As the global economy continues to recover from successive crises, a new announcement from the IMF reveals a mixed trend: global public debt will reach 100 trillion dollars by the end of 2024. This staggering amount, equivalent to 93% of global GDP, represents a critical point in the budgetary management of states. The world now finds itself at a crossroads where managing this colossal debt has become more crucial than ever.

Finance News

The funding rate for Bitcoin futures has reached a multi-month high. Amid the volatility, this indicator could well reflect a renewed sense of confidence and signal a bullish trend in the short and medium term. As a result, investors are now closely watching every movement, in a context where Bitcoin has broken the $65,000 mark.

Wecan continues to evolve and strengthen its ecosystem. In 2024, the partnership with WIZE, a Swiss leader in wealth management software, marks a crucial step in simplifying compliance processes for asset managers and banks. This collaboration illustrates Wecan's commitment to building a digital environment that addresses the contemporary challenges of the financial industry.

After a difficult start to the month, Bitcoin rebounds with a rise of over 5% at the beginning of this week. Let’s examine the upcoming prospects for BTC’s performance. Bitcoin (BTC) Performance Situation After briefly falling below $60,000, Bitcoin attracted buying interest that allowed it to rebound and break through…

This case is just one piece of the vast puzzle of economic sanctions against Russia, but it highlights the difficulty of tracking and seizing assets acquired through sophisticated financial arrangements. As French justice intensifies its efforts, international pressure for greater financial transparency is mounting. The next steps in this investigation, and those to come, could redefine the tools for combating transnational financial crime. Thus, the implications for Russian oligarchs and their networks in Europe are immense, and such actions could inspire other jurisdictions to act.

The 2024 Nobels sound the alarm: economic inequalities would be the rotten fruits of our failing institutions.

The Taiwan Strait is once again boiling, and tensions between China and Taiwan are reaching a critical threshold. At the beginning of this week, Beijing intensified its show of military force by deploying fighter jets and warships all around the island, in what is described as a direct warning to Taiwanese "separatists." This surge in tension comes in a context where relations between Beijing and Taipei have continued to deteriorate since Lai Ching-te came to power in 2024, raising fears of an escalation with unpredictable consequences.

France is undergoing an unprecedented budget crisis. The deficit is likely to exceed 6% in 2024. France now risks bankruptcy, which would plunge the entire euro area into the abyss.

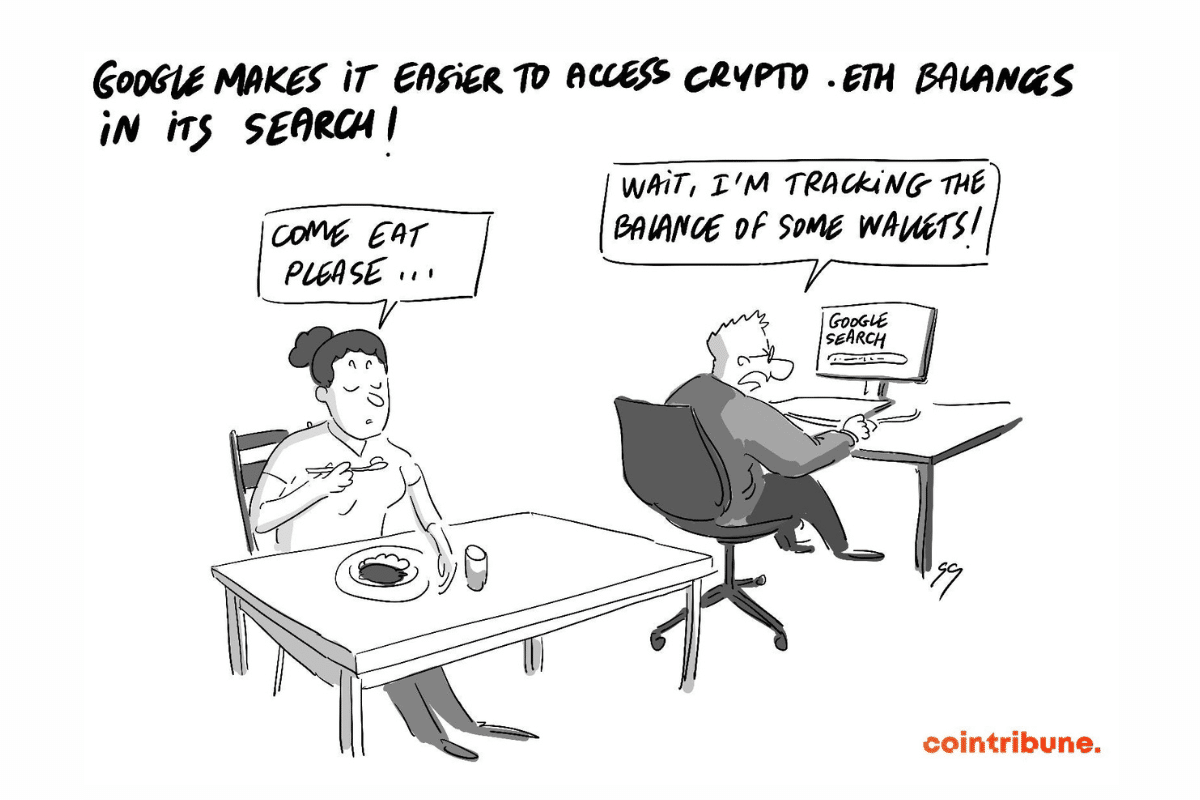

While Bitcoin, the most emblematic of cryptocurrencies, is experiencing a period of relative calm in the media, memecoins are emerging as true stars of the moment. A drastic drop in Google search volumes for Bitcoin reflects this unexpected dynamic. Meanwhile, memecoins, driven by platforms like Solana and Tron, are attracting unprecedented attention. Is this shift indicative of a lasting change or merely a passing situation?

The EUR/USD exchange rate recently dropped to around 1.0900, influenced by an increasingly accommodative market sentiment towards the European Central Bank (ECB). This bearish trend, observed for four consecutive sessions, is primarily due to expectations of an interest rate cut by the ECB during its upcoming financial meeting scheduled for this Thursday.

Amid revolutionary announcements, technological evolutions, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic disputes. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The upcoming BRICS summit, which will take place in Kazan, Russia from October 22 to 24, appears to be a key milestone in the ongoing international reshaping. By bringing together several rising powers and strategic partners at the same table, this summit aims to strengthen the bloc's influence on global economic, political, and diplomatic issues. The presence of Antonio Guterres, Secretary-General of the United Nations, at the heart of these discussions is a strong sign of recognition of the growing importance of the BRICS. More than just a diplomatic trip, his participation reflects a desire for openness and the integration of this group into global governance.

Discover China's new economic measures and why they leave investors skeptical about the real estate crisis.

Millennials? Always fully invested in crypto, treating themselves to a little ETF to cushion the digital shocks!

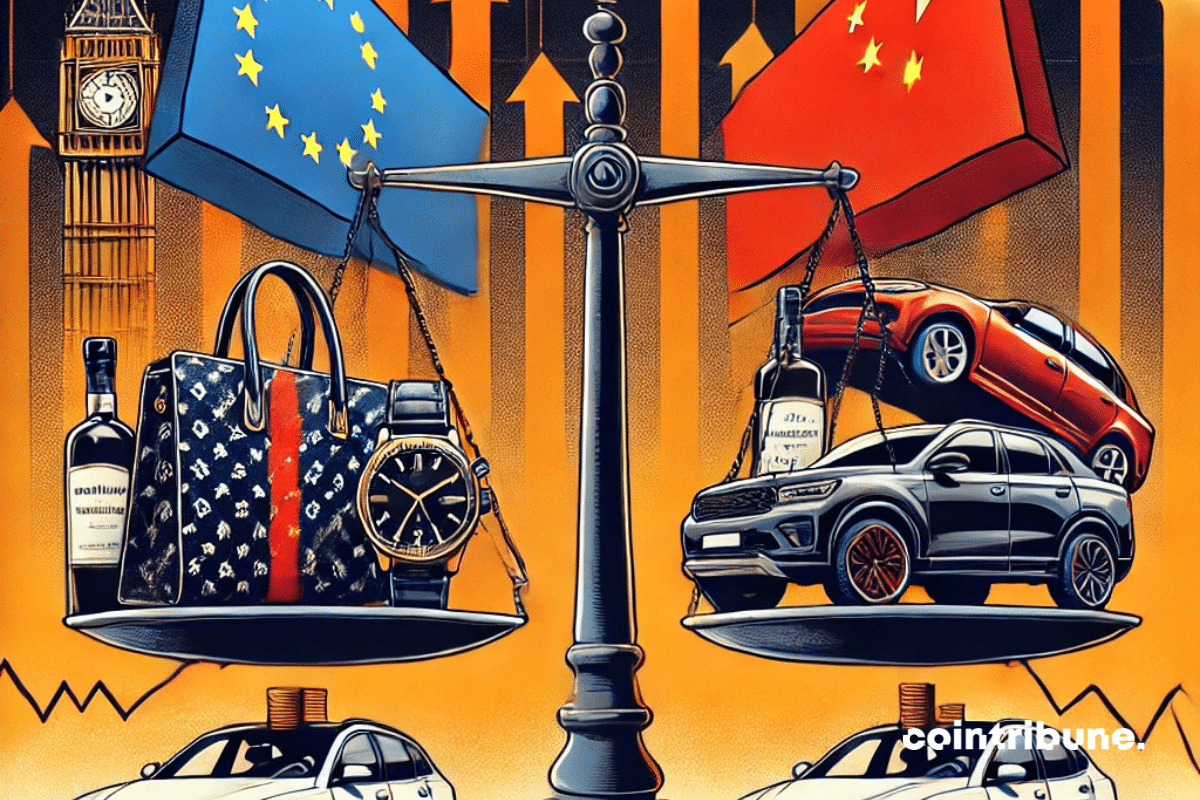

The trade war unfolding between the European Union and China is taking an unexpected turn. As the first sanctions hit strategic sectors such as electric vehicles and spirits, a new player enters the turmoil: European luxury. This economic stronghold, which symbolizes both creativity and prosperity in Europe, now finds itself at the center of speculations about potential Chinese retaliation. But behind this apparent storm, a more subtle equilibrium is taking shape. Experts, aware of the colossal economic stakes for China itself, are questioning: Will Beijing really take the risk of stifling one of the engines of its domestic consumption? In this article, we will first analyze the immediate consequences of this crisis on the financial markets of European luxury. Then, we will delve into the long-term perspectives and scenarios that could shape the relations between these two economic giants.

Here is a budget! Barnier sizes, cuts, siphons... and the French grumble louder than ever.

Inflation, often seen as one of the important economic indicators, shapes the trajectory of global financial markets. This time, the new data on inflation in the United States reveals a potentially crucial change for the crypto sector, and in particular for Bitcoin.

The Bitcoin market is in perpetual flux, influenced both by external events and the silent movements of large whales. These historical investors, holding vast amounts of Bitcoin for over seven years, play a decisive role in market fluctuations. Yet, according to an analysis by CryptoQuant, these whales remain strangely inactive, casting a veil of uncertainty over the direction the market might take in the coming months.

The Bitcoin network is currently facing a quiet but serious threat. Approximately 13% of the nodes that maintain and secure the blockchain are vulnerable to a critical flaw that could cause them to fail. This vulnerability, identified in May 2023, still persists on several nodes that have not yet been updated with the latest version of the Bitcoin Core software. While Bitcoin's security is often touted for its robustness, this issue reveals systemic flaws related to the management of essential software for the proper functioning of the network.

Inflation down in the United States? Yes, but be careful: between hurricanes, strikes, and unemployment, the economy has not said its last word!

Heated debate at the FED! Inflation and interest rate cuts divide financial experts who can no longer understand each other.

The future of Western aid to Ukraine is currently hanging in the balance, faced with a series of uncertainties. On one hand, the Kiel Institute, a well-known German research institute, warns of a potential drastic reduction in financial support should Donald Trump return to the White House in 2025. On…

A wave of massive ETH sales from the PlusToken affair, an old Ponzi scheme that wreaked havoc in 2019, is bringing back ghosts from the past. This situation, reminiscent of the events of 2021, is putting pressure on the price of Bitcoin and causing panic among some investors.

This Wednesday, October 9, 2024, François Villeroy de Galhau, Governor of the Bank of France, made a direct call: "It is time for everyone to make an effort." In a context where public finances are spiraling out of control, with a deficit that has widened by 100 billion euros since January, this statement leaves no room for ambiguity. Every economic actor, from citizens to businesses and local authorities, must accept sacrifices to avoid a budgetary collapse.

The world of cryptocurrencies is ruthless. While some projects emerge with brilliance, others struggle to convince or sink into obscurity. This harsh reality is what Max Keiser, an iconic figure of Bitcoin maximalism, bluntly reminds XRP holders. With a statement as sharp as it is expected, he announces that "the XRP rally will never happen," attacking Ripple's cryptocurrency once again. While the XRP community still hopes for a rebound, the latest developments in the lawsuit against the SEC continue to weigh down its price. Nevertheless, optimistic voices persist and bet on a potential technical reversal.

Bitcoin is soaring, but Wall Street is snoozing. While Americans are counting sheep, Asians are driving up BTC!

Chinese Commerce Minister Wang Wentao recently expressed his "serious concerns" to his American counterpart Gina Raimondo, amid rising tensions that threaten the world's economic balance.

Asian financial markets are plunging, and this shockwave is resonating far beyond the Pacific, reaching European and American stock exchanges. While China delays deploying sufficient stimulus measures, Wall Street is trying to recover, supported by the tech sector. But for how long? The global stock market is going through a…

On Polymarket, it’s 12.7% that take the prize… the others remain in "dreamer" mode with their Bitcoins.

The TON blockchain, once developed by Telegram, has just crossed a key threshold: that of 100 million active users. This figure reflects rapid and massive adoption, propelled by a series of technological developments within the ecosystem. However, this rise raises questions about the mixed performance of Toncoin, the native cryptocurrency of TON.