Amidst a disheartening stagnation of Bitcoin and a rush towards gold, the markets are shaken by this dual phenomenon where each rise in gold seems to crush the weak hopes of BTC.

Crypto News

Bitcoin has been navigating a narrow corridor for weeks, between $93,300 and $98,500. A precarious, almost hypnotic balance, where each oscillation seems to hold its breath. Traders scrutinize the charts, indicators flash silently. But this stagnation is merely an illusion. Beneath the surface, the numbers whisper a different truth: consolidation could soon shatter. The burning question is: how long will this calm last before the storm?

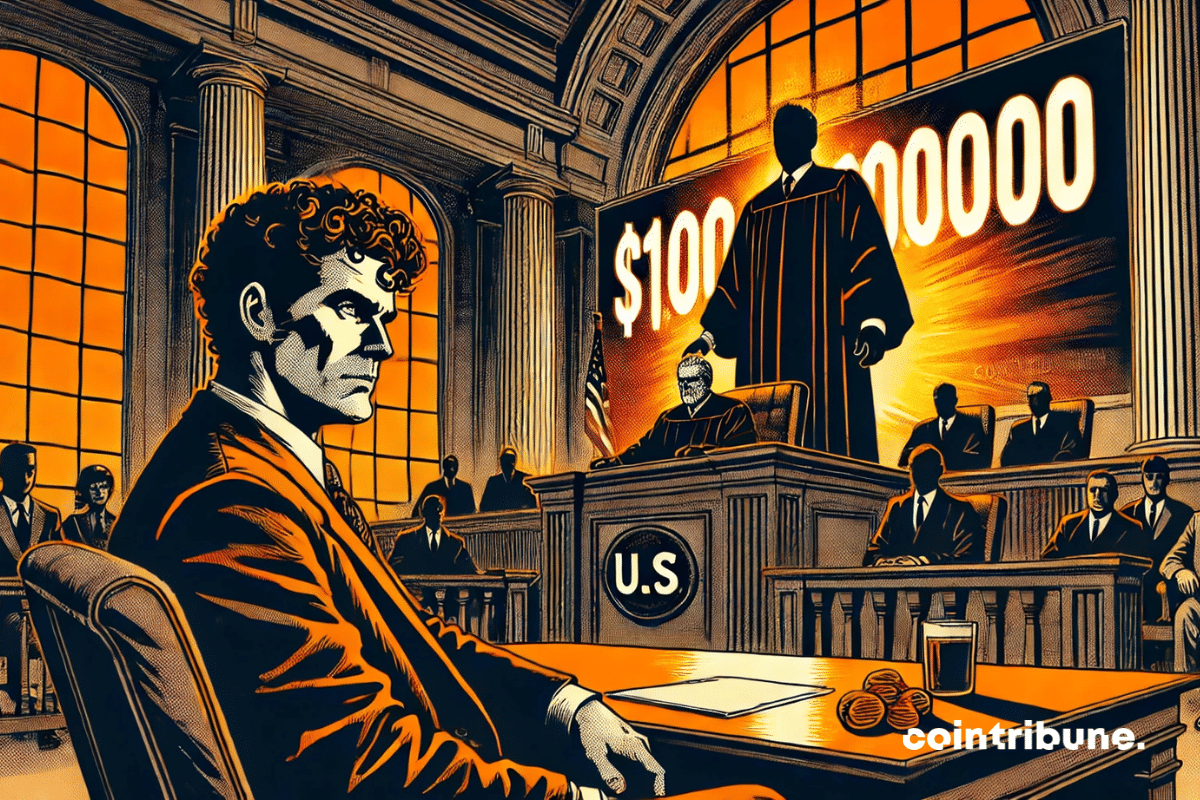

A New York court has just ordered the permanent confiscation of the assets of Sam Bankman-Fried (SBF), the former CEO of FTX, with a total value nearing one billion dollars. This historic decision comes as the crypto exchange has just begun to repay its first creditors.

Access to cryptocurrencies remains a barrier for the general public, often deterred by the complexity of wallets and private keys. However, the mass adoption of Bitcoin depends on the ability of companies to make its use as seamless as a traditional Web2 service. In this dynamic, Google seems to want to play a key role by facilitating the integration of Bitcoin wallets through its own ecosystem. An initiative unveiled by Kyle Song, a Web3 specialist at the tech giant, which paves the way for broader BTC adoption. This announcement raises as many hopes as questions about the future of decentralization.

"We, central bankers, should study it and explore the technology on which it is built. Studying Bitcoin will not harm us – on the contrary, it will strengthen us," said Aleš Michl, governor of the Czech National Bank (CNB). These statements come three weeks after he presented, during a CNB board meeting on January 30, a proposal to create a "test wallet" in bitcoin. This initiative aims to analyze this highly volatile asset and experiment with its use in the central bank's reserves.

As Bitcoin hovers around 96,000 dollars, Ki Young Ju, CEO of CryptoQuant, asserts that a major correction should not jeopardize the bull run in 2025. This analysis comes amid a context of growing institutional adoption, particularly by U.S. states.

Binance US announces the resumption of deposits and withdrawals in United States dollars (USD), ending 18 months of suspension of its services. This reactivation comes as the regulatory framework for cryptocurrencies is becoming clearer in the United States.

Bitcoin sways under a threatening sky, and nearly 300 million dollars vanish in the storm. Traders, like tightrope walkers, are scrutinizing the bar at 96,000 dollars.

MicroStrategy navigates like an insatiable giant. As bitcoin hovers around $96,000, the firm led by Michael Saylor has just unveiled a new bold move: a $2 billion convertible bond issuance aimed at boosting its bitcoin treasury. A daring, almost provocative strategy that raises questions as much as it fascinates. How has a traditional company transformed into a crypto behemoth? And above all, how far will this quest go?

The Hyperliquid token (HYPE) experienced a decline of nearly 6% over the past 24 hours, despite the recent launch of HyperEVM, an update aimed at expanding the decentralized finance (DeFi) capabilities of the platform. This price drop occurs in a context where a positive market reaction was expected following this significant innovation.

The largest NFT marketplace in the world, OpenSea, has just announced the suspension of its new XP rewards system, introduced on January 28, following a wave of criticism from its community. This decision comes at a particular time when the platform is trying to reinvent itself with the recent launch of its SEA token.

According to the latest data from Santiment, Ethereum (ETH) shows encouraging signs of recovery, particularly due to a significant movement of holders who are massively withdrawing their ETH from exchanges.

Periods of calm in the Bitcoin market are often misleading. Indeed, when volatility collapses, it gives way to brutal amplitude movements, capable of surprising both seasoned investors and short-term speculators. Today, several technical indicators suggest a scenario similar to that of August 2023: a temporary drop in BTC before a major rebound that could take it up to $85,000. An analysis conducted by CryptoQuant reveals that the current market conditions resemble a past configuration where prolonged stagnation led to massive position liquidations before giving way to a strong bullish trend.

The long-awaited refunds from FTX officially began on February 18, 2025, at 3:00 PM UTC, with already 800 million dollars distributed to 162,000 accounts. Many users confirm having received their funds through the Kraken platform.

The crypto market is going through a new period of turbulence, and Solana (SOL) is directly suffering the consequences. In 24 hours, the cryptocurrency has dropped by 6.2%, reaching $166.42, its lowest level since mid-December. This decline occurs in the context of controversies related to memecoins based on its blockchain, notably LIBRA.

OpenSea, the world leader in the NFT market, announced on February 13 the launch of its own token, called SEA. This major decision comes with a complete overhaul of the platform that has dominated the sector since 2017.

The crypto universe has just experienced a new earthquake. Pump.fun, a platform known for its express rises of ephemeral tokens, today accuses internal actors of having manipulated its ecosystem. A revelation that sheds stark light on the structural flaws of a sector that is nonetheless accustomed to turbulence. Far from the usual denunciations of external fraud, it is the heart of the system that seems to have trembled here. How could a platform boasting transparency become the stage for such a scenario? And what does this episode reveal about the urgency to reinvent the rules of the game?

The proliferation of cryptocurrencies is out of control. Is this the last stand before the purge and the triumph of bitcoin?

Investors are massively taking short positions on the Solana (SOL) cryptocurrency as the ecosystem faces a series of scandals related to memecoins. Data from exchange platforms reveals a significant increase in bearish bets, reflecting a growing sentiment of distrust towards the network.

Crypto exchange-traded products (ETPs) saw their first net capital outflows in 2025, ending a streak of 19 consecutive weeks of inflows. According to a recent report published on February 17, crypto ETPs experienced a loss of $415 million during the last trading week, with bitcoin leading the outflows!

Changpeng Zhao (CZ), co-founder of Binance, and Yi He, head of customer service, firmly denied speculation regarding a potential sale of the world's largest cryptocurrency exchange. These statements come amidst a backdrop of regulatory tensions and significant asset movements.

Bitcoin is once again at a critical turning point. After weeks of consolidation in a narrow range, leading technical indicators suggest a bearish scenario that could shake the market. According to Material Indicators, several death crosses have appeared on the daily BTC charts, a signal generally associated with an increase in selling pressure. This setup is worrying traders, especially as the $92,000 level may be tested as support. Should we expect a simple temporary correction or a more prolonged downward phase?

During the week of February 10 to 14, 2025, Bitcoin and Ethereum ETFs experienced massive capital outflows, exceeding 700 million dollars. This phenomenon raises concerns among investors and significantly impacts the price of cryptocurrencies. What factors led to these withdrawals and what are the consequences?

The intoxication of power, the bite of scandal. Accused of fraud, Javier Milei wavers, pursued by justice and abandoned by a betrayed nation. The storm is brewing in Argentina.

Bitcoin continues to assert itself. This time, twelve American states are making headlines with a colossal investment of 330 million dollars in Strategy, formerly known as MicroStrategy. This move marks a major turning point in the integration of crypto into institutional portfolios.

Bitcoin (BTC) continues to test traders' patience as its price stagnates below the $100,000 mark. Between potential bullish pressure and signs of weakness in the markets, here are the 5 key elements to watch this week.

The crypto market is often driven by spectacular announcements and hopes of institutional adoption. Indeed, one of the latest events, the filing of a Cardano ETF (GADA) by Grayscale, triggered a wave of optimism around the ADA token. This caused a 20% jump in just a few days. However, this euphoria was not enough to push Cardano to the next level: its price quickly encountered a key resistance before retreating.

The crypto market is currently experiencing a period of uncertainty, as Bitcoin, which had recently reached historical highs, is showing signs of weakness. Experts from CryptoQuant have identified concerning indicators suggesting a possible impending bearish phase.

Investors in Ether (ETH) are closely monitoring developments in the options market, where a clear majority of contracts bet on a price increase in the medium term. However, this bullish trend is tempered by persistent volatility and a critical threshold at $2,600, below which $500 million in liquidations could be triggered. As the February and March expirations loom as a major turning point, the market oscillates between hope and caution.

Amid revolutionary announcements, technological advancements, and regulatory turbulence, the crypto ecosystem continues to prove that it is both a territory of limitless innovations and a battleground for regulatory and economic challenges. Here is a summary of the most significant news from the past week surrounding Bitcoin, Ethereum, Binance, Solana, and Ripple.