MEXC Ranks First In Cryptocurrency Futures Liquidity in The Bear Market

Since the introduction of cryptocurrency exchanges, which have played a significant role in onboarding new users to the cryptocurrency world, the cryptocurrency and DeFi space have rapidly evolved. Futures trading was a game changer in DeFi because it was designed to mimic the existing futures contract structure in the traditional financial market and was a massive determinant of mainstream adoption when it was introduced in 2017. Since 2017, major cryptocurrency exchanges have offered futures trading. In this article, we will look at futures trading and a specific exchange, MEXC, which ranks first among all top cryptocurrency exchanges in cryptocurrency futures liquidity.

Photo by Markus Spiske on Unsplash

What Is Futures Trading?

In layman’s terms, futures trading is an agreement to buy or sell an asset at a predetermined price later, whether physical or digital. Futures trading is a standard trading method on stock exchanges and other platforms, but cryptocurrency exchanges have incorporated it as a trading option on DeFi. Futures trading is widely accepted in cryptocurrency and is set to become fully mainstream in the DeFi summer of 2020. Despite being in a bear market for the better part of a year, futures trading volume remains strong, with about $1 trillion in perpetual futures trading volume during the second quarter of this year.

A futures contract allows a trader to speculate on the price direction of a commodity, mainly through cryptocurrency exchanges. If a trader purchased a futures contract and the commodity price rose and traded above the original contract price at expiration, the trader would profit. The futures contract—the long position—would be sold at the current price before expiration, closing the long position.

The price differential would be settled in cash in the investor’s account, with no physical product exchanged.

Furthermore, according to TokenInsight research, the annual trading volume for futures last year was around $57 trillion, accounting for more than half of the total cryptocurrency trading volume. In addition, traders can also enter a speculative short position if they believe the underlying asset price will fall. If the price drops, the trader will enter an offset position to close the contract. Again, the net difference would be settled at the contract’s expiration. An investor would profit if the underlying asset’s price was lower than the contract price and lose if the current price was higher than the contract price.

MEXC Leading The Futures Sector

As the popular saying goes, “ liquidity is king.” The liquidity of the digital tokens offered by the trading platform is the key reference point for cryptocurrency traders when assessing the quality of futures trading. The greater the depth of the trading platform’s futures products, the narrower the spread, the more seamless the transaction, and the lower the trading cost. The most important aspect is that, in the event of significant fluctuations in the crypto market, products with greater depth are far less likely to be accidentally liquidated.

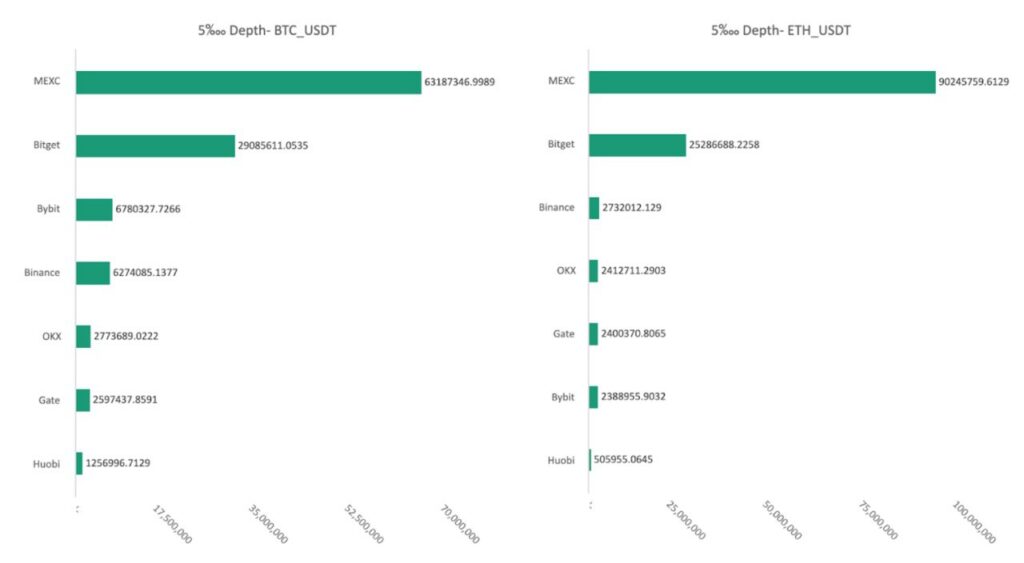

According to a study that compared the contract liquidity depth indicators of trading platforms such as Binance, Bybit, MEXC, OKX, Huobi, and Bitget, as well as the futures trading of the top 50 crypto tokens by market value, the leading three platforms in terms of depth performance are MEXC, Bitget, and Binance. Using Bitcoin as an example, the futures trading depth of BTC USDT on MEXC increased from $60 million in early August to $100 million from August 4 to September 1, the highest percentage increase in that period across multiple exchanges.

Deep liquidity helps protect users from liquidations/irregularities in prices whenever there’s a massive dump, usually occurring during the bear market. Futures is an integral aspect of cryptocurrency trading. These are some things to check out before trading in a volatile market such as this for asset security and safety.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Lorsque j'ai commencé à travailler dans la crypto en 2017, 95% des gens ne savaient presque rien à ce sujet. À vrai dire, peu de choses ont changé depuis. Cependant, il semble y avoir une lumière au bout du tunnel, et je tiens à l’opportunité d’y être impliquée

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.