On the brink of a total shutdown, Washington shakes global markets. This Monday, September 29, the budget deadlock in the US Congress revives the specter of a shutdown as early as Wednesday, plunging investors and institutions into uncertainty. In an already uncertain climate, marked by central bank hesitations and the fragility of US indicators, this political stalemate raises fears of a major loss of visibility. Investors are repositioning urgently, between a flight to safe havens and anticipation of macroeconomic turbulence.

Finance News

The cryptocurrency market faces renewed pressure, with both Bitcoin and Ethereum testing key support levels after a week of declines. Predictably, this market dip has left traders weighing whether this downturn signals further weakness or a chance to re-enter. Amid the uncertainty, President Donald Trump's son, Eric Trump, has stepped in with a familiar message, urging market participants to “buy the dips.”

While some governments are struggling, Singapore and Dubai are fueling crypto. What if the finance of tomorrow came from... paradise islands obsessed with wallets?

James Wynn, the man who flirted with billions in crypto, now bets on ASTER… An airdrop, a 3x leverage, and a lot of boldness: hold-up or hara-kiri?

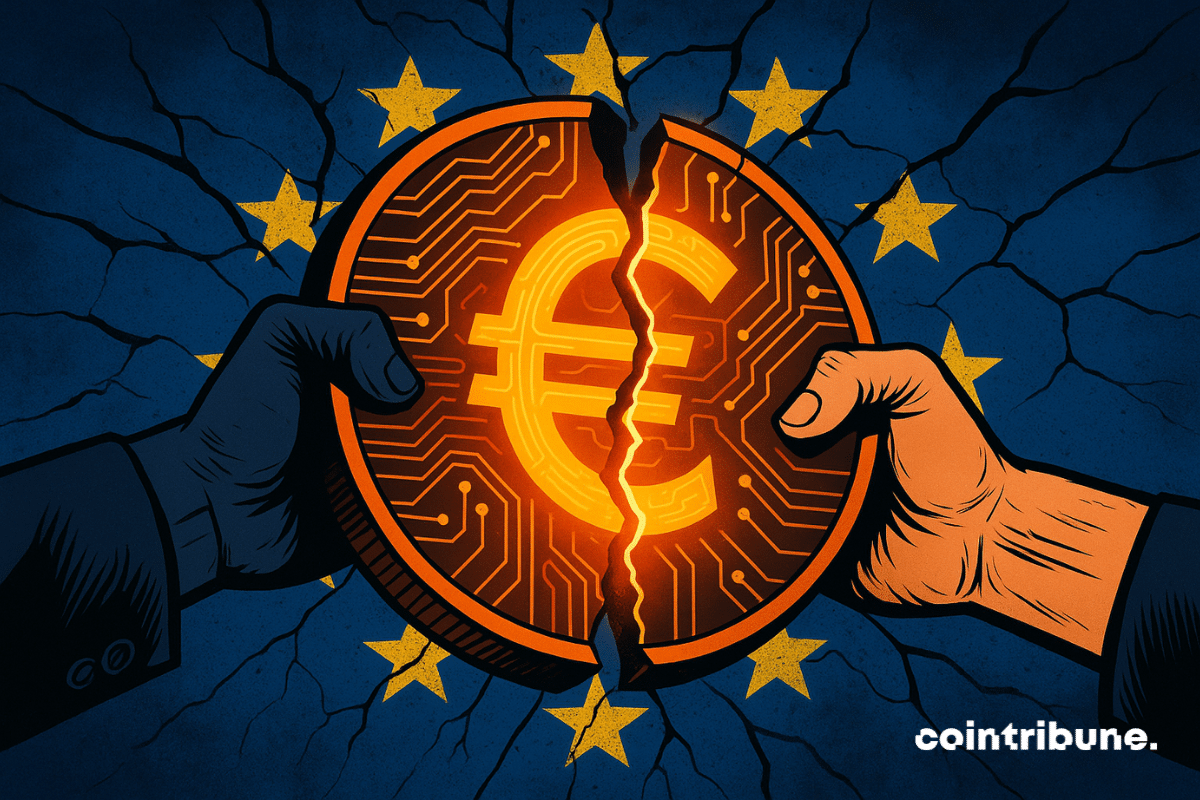

While Europe accelerates towards digital payments and prepares the digital euro, the ECB creates a surprise. It recommends keeping cash at home. This injunction reveals a reality too often overlooked in official speeches: the fragility of digital systems in the face of crises. Such a deliberate return to cash does not mark a step backwards, but a clear anticipation of systemic risks, between outages, geopolitical tensions and cyberattacks.

Ethereum shunned, Wall Street panics, BlackRock empties its bags... Crypto smells burnt, but some billionaires seem to sense a good buyout scent. The smell of sales?

Leading blockchain analytics platform is set to test the heights of artificial intelligence in cryptocurrency by unveiling a mobile agent designed to make trading more interactive. The crypto intelligence firm aims to simplify on-chain trading by introducing a natural conversation feature.

The PCE inflation figures for the month of August, published this Friday, September 27, confirm apparent stability, with progress as expected. A key indicator for the Federal Reserve, the PCE remains above the target, while American consumption continues to surprise with its strength. In a context of monetary tension, these data maintain uncertainty about the future trajectory of interest rates.

Vanguard, bastion of financial conservatism, is preparing to take an unexpected step towards cryptos. The asset management giant is considering opening access to crypto ETFs on its brokerage platform. If this development materializes, it would mark a major strategic turning point and strengthen the anchoring of these assets in the institutional financial landscape.

While Aster is leading, Bitwise plays its joker: an ETF on a declining crypto. Should you bet on HYPE... or on the high hopes of financiers?

The People’s Bank of China (PBOC) has just inaugurated an international center dedicated to the digital yuan in Shanghai. A strong signal: Beijing wants to impose its e-CNY as a pivot of a new global monetary order. Can this initiative really challenge the dollar’s hegemony and compete with stablecoins dominated by the greenback?

A brand new DEX, a former Binance boss behind the scenes, billions pouring in... Aster propels crypto into a frantic dance between hype, incentives, and suspicious concentration.

The tokenization of real assets (RWA - Real World Assets) represents one of the most promising sectors of the crypto ecosystem in 2025-2026. The integration of recognized assets on the blockchain through RWAs constitutes a significant innovation that is a central narrative of the 2024-2025 crypto season. In this dynamic context, Real Finance (REAL) positions itself as a major player by developing a complete infrastructure to facilitate the integration of real-world assets into the Web3 ecosystem.

Europe’s digital euro may not be ready for mainstream use in the near or medium term, according to ECB Executive Board member Piero Cipollone. Despite recent progress in discussions and political negotiations, Cipollone noted that mid-2029 remains the most realistic timeframe for a launch, as key technical decisions are still pending.

Polymarket introduces annualized rewards for long-term positions, supporting accurate pricing in high-profile political and global markets.

China announces that it is giving up some of its privileges at the WTO. This move, described as "major" by the organization's director-general, Ngozi Okonjo-Iweala, reshuffles the cards of global trade. Made by Li Qiang himself, this decision marks a strategic shift for Beijing authorities, long accused of unfairly benefiting from multilateral rules.

Bitcoin, once called a bubble, is now creating millionaires in series: 145,000 in one year. Bankers are grinding their teeth, speculators are popping champagne.

The Federal Reserve has made its decision, but without certainty. According to Jerome Powell, no interest rate adjustment will be without consequences. While several central banks have started a cycle of rate cuts, the Fed chairman warns of a strategic deadlock. In a context where inflation remains resilient and employment wavers, every decision becomes risky. A strong signal sent to the markets closely watching every word from the Fed as a decisive monetary turning point approaches.

World Liberty Financial appears poised to build on its market entry by pursuing utility-focused growth. The crypto venture, backed by the Trump family, has outlined plans to issue a debit card and retail application, as per recent reports.

Economy: JPMorgan anticipates tensions on the Fed and integrates stablecoins without fearing for its deposits. We tell you more here!

While retail investors tremble at the slightest dip, corporate whales are devouring millions in bitcoin. Coincidence? Or a new strategy from the "private central bankers" of crypto?

At Saylor's, the vaults overflow: 639,835 bitcoins in reserve! While Wall Street grimaces, Strategy plays the global treasurer of an increasingly coveted digital gold.

With renewed confidence in the crypto market following macroeconomic events, the decentralized finance (DeFi) niche is showing strong performance, as evidenced by its recent growth. The latest data now shows that the sector could be poised to touch the previous peak it reached nearly four years ago.

Promised for 2026, the digital euro is already causing waves: Lagarde sees sovereignty, Navarrete calls it a useless gadget, and banks fear a digital bank run.

Two crypto platforms are fiercely competing: Kalshi captures the volumes, Polymarket buys respectability. Sports betting, regulators, and billions join the prediction feast.

As the conflict in Ukraine drags on, the European Union opens a new front: that of cryptos. For the first time, Brussels plans to directly sanction crypto platforms, integrating these decentralized infrastructures into its economic measures against Moscow. A discreet but strategic shift, integrating cryptos into the realm of international pressure tools.

What will China do if the United States truly start selling gold to embrace bitcoin?

Powell cuts timidly, Trump shouts louder than ever, and crypto cheers. In Washington, the FED lowers its arms, while Bitcoin and stablecoins revise their choreography.

The internationalization of the Chinese currency is no longer a fantasy. The growth of international payments in yuan is skyrocketing. Bitcoin is lurking.

Ethereum network stakers are facing record-long exit times, with about 2.5 million ETH ($11.25 billion) pending withdrawal from the validator set, according to dashboard reports. Given this backlog of unsettled transactions, the waiting time for withdrawal has stretched to more than 46 days—the longest in the network's history. For comparison, the last big peak in wait time, which occurred in August, only had an 18-day wait.