With liquidity across the Digital Asset landscape coninuing to rescind, we assess the activity of both the On and Off-Chain environment, and produce a new framework to help identifify peak Altseason regimes.

— glassnode (@glassnode) October 10, 2023

Discover more in the latest Week On-Chain👇https://t.co/CDvm0PugY7 pic.twitter.com/wssftzRm03

A

A

Altcoin Liquidity Decreasing, Is the Crypto Market in Crisis?

Fri 13 Oct 2023 ▪

3

min read ▪ by

Invest

▪

Glassnode, the cryptocurrency analysis company, has suggested a decrease in liquidity in the altcoin market. This situation is said to be linked to a waning appetite for cryptocurrencies. The company specifically points out a market weakness based on the fundamental parameters of altcoins, which are at critically low levels.

Investors are less interested in cryptocurrencies

According to Glassnode’s analysis, it is evident that liquidity in the altcoin market has decreased. Long-term investors continue to increase their holdings, reducing liquidity by limiting active transactions. This reflects a low liquidity environment in the market, indicating a diminished risk appetite for the new altcoin landscape. It also underscores the current liquidity shortage in the crypto market.

While exchange interactions remain at cyclically low levels, liquidity in cryptocurrencies continues to dry up. This underscores the current market’s acute indifference, explains Glassnode. Although hodlers are increasing their holdings to new highs, the growing number of them restricts the tradable supply. This leads to a tightening of active trading.

This new framework for altcoins simulates the cascading effect of capital rotation, despite the high volatility in altcoin valuations. Glassnode concludes that the risk-taking regime is not in effect, indicating the current liquidity shortage.

A bearish market similar to previous ones?

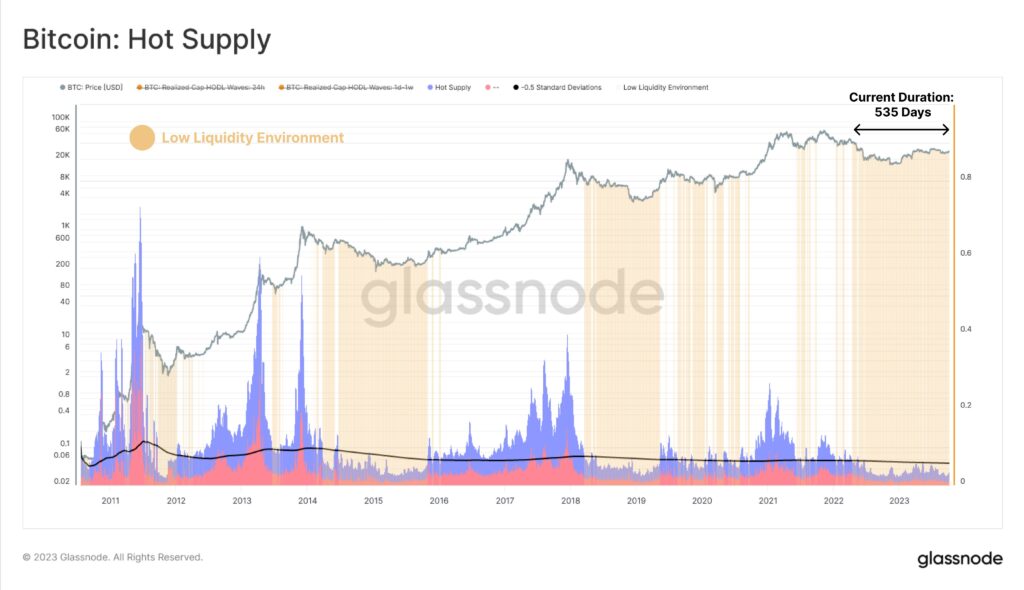

Glassnode also relied on Bitcoin’s hot supply metric, which represents the volume of cryptocurrency exchanged in the past week. It reached its lowest levels observed in bear markets for Bitcoin liquidity. Glassnode stated that this liquidity stagnation is particularly evident when evaluating the hot supply metric.

It compares the hot supply to Bitcoin’s long-term average supply with a standard deviation of less than -0.5. This creates a framework showing periods of low liquidity and market contraction when hot supply falls below this level. This indicates that current liquidity conditions are similar to the bear markets of 2014-2015 and 2018-2019.

Meanwhile, Bitcoin continues to exhibit volatility in the range between $26,000 and $28,000. Furthermore, the price of this cryptocurrency has failed to break through the downward sloping resistance that has formed since the yearly high of $31,800. At the time of writing, the price of Bitcoin is currently at $26,800 and could experience further declines.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Je suis passionnée par les cryptomonnaies, un monde que j'ai découvert il y a peine 3 ans. Mon seul but est de vous informer de cet univers incroyable à travers mes articles.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.