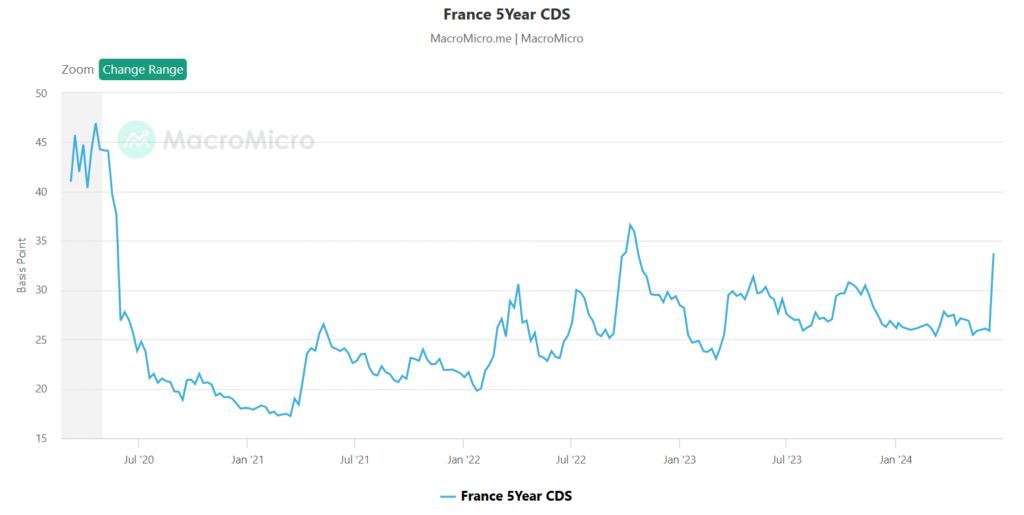

Le coût du CDS (Credit Default Swaps) pour la France s’est envolé.

— Guillaume Graf (@graf_trading) June 16, 2024

Investir dans des obligations françaises devient de plus en plus risqué.. pic.twitter.com/7OtKmM19OC

A

A

Market Panic After National Assembly Dissolution

Mon 17 Jun 2024 ▪

10

min read ▪ by

Getting informed

▪

Crypto regulation

The dissolution of the National Assembly has brought great uncertainty to the markets. In one week, the CAC 40 dropped by nearly 7% to erase its gains since January 1st. Meanwhile, the CAC for small capitalizations fell by nearly 11%. Uncertainty about the election outcome and growing economic confusion weigh on many stocks and sectors. In particular, the banking sector was heavily penalized. The rise in the cost of French debt could also worsen the already critical situation of public finances. Analysis of a dramatic week.

France tumbles after the dissolution

While the S&P 500 closed in the green for the week, the CAC 40 erased all the performance observed since January!

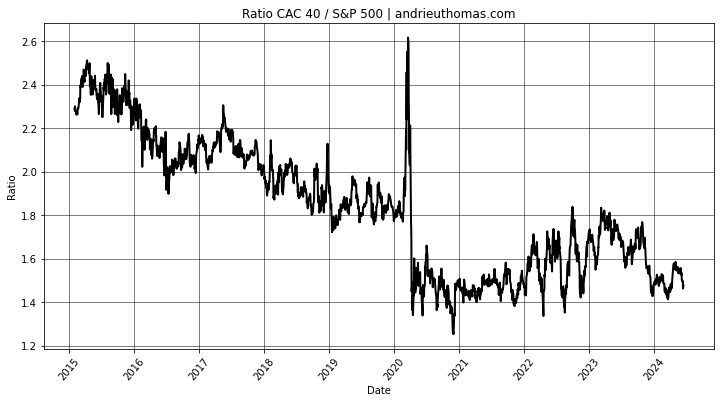

The performance gap of the week reaches almost 9%. The previous week, the ECB had cut rates, preceding the rate cut expected later from the FED. Despite the change in monetary policy, the CAC 40 seems to be entering a new period of underperformance compared to the S&P 500. Since 2015, the relative value of the CAC 40 compared to the S&P 500 has almost been halved.

Small capitalizations are the most impacted by electoral uncertainty, as a large part of their revenue is generated in France. Banking stocks also plummeted significantly during the week: -12% for BNP, -11% for Crédit Agricole, and up to -15% for Société Générale. Other stocks, like TF1, lost more than 17% due to concerns over the privatization of public broadcasting, which would increase competition in the sector. So how can we explain this drop and these concerns?

It is indeed recurrent in history to observe crashes or panics for political reasons. Changes in programs, declarations of war, or budgetary instabilities often lead to panics. Nevertheless, the markets do not sanction the results of the European elections but the prospect of the legislative elections. A change of government would indeed bring a change in economic policy with structural results, more or less.

What are the consequences for the euro and your savings?

The euro also seems to have stumbled this week under the pressure of political instability. The value of the euro against the dollar fell by 1.7% over the previous week. Downward pressures on the euro are also strengthening due to the ECB’s more lenient monetary policy. If the euro’s decline is still moderate, it is quite possible that growing instability in France could lead to instabilities at the European level.

“The ECB is driving a potentially lasting rate cut while the FED remains inflexible. A lasting gap in the benchmark interest rate between the various central banks could thus harm the value of the euro. Meanwhile, the rate cut occurs while growth in the eurozone is almost stalling. Additionally, the interest burden weighs heavily on many states and businesses.”

ECB pivot: what consequences? – Cointribune

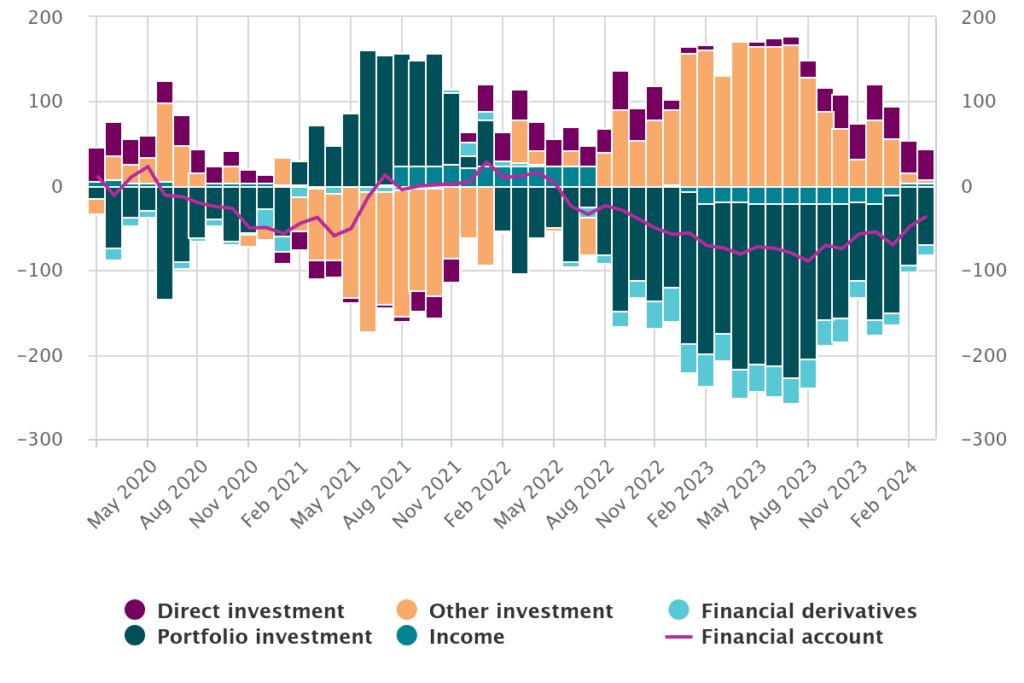

The risks of a significant drop in the value of assets in France entail an economic risk. Indeed, while several banks have suffered a sharp decline, an excessive depreciation of public debt would put at risk fundamental French investments, such as life insurances. But this risk is still distant. Nevertheless, an excessive economic risk would reduce foreign investments. Yet, the presence of a significant trade deficit requires France to have incoming capital flows. The reduction in foreign investments would immediately decrease the standard of living in France. In this perspective, the effects of the trade deficit would be felt, in the absence of capital returns to offset the trade balance.

Are political programs that unclear?

In the fall of 2022, former Prime Minister Liz Truss announced a £45 billion tax cut without funding. This mistake earned her a significant market sanction, which ultimately led to her resignation… Are we going to experience the same scenario?

Although many more or less accurate estimates circulate, it is clear that the Nouveau Front Populaire, like the Rassemblement National, propose increases in public spending. The financing of these expenses remains unclear to the markets, which precisely worries the markets. Moreover, these programs come at a time when debt is already at a record level. The presence of significant public deficits also prevents any room for maneuver for a new government. The dissolution could also promote a situation of political instability and regular alternation of reforms.

Thus, the cost estimates of the proposed reforms range from 100 billion euros for the RN to more than 200 billion euros for the NFP. Such an increase in public spending would be unprecedented and would raise the spending-to-GDP ratio to over 60% or 65%. Unheard of in the history of global capitalism. This leap into the unknown could harm market stability, as some economists point out.

“The markets will go wild, it’s a hit of 200 basis points and then it will be a full reversal, anticipates an economist. When we do aberrant things financially, we explode interest rates, for sovereign debt, but also for households who can no longer borrow.”

Sylvain Bersinger for BFM Business, economist at Astéres consulting firm.

Will the cost of debt increase?

French public debt is 53.2% held by foreigners. With nearly 3000 billion euros in debt, France is one of the most lax countries in terms of spending in recent years. In 2023, the interest burden, that is, the sole cost of interest, was close to 51 billion euros, or more than 760€ per French citizen. This burden could climb to 70 billion euros by 2027.

Moreover, the average lifespan of French debt is close to 8 years. In this context, a sustained increase in the interest rate on French debt would cause an increase in the cost of debt. A rate close to 4%, like Italy, would lead to more expensive debt issuances. In this example, the cost of debt could reach nearly 100 billion euros in the long term, which is not sustainable at present.

The cost of insurance on French government debt at 5 years (CDS) also increased by 16% in one week. Credit default swaps, also called CDS, are financial instruments for which the buyer pays premiums to the seller in exchange for compensation in case of credit default. The cost of insurance on French debt has thus returned to its highest since the period of interest rate rises in 2022.

How far could the drop go?

The CAC 40 confirmed a double top forming since March 2024. The strong downward pressure following the announcement of the dissolution thus triggered a break of the figure. The technical target suggested by this figure is thus close to 7500 points, a target reached by the end of the week. The violent drop observed thus filled two major gaps opened in January and February 2024. The market drop observed over the past week seems to be well contained technically.

Nevertheless, the closing at 7503 at the end of Friday’s session led to a break of the upward trendline built since September 2022! The confirmation of this break during the week could thus push the CAC 40 around 7,250 to 7,000, without a new reaction.

In conclusion

In the end, the political risk in France has canceled all the performance of the year. Growing political instability could heavily weigh down on the risk and value of financial assets in France, and potentially in Europe. The pressures on the euro are thus rather downward, while the CAC 40 does not seem to regain calm. The lack of clarity in the political situation on one hand and in some programs on the other hand imposes great uncertainty on the markets.

Conversely, an easing of the political situation could constitute an interesting entry point. But technical signals still invite caution. This political scene unfolded since the dissolution will have had only one benefit: reminding the importance of diversifying assets abroad.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Author of various books, financial and economics editor for many websites, I have been forming a true passion for the analysis and study of markets and the economy.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.