LIBRA Crashes, Javier Milei Under Pressure, CZ Plays The Wise Man After The Crash

Javier Milei, the Argentine president with a budget sliced by a cleaver, is making headlines once again. But this time, it’s not for a shocking reform, but for a resounding crypto affair. His open support for the digital currency Libra has turned into a financial catastrophe, destroying billions in just a few hours. A golden argument for his opponents who dream of an impeachment. Behind this fiasco, massive withdrawals and dubious financial engineering transformed this project into one of the biggest crypto scams in history.

Crypto scandal in Argentina: a lightning heist of 107 million

It took only three hours to turn crypto Libra into a field of ruins. Driven by Javier Milei, this new digital currency was meant to ” encourage the growth of the Argentine economy “.

In reality, it mainly encouraged a handful of insiders to fill their pockets.

According to Lookonchain, eight crypto wallets linked to the Libra team siphoned liquidity from the project, cashing in 57.6 million dollars in USDC and 49.7 million in Solana (SOL).

Summary: a market capitalization plummeting from 4.56 billion dollars to 257 million in eleven hours. A speed record in the ” white-collar scam ” category.

The signs of the scam were visible right from the start:

- 82% of tokens immediately resellable;

- a website cobbled together in a few hours;

- a Google form to “request funding”.

But blinded by FOMO (Fear of Missing Out), investors dove headfirst. The euphoria was short-lived. As soon as the first insiders started selling, the house of cards collapsed.

CZ from Binance sounds the alarm

In the face of disaster, Changpeng Zhao (CZ), founder of Binance, spoke up to remind some basic rules:

” The economy of tokens matters! ”

A reminder that comes a bit late for those who saw their portfolios turned to ashes.

In a post on X, CZ listed the warning signals to watch for before investing. Among them:

- Check the tokenomics (which Libra never disclosed);

- Avoid projects where too many tokens are in the hands of a few players;

- Beware of cryptos pushed by celebrities or politicians.

The story of Libra eerily resembles other fiascos, like the BROCCOLI memecoin inspired by CZ’s dog. Except this time, the scam was well-oiled.

Julian Peh, founder of KIP, had meticulously woven his ties with Javier Milei since 2021. By joining the Buenos Aires blockchain committee, he gained the president’s trust and sold him the idea of a national token.

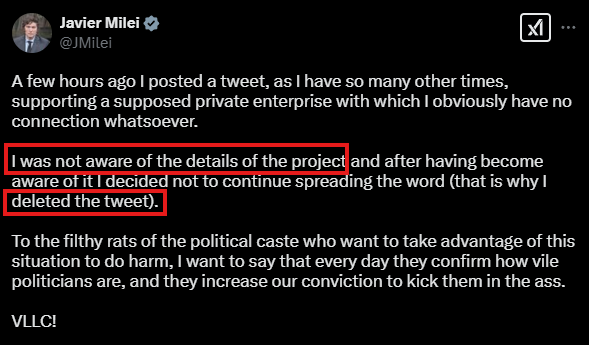

A single official tweet from Milei was enough to trigger a buying frenzy. In just a few hours, Libra weighed 4 billion. But the insiders waited for their moment: 87 million cashed, tweet deleted, curtains.

The crypto universe in full storm

The Libra scandal not only devastated the finances of small investors, but it also shook the entire crypto universe. In three hours, this fiasco sucked up 6 billion dollars of liquidity from the market. Even the TRUMP coin, launched in January by the former US president, faced a brutal slowdown.

On X, The Kobeissi Letter summarizes the affair in a killer punchline:

” Javier Milei has destroyed the memecoin market. 4.4 billion wiped out in 5 hours. The biggest rug pull in history? “

Meanwhile, Milei is playing the conspiracy card, accusing his political opponents of exploiting the affair to harm him.

” Dirty rats of the political caste “, he spat in a furious message.

Thus, this fiasco goes beyond the mere crash of a memecoin. It deeply tarnishes Milei’s presidency, once celebrated by the crypto community as ” bitcoin president “. Enough to cool the ardor of investors and remind once again that cryptocurrency is a Wild West where even suited cowboys can be outlaws.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.