$50,000 a #Bitcoin is inevitable ! 🚀🚀🚀

— Titan of Crypto (@Washigorira) July 12, 2023

While some are still expecting a #BTC at $10k-$12k this year, I think it's gonna fly soon. 🫡 pic.twitter.com/vDCCd8ukqj

A

A

Bitcoin (BTC) at $50,000 – Is it inevitable? July 13 technical analysis

Fri 14 Jul 2023 ▪

3

min read ▪ by

Invest

▪

Invest

Yesterday’s release of the US inflation rate suggests an imminent rise for the queen of cryptos. Bitcoin (BTC) seems headed inevitably for $50,000.

Bitcoin (BTC) maintains its bullish trend.

The US annual inflation rate turned out to be lower than forecast (3% instead of 3.1%). This macroeconomic data favors a rise in BTC, but it is having difficulty breaking through the $31,000 barrier in the long term.

Despite this, Titan of crypto, a crypto analyst followed by over 38,800 followers, remains optimistic in his analysis on Twitter. While some predict a further correction, this analyst is convinced that “bitcoin (BTC) at $50,000 is inevitable”.

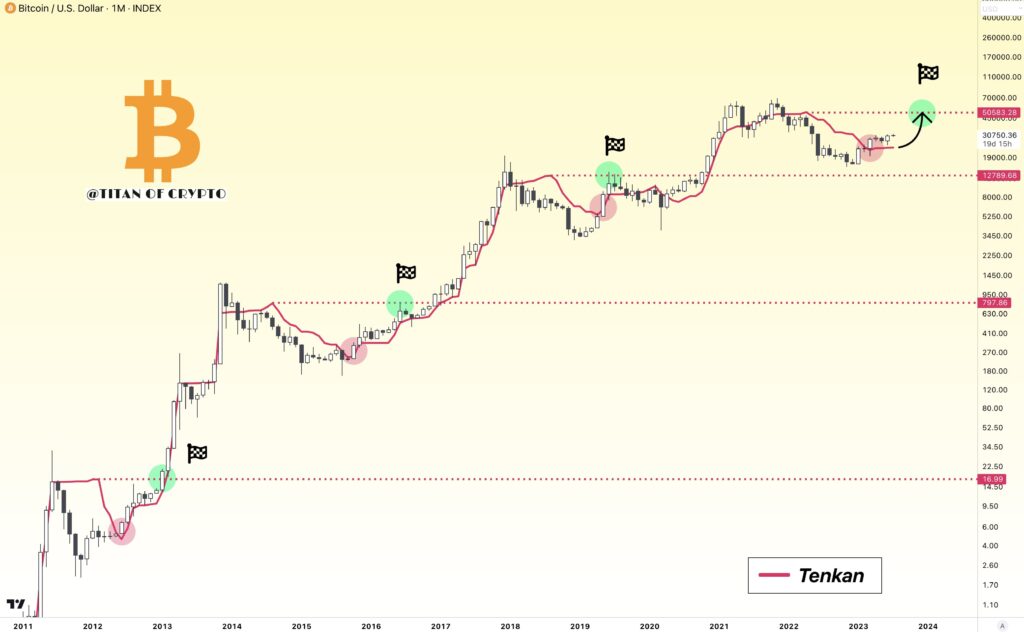

On the monthly BTC chart, it shows a recurring cyclical pattern since 2012. It involves a break of the Tenkan (in red), followed by a rise to the last peak of this indicator (in green).

With the rise seen at the start of the year, bitcoin (BTC) has managed to break through the monthly Tenkan. So, according to this cycle, the rise should continue all the way to $50,583, the level corresponding to the last Tenkan peak.

All that’s missing is a catalyst.

It’s important to remember that the sharp rise since June 15 came on the heels of a drop in US CPI. Secondly, the demand for Bitcoin ETFs from Blackrock definitely triggered this explosion in the bitcoin (BTC) price. These two conditions have now almost been met.

Indeed, the macroeconomic data (inflation rate) published yesterday is favorable to a rise in bitcoin (BTC). If Bitcoin ETFs are approved, a bullish recovery is imminent.

In this case, a buy position at $29,534 could be interesting. The nearest target is $35,000, but BTC could reach higher levels. Indeed, given the cycle identified by Titan of Crypto, bitcoin (BTC) at $50,500 is only a matter of time.

Entry: $29,619 ;

Stop: $29,000;

Target 1: $35,000;

Target 2: $50,500.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Je suis passionnée par les cryptomonnaies, un monde que j'ai découvert il y a peine 3 ans. Mon seul but est de vous informer de cet univers incroyable à travers mes articles.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.