Neutral Fear & Greed Index, Decline Of Capital: Will Bitcoin Finally Bounce Back?

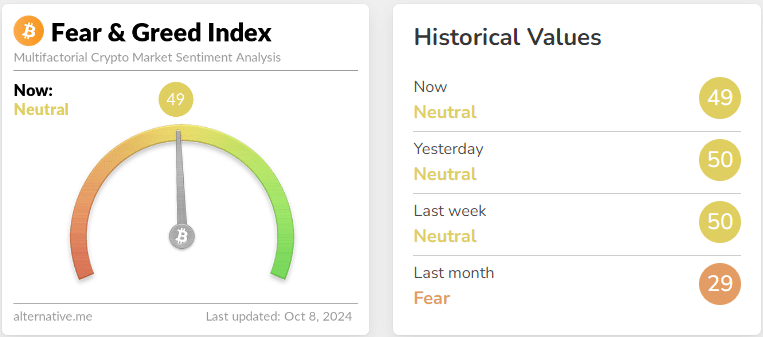

After a series of relentless fluctuations, the crypto fear and greed index is back in neutral territory. This return to balance after weeks of tension indicates a relative stabilization of the market. However, this calm could quickly dissipate, paving the way for unexpected price movements. In this context, analyzing current resistances and technical indicators is crucial to anticipate Bitcoin’s next moves.

Bitcoin: between resistances and buying opportunities

The famous bitcoin, after having tested several resistances – including one at $64,000, is facing a delicate situation. The recent fluctuations between 66.5k and 60k have not caused an investor panic, but selling pressure remains palpable.

Technical indicators are clear: bitcoin is navigating troubled waters, with an RSI showing a neutral reading of 52, and an OBV betraying stable sales over the past two weeks, despite a slight recovery.

For thrill-seekers, the zone of 58k to 60k dollars could well become a real eldorado for buyers. Here are three key points to watch:

- A drop to 58k-60k represents a great buying opportunity – how to buy Bitcoin ;

- A move above 66k-67k could mark a shift in sentiment towards greed ;

- The CMF, pointing at -0.09, continues to indicate strong capital outflows, reinforcing the idea that the market is still fragile.

Crypto market: towards a recovery or a pullback?

On the side of the crypto market in general, the trends observed on the dominance of USDT deserve special attention. Traditionally, an increase in Tether’s dominance, a company that has just celebrated its 10th anniversary, signals that investors prefer to take refuge in stablecoins, a sign of distrust towards the market. Currently, this dominance has been increasing since March, reflecting intensified caution among investors.

However, the threshold of 5.79% constitutes a resistance, and a return to the downside could indicate a short-term recovery for Bitcoin and other top cryptos. If this resistance is broken, traders will need to remain vigilant and adjust their strategies according to future market trends. As noted in a recent report, a correction could well revive interest in long positions on BTC.

These positions could be accentuated by the technological advancements that should arrive by the end of the year and could increase adoption – as stated by Gracy Chen, Bitget CEO:

By the end of 2024, the DeFi space is anticipated to advance with the development of more complex financial products and services emerging. (…) In terms of Bitcoin scalability solutions, innovations such as Ethereum 2.0 and Layer 2 solutions have increased transaction speeds and reduced costs, making cryptocurrencies more suitable for everyday use. Bitcoin’s Layer 2 solutions are expected to take shape by early 2024, expanding its range of applications.

In summary, this analysis emphasizes that the return of the crypto Fear & Greed index to neutral territory offers a new market reading, reminding the importance of monitoring technical and sentimental data to anticipate upcoming fluctuations.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.