Thailand No Longer Wants the Dollar

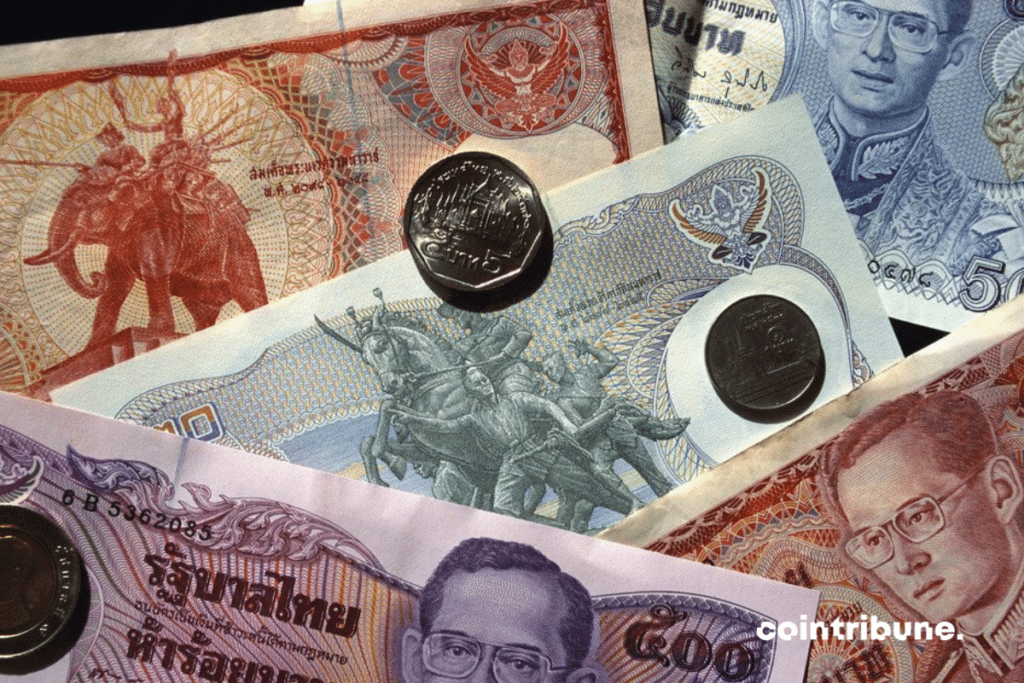

The de-dollarization continues in Asia. Following nations like India or Indonesia, Thailand is now also shunning the dollar.

Unwelcome Dollar

The Bank of Thailand supports the use of local currencies instead of the US dollar to settle its international trades, as advocated by the deputy governor of the Thai central bank.

Alisara Mahasantana believes that the use of local currencies (such as the Chinese yuan, the Malaysian ringgit, the Indonesian rupiah, and the Japanese yen) will minimize the risks posed by fluctuations in the US dollar. The goal is to provide Thai businesses with an alternative.

“During periods of significant dollar volatility, business operators can opt to use these local currencies for payments instead. This reduces the risk associated with exchange rates, making trade negotiations easier,” she said.

However, this explanation appears to be more of a facade. Indeed, there is a palpable global rebellion against the imperial currency. This is in light of the sanctions against Russia, which had approximately $300 billion of foreign exchange reserves confiscated.

If the world’s foremost nuclear power can be plundered, no one is immune if they do not align with American foreign policy. Asian countries have understood this well.

Indonesia, Malaysia, and Thailand, in fact, signed a tripartite agreement earlier this summer, initiating the promotion of commercial trade in their national currencies.

Abandoning the dollar, euro, and British pound was also highlighted by the Association of Southeast Asian Nations (ASEAN) at the beginning of the year.

The Gold Rush

The Bank of Thailand is betting on gold to diversify geopolitical risks. Gold remains a safe haven, as stated by Alisara Mahasantana to Bloomberg News.

“Gold purchases help protect Thailand’s foreign exchange reserves,” she said. These reserves are currently valued at $210 billion.

Indeed, a significant portion of these reserves is in US Treasury bonds. However, their value has declined due to the Fed’s rising interest rates…

The governor revealed a substantial increase in their gold reserves to mitigate such risks. These reserves have more than doubled since 2019. Many other central banks, including those of China, Poland, and Turkey, are following suit.

The price of gold is currently on the verge of setting a new record. This surge is due to central banks’ purchases anticipating the new Bretton Woods.

The conflicts in Ukraine and the Levant symbolize the global rejection of American imperialism. Nations no longer want to finance US debt and are taking advantage of the breach opened by Moscow to resist.

Gold always returns to the center of trade when war breaks out. However, now a new contender for the title of international reserve currency is knocking on the door: Bitcoin.

Unlike gold, of which approximately 3,000 tons are mined each year, there will never be more than 21 million bitcoins. Additionally, Bitcoin costs nothing to move from one end of the world to another…

All central banks will sooner or later have to acknowledge that Bitcoin is a superior safe haven compared to gold. Following the upcoming halving in May, Bitcoin’s monetary inflation will officially be lower than that of gold…

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Bitcoin, geopolitical, economic and energy journalist.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.