Negative flows for Bitcoin ETFs: $642 million evaporated in 24 hours

Spot Bitcoin ETFs have seen significant outflows in recent days, with the Grayscale Bitcoin Trust (GBTC) recording a record loss of $642.5 million in a single day. However, analysts remain optimistic about the future of these innovative financial products.

GBTC Loses $642 Million in One Day

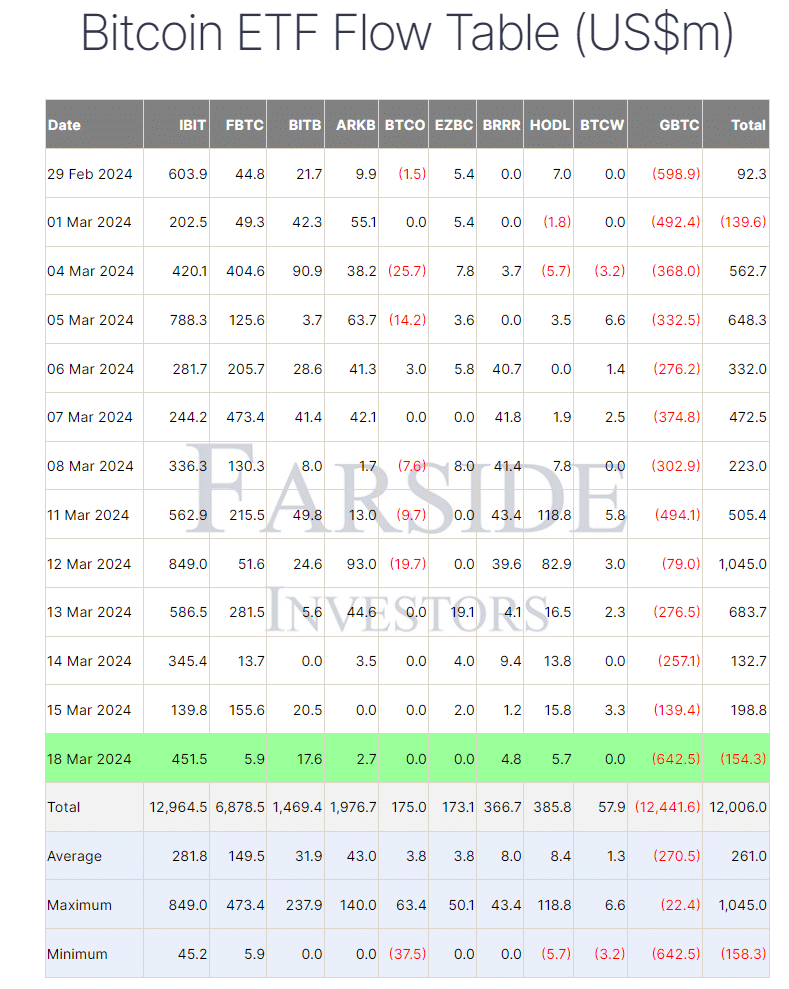

The market for spot Bitcoin ETFs is going through a tough period, as evidenced by the recent massive capital outflows. On March 18th, the Grayscale Bitcoin Trust (GBTC) experienced record outflows of $642.5 million, marking its largest single-day outflow since converting to a spot ETF on January 11th.

At the same time, inflows into the second-largest fund, Fidelity’s Bitcoin ETF, dropped to a historically low level of only $5.9 million.

These figures, provided by Farside Investors, highlight the current volatility of the crypto market. In total, spot Bitcoin ETFs recorded net outflows of $154.3 million on March 18th.

This trend occurs in the context of a decline in BTC prices, which traded at $65,875 at the time of publication, down 10.5% from its last high on March 14th at $73,797.

Several factors are cited to explain this correction, including the slowdown in Bitcoin ETF flows, the approach of the next “halving” (reducing mining rewards by half), and the imminent FOMC meeting of the U.S. Federal Reserve scheduled for March 20th.

Despite these headwinds, some analysts remain confident in the potential of spot Bitcoin ETFs. Grant Englebart, vice president of Carlson Group, revealed that only a handful of advisers from his company had seen clients allocate funds to these products, with an average investment ratio of 3.5% of the total funds.

A sentiment shared by Eric Balchunas, ETF analyst at Bloomberg, who points out that the incoming flows are mainly from early users already familiar with bitcoin.

Unbroken Growth Potential for Spot Bitcoin ETFs

While massive outflows from GBTC can be concerning, it is important to put their long-term impact into perspective. With about 370,000 bitcoins still held by the fund, Grayscale has a significant margin to maneuver.

“GBTC had 378,000 bitcoins and sold 9.6 000 bitcoins today. The good news is that they can’t continue at this rate for long,” commented Allesandro Ottavani, a crypto market specialist, on Twitter.

Interest in spot Bitcoin ETFs remains strong, as evidenced by the recent approval of nine new funds by major players such as BlackRock and Fidelity. The conversion of the Grayscale Bitcoin Trust into a spot ETF on January 11th marked an important milestone in democratizing these products among institutional and individual investors.

While financial advisers are not yet actively soliciting their clients to invest in Bitcoin ETFs, experts believe that incoming flows could intensify in the future as these products gain in maturity and visibility.

The current market volatility should not overshadow the long-term potential of these innovative financial instruments, which pave the way for easier exposure to bitcoin and its underlying blockchain.

Despite the record outflows recorded by GBTC and the temporary drop in the price of bitcoin, spot Bitcoin ETFs have bright days ahead. The optimism of analysts and the growing interest from investors suggest a promising future for these products, which are revolutionizing the way market participants access the leading cryptocurrency.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Passionné par le Bitcoin, j'aime explorer les méandres de la blockchain et des cryptos et je partage mes découvertes avec la communauté. Mon rêve est de vivre dans un monde où la vie privée et la liberté financière sont garanties pour tous, et je crois fermement que Bitcoin est l'outil qui peut rendre cela possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.