170 million users, $213 million in security... Explore in detail the 2023 balance sheet of the crypto exchange Binance.

Exchange News

The year 2023 has not been a smooth one for Binance. The crypto firm faced a number of legal challenges that put a strain on its operational performance. However, its user base did not let it down. On the contrary, its user base has grown as the company has stepped up its compliance efforts.

Wait over! Crypto exchange Mt. Gox finally reimburses its creditors and releases the funds locked for 10 years. Details here!

Almost every day, the crypto exchange Binance finds itself at the center of a new intrigue. The latest one concerns the firm's data request portal, which is said to have been breached. The situation is particularly significant because it involves potentially compromised personal data of crypto users.

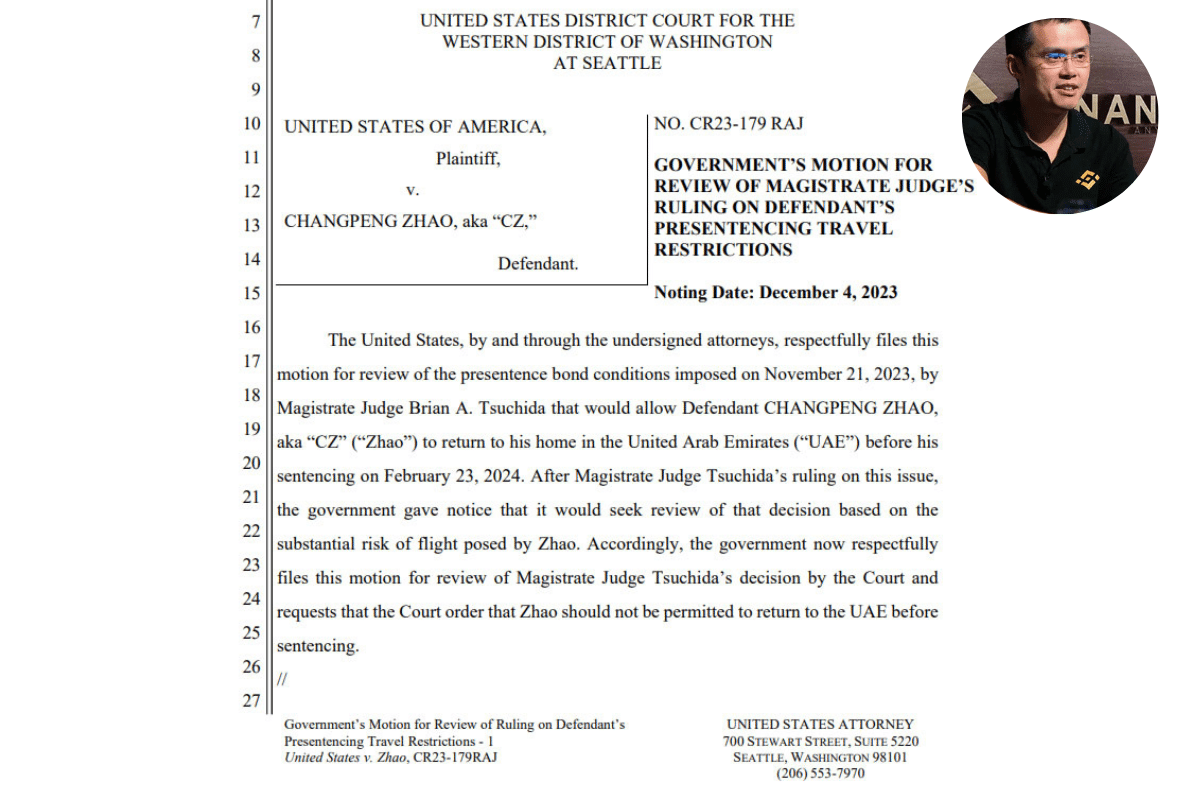

Recently, Binance has reached an agreement valued at over $4 billion to drop investigations conducted against it by the US Department of Justice (DOJ). A similar agreement, involving, like the previous one, Changpeng Zhao, the former CEO of Binance, has been concluded most recently. This time, with the Commodity Futures Trading Commission (CFTC).

It has emerged that despite its $4.3 million deal with the U.S. Department of Justice (DOJ), Binance is still facing attacks from the SEC. But apparently, Binance is not backing down. The exchange recently challenged the regulatory legitimacy of the financial regulator, particularly forcefully.

2023 marks a new era, where Binance, the titan of crypto exchanges, sees its empire wobble. Meanwhile, OKX, another key player in the market, climbs the ranks with remarkable assurance. But what could have caused this upheaval on the crypto chessboard?

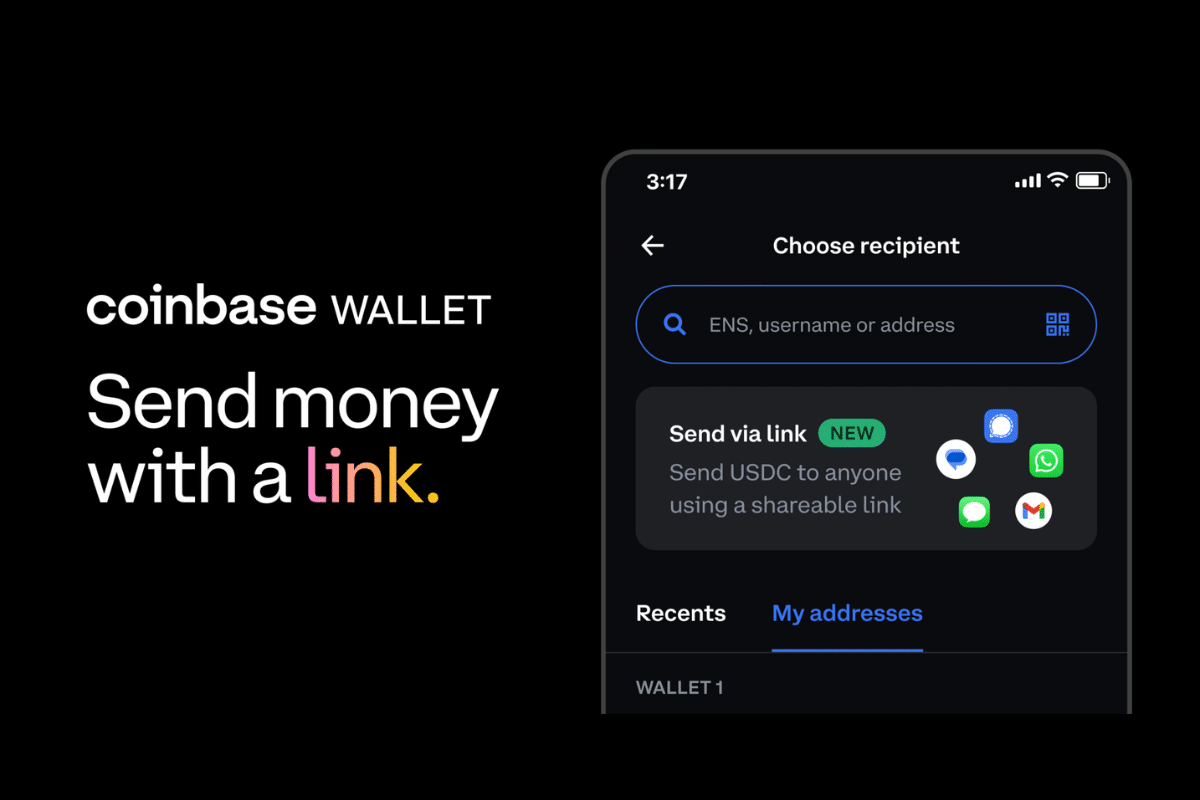

"Coinbase is revolutionizing crypto payments on social networks. Discover how this new service works in this article."

The transfer of the cryptocurrencies earned from this drop will occur in mid-January.

""""

Discover the transformation of Binance under Richard Teng: a traditional financial structure focused on transparency and compliance.

As part of the agreement he signed with the US Department of Justice (DOJ), Changpeng Zhao (CZ), the former CEO of the crypto exchange Binance, pleaded guilty. The arrangement spares the company he founded from a trial that could destroy it. As for him, he will still have to face the full force of the law. His defense lawyers have just proposed a rather unprecedented sanction option for their client.

The Binance affair takes an unexpected turn as U.S. prosecutors attempt to prevent the former CEO CZ from leaving the United States. The risk of flight looms, raising crucial questions about the future of the crypto exchange.

A judge has allowed CZ, the former CEO of Binance, to reside in the UAE awaiting his sentence. A decision that will influence the future of crypto!

The potential link between the crypto firm Binance and terrorism financing is still stirring reactions. Specifically in the United States, where Congress has called on the federal administration to shed light on this allegation. This is to be done by openly addressing certain aspects of this issue.

Yesterday, crypto firm Binance and the SEC jointly filed a lawsuit seeking a restraining order. The judge outright rejected the request. Here are the reasons given by Judge Amy Berman Jackson, who ruled on the case.

In the crypto universe, the market has just experienced a major shock. Within 24 hours, a wave of liquidations swept away $200 million, a tremor that not only shook investors but also revealed the hidden forces that govern this market. This sharp correction, following a period of uptrend, raises crucial questions about volatility and stability in the world of crypto.

After several months of litigation, the case between Binance and the SEC is far from over. The SEC has taken legal action against the world's largest crypto exchange. But Binance has challenged the SEC's authority by filing a motion to dismiss the case against them. What exactly is the status of the lawsuit? Focus on the latest news on the Binance v SEC case.

The crypto industry is rocked by a series of major departures at Binance, one of the key players in the sector. These resignations, including that of the head of Binance UK and the director of Binance France, reflect the turbulence the crypto company is currently facing. Let's delve into the behind-the-scenes of these departures.

Binance réalise régulièrement des travaux de maintenance opérationnelle des cryptos disponibles sur sa plateforme d’échange crypto. La plus récente activité de ce genre en date a concerné la crypto Tron, effectuée mercredi 18 octobre dernier.

Binance, the leading cryptocurrency exchange platform, is currently facing massive capital outflows. These movements appear to be motivated by growing concerns about regulation.

In the ever-fluctuating realm of the crypto sphere, northern lights are not uncommon. But sometimes, one star shines brighter than the rest, altering the nighttime landscape of the financial sphere. That star today is Binance with its Copy Trading introduced on October 9, 2023.

Following the FTX incident, Binance opted for transparency to maintain the trust of its hundreds of millions of users. Thus, in November 2022, the crypto giant engaged Mazars, an international auditing firm, to facilitate access to reliable data concerning customers' holdings in BTC, ETH, USDT, and more. In early October, Binance released its 11th Proof-of-Reserves (PoR) report. Details follow.

Before November 2022, no one expected the American crypto exchange FTX, valued at over $32 billion, to meet such a tragic end. Colossal losses for the company, its creditors, and its founder Sam Bankman-Fried, investments worth thousands, if not hundreds of thousands, of dollars lost for its creditors (including individuals and institutions), plummeting cryptocurrency prices (Bitcoin, Ethereum, etc.). The toll is heavy. Now that the fallen young CEO of FTX is summoned to court to answer for his actions, we share some details that will send shivers down your spine.

An expert recently insinuated that the Binance exchange may have contributed to the downfall of the high-profile FTX exchange, a story that has been making headlines. This allegation has sent shockwaves through the crypto community, prompting responses from John Deaton, Ripple's lawyer, and Changpeng Zhao (CZ), the founder of Binance.

Did Binance exacerbate the situation as FTX showed signs of fragility? That's what Nir Lahav and his group believe, and they didn't hesitate to file a class-action lawsuit accusing CZ and Binance of contributing to their competitor's downfall through their November tweets.

A New Twist in the FTX Saga! Less than 24 hours before the start of his trial, Sam Bankman-Fried, the former CEO of the crypto exchange, is once again implicated in a suspicious affair. The fallen crypto king allegedly considered preventing Donald Trump from running in the presidential elections. And SBF was reportedly willing to dig deep into his pockets to buy the American statesman, according to the latest revelations.

It's truly the end! Binance and PaySafe are now heading in opposite directions. But after the contract expiration, the cryptocurrency giant is struggling to find new banking partners in France. However, it appears that the crypto exchange may have found a solution to its problems.

No, it's not over yet! The ongoing dispute between Binance and the SEC seems far from reaching a resolution. However, it appears that BAM Trading and BAM Management, two entities of the crypto company, have been granted an extension to respond to court orders.

Bitfinex, a state-of-the-art digital asset trading platform, has announced a strategic integration with Zodia Custody, a leading digital asset custodian backed by Standard Chartered, SBI Holdings, and Northern Trust. The integration will allow Zodia Custody clients to trade on Bitfinex while their assets remain securely held…