is revealing October's inflation figures, an announcement that could give new momentum to the recent surge in Bitcoin.

For Michael Saylor, Bitcoin doesn't need to replace fiat currency to reach several hundred trillion dollars.

Indeed, the FTX storm has wreaked havoc in the United States, Japan, and even France, but this hasn't prevented an increase in the rate of crypto adoption in France. According to a report by the Financial Markets Authority (AMF), the number of local adults investing in cryptocurrencies has relatively increased. Details!

The BRICS countries want to get rid of the influence of the US dollar. This is a high-stakes issue for this group of countries, especially for Russia, which is facing a series of financial measures taken by the West in response to the invasion of Ukraine. It seems that the country is maneuvering to overcome these sanctions. And it is apparently succeeding as the Russian currency, the ruble, has surpassed the dollar in the foreign exchange market.

The launch of the first spot Bitcoin ETF in the US is inching closer to reality, and one crypto project is already capitalizing on the excitement.

The SEC is now out of options, according to pro-crypto law experts who have followed the case against Ripple from the start. However, the matter is not quite closed. Aside from the remediation phase in which the crypto company might pay a hefty fine, a new showdown before the Supreme Court could soon take place between the two parties.

The Crypto-Asset Reporting Framework (CARF) is an initiative by the Organisation for Economic Co-operation and Development (OECD). Introduced last year, CARF aims to foster international, automatic, and transparent exchange of tax information on cryptocurrencies. Several countries, including France, have adhered to it.

Everyone is eagerly waiting for the FED to start lowering its rates (pivot). That's what traders are betting on.

Switzerland is reportedly about to enact a law aimed at protecting its systemic banks against bank runs.

Ethereum crypto: on-chain and technical indicators suggest the imminent arrival of a significant bullish wave.

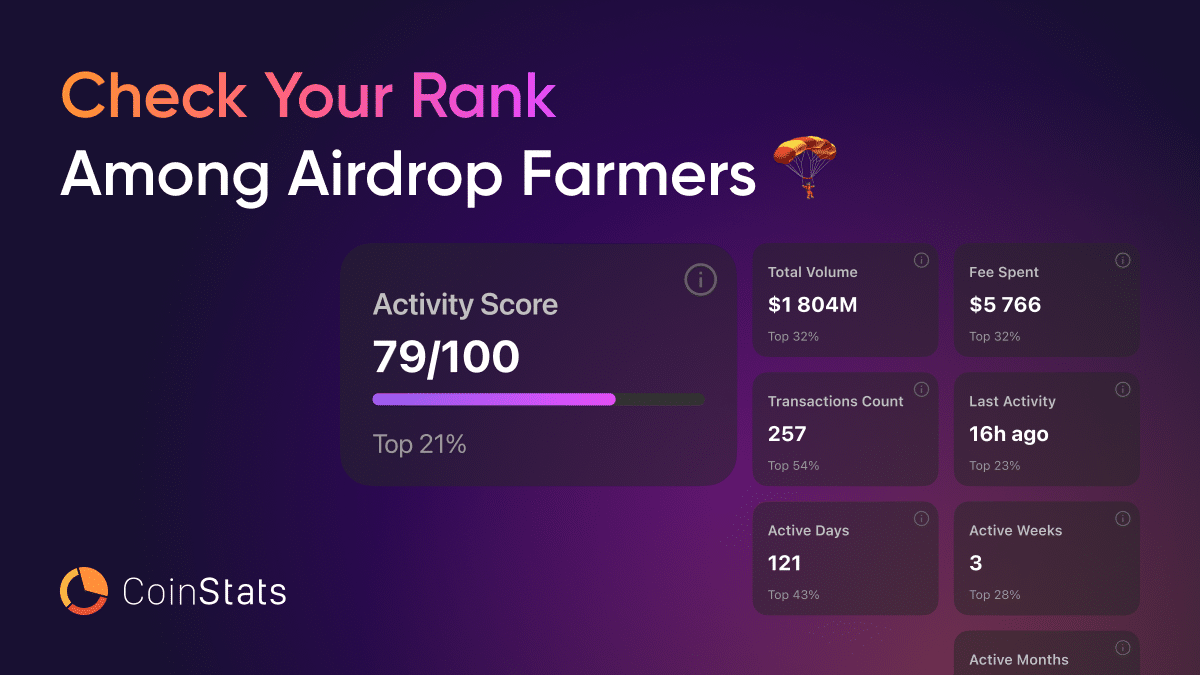

With crypto airdrops gaining popularity, keeping track of your wallet’s performance has never been so pertinent.

Bitcoin (BTC) is not just booming. The biggest cryptocurrency in the market is on fire, surpassing unattainable highs since the beginning of the year. In this context, bitcoin holders, for a large part of them, have made profits. This is at least the opinion of famous crypto analyst Plan B.

The de-dollarization continues in Asia. Following nations like India or Indonesia, Thailand is now also shunning the dollar.

After months of operational struggle, Bitcoin (BTC) reigns over the ecosystem stronger than ever. In the past 24 hours, the asset's valuation increased by 3.18%, surpassing the symbolic $35,000 mark. This brought delight to enthusiasts of this crypto asset. A Canadian parliamentarian, a few days ago, encouraged the public to actively engage with this cryptocurrency that continues to surprise.

The Bitcoin has just delivered a performance worthy of a mythological epic. Three addresses, which could be compared to dormant titans of the crypto era, have broken their six-year slumber to transfer a fortune of 6,500 BTC, equivalent to approximately $230 million. An event that tears the veil of routine and shakes the markets.

PayPal, the payment giant, has just achieved another crucial milestone. Indeed, the UK's financial market regulator, the Financial Conduct Authority (FCA), has granted it the green light to offer crypto services across the entire territory of the United Kingdom. Let's take a closer look!

The Bitcoin, a flagship currency in this universe, is at the center of attention. With the arrival of November, investors, experts, and the curious pose an essential question: will Bitcoin continue its meteoric rise or experience a spectacular fall?

Dubai, October 25, 2023 – The 11th edition of the Blockchain Life Forum, widely recognized as the premier meeting point for global cryptocurrency leaders, concluded with a gathering of over 7000 attendees from 120 countries. Blockchain Life has become the center of crypto activities, as well as one of the largest and most important events in the world, summing up the Crypto Year.

X (formerly Twitter) has lost more than half its purchase price. The culprit is known!

The BRICS have officially decided to leave the dollar. In the meantime, the question of the currency's use in settling international transactions seems to be a point of contention between the member countries. Here's what it's all about.

What is the state of crypto adoption in the Maghreb? It's not an insignificant question, especially as the region is far from being the continent's crypto powerhouse. Sub-Saharan Africa is leading the way, driven in particular by Nigeria. Figures show that in this West African country, more and more people are holding cryptos or are aware of their existence. In fact, several Maghreb countries are not far behind in this dynamic, even if the relative weakness of this craze must be acknowledged. In what follows, we look at the trends in crypto adoption in the Maghreb and the reasons behind them.

China's hegemonic ambitions in the economic sphere have been well-known. The desire of the Asian giant and its BRICS partners to move away from the dollar is essentially an expression of this ambition. This ambition has recently seen progress involving the euro, the currency used in the European area.

After coming perilously close to the worst during the crypto exchange FTX's fall, Solana has skyrocketed in the charts. Staking the Solana (SOL) cryptocurrency, which is now one of the top-performing cryptos of 2023, has generated over 200% in profits throughout the year. A performance that completely outshines that of its competitor, Ethereum.

"The Bitcoin Spot ETF is a financial product that allows investors to access the Bitcoin market without directly owning the cryptocurrency. According to a study by Galaxy Research, the Bitcoin ETF could experience tremendous success in the years to come. Details below!

The year 2023 will be remembered as a tumultuous period for cryptocurrency investors. While the market faced challenges, such as the overall cryptocurrency market cap contraction, Ethereum's depreciation, and a decline in total value invested in decentralized finance (DeFi), it also witnessed significant progress. Among these advancements, notable developments include continued institutional adoption, a growing interest in layer 2 solutions, and, most importantly, significant changes in cryptocurrency regulation. This article will specifically explore the recent developments in cryptocurrency regulation within the EU and on a global scale. Let's take a closer look.

On Monday October 23, the Depository Trust and Clearing Corporation (DTCC) had listed BlackRock's iShares Bitcoin Trust (iBTC), to which it had added the ticker. This symbol, used to identify the asset manager's ETF, was withdrawn on Tuesday October 24. The latest news confirms the relisting of BlackRock's Bitcoin ETF.