Discover the bold visions of investors on the evolution of crypto financing in 2024. Unprecedented revelations await you!

Finance News

Solana has performed exceptionally well in recent months. A bullish momentum that has earned it the label of “Ethereum killer”. However, according to maximalist Max Keiser, SOL, Solana's native cryptocurrency, could experience a significant drop. Here's what it's all about.

The bull run in the crypto market continues, attracting more and more investors: a massive influx of $24.2 billion into the market.

Ethereum: Justin Sun withdraws $13.8 million from Binance, raising questions about his motivations!

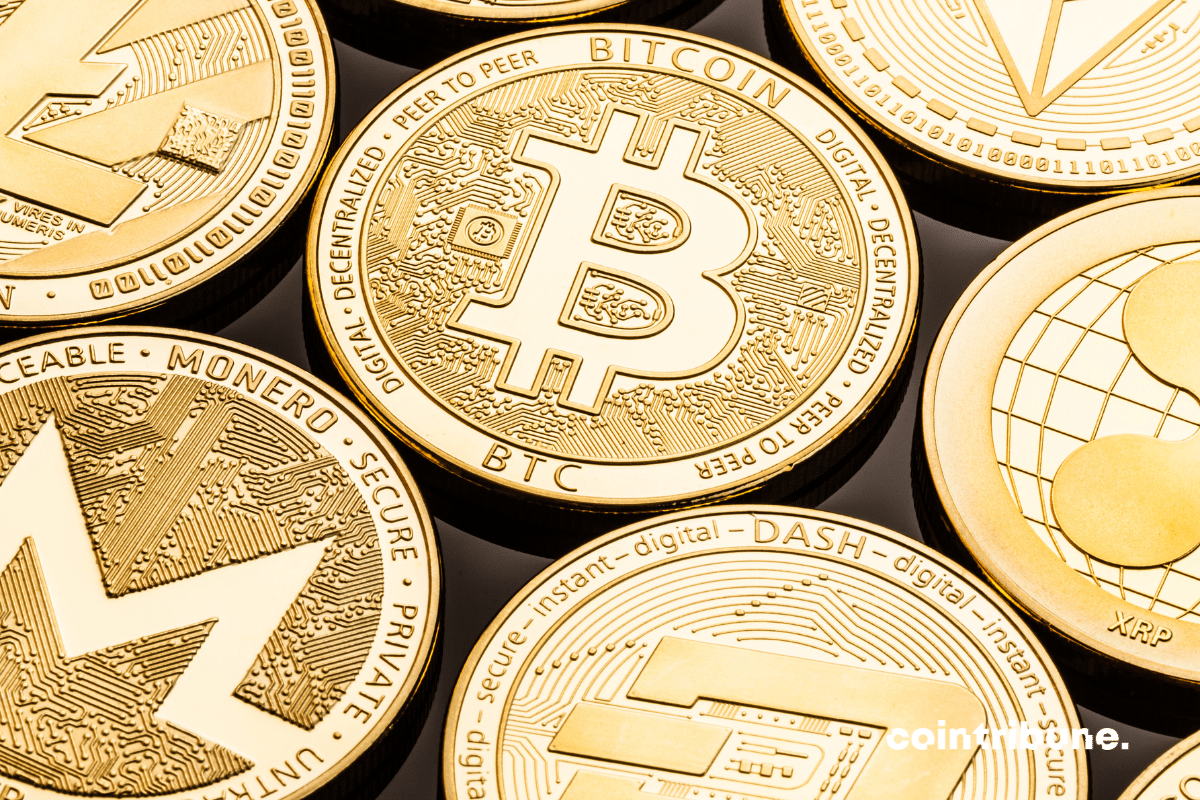

Throughout this year, the flagship cryptocurrency, bitcoin (BTC), has shown unparalleled resilience. Its performance positions it as one of the most efficient assets in the financial market this year. These are the conclusions of a recent crypto study conducted by Kaiko Research.

No conditions will be imposed on these 'altruistic foreigners': they just need to make donations in BTC.

The tokenization of real assets is gaining momentum. And this trend is not expected to weaken. This is what Moody's bank says, stating that the move towards this crypto option should benefit Ethereum in 2024.

Pending SEC decision on Bitcoin ETFs, Coinbase warns of major risks associated with this digital asset!

Some crypto users holding Dogecoin (DOGE) became millionaires in 2023. A direct consequence of the dynamism that this asset has experienced throughout the year. This, in a particularly bullish crypto context in recent weeks. But this outcome is somewhat mixed. We explain why.

With a rise of nearly 150% over the course a year, Tron has established itself as a key player in the cryptocurrency universe. Let's examine the future outlook for the price of TRX together.

Like VanEck, Bitwise, and Bitget before it, the Messari platform recently published a fairly comprehensive summary of the crypto industry in 2024. The company projects what it believes will be the major trends in this constantly developing market. Messari addresses almost all segments of the crypto industry in 10 key points, from investment to peer-to-peer infrastructure, layers-1, CeFi, DeFi, crypto products, and even the key figures to follow in the crypto sector in 2024. As you may have understood, Messari's projections, spanning 192 pages, aim for completeness. However, this article's goal is not to provide a comprehensive review, but rather to focus on some of the most relevant points mentioned.

The BRICS have co-opted several countries this year. A historic geopolitical moment that is expected to continue in 2024. An official from the group of countries revealed that six new countries will join the organization next year.

As 2023 draws to a close, it's time for major projections about the trends that will dominate the crypto ecosystem in 2024. We have already presented VanEck's forecasts regarding the developments in this market next year. Keeping in line with providing you with an overview of the expected movements in this industry, we have also presented Bitwise's crypto predictions for this period. In the following lines, we will present Bitget's crypto speculation for 2024. What makes these forecasts unique is that they do not address the entire crypto industry, but rather focus solely on the ecosystem surrounding the flagship cryptocurrency: Bitcoin (BTC).

Since its spectacular rise on October 23rd, a day when it was flirting with $35,000, bitcoin has seen little decline. Today, the queen of cryptocurrencies surprised the community again by trading at $44,200. What can we expect from this change of pace?

No one wants to sell their bitcoin: are we preparing for a new ATH?

The Ethereum price finished the second week of December on a negative note, recording a drop of 6% and seems to continue its bearish movement. Let's examine together the future outlook for the ETH price.

Blockchain technology is revolutionizing various industries by providing transparent, secure, and efficient solutions for managing data and transactions. It has the potential to transform sectors such as finance, supply chain, healthcare, and many more. The decentralized nature of blockchain ensures that no single entity has control over the network, making it resistant to fraud and censorship. With its ability to automate trust and eliminate intermediaries, blockchain is paving the way for a new era of digital innovation.

Bitcoin ended the second week of December on a negative note, recording a 5% decline. However, it has started the new week on a positive note. Let's examine the future outlook for BTC's price together.

Wave by wave, the European Union (EU) has taken various sanctions against Russia since the invasion of Ukraine, with the goal of suffocating the country's economy. In this context, the European organization has just adopted a 12th wave of sanctions specifically targeting crypto activities conducted by Russians.

Fidelity, the second largest investment fund after Blackrock in the ETF race, sees bitcoin reaching 15 trillion dollars within seven years.

It seems that everything is coming together for Bitcoin to have an explosive year in 2024. This week has been more significant than most others in terms of the state of the markets. Two major events happened simultaneously with the release of the latest inflation data and the December meeting of the Federal Reserve, which announced plans for a rate cut.

The founder of the crypto firm Cardano, Charles Hoskinson, is opposed to any crypto collaboration involving this blockchain and Ripple's XRP. In a recent media release, the CEO discussed the reasons underlying this position, which he does not seem willing to change.

Week after week, the crypto sector continues to innovate and redefine the boundaries of finance and technology with boldness and creativity. In this weekly recap, we will delve into the most significant news of the past week, from El Salvador's pioneering Bitcoin bonds initiative to Donald Trump's controversial NFT collection, and the promising prospects of SEC approval for Bitcoin Spot ETFs. We will also examine the security incident at Ledger, the implications of BlackRock's entry into Bitcoin mining, and current trends surrounding Ethereum and Solana.

Crypto market decline: Bitcoin, Ethereum, Solana, and XRP in decline. Is this the end of the bull run or just a correction?

The principle of investing in the stock markets is to seek reward in exchange for the risk taken. That's why we will see if incorporating bitcoin into a portfolio can be a positive element.

The next two years are expected to see a significant increase in the volume of asset trading on the blockchain, according to Mathew McDermott, Global Head of Crypto Assets at Goldman Sachs. He explains that since the beginning of 2023, the bank's clients have shown a “huge appetite” for crypto assets and crypto derivative trading. This was reported during an interview with Reuters.

Central Bank Digital Currencies (CBDCs) are not popular. They are strongly criticized for the threats they pose to individual privacy. However, the crypto firm Ripple has just released a white paper that promotes the utility of these controversial assets.

Jan van Eck, CEO of VanEck, has once again spoken about bitcoin. Apparently, nothing has changed: he still holds the queen of cryptocurrencies in high esteem. Additionally, he has predicted a new All-Time High (ATH) for this “essential” digital asset within the next 12 months. Details!

Liquid staking is gaining popularity. This is due to the crypto advantages it offers to users, as opposed to the traditional staking methods. In this article, we will discuss the concept of liquid staking and present the main crypto platforms that offer this service to their users.

Jimmy Wales, the co-founder of Wikipedia, recently criticized Bitcoin (BTC). He derided the flagship cryptocurrency, claiming that it lacks functional relevance and causes monetary losses to its users, unlike a traditional bank account. The crypto community did not hesitate to respond to him.