How to manage your bitcoins at retirement? Is it better to simply sell your BTC, or to use them as collateral with a bank and live on credit?

Finance News

Switzerland, once a discreet safe haven, is preparing to empty its crypto pockets to 74 countries... Enough to make digital anonymity enthusiasts hiding in the Alps tremble!

"MiCA not even digested, here is Brussels already sharpening its axe against DeFi: another crypto-legislation to silence the rebel codes before 2026?"

As markets scrutinize every move of the Fed and US public debt hits new records, Donald Trump is launching a vast fiscal project. His proposal is to extend and amplify the tax cuts of 2017. While his supporters see it as a growth lever, economists fear a massive budgetary drift. This text, dubbed "One Big Beautiful Bill", crystallizes the tensions between political ambition and financial viability.

Musk plays the cartomancers 2.0: crypto bets on X, algorithms as a crystal ball, and the press relegated to the status of folkloric prediction.

When Musk threatens space and Trump cuts the funding, it's crypto that takes a hit. A duel of egos, billions vanished and bewildered investors... Who really benefits from the chaos?

The rift between Donald Trump and Elon Musk, once strategic allies, is now laid bare. Amidst vehement criticisms, accusations of ingratitude, and budgetary tensions, their public confrontation reveals the fault lines of a power shared between ballots and algorithms. This clash, sparked from the Oval Office to social media, could redefine the balances between political influence, industrial ambitions, and electoral prospects.

The public debt of the major economic powers of the G7 is at the center of concerns in 2025. Amid growing worries and heightened vigilance, the fiscal management of these nations is becoming a key indicator of global economic stability. The downgrade of the United States' triple-A rating and disappointing bond sales in Japan perfectly illustrate this new tension and highlight the risks associated with increasingly unsustainable levels of indebtedness. These alarming signals reinforce investors' doubts and amplify the volatility of global financial markets.

JPMorgan, long hesitant about cryptocurrencies, marks a major turning point in the banking sector. The American bank announces the integration of Bitcoin ETFs as loan collateral, a decisive step towards the adoption of these assets. As regulation takes shape and institutional investor interest grows, this evolution could redefine the relationship between traditional finance and blockchain. This change signals a new era for financial products, placing cryptocurrencies at the heart of mainstream banking services.

What if your Visa card became your ultra-secure crypto wallet? Discover Tangem Pay, the revolution that combines self-custody, bankless payments, and Web3 technology. An innovation that could transform your spending... into financial freedom.

The new South Korean president, Lee Jae-myung, is very favorable to bitcoin. The list of pro-bitcoin countries is growing day by day.

Tension is rising around the giant Republican budget bill, a pillar of the Trump agenda. It is Elon Musk, former advisor and head of Tesla, who ignites the debate by denouncing it as a "financial abomination." A few days after leaving the administration, his public charge upsets the political balance. As Congress prepares to finalize the text, this unexpected intervention resonates as a major warning about upcoming fiscal excesses.

European markets are wobbling, investors are fleeing, and even companies are panicking. What lies behind this economic chaos? A burning question resurfaces: Has Europe destroyed our economy? Discover what no one dares to say.

WisdomTree already has its ETF, but the SEC wants to rethink the rules. Bitcoin in-kind? Possible. Behind this step towards innovation, the agency is sharpening its tools to maintain control.

As global trade lines shift under geopolitical pressure, Moscow is considering swapping traditional currencies for cryptocurrencies for its agricultural exports. This is not a marginal experiment but a massive project: the settlement of 49.5 million tons of grain could be done in crypto. An initiative that, if realized, would redefine the rules of trade for sanctioned states and impose blockchain as an alternative to dominant financial systems.

Morgan Stanley shakes the markets. Indeed, the investment bank forecasts a 9% drop in the US dollar within a year, bringing the currency down to its lowest levels since the pandemic. A shocking projection, published on May 31, which challenges the greenback's dominant status in the global monetary order and fuels fears of a lasting shift in international financial balances.

The new Polish president is pro-bitcoin, but probably more out of electoral opportunism than due to a clear strategy like that of the United States.

While Bitcoin is napping above 100,000 dollars, Ethereum is filling the coffers. Funds are pouring in, ETFs are buzzing: who said that crypto is running out of steam?

Medellín, dubbed the "city of eternal spring," has become a symbol of urban transformation in Latin America. With its modern infrastructure, commitment to sustainability, and exceptional quality of life, the city is increasingly attracting international investors. The El Poblado neighborhood, and more specifically Provenza, is at the heart of this dynamic, offering a unique blend of vibrant nightlife and residential serenity. And all of this is now within reach thanks to RealT.

The Dollar is skyrocketing, gold is faltering, mining giants are collapsing... What is happening behind the scenes of the global economy? Discover why bitcoin might just emerge unscathed from the monetary shockwave!

And what if one of the largest capital transfers in modern history was already underway, away from the spotlight? In the face of rising geopolitical tensions and the fatigue of the dollar-dependent model, Asian nations, led by the BRICS, are initiating a withdrawal of about 7.5 trillion dollars in American assets. This reorientation, based on strategic choices and concrete data, challenges the foundations of Western finance and signals a silent yet decisive restructuring of the global monetary order.

Panetta believes that only a central digital currency can mitigate the risks posed by foreign platforms. Details here!

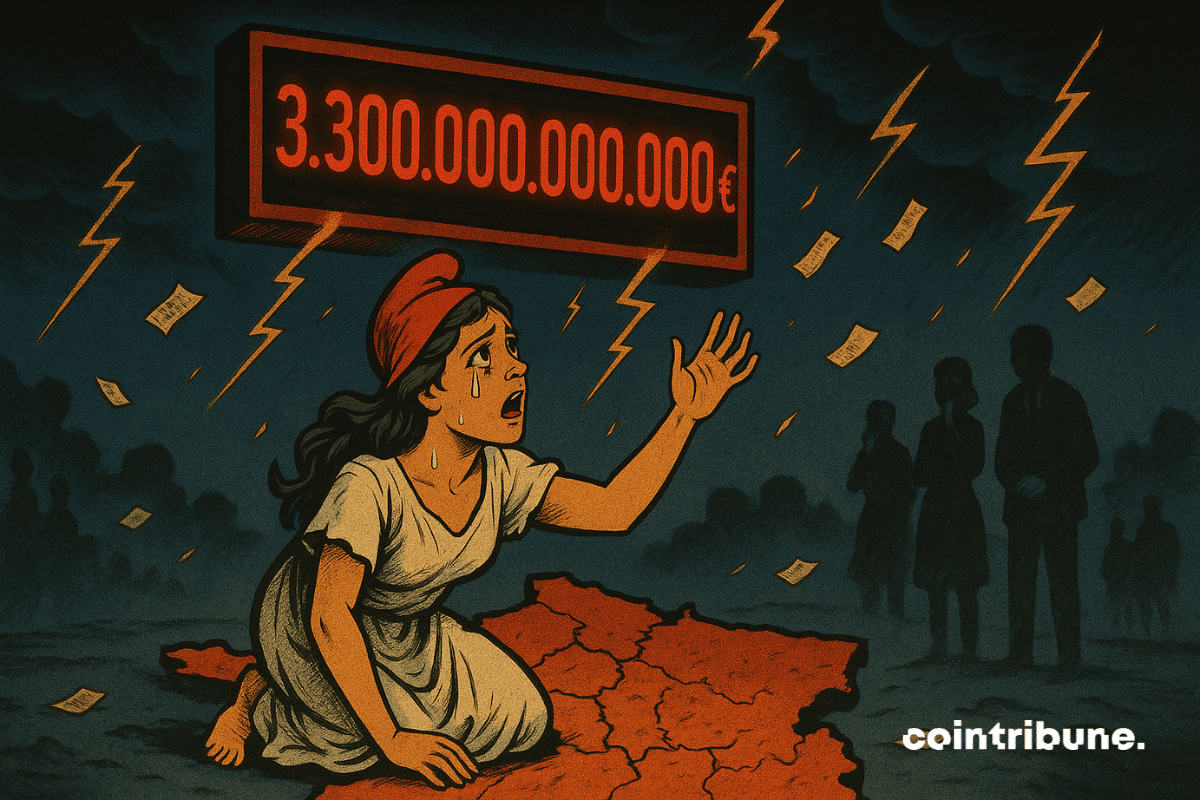

FTX is (finally) refunding other former clients... but not as planned! 5 billion at stake, anger from creditors, and scams lurking. Why could this refund reignite the turmoil? Discover what this shocking operation conceals.

Will the Fed really keep its rates unchanged in June? Between persistent inflation and a surprising labor market, discover why this decision could disrupt the economy and the markets, including Bitcoin!

Present since 2017 under the name EthLend, Aave reflects the transformation of DeFi. Indeed, five years after the DeFi Summer of 2020, during which decentralized finance emerged from its embryonic phase, this new economic sector has entered a new phase.

Interest rates are raising concerns. François Bayrou warns that the topics of pensions and debt will need to be revisited. New generations would do well to turn to bitcoin...

"Ledger sorts its Visa crypto card in the USA with Bitcoin cashback. Discover all the details in this article."

After six quarters of decline, the French real estate market surprises with an unexpected flicker: prices are slightly rising again. According to notaries and the Insee, the 0.5% increase at the beginning of 2025 marks a discreet yet strategic break. While many were betting on a continuation of the decline, this signal rekindles bets on the sector's evolution. For investors seeking diversification, including in the crypto sphere, this shift could very well reshuffle the cards of short-term wealth allocations.

After a marked correction, avalanche stagnates under key levels: between selling pressure and latent bullish bias. Find our complete technical analysis and AVAX outlook.

Slowly but surely, the power is preparing minds for the end of cash. Fortunately, there will always be bitcoin.