Binance, the giant cryptocurrency exchange platform, is facing disruptions with its payment partner, Paysafe, in Europe. Some European users are experiencing difficulties in making euro withdrawals due to early closures initiated by Paysafe.

Exchange News

Huobi Global and Binance are two prominent crypto companies. In the crypto industry, rivalries are not uncommon. However, Binance CEO CZ remains sportsmanlike in the face of comparisons and extends a hand to his counterpart Justin Sun as his exchange falls victim to a hack.

Huobi has become a hacker's latest target! While the cryptocurrency exchange, now known as HTX, had a bright future ahead of it, an unfortunate event has disrupted its day-to-day operations. However, things should be less difficult to deal with as the identity of the hacker is not unknown.

After complying with the FSMA's decision, the Belgian regulator for cryptocurrencies and finance, Binance had to suspend its activities in the country back in June. Three months later, the world's largest cryptocurrency exchange announces a triumphant return to Belgium. What has changed since then? Let's delve into it.

In an environment where crypto regulation is tightening and legal battles are intensifying, Binance, the world's leading exchange platform, is facing challenges in several jurisdictions. We had the opportunity to interview David Prinçay, CEO of Binance France, to find out more about the current situation.

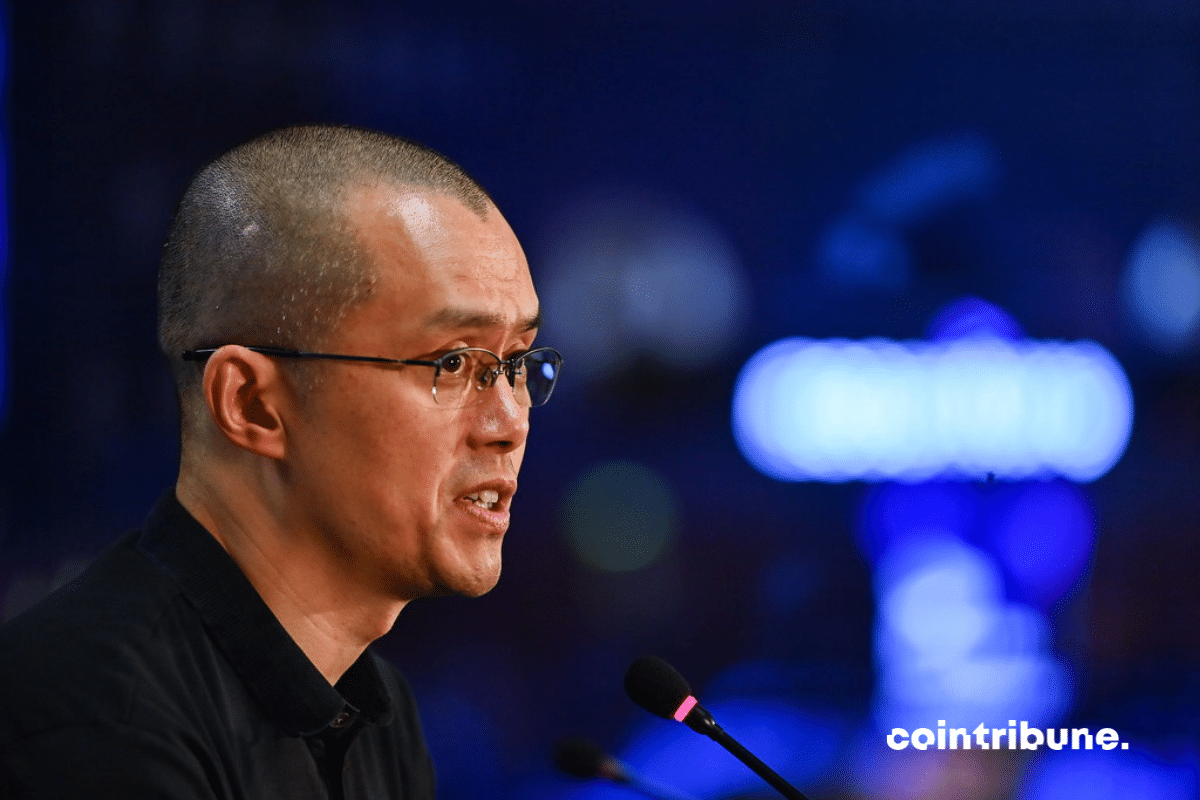

Recently, the CEO of Binance stepped up to defend his highly popular cryptocurrency exchange. According to the latest news, Changpeng Zhao, aided by Binance.US lawyers, has asked the court to dismiss the US SEC's lawsuits. Let's break it down!

Given its trajectory, the legal battle between Binance and the SEC is expected to persist, akin to the Ripple case. The Securities and Exchange Commission appears to have multiple strategies at its disposal, while Binance remains resolute. Recently, its CEO, Changpeng Zhao (CZ), defended his cryptocurrency exchange on X (formerly Twitter). Here are the key points:

There will be some rumblings in the crypto industry in the next few days. Because if approved, FTX will liquidate a large number of its digital assets. There's talk of a plan to sell $200 million in cryptocurrencies. Something to keep an eye on!

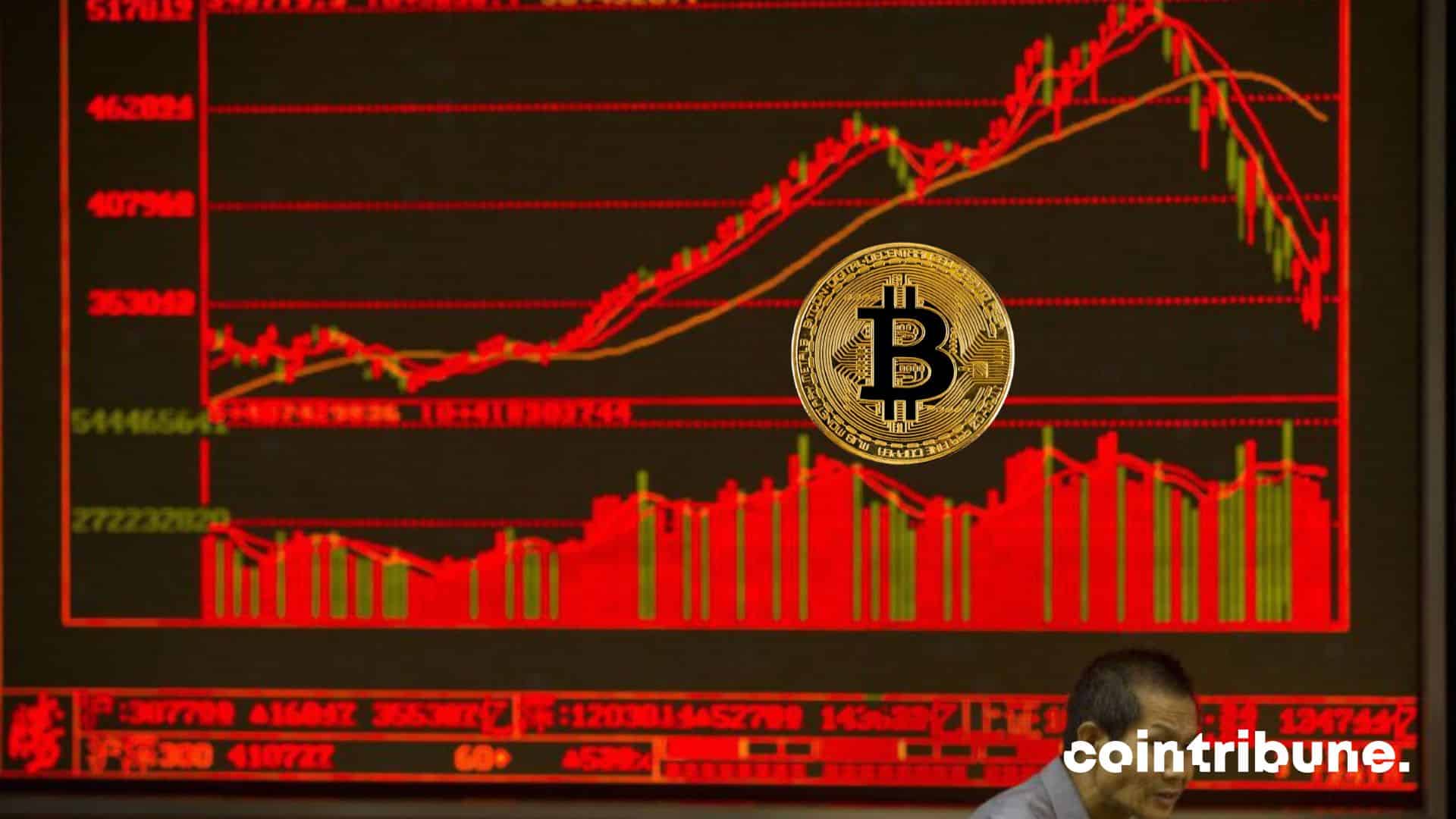

A recent data analysis reveals that bitcoin reserves held by several exchanges are falling sharply. This trend could have major implications for the crypto market. In particular, exchanges could soon run out of liquidity and see their trading volumes plummet.

Do you have liquidity on Binance Liquidity Swap? Binance has just decided to remove a total of 39 liquidity pairs from its Binance Liquidity Swap platform. The list includes PEPE Coin pairs, despite the crypto's astronomical price growth in 2023. Back to the specifics of this decision.

Binance is currently experiencing a number of setbacks. Some are regulatory, others financial. Against this backdrop of uncertainty, the crypto platform wants to bank on improving its BNB Smart Chain blockchain.

COIN: A Founder's Story is a documentary directed by Emmy Award-winner Greg Kohs. It tells the story of the creation of Coinbase, the world's first publicly listed cryptocurrency company. The film follows Coinbase's founders, Brian Armstrong and Fred Ehrsam, from the beginning of their adventure to the company's listing on the stock exchange.

Coinbase CEO Brian Armstrong said the SEC asked the platform to remove any assets other than Bitcoin from its list. All crypto assets except Bitcoin were, in fact, securities and had to be removed from the list, the regulator said. According to Armstrong, accepting this request would lead to the end of the crypto industry.

Binance, the world's largest crypto exchange platform, will be listing the very first digital dollar. For this occasion, find out everything there is to know about FDUSD, from its creator to how it works, and all the benefits the CZ-based company has to offer.

The Ripple VS SEC case has undeniably left its mark on the crypto market. The case has taken a new twist, with Judge Analisa Torres ruling in favor of the crypto company. Even if this is only a partial victory, Ripple intends to take advantage of this opportunity to broaden the prospects for XRP adoption.

At a time when FUD is reaching its peak in the cryptosphere, Binance has announced a voluntary interruption of some functionalities linked to Market orders. Although the company has promised to resolve the problem immediately, some crypto investors are in doubt.

Ripple's battle with the SEC came to an end last week. While the settlement company must feel relieved, the regulator hasn't said its last word. If CEO Gary Gensler's statements are anything to go by, it's not all over yet.

The SEC, often known for its outbursts against companies operating in the crypto market, has just made a big decision. The American regulator has just accepted BlackRock's application for a Bitcoin exchange-traded fund (ETF). This decision could mark a new turning point in the institutional adoption of bitcoin (BTC).

While networks are renowned for their security, this doesn't always prevent malicious individuals from circumventing it. Once again, Poly Network has been targeted by an attack that has compromised numerous assets. As a result, its services may be temporarily interrupted.

In a ruling that could have major implications for the privacy of crypto transactions, the US federal court has ordered cryptocurrency exchange Kraken to provide detailed information about its users to the Internal Revenue Service (IRS). This decision follows an IRS investigation into the tax compliance of Kraken users.

Many believed that Binance would come to an early end after the SEC began its attack earlier in June. But the tables have turned in recent days. The court recently ordered the two protagonists to reach an out-of-court settlement. According to the latest news, Binance.US is about to take the matter to court over a mistake made by the SEC.

On Tuesday June 20, EDX Markets, a new crypto exchange, announced the launch of its trading activities. The launch did not go unnoticed in the ecosystem, as the platform enjoyed the support of a consortium of popular institutions in the financial universe. These include Wall Street giants Fidelity Investments, Charles Schwab and Citadel Securities.

In the SEC VS Binance case, a US federal judge has rejected the request from the US regulator. Quick breakdown: Binance US assets will not be frozen. However, the judge demands further negotiations between the SEC and Binance lawyers. The goal is to define boundaries and resolve security issues.

Legal actions against crypto firm Binance have become one of the significant events in the crypto news this week. The news has caused a wave of consequences that could significantly impact the company's performance.

The legal battle initiated by the SEC against Coinbase and Binance is significantly harming the crypto industry. Some experts believe that it exacerbates the already existing risks in this sector, to the detriment of users who now have to think about protecting their interests.

The Binance-SEC case seems to be progressing very quickly. Just one day after filing a complaint against the crypto exchange, the regulator is taking a new step. The SEC is currently seeking to freeze Binance's assets and even wants to go further by blocking any access of Binance and its CEO Changpeng Zhao to the funds of U.S. clients.

The SEC has revealed a whole list of shitcoins that Binance should have registered as securities. What about Ethereum? And wash trading?

Binance is currently facing legal action brought by the SEC. The reason behind the lawsuit is the trading of tokens deemed as securities. Binance CEO has responded to these accusations, while the platform has expressed its disappointment with the filed complaint by the SEC.

After the CFTC, it's now the SEC's turn to go after Binance and its founder Changpeng Zhao (CZ).

The crypto market has promising days ahead. At least, that's what Changpeng Zhao, CEO of Binance, the world's largest cryptocurrency exchange in terms of trading volume, claims. In a recent interview with Bankless, Zhao predicted a series of successes for the industry and highlighted potential future scenarios. Let's briefly decipher his statements.