Washington cuts in post-crash regulation: a small snip to the SLR to inflate the economy... or the next bubble? Thrilled banks, shivering taxpayers. Who pays the price?

Finance News

Unbeknownst to the general public, a monetary shift is taking place in Europe. The US dollar is losing ground there. Since the beginning of the year, foreign companies and funds are demanding payments in local currencies, revealing a strategic fracture at the heart of continental finance. This movement, far from being anecdotal, aligns with the ambitions of the BRICS, who are determined to erode the hegemony of the greenback. Discreetly, it is the very architecture of international trade that is wavering, driven by an emerging alliance in search of economic sovereignty.

Trump promised miracles, Moody's delivers slaps: the American economy is sinking, the debt is exploding, and the rating falls. Budget magic or just an electoral sleight of hand?

Bitcoin has stood the test of time. Buying bitcoins today is significantly less risky than it was 10 years ago, 5 years ago, and even 1 year ago.

The BIS and the Fed unveil an innovative toolkit for tokenization. Discover all the details in this article!

Addentax invests 800 million dollars in crypto to strengthen its strategic positioning. We provide you with the details in this article!

After several years of hostility towards Bitcoin, Taiwan may soon reconsider its viewpoint given its precarious geopolitical situation.

Polymarket reached an all-time high in new market creation in April, but trader activity and trading volume have slowed since the 2024 U.S. election. Speculation around a possible token launch could drive renewed engagement and further growth.

Every year, billions lie dormant in fixed assets: real estate, raw materials, receivables. The economy suffers, investment stagnates, and inclusion decreases. What if the solution came from Web3? Real believes that everyone should own a share of the real world. Through its dedicated blockchain, it finally makes tokenization fluid, transparent, and inclusive.

After a correction phase, Ondo is showing encouraging signs of interest. Find our complete analysis and the technical perspectives of ONDO.

Trump eases up (a bit) on customs tariffs: the economy breathes, analysts cough, and Beijing chuckles. 90 days of truce, or 90 days until the storm?

For a long time perceived as followers, the BRICS are now at the forefront of global growth. According to the latest forecasts from the IMF, these emerging powers will show an economic momentum in 2025 that is significantly higher than that of the United States. This quantitative shift is becoming strategic: the rise of the BRICS is no longer a trend; it is a fact. Their collective performance is redefining the balance of power and necessitating a re-examination of geo-economic equilibria.

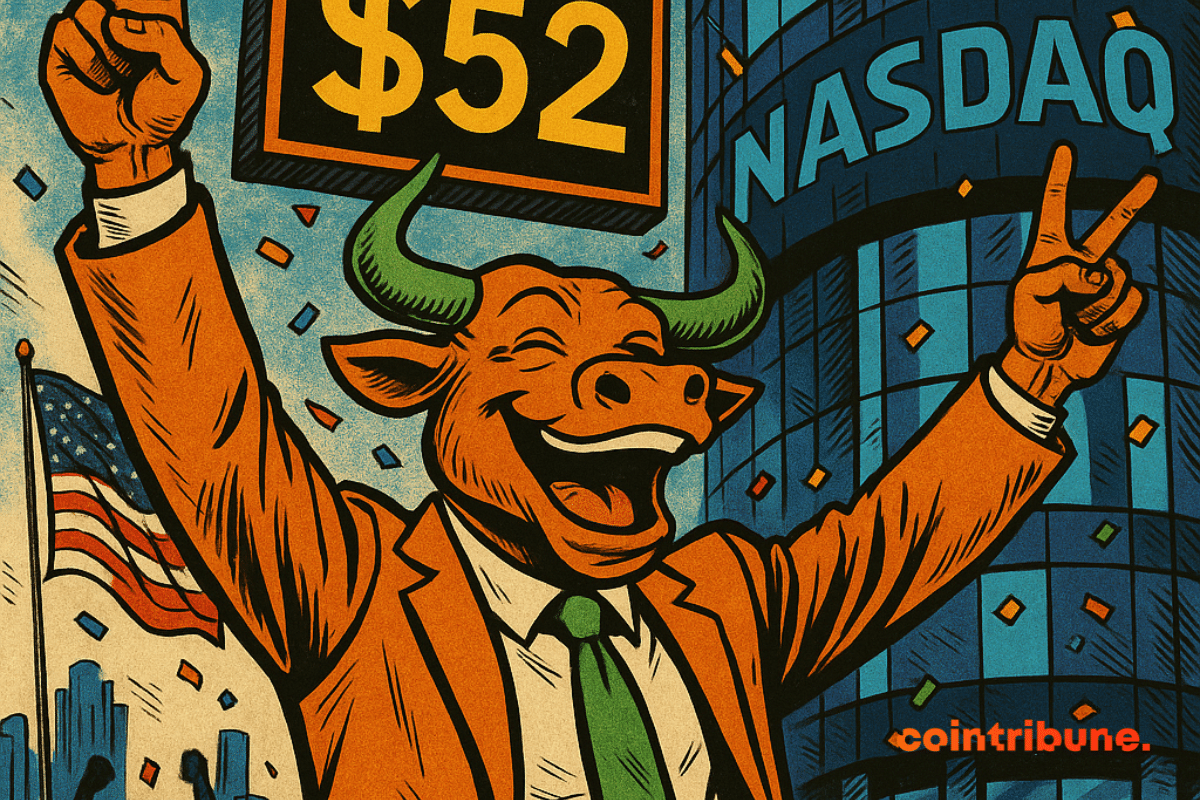

eToro's IPO launches on Nasdaq at $52 per share, exceeding expectations. The company raises $310 million, valuing it at $4.2 billion, and positions itself to compete with platforms like Robinhood.

It's a paradox that would make even the most seasoned economists raise their eyebrows: while the dollar wavers, the Asian economy is rising up with an almost insolent confidence. At a time when the American Federal Reserve is hesitating on interest rates, and trade tensions seem to be easing without really dissipating, Asia is benefiting from an unexpected boost. This shows that even in the global monetary fog, some find their way.

Ethereum shows a rebound of more than 50% in less than two weeks. Find our complete analysis and the current technical perspectives for ETH.

The BIS reveals that $600 billion in crypto circulated in 2024, primarily for speculation, not for real use. Details here!

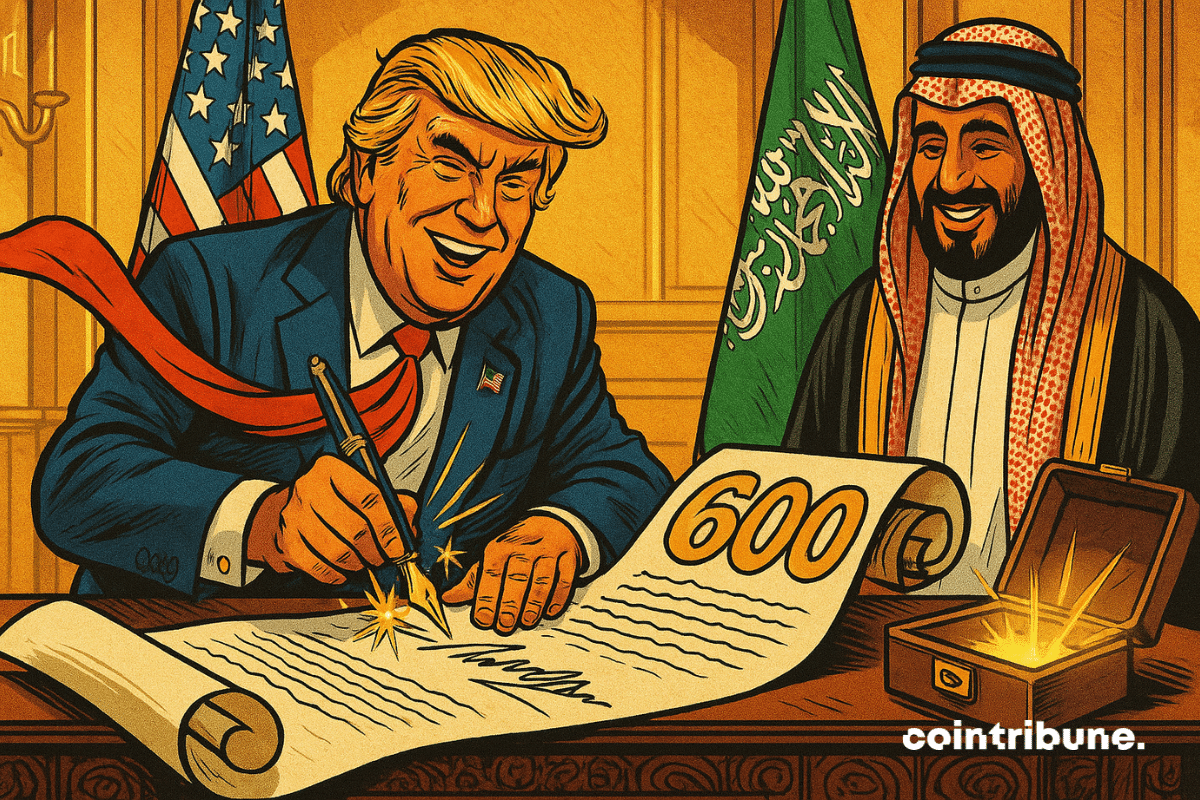

On May 13, 2025, in Riyadh, Donald Trump signed a strategic partnership with Saudi Arabia valued at 600 billion dollars. Beyond the amount, it is the nature of the alliance, encompassing defense, tech, and energy, that is striking. As Washington strengthens its foothold in the Middle East and Riyadh accelerates its post-oil transformation, this agreement redefines the power dynamics between two powers seeking global influence.

American inflation defied all doomsday predictions in April, falling to 2.3% despite the implementation of massive tariffs by the Trump administration. This unexpected decline raises a troubling question: what if analysts had exaggerated the impact of protectionist measures? Are fears of an inflationary spiral overstated?

Bitcoin accelerates and moves back above $100,000: find our complete analysis and the current technical outlook for BTC.

Ethereum, powered by the Pectra update, is surprising. In just five days, the crypto ETH jumps by 42%. It surpasses Coca-Cola and Alibaba in market capitalization. This meteoric rise shakes traditional markets. Today, the time is no longer for the anonymous ambitions of established values. It is about the emergence of a decentralized network that is redefining the financial hierarchy.

The U.S. and China agree to pause tariffs for 90 days, boosting crypto market optimism with Bitcoin and others seeing strong gains.

There are days when markets scream, but few know how to listen. A sudden Bitcoin surge, a flood of institutional capital—and yet, most internet users miss the signal. Why? Because raw information isn’t opportunity until it becomes actionable. In this era ruled by ETFs and bots, one key question emerges: can you monetize these signals without being glued to your screen? The answer is yes—if you have the right tool and a strategy that reads between the lines of the order book.

The world of investing has been revolutionized over the past decade by the democratization of ETFs and passive management. However, this investment strategy is beginning to show signs of worrying fatigue. With potentially overvalued markets and anemic return forecasts for the next decade, it becomes urgent to question ETFs.

In a world where geopolitical fault lines are shifting rapidly, Saudi Arabia plays a delicate tune between two rival blocs. Solicited by the BRICS but still closely tied to the United States, Riyadh is biding its time, suspending its official membership despite signals of openness. While Beijing lures with its economic promises and Washington threatens with tariffs, the kingdom is preserving its options. Does this tactical ambiguity mask a pre-established strategic direction or is it preparing for a major rebalancing on the global chessboard?

As the Russo-Ukrainian war drags into its fourth year, a possible meeting between Volodymyr Zelensky and Vladimir Putin in Istanbul could reshape the dynamics. For the first time in months, Kyiv is open to the idea of direct talks. Zelensky announced this Sunday, May 11, that he would await Putin on Thursday, May 15, in Istanbul. However, Ukraine sets a firm condition: no exchanges will take place without a total ceasefire, which is demanded from this Monday. This is a significant requirement in a conflict where every diplomatic gesture is closely scrutinized.

Chinese economy: prices are sinking, the people are saving, Beijing is patching things up, dishes are changing. The dragon is coughing, but still plays the mystery card to avoid being roasted.

As the conflict in Ukraine reaches a critical juncture, Kyiv and its Western allies are proposing a comprehensive, unconditional ceasefire for 30 days. Supported by Washington and major European capitals, this initiative aims to create a pathway for negotiations. However, beyond the call for a truce, one question looms: will Moscow see this as a genuine hand extended or a tactical maneuver concealing a strategic advantage for Ukraine? The answer could reshape the balance of power diplomatically.

Refounding or not, the Ethereum Foundation continues to support the ecosystem: millions distributed, subsidized crypto-tech, Vitalik in quantum mode, and pampered developers. Who said austerity?

With Pectra, Ethereum promises the future but stacks ETH with the big players: decentralization or private club? The small stakers, on the other hand, count their crumbs on the blockchain.

Morgan Stanley estimates that bitcoin is now significant enough to be considered an international reserve currency.