Michael Saylor Doesn't Stop: +6,556 Bitcoin For Strategy

While bitcoin remains around 85,000 dollars, Strategy, the company led by Michael Saylor, continues its ambitious accumulation strategy. In one week, the company invested more than 550 million dollars to strengthen its already colossal position in the crypto queen.

Strategy continues its massive bitcoin buying spree

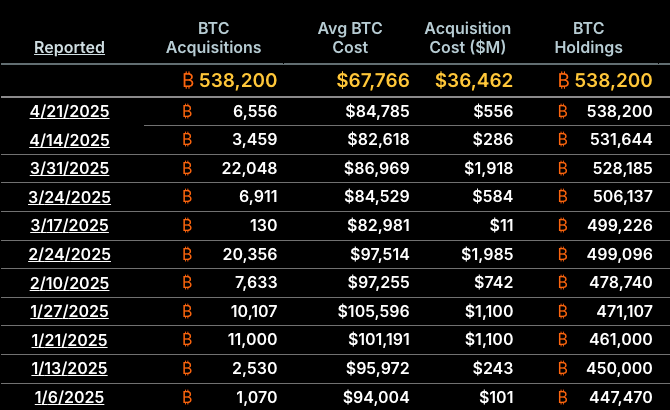

The frenzy of bitcoin purchases by Strategy is not slowing down. Michael Saylor’s company, already known as one of the largest institutional holders of BTC in the world, announced that it acquired 6,556 bitcoins between April 14 and 20, 2025. Total transaction amount: 555.8 million dollars, an average price of 84,785 $ per bitcoin.

With this acquisition, Strategy brings its total holdings to 538,200 BTC, for a cumulative purchase value of 36.5 billion dollars, an average cost of 67,766 dollars per unit! This represents 1.2% of its total holdings.

A strategy financed by the stock markets

This new investment in bitcoin was made possible thanks to fundraising from the sale of common shares and preferred securities. Strategy thus issued 1,755,000 shares for 547.7 million dollars, and 91,213 series A preferred shares for 7.8 million dollars.

After a brief pause in its purchases in early April, Michael Saylor seems to be relaunching his aggressive accumulation strategy. Since the beginning of 2025, Strategy has already acquired 91,800 bitcoins, representing 17% of its total reserves.

Michael Saylor still as bullish on bitcoin

The company thus confirms its long-term vision of BTC as a strategic store of value. For Michael Saylor, every dip is an opportunity. The businessman now relies on bitcoin’s programmed scarcity and macroeconomic tensions to grow his digital treasure.

With already more than 13,000 institutions investing and 538,000 bitcoins in portfolio, Strategy confirms its status as an institutional giant in the sector. Michael Saylor continues to transform the company into a true digital vault, betting on growing adoption and sustainable appreciation of bitcoin in an increasingly uncertain global economic context.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The world is evolving and adaptation is the best weapon to survive in this undulating universe. Originally a crypto community manager, I am interested in anything that is directly or indirectly related to blockchain and its derivatives. To share my experience and promote a field that I am passionate about, nothing is better than writing informative and relaxed articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.