The Bybit EU platform finally launches its long-awaited "Recurring Buy" feature. European users can now schedule recurring cryptocurrency purchases directly from their bank card, at a daily, weekly, or monthly frequency. A revolution for DCA enthusiasts.

Exchange News

In 2026, the crypto universe will change its face. Binance announces a historic shift driven by different factors. All the details here!

Binance has suspended withdrawals via Visa and Mastercard for its users in Ukraine. The measure, linked to its fiat provider Bifinity, comes amid increasing regulatory pressures in Europe. This decision complicates access to funds for Ukrainians, already weakened by war and financial restrictions.

Coinbase pays for justice, not ransom. Data leak, arrest in India, bounty for whistleblowing... courtroom crypto-comedy in several acts.

Coinbase Institutional sees in 2026 much more than a simple market rebound: a strategic shift. In a 70-page report published in mid-December, the platform anticipates a deep integration of cryptos at the heart of global finance. While this year has been marked by volatility and persistent regulatory uncertainties, Coinbase is betting on a new emerging phase where regulation, institutional adoption, and new uses will sustainably reshape the crypto landscape.

Caroline Ellison has left federal prison for community confinement after serving part of her sentence for her role in the FTX collapse, as legal proceedings and bankruptcy payouts continue.

Over the past year, OKX has been steadily expanding across Europe—we're listening to what traders want and building the products they need. From advanced trading tools to deeper liquidity and new institutional partnerships, Europe has quickly become one of the most important regions driving OKX’s global growth.

One week after the launch of the new version of Read2Earn, Cointribune steps up the pace. This time, the program is enriched with a special quest in partnership with the crypto exchange Kraken, one of the most recognized players in the sector. Objective: to help you better understand how to invest in crypto with complete peace of mind, while giving you access to an exclusive contest with rewards at stake.

The continuous decline of bitcoin reserves on Binance attracts the attention of analysts as the asset trades near $93,000. The latest data from CryptoQuant confirms an unprecedented drop, raising questions about the current market structure. This movement, far from indicating immediate weakness, invites examination of what drives these fund outflows and what they truly reveal about bitcoin's dynamics.

In a DeFi market seeking stability, the launch of StandX on November 24, 2025, does not go unnoticed. This new DEX, dedicated to perpetual contracts, introduces an automatic yield stablecoin, without staking action. Supported by a team from Binance Futures and Goldman Sachs, the project claims a community-driven and self-financed approach. Unlike classic models, StandX aims to establish itself in a sector still largely dominated by centralized platforms.

Binance redistributes roles: Yi He takes the stage. Should crypto investors rethink their strategy? Details here!

Momentum around Coinbase is rising as the company enters a new phase of financial stability and public-sector experimentation. Latest data show revenue increasing while costs remain controlled. And as expected, this combination has created a sturdier foundation than in earlier market cycles.

Binance records a marked decrease in its Bitcoin and Ethereum reserves. At the same time, stablecoin deposits reach unprecedented levels. This surprising contrast draws the attention of analysts, who see a strong signal: the market is not disengaging, it is repositioning.

Upbit admitted a wallet flaw led to a recent hack and authorities suspect the North Korean Lazarus group is behind the attack.

The regulated MiCAR exchange platform multiplies attractive campaigns to entice European users, featuring record cashback, daily draws, and exceptional welcome bonuses.

Coinbase Ventures has just unveiled its investment strategy for 2026, outlining the strong points of a changing Web3 ecosystem. Nine key areas have been identified, revealing the sectors where capital could soon flow. More than a simple manifesto, this roadmap lays out the technological and economic bets of one of the most influential players in the crypto industry, a strong signal sent to developers, investors, and builders of the decentralized web.

On 26 Aug 2025, BYDFi, a Singapore-based crypto exchange, sealed a multi-year partnership with Newcastle United, a flagship Premier League club. More than a publicity move, this alliance between football and blockchain marks a strategic push into the global market. In a competitive sector, BYDFi is betting on the media power of sport to position itself as a central player in crypto. It is a strong signal sent to the industry and perhaps a turning point in the battle between exchanges.

Trading activity on crypto-based forecasting platforms has climbed sharply this year, with services like Kalshi and Polymarket seeing noticeable growth. Amid this upward trend, Coinbase appears to be building its own prediction-market site. Images shared by a tech researcher suggest the project is already taking shape and may involve support from Kalshi.

Nearly ten years after its spectacular collapse, Mt. Gox resurfaces. Indeed, the former Japanese bitcoin giant suddenly moved over 10,000 BTC, worth $953 million, after eight months of silence. This massive transfer rekindles fears of a large-scale liquidation. Worse still, creditors, already battered, will have to wait until 2026 to hope for reimbursement. Enough to revive tensions around the oldest scandal in crypto history.

The Bybit EU exchange, the world’s second-largest platform by transaction volume, is launching a highly attractive new promotional campaign for European users. The flagship offer right now: deposit 100€ and receive up to 70 USDC as a bonus. This initiative is part of a broader strategy to conquer the European market, now regulated by the MiCA (Markets in Crypto-Assets) regulation.

No bridges but with panache, Pact Swap slashes fees and smashes complexity: crypto finally discovers a DEX that does not chain its users.

Coinbase is selling its tokens left and right, Monad is rowing toward the masses, and crypto is finally tasting the joys of fair auctions... Americans included. And with no fees, please!

Sam Bankman-Fried, former fallen crypto icon, plays his last card before the justice system. Sentenced to 25 years in prison for fraud, the former CEO of FTX is contesting his trial before a federal appeals court in New York. His defense argues that the company was not insolvent and that clients could have been reimbursed if time had not run out. A strategic appeal that could disrupt the legal reading of the collapse of one of the largest crypto empires.

Coinbase is pushing to expand its stablecoin business through a potential $2 billion acquisition of BVNK, reflecting growing interest in crypto payment systems.

In October, decentralized platforms reached a historic milestone. More than $1.3 trillion in perpetual contracts were traded in one month. A symbolic threshold, never reached before, illustrating a profound shift in the crypto ecosystem. Long dominated by centralized platforms, the derivatives market is witnessing a new dynamic, driven by DeFi. This rapid growth is not by chance but the result of a structural change in usage, tools, and trader confidence.

While the small fry are stirring, crypto whales quietly pile up BTC on Binance... What if the real maneuvers are unfolding in the silence of order books?

The cryptocurrency ecosystem has just experienced a major turning point with the announcement of a strategic partnership between Kraken, one of the most respected exchange platforms in the world, and Circle, the undisputed leader in stablecoins. This alliance, formalized in September 2024, promises to transform the user experience for the USDC (USD Coin) and EURC (Euro Coin) stablecoins on the Kraken ecosystem.

Kraken has just reached a major new milestone by launching Kraken Perps (Kraken perpetual contracts), available since September 11, 2025, in select regions for eligible clients worldwide. This initiative marks a significant democratization of crypto derivatives trading, previously reserved for experienced traders.

On October 16, 2025, Bybit EU officially launched its Rewards service, a fixed-term product designed for the Bybit EU Earn platform. This initiative marks an important step in the exchange's strategy to conquer the European market, six months after obtaining its MiCA license from the Austrian financial authority (FMA) in May 2025.

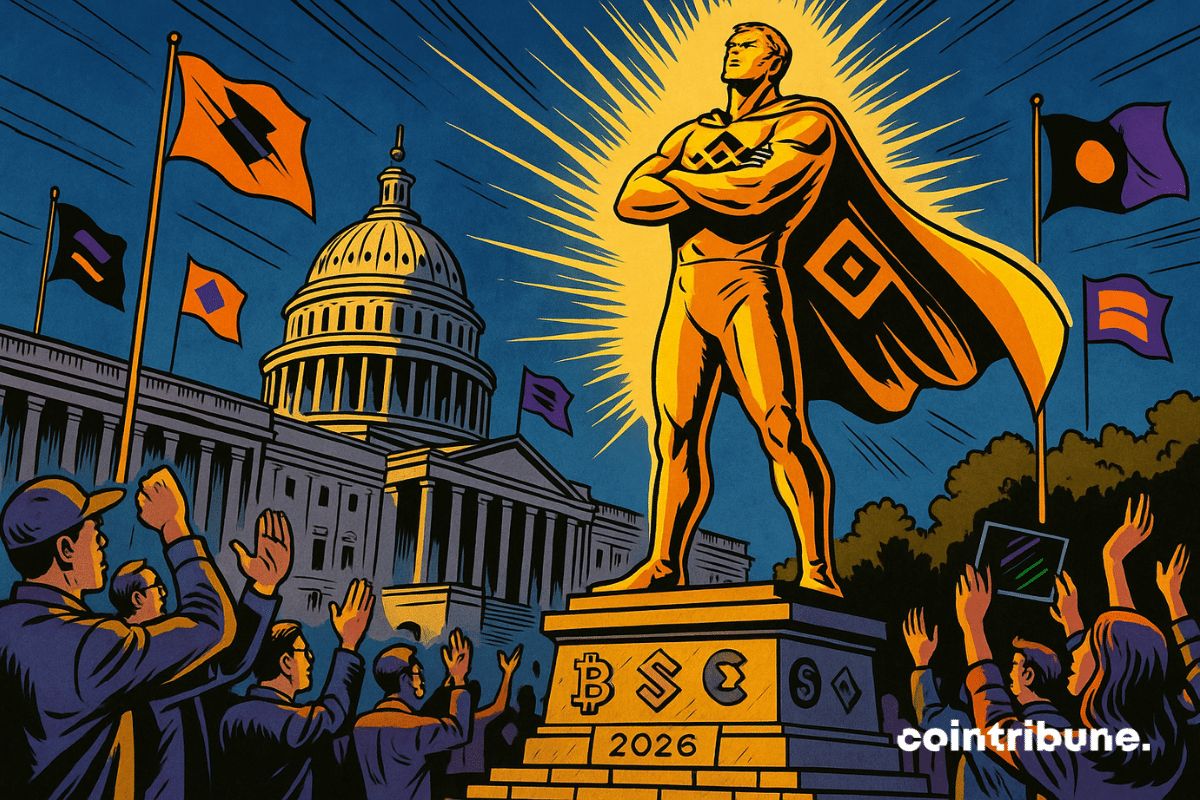

This Tuesday, a 4.27-meter golden statue depicting Changpeng Zhao, founder of Binance, briefly took its place in front of the Capitol in Washington. This spectacular installation comes a few days after the presidential pardon granted by Donald Trump to CZ, convicted in 2023 for violations of anti-money laundering laws. In a climate where crypto figures are increasingly occupying public space, this unexpected tribute marks a symbolic turning point between justice, political power, and the cult of blockchain innovation.