Crypto is undergoing a revolution in 2025: fundraising has jumped by +150% in one year, smashing all records. Which projects attract billions? Which sectors are booming? Analysis of a historic growth that is redefining the digital economy and opening unprecedented opportunities for investors.

Crypto News

While the Bitcoin market remains under pressure, an analyst suggests that the bottom may have been reached. Contrary to the climate of distrust, he envisions a rebound towards 100,000-110,000 dollars, reigniting speculation about a trend reversal. This scenario, based on precise technical indicators, contrasts with the prevailing sluggishness and captures investors' attention.

Ethereum is about to revolutionize its network with a gas limit raised to 180 million. Anthony Sassano reveals how this update could reduce fees and boost scalability! A major breakthrough for the crypto ecosystem.

After 18 days in the extreme fear zone, the crypto market shows a first sign of relief. The Crypto Fear & Greed Index rises slightly, finally leaving its lowest level. This rebound occurs while November, traditionally favorable to Bitcoin, ends in uncertainty.

Ripple USD has entered a new phase of market growth as it surpasses the one-billion supply mark on Ethereum. RLUSD’s fast expansion has strengthened its position among major stablecoins, showing steady demand across trading platforms, wallets, and payment services. For an asset less than a year old, this milestone represents a notable achievement for the dollar-pegged stablecoin.

What if the market was massively wrong about bitcoin? For André Dragosch, head of research at Bitwise Europe, the current context oddly resembles that of March 2020, during the crash caused by the pandemic. In a tense post-halving climate and facing contradictory macroeconomic signals, he believes bitcoin today offers one of its best risk/reward profiles since the health crisis. This statement shakes certainties and reignites the debate on the timing of market entry.

Do Kwon, former DeFi star, is now at the center of an unprecedented judicial scandal. Less than two years after the collapse of Terra-Luna, which swallowed $40 billion, he is trying to avoid a heavy sentence in the United States. His goal is to convince the court to limit his sentence to five years in prison. Two weeks before his hearing, this request reignites debates about the responsibility of crypto founders in the face of the devastating consequences of their projects.

Barcelona faces criticism after partnering with little-known crypto firm ZKP, raising concerns that fans could be exposed to high-risk digital tokens.

The crypto industry has just proven it can change lives. After the devastating fire in Hong Kong, the deadliest in 80 years, Bitget, Binance, KuCoin, Tron and many other players joined forces to raise $3.2 million. How will these donations transform humanitarian aid?

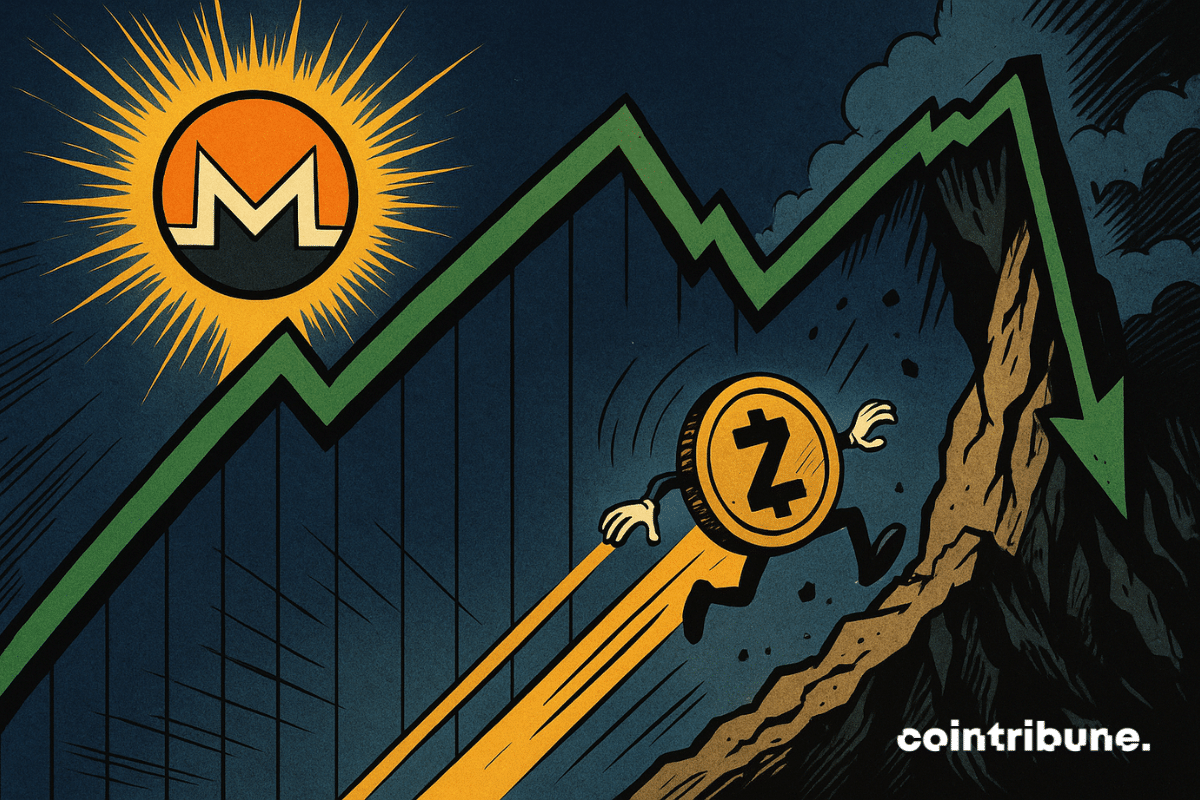

Monero (XMR) gained more than 23% this week, while Zcash (ZEC) dropped by nearly 25%. Such a gap highlights the high volatility of the privacy coins market, in a context of low activity related to Thanksgiving. This divergence between two key privacy assets raises questions about the internal dynamics of the sector.

XRP shows an increase of 0.85% at $2.22, but its trading volume collapses by 31.87%. A puzzling paradox that raises questions: Are crypto traders losing confidence despite rising prices? Analysis of the numbers and stakes to understand what is really at play behind this trend.

Bitcoin still under $100,000... but the crypto industry is rejoicing. Whales sell, small buyers buy, hopes rise: what if the crypto winter was just an illusion?

After a historic series of 18 flawless days, Solana ETFs have just marked their first halt. The 21Shares Solana ETF faced massive withdrawals, dragging the entire sector into the red. Does this sudden reversal mark the end of the euphoria around SOL?

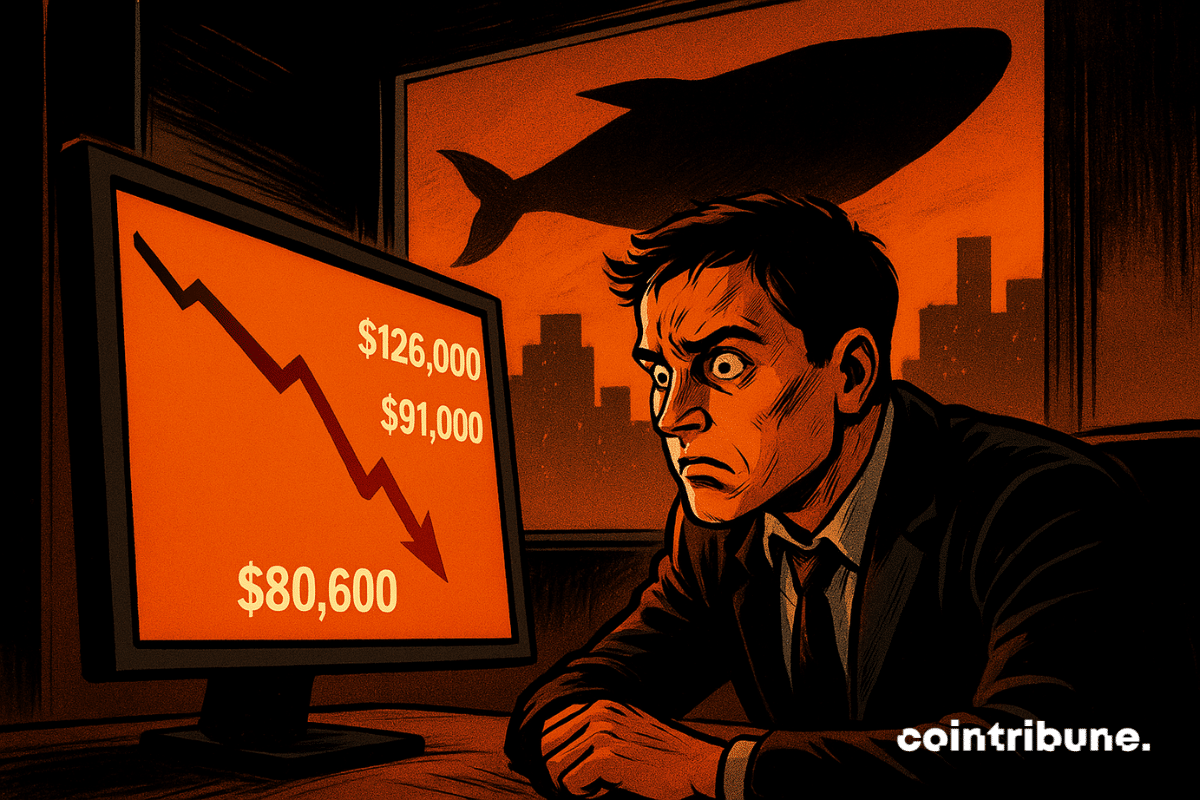

Fresh selling from large Bitcoin holders is putting renewed pressure on an already shaky market, as traders deal with one of the steepest pullbacks of the year. Price softness, rising exchange inflows, and cautious positioning across major trading venues all point to a market still trying to find its footing. Analysts at CryptoQuant say continued whale deposits could push Bitcoin lower if the pattern persists.

The imminent launch of a structured product on bitcoin by JPMorgan is causing reactions. For part of the crypto community, this is not just a simple financial innovation, but a targeted offensive against actors like Strategy. As bitcoin gains ground as a reserve asset, the divide between traditional finance and pro-BTC strategies becomes clearer. Behind the apparent neutrality of the markets, some denounce an attempt to influence aimed at weakening the companies most exposed to the asset.

Bhutan surprises by entering the Ethereum universe. This small Himalayan state staked 320 ETH, nearly one million dollars, via the Figment validator, thus asserting a clear strategy of integration into the blockchain. Far from a simple investment, this initiative is part of a broader technological shift, where digital sovereignty and public infrastructure meet on Ethereum. A rare approach at the state level, redefining the contours of national engagement in the crypto ecosystem.

After months of tension, BTC finally crosses $90,000, offering unexpected relief to BlackRock Bitcoin ETF holders. How does this historic rebound redefine the crypto investment landscape? Dive into the analysis of a turnaround that changes everything for institutional and retail investors.

Upbit’s Solana wallet was breached, prompting the exchange to pledge full reimbursement and move remaining assets to secure storage.

Bitcoin and USDT maintain an inverse relationship that directly influences crypto market movements. According to Glassnode, this negative correlation could well dictate the trends towards the end of 2025. An exclusive analysis that sheds light on investors' strategies and projections for December. Not to be missed.

The digital identity project World, co-founded by Sam Altman, suffers a major setback in Southeast Asia. Thai authorities demand the immediate deletion of biometric data from over a million users. A decision that rekindles the debate on privacy protection in the age of artificial intelligence.

An ETF on a privacy coin? Grayscale dares where no one has gone before. Discover how Zcash could shake the US market.

While Bitcoin nears the highs, XRP quietly courts Wall Street with its ETFs... What if the real crypto maneuvers are played far from the spotlight? To watch.

Growing confusion over Polygon’s token identity has prompted project leaders to reconsider a decision made just a year ago. Concerns from everyday users and long-time holders have reopened the discussion about whether the network should drop its current POL ticker and restore MATIC, the name many still recognize.

XRP just recorded one of its strongest on-chain activity spikes in months. A sudden 1.48 billion surge in payment volume pushed network usage to its highest level in weeks and coincided almost perfectly with an $8 million increase in market capitalization

When more than 8% of Bitcoin changes hands in a few days, it is never just a simple technical twitch. It is a massive shift of digital wealth, almost a silent earthquake that speaks volumes about the market's pulse. This week, the network experienced one of its most striking supply movements since the creation of the protocol. A true reshuffling of the cards, while the markets anxiously await the Fed's decision in December.

S&P Global Ratings has just downgraded USDT to its lowest stability level. A rare decision targeting the world’s most used stablecoin and raising doubts about its ability to maintain its peg to the dollar. At a time when regulators are tightening the noose around cryptos, this evaluation revives debates on the solidity of Tether’s reserves and the systemic risks stablecoins pose to the entire market.

Trump buys back his WLFI token relentlessly. Between crappy shitcoin and dwindling fortune, the family crypto empire is rocking hard. And to think they saw it as digital freedom...

Bitcoin has fallen more than 22% in one month, casting doubt on its momentum. Yet, behind this pullback, several signals point to a possible return to the symbolic threshold of $112,000. While markets are restless, institutional and retail investors watch four key factors likely to revive the bullish trend. In a context of macroeconomic uncertainty and tension in derivative markets, the scenario of a rebound can no longer be ruled out.

Bitcoin is crashing, but K33 Research experts see a golden chance. After a 36% drop, is the sell-off approaching saturation? Discover why this correction could be the relative buying opportunity of the year and what analysts forecast for 2026.

Bitcoin crash: Strategy reassures investors with a 70-year plan. New era or last gasp? Analysis of a risky bet.