The bull run could happen sooner than you think

Inflation has been galloping for almost two years, mainly due to the profligacy of central banks. Since then, central banks have turned around and become a little more vigilant. Nevertheless, they face a colossal dilemma: the peril of debt or the peril of inflation. It’s reasonable to assume that central banks will react this time, as they have every other time: by rearming their monetary bazooka. If so, it could well be the return of happy days for bitcoiners. Let’s talk bull run.

The holy printing press

It’s hard to believe that nearly three years have passed since the U.S. government, in collaboration with the Federal Reserve, injected trillions of dollars into the economy in response to the pandemic and the consequences of the 2020 confinements.

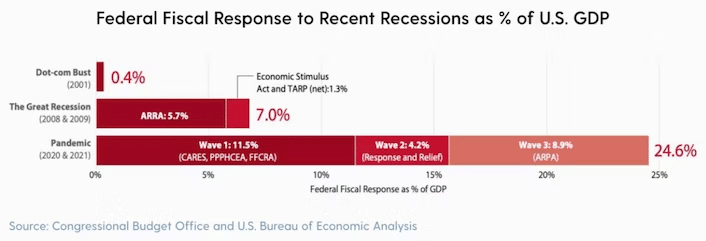

The federal budgetary response to the pandemic made a mockery of past stimulus plans. In total, the combined stimulus accounted for 25% of the debt-to-GDP ratio. To put this in perspective, the fiscal response during the 2008 global financial crisis represented just 7.0%.

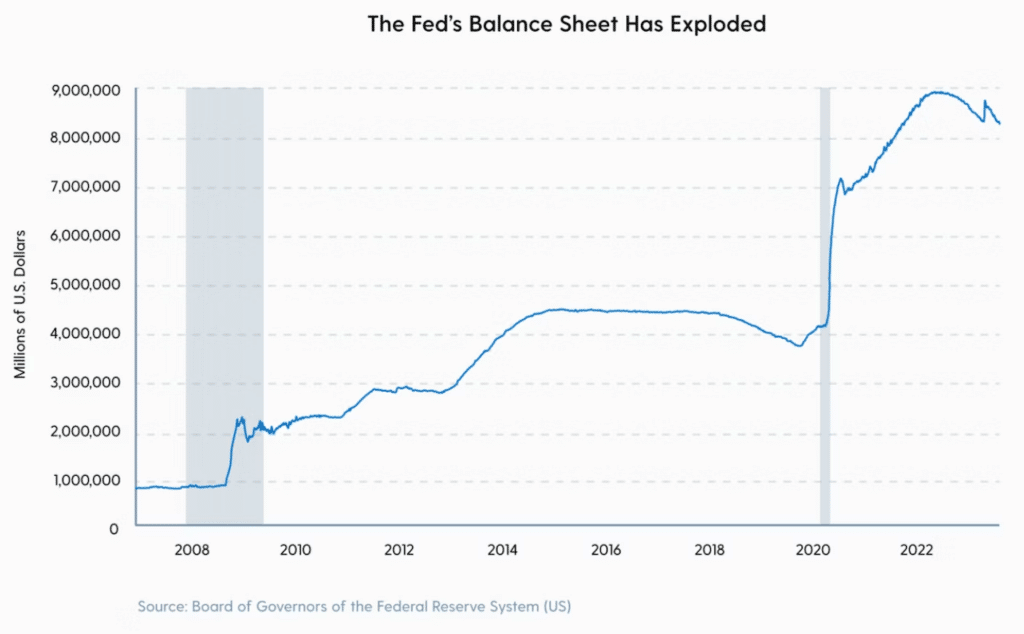

The Federal Reserve mainly monetized these fiscal stimulus measures, whose balance sheet exploded during the pandemic. Unlike previous times, the Federal Reserve monetized multi-billion dollar fiscal stimulus packages passed by Congress, which were injected directly into the real economy.

No matter the cost

In addition, $455 billion was voted by the CARES Act to fund the Fed’s new large-scale asset purchase program (quantitative easing). This $454 billion was used by the Fed to add some $4,000 billion in assets to its balance sheet, which it did quickly.

As an indication of the scale and speed of the Fed’s QE program in 2020, the Fed bought $625 billion worth of bonds in one week, more than its entire QE program during the global financial crisis a decade earlier.

In his book “The Lords of Easy Money”, Christopher Leonard beautifully illustrated the size and speed of the Fed’s quantitative easing program when he wrote:

“In about ninety days, the Fed created $3 trillion. That’s as much money as the Fed would have printed in about three hundred years at its normal pace before the 2008 financial crisis.”

Money in spades

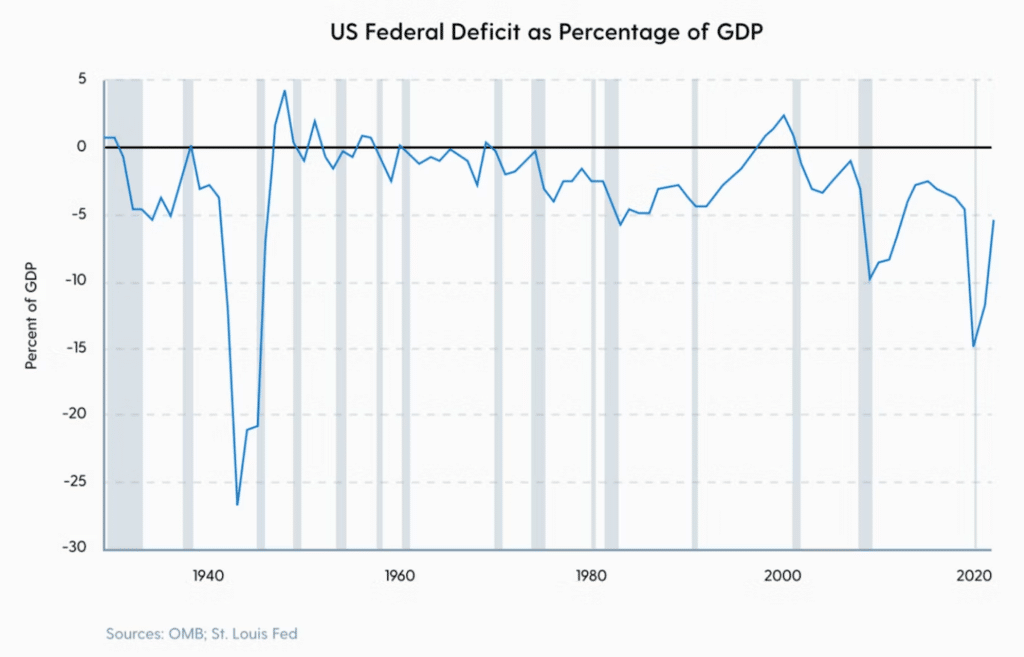

The scale of the fiscal and monetary measures taken by the United States to deal with the pandemic and the stalled economy, measured as a percentage of GDP, is staggering. Indeed, the combined effect of federal deficits and balance sheet expansion was even more extreme than during the Second World War.

We could debate endlessly whether these actions by the central bank and government were justified to avert a dramatic recession and help households and businesses in need. The fact remains that the scale and speed of these measures are unprecedented.

These ultra-accommodating monetary policies and lax fiscal policies have led to the highest inflation in decades. The Bank for International Settlements’ recent annual report revealed how the policies of central banks and governments in response to the stalemate of the pandemic contributed, directly and indirectly, to the surge in inflation.

“With hindsight, the extraordinary monetary and fiscal stimulus measures implemented during the pandemic, while justified at the time as insurance policy, seem too large, too broad and too long-lasting. They contributed to the current inflationary surge and financial vulnerabilities”, Bank for International Settlements.

The graphs below illustrate the correlation between core inflation, government spending and lax monetary policy.

One deviation too many

Deviating from the Taylor rule means that a central bank sets interest rates that are not in line with what this guideline recommends when it comes to its inflation objectives.

For example, if the Taylor rule suggests that the interest rate should be raised because of high inflation, but the central bank decides to maintain or even lower the interest rate, it can be said to deviate from the Taylor rule.

This deviation was evident when the Fed continued to keep interest rates close to zero while price index inflation rose throughout 2021.

During this inflationary surge resulting from political decisions taken in recent years, it has been difficult for investors to protect their wealth. Investors no longer live in a world where a traditional 60/40 portfolio of bonds and equities can preserve wealth and grow it over time.

Holding bonds now entails risks that didn’t exist before, when inflation and interest rates were low. With government and central bank policies fuelling inflation, investors must look beyond bonds to protect their savings.

Historically, the best-performing investments during earlier periods of high inflation were rare, hard assets.

One such asset is bitcoin. How has bitcoin fared since governments spent trillions and the Federal Reserve’s balance sheet exploded?

Bitcoin performance since the monetary bazooka

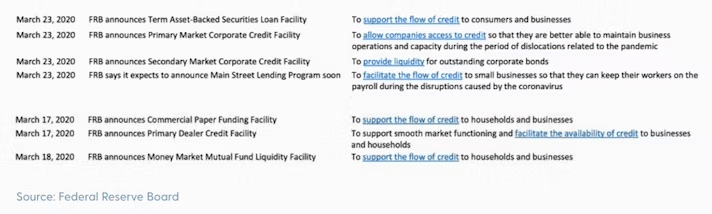

On the night of Sunday, March 15, 2020, Fed Chairman Jerome Powell announced a series of radical measures in response to the growing distress in the bond markets and the collapse of the equity market the previous week.

On that fateful night, the Fed:

- reduced its benchmark interest rate by a full percentage point to close to zero (0-0.25%), and introduced forward-looking indications that it would keep rates at this level for the foreseeable future.

- announced that it would purchase at least $700 billion of government bonds and mortgage-backed securities over the next few months, as part of a vast quantitative easing operation.

- Encouraged banks to use their discount window, lowered the discount rate to 0.25% and reduced reserve requirements for quantitative easing.

- Strengthened US liquidity swap lines by lowering currency swap rates with the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank and the Swiss National Bank.

In addition, a week after the largest quantitative easing operation in history, the Fed announced that it would continue to buy Treasury bonds, mortgage-backed securities and, for the first time, commercial mortgage-backed securities “in whatever quantities are necessary”.

“We will do whatever it takes,” the Fed said.

“Whatever it takes”

The Federal Reserve then purchased $120 billion worth of bonds every month from June 2020 to November 2021, a rate of bond purchases unprecedented in its history.

Let’s recap the Fed’s actions to underscore why March 15, 2020 is a critical date in financial history. It was on this night that the monetary bazooka was activated in “infinity” mode.

On that Sunday evening, the Federal Reserve shifted into high gear to maintain the flow of credit and liquidity to financial markets and the economy. It is therefore a logical starting point for measuring asset performance since these inflationary policies were implemented.

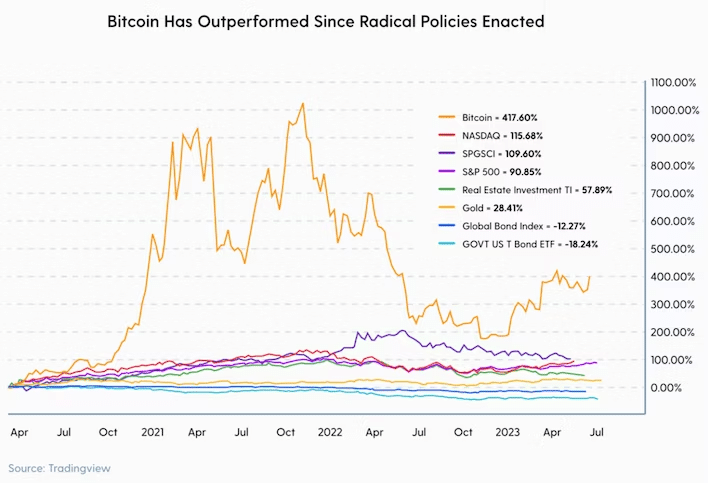

When we look at bitcoin’s nominal returns relative to other major asset classes since that fateful date, we see that it has clearly performed well in this new inflationary environment.

When they print money, bitcoin outperforms

This outperformance shows that bitcoin has protected investors’ purchasing power better than any other asset class since the central bank and government flooded the economy with liquidity and the inflation rate soared. Perhaps the best way to understand this dynamic is to examine the relationship between bitcoin’s price and the expansion and contraction of the Fed’s balance sheet.

Bitcoin’s rise in 2020 coincided with a quantitative easing program that began during COVID-19 and increased institutional interest in crypto markets.

QE or not QE?

In the wake of the global financial crisis, there have been numerous cycles of quantitative easing and tightening. After many years of interest in the idea of reducing the size of its balance sheet, the Fed finally began to do so in 2018 as part of a process known as Quantitative Tightening.

This process continued until late 2019, when the Fed pivoted and implemented what became known as “QE-not-QE” with the aim of preventing the repo market from seizing up.

The Fed’s balance sheet swelled once again. Shortly afterwards, the monstrous quantitative easing programs were launched in 2020. Since April 2022, the Fed has been reducing its balance sheet. The Fed’s balance sheet peaked at almost $9,000 billion at the beginning of 2022 and currently stands at $8,300 billion.

If we examine the history of quantitative easing, and the resulting increase and decrease in the size of the Fed’s balance sheet, we can also observe a notable trend in the price of bitcoin. Primarily, it seems that the price of bitcoin explodes during periods of balance sheet expansion and falls when the Fed’s balance sheet contracts.

How is bitcoin reacting?

This makes intuitive sense if we understand that quantitative easing leads to higher asset prices and increased liquidity in the system. The bitcoin price seems to respond favorably to periods when the Fed is engaged in quantitative easing and market and liquidity conditions are favorable. We can see that when the Fed attempts to reduce the size of its balance sheet with QT, as in 2018 and 2022, the bitcoin price suffers.

This shows that bitcoin’s performance is intimately linked to the fiscal profligacy of governments and the accommodating policies of central banks. When central banks adopt loose monetary policies and governments open their coffers, liquidity and inflation rise – and with them, the bitcoin price.

Today, the Federal Reserve persists in its strategy of quantitative tightening, attempting to reduce its balance sheet while raising interest rates in order to tighten monetary conditions. As a result, the bitcoin price has stagnated, remaining suppressed since it peaked at the end of 2021.

This scenario begs the question: when will the Fed need to resort to balance sheet expansion again?

Will the thorny US debt issue give birth to a bull run?

A common expression in bitcoin circles is that bitcoin acts like a liquidity sponge. This has been the case since March 15, 2020, as evidenced by its share price.

Central banks themselves (the BIS) have proven to us that lax monetary policy and fiscal spending can lead to inflationary pressures, particularly asset price inflation. We also know that the price of bitcoin follows the size of the Fed’s balance sheet.

Looking at the current US fiscal landscape, it’s fraught with challenges. The U.S. has already posted a federal deficit of over $1.5 trillion in the last 12 months. Worse still, tax revenues continue to decline while spending remains high.

Solving this budgetary problem is not helped by the Federal Reserve’s ongoing interest rate hikes, which are designed to combat inflation but which, paradoxically, widen the budget deficit by increasing interest charges on the federal debt. In other words, the Fed’s inflation-fighting policy is exacerbating the very thing that has contributed to it, namely the great waves of deficit spending.

From bad to worse

This underlines the rope the Fed has to walk: high debt levels, as a percentage of GDP, can seriously hamper its ability to fight inflation through higher interest rates.

In a dark paradox described by the BIS, monetary and fiscal policies can end up in a deadly tug-of-war when these dynamics are at work. “A loose monetary policy can encourage the government to take on more debt; an expansionary fiscal policy can prevent monetary policy from being as tight as necessary,” warns the BIS.

All indications are that Federal Reserve officials will continue to raise interest rates, especially if inflation proves stubborn. They have already raised rates by 500 basis points, and further increases seem likely based on their recent messages.

In this case, debt servicing costs will only increase, as will the federal deficit. This could also prompt bond investors to sell their bonds, recognizing that the Fed will have to raise interest rates even higher if inflation persists.

Yields could then soar even higher, further inflating debt servicing costs. Bond yields continue to climb, with yields on 10-year and 2-year Treasuries recently reaching their highest levels since 2008.

Anticipating the limit to forestall a bull run

How far will the Fed and Treasury allow interest rates (and therefore debt servicing costs) to soar before fiscal concerns overshadow their inflation concerns?

No one can know for sure what the central bank or the government will decide to do in this context. But if yields continue to rise as bond investors sell off their holdings and the economy continues to spiral out of control, historical precedent suggests that the Fed will inevitably step in with bond-buying programs to “facilitate the flow of liquidity and credit” and reduce borrowing costs for the government. At this stage, it would be more shocking if the Fed did not intervene.

In this scenario, the Fed’s balance sheet would expand again, and at that point, history suggests that one of the best assets for investors to hold during a period of balance sheet expansion is bitcoin.

As a hedge against irresponsible fiscal and monetary policies, bitcoin has proved its worth in its first fourteen years of existence. Considering the difficult situation the government and central bank currently find themselves in, given debt levels and high levels of inflation, it’s hard to see how we won’t continue to see the same policies implemented with similar results in the years to come.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Chaque jour, j’essaie d’enrichir mes connaissances sur cette révolution qui permettra à l’humanité d’avancer dans sa conquête de liberté.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.