In the shadow of tyrannies, outstretched hands receive satoshis. The HRF sows crypto light in the invisible pockets of silent resistances, where fiat no longer prevails.

Finance News

While European markets are experiencing a technical rise, attention turns to Washington. Supported by encouraging economic indicators, the main stock indices of the Old Continent closed in the green this Tuesday. However, this improvement remains fragile. Investors are holding their breath ahead of potentially decisive announcements from Donald Trump, who could reignite the United States' trade offensive. The possibility of new customs barriers raises tensions and threatens to reshape the dynamics of the global economic balance.

Elon Musk's influence now transcends the boundaries of the technology industry. As the billionaire expands his grip on key sectors – from electric cars to social media – his unprecedented closeness with the SEC raises urgent concerns. Maxine Waters, an influential Democratic figure, sounds the alarm: Musk's privileged access to sensitive data from the financial agency could threaten market stability. Between conflicts of interest and systemic risk, the stakes go beyond mere corporate rivalries.

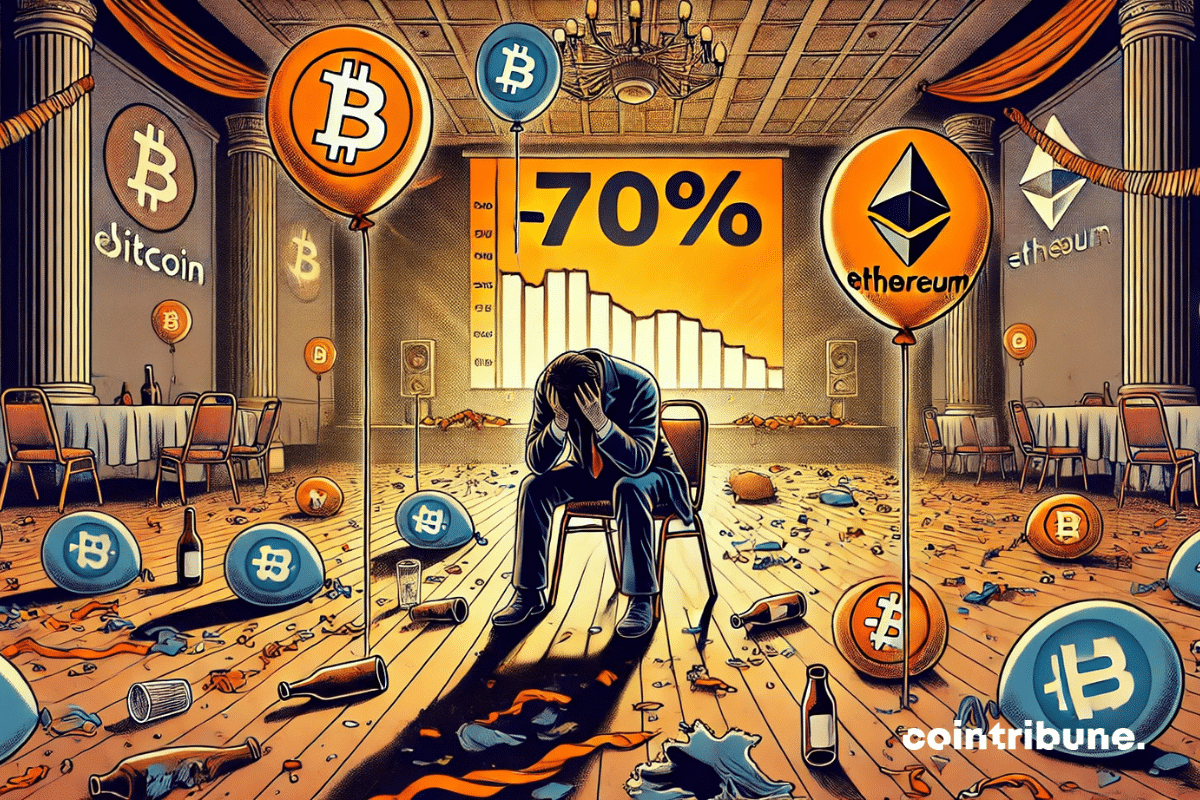

Solana groans, Bitcoin stumbles. The crypto market, drunk with hope yesterday, is reeling under the blows of tariffs. Trump did not free the dollar, but rather chained digital assets.

In light of the deadlock in the conflict in Ukraine, Donald Trump is changing his tone and threatening Moscow with an economic sledgehammer. The American president, who has so far been measured towards the Kremlin, is now brandishing the card of tariff sanctions on Russian oil. The stated objective is indeed to force Vladimir Putin to move towards a ceasefire. A shocking statement that fractures diplomatic balances and elicits reactions even in European capitals, at a time when the slightest tension can redefine the global geopolitical chessboard.

The Middle East is currently undergoing a profound reconfiguration of its alliances and historical rivalries. The gradual collapse of the Syrian regime and the weakening of Iran are reshuffling the cards in an already unstable region. This new dynamic is bringing Turkey to the forefront as a regional expansionist power, potentially pushing Israel and certain Arab countries towards an unprecedented alliance.

As wealth inequalities worsen, another reality looms: Generation Z, often perceived as economically fragile, is set to become the richest in history by 2045. A study by Bank of America challenges preconceived notions by projecting an unprecedented shift of wealth towards this hyperconnected youth. Contrary to alarmist narratives, these forecasts reveal a generation on the rise, driven by economic, educational, and digital dynamics that are reshaping the contours of global financial power.

Under a heavy fiscal sky, cryptos and stocks waver. Trump's "Liberation" resembles a storm. The wind shifts, and hopes dwindle, one tweet after another.

A cold wind blows over crypto. The post-electoral momentum is fading. Bitcoin and Ethereum are wavering. The market looks elsewhere, uncertain, without a compass, waiting for the next breath.

The dominance of the US dollar in international trade and global reserves has never been so challenged. Indeed, Deutsche Bank is sounding the alarm on a growing phenomenon: dedollarization among the allies of the United States. In the face of geopolitical tensions and financial sanctions, several nations are seeking to reduce their dependence on the greenback. If this trend accelerates, the impact could be considerable, drastically altering the global monetary balance and redefining the power dynamics within the international financial system.

And if independence no longer came through weapons, but through blocks of code? The BRICS dream of sovereignty in cryptocurrencies, with Siluanov as a digital scout.

A global study reveals that real estate remains widely used for money laundering, with gaps identified in all the analyzed countries, including France, which nevertheless ranks among the good students.

Central bank digital currencies would eliminate all privacy, but few seem to care. Fortunately, there will always be Bitcoin.

Gold is no longer just a safe haven. It has become an instrument of economic power. In 2024, the BRICS have massively accumulated the precious metal, anticipating a tightening of American trade policies. This bet is proving to be worthwhile, as the new tariffs announced by Donald Trump triggered a historic surge in gold prices. As the trade war intensifies, the yellow metal is asserting itself as the monetary weapon of emerging powers against the dominance of the dollar.

While the stock market stumbles, gold dances on the ashes of commercial promises. Trump stirs the embers, the Fed holds its breath in this theater of golden uncertainty.

Blockchain, often perceived as a shadowy area conducive to illicit activities, has just shown its other face: unrelenting traceability. In March 2024, the U.S. Department of Justice announced the seizure of $201,400 in crypto linked to Hamas. Behind this spotlight is hiding much broader stakes than merely the confiscation of assets. Between increased regulation and myths to be deconstructed, this case raises crucial questions about the future of terrorist financing in the digital age.

The American economy is entering a turbulent zone. Trump is taxing cars, the markets are derailing. All the details in this article!

Nubank adds 4 new assets to its portfolio. A strategic expansion that could be a game changer in the Brazilian crypto market!

Crypto payments are booming, but a danger persists. Bitget Wallet reveals all in its report! Details in this article.

eToro is making its mark in the big leagues. The social trading platform, a symbol of the democratization of investment, has officially launched its initial public offering (IPO) process in the United States. In a market where tech IPOs are regaining momentum, this strategic move underscores eToro's ambition to consolidate its global presence and compete with American giants in online brokerage.

BlackRock launches its iShares Bitcoin ETP, a bold bet on a hesitant European market. Will BTC finally establish itself against traditional assets?

The world of crypto continues to blur the lines with traditional finance. This time, it's BlackRock making a media splash by integrating Solana into its tokenized monetary fund, BUIDL. This decision is not just a simple technical adjustment, but a strong signal: blockchain is no longer a marginal experiment. It is becoming the backbone of a financial revolution in progress.

Finally, the wall of distrust is crumbling. BoursoBank, the French giant of online banking, reaches a historic milestone by incorporating crypto ETPs into its offering. A notable turnaround for this subsidiary of Société Générale, which has long been distant towards digital assets. By partnering with CoinShares, the European leader in the sector, the platform breaks into the traditional world of finance. Bitcoin, Ethereum, XRP... These names now resonate in the portfolios of ordinary investors. One more step towards the normalization of cryptos? Much more: a silent revolution.

Russia is at a major economic turning point, burdened by surging military expenditures and an escalating energy crisis. As financial resources dwindle, the cost of the conflict in Ukraine becomes unsustainable. By 2025, rising military spending and falling energy revenues will confront the country with an unprecedented economic challenge.

The stimulus from monetary easing and the public deficit bodes very well for Bitcoin, which remains poised just below $100,000.

The announcement was like a pin pulled grenade: Trump Media (DJT), the company behind Truth Social, is partnering with Crypto.com to launch a range of ETFs and exchange-traded products (ETPs) starting in 2025. In the wake of this news, DJT stock jumped by 9% in after-hours trading. Far from being just a media stunt, this partnership marks a key milestone in Donald Trump’s strategy to infiltrate the crypto ecosystem. Between blockchain technology and electoral ambitions, we analyze an audacious move.

While the markets slept, Strategy filled its digital vault with 506,137 shards of digital gold, each bitcoin stolen from silence for 33 billion reasons.

The Bank of France finds itself in 2024 facing an unprecedented financial situation with an operating loss of 17.7 billion euros. This loss, far from being anecdotal, highlights deep vulnerabilities within the European financial system, exacerbated by inflation, rising interest rates, and the management of public debts.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic disputes. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Under the neon lights of Wall Street, History seems to stutter. The stock market stumbles, drunk on speculation, while the old crashes smile in the wings, ready to take the stage again.