Trade tensions between the United States and its major partners have resurfaced, reviving the specter of a new economic war. Washington has announced an increase in tariffs targeting Canada, Mexico, and China, a decision that marks the return of the protectionism favored by Donald Trump. This tariff offensive has immediately sparked reactions everywhere, particularly in Europe, where the European Commission is closely monitoring the situation. Although the European Union is not yet directly affected, Brussels fears an expansion of American measures and warns that it will not remain passive. The Commission has already expressed its strong disagreement with this policy and states that it is ready to adopt retaliatory measures to protect the continent's economic interests. In the face of this new trade offensive from the United States, the risk of escalation between the two blocs cannot be ruled out.

Finance News

The crypto market has just experienced an unprecedented financial tsunami. In 24 hours, 2.24 billion dollars evaporated under the blows of trade wars, propelling Ethereum to the forefront of a historic debacle. A massive liquidation, driven by Donald Trump's surprise announcement on customs duties, shattered the records of the FTX crisis and the COVID-19 crash. Behind these dizzying numbers, over 730,000 traders saw their positions turned to ashes. How could a political tweet shake a decentralized ecosystem? Let's dive into the machinery of this debacle.

Blockchain-based finance is evolving rapidly, providing innovative solutions to democratize access to investments and financing. Among the challenges still present in this ecosystem, the integration of real-world assets (RWA) remains a central issue. The collaboration between Lumia and Credefi aims to address these challenges by combining layer 2 (L2) infrastructure and expertise in RWA-backed loans.

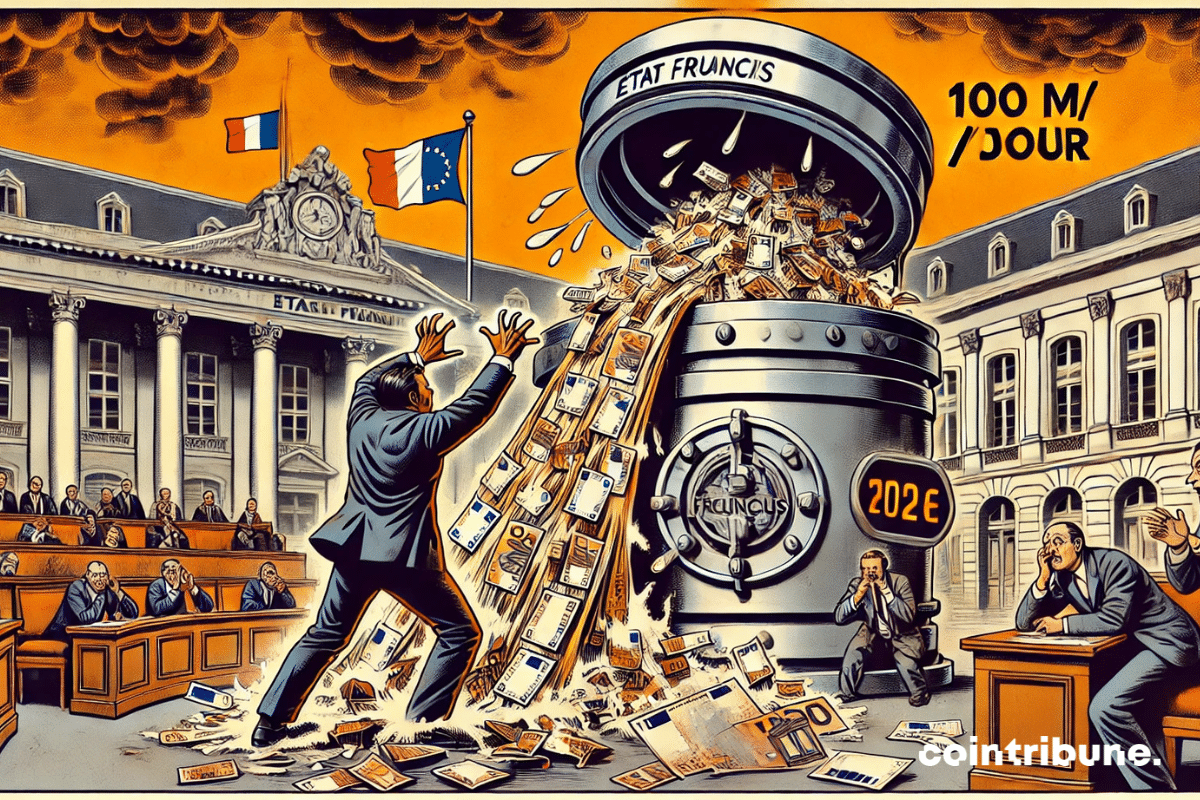

The deficit is growing, taxes are rising, but Bayrou persists. Clinging to his 49.3 like a castaway to his buoy, he defies the political storm that is looming.

Amid revolutionary announcements, technological developments, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground of regulatory and economic struggles. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.

Donald Trump unveils his radical strategy to counter the monetary ambitions of the BRICS. In response to their proposal for a common currency, he threatens to impose 100% tariffs against any country that adopts it. This tough approach masks secret negotiations that could reshape the global monetary order.

The United States is reviving trade tensions with its major economic partners. Donald Trump has just announced massive new tariffs on imports from Canada, Mexico, and China, and is reigniting an aggressive protectionist policy. Presented as a response to the fight against fentanyl trafficking and illegal immigration, this decision primarily fits into a broader strategy aimed at renegotiating North American trade agreements and protecting the American industry from Chinese competition. This escalation has immediately provoked a virulent reaction from the targeted countries, which are already preparing retaliatory measures, foreshadowing a new economic showdown with uncertain consequences.

After a decade of exceptional growth, India's economy is showing signs of slowing down. Government forecasts predict a growth rate between 6.3% and 6.8% for 2025, a significant decline from the 8.2% of 2023-2024.

The French economy ends the year 2024 on a worrying note with a contraction of 0.1% of its GDP in the fourth quarter. This situation arises in a particularly tense context, where the public deficit reaches the alarming level of 6% of GDP, placing France among the worst performers in the eurozone.

The status of the US dollar in the global economy once again causes tensions. While the BRICS seek to free themselves from its hegemony, Donald Trump brushed aside any possibility of dedollarization. "There is no chance that the BRICS will replace the US dollar in international trade or elsewhere," he stated. This declaration comes at a time when China, Russia, and their allies are intensifying their efforts to limit their dependence on the greenback, particularly through exchanges in local currencies and the establishment of alternative financial infrastructures. Behind this statement from the American president, one question arises: is the dollar really unassailable, or are we witnessing the beginnings of a new monetary order?

Rents in France continue to rise in 2025, putting pressure on household budgets in a rapidly transforming real estate market. With an average cost of 723 euros per month including charges, the increase reaches 3.3% compared to 2024. This phenomenon, which spans the entire territory, reveals significant disparities between major metropolitan areas and more affordable cities. While some regions experience a surge in prices, others remain more accessible. What are the factors behind this rental inflation and which cities are the most affected?

In a constantly changing world, where every political decision redraws the contours of power, a major phenomenon is emerging: the rise of the BRICS. This acronym, once seen as a symbolic grouping of major emerging economies, now asserts itself as a driving force of geopolitical balance. With the recent expansion of this bloc to new influential members, the global landscape is enriched with unprecedented dynamics, challenging the hegemony of Western institutions. While Donald Trump embarks on a second term in the United States, focused on a protectionist and isolationist policy, the rise of the BRICS represents a strategic challenge with profound implications.

The employment situation in France is experiencing a worrying deterioration. According to the latest figures published on January 27, 2025, by the Ministry of Labor, the number of unemployed job seekers without activity (category A) surged by 3.9% in the fourth quarter of 2024 compared to the previous quarter. This represents an additional 117,000 unemployed individuals, bringing the total to 3.1 million people, a level not seen in a decade, excluding the Covid-19 period.

For several decades, French budget management has been a source of recurring tensions, but the current situation has reached an unprecedented level. In 2025, the censorship of the budget voted by the Senate plunged the country into a major financial crisis, with losses estimated at 100 million euros per day. In the absence of a new text validated by the National Assembly, the budget for 2024 remains in effect, depriving the state of essential revenue and savings measures. Amélie de Montchalin, Minister for Public Accounts, warns about the repercussions of this deadlock and emphasizes both its economic cost and the institutional challenges it reveals.

A Chinese startup is redefining the stock market and AI, causing Nvidia to drop by 17%. Details in this article!

For several decades, global economic alliances have been evolving due to geopolitical and economic transformations. The BRICS bloc embodies this dynamic through its expansion to new members in order to consolidate its influence on the international stage. In 2023, Saudi Arabia, the world's largest oil exporter, received an official invitation to join this strategic alliance. However, unlike other countries such as Iran or the United Arab Emirates, which quickly accepted, Riyadh is adopting a cautious stance. Faisal Al-Ibrahim, the Saudi Minister of Economy and Planning, emphasized that the kingdom continues to carefully assess the implications of membership. This strategic choice raises questions about Saudi Arabia's true intentions and its future role in this new economic balance.

When Trump decrees, cryptos ignite: Bitcoin recently at $109,000, ETPs feast on $1.9 billion.

The cryptocurrency XRP is making headlines again despite the fact that the Lightning Network has rendered it completely useless for a long time...

Amid revolutionary announcements, technological advancements, and regulatory upheavals, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic conflicts. Here is a summary of the most significant news from the past week regarding Bitcoin, Ethereum, Binance, Solana, and Ripple.

The return of Donald Trump to the White House in January 2025 marks a historic break in American politics. In less than a week, the president signed 78 decrees affecting various areas such as domestic policy and international aid.

The dream of owning a detached house with a garden, shared by nearly 80% of the French according to a recent study, could soon become unattainable. The reason is a reform introduced by the Climate Resilience Law which aims to reduce land artificialization to preserve natural, agricultural, and forested areas. By 2050, this measure aims to achieve "net zero artificialization," which radically changes urban planning rules. This project, although ecological, is already causing a surge in the price of buildable land and limiting its availability, raising concerns among future homeowners and real estate professionals.

Between record figures and subtle strategies, BlackRock's Bitcoin ETF charts its course. The shine of the crypto beacon lights up finance.

The relationships between political leaders and financial institutions are going through a phase of great tension. Donald Trump, the President of the United States, has strongly criticized the Federal Reserve (Fed) and is calling for an immediate reduction in interest rates. This appeal, made during the World Economic Forum in Davos, comes at a time when the Fed, led by Jerome Powell, is maintaining a cautious approach in the face of persistent inflation and a strong labor market. Such a showdown highlights critical stakes for the American economy, raising questions about the independence of central banks on a global scale.

The decree by Donald Trump and the repeal of the deadly accounting standard SAB 121 are very promising for bitcoin. Promise Kept Donald Trump promised that his government would stop putting obstacles in the way of bitcoin. This promise has been fulfilled with the decree “Strengthening…

Economic tensions between major powers are reaching a new level. The President of the United States, Donald Trump, has issued a direct threat to the member countries of the BRICS alliance, which are seeking to reduce their dependence on the U.S. dollar. In response to these de-dollarization initiatives, he announced 100% tariffs on their exports to the United States. This stance, accompanied by the establishment of a new agency to collect these customs duties, reflects a clear intent to defend the supremacy of the dollar and to counter any challenges to American economic hegemony. As the BRICS explore alternative payment systems, this statement could redefine the power dynamics on the global geopolitical and commercial stage.

Bitcoin, this $100,000 digital mirage, attracts Morgan Stanley into a dance where profits skyrocket and sanctions loom.

Saudi Arabia has unveiled an ambitious economic project led by Crown Prince Mohammed bin Salman, aiming to invest 600 billion dollars in the United States over four years. This commitment is part of the Kingdom's economic diversification strategy, a cornerstone of its Vision 2030. By strengthening its trade ties with Washington, Riyadh seeks not only to diversify its economic partnerships but also to consolidate its influence on the international stage. This plan, which comes amid a redefinition of global balances, underscores the growing importance of economic cooperation as a lever for geopolitical stability and mutual growth.

After crossing the $4,100 mark, Ethereum faced bearish pressure that caused a decline of nearly 30% in its price. Let's examine the future prospects for ETH.

The mortgage credit market is undergoing a major shift at the beginning of 2025. After a rapid increase between 2022 and 2023, interest rates have been continuously declining for more than a year, with the hope that they will fall below the symbolic threshold of 3% in the coming months. This evolution, driven by the slowdown in inflation and the accommodative monetary policy of the European Central Bank (ECB), is attracting the attention of households and investors. However, these promising figures are set against a fragile economic context, characterized by low growth and rising financial uncertainties. It therefore becomes crucial to understand the underlying issues and their implications for the future.

In 2024, regulated savings accounts in France, the Livret A and the Livret de Développement Durable et Solidaire (LDDS), reported a record amount of 16.8 billion euros in interest for savers. This impressive sum was announced by the Caisse des Dépôts, highlighting the ongoing appeal of these savings products despite an uncertain economic context.