FOMC DOT PLOT pic.twitter.com/qwk4iRTgZK

— Breaking Market News (@financialjuice) September 20, 2023

A

A

Fed Warns That Inflation will Remain High

Thu 21 Sep 2023 ▪

4

min read ▪ by

▪

Crypto regulation

The Fed has maintained its benchmark interest rate unchanged at 5.50% after eleven increases since March 2022.

Fed slows down

Like the ECB, the U.S. central bank signals the end of rate hikes. However, while the turn of events was widely anticipated, the famous ‘dot plot’ held a surprise.

The median projection for the benchmark rate is 5.625% by the end of 2023. Therefore, it is expected that the Fed will raise its rate again before the end of the year. Out of the 19 governors, 12 anticipate an additional hike, while seven do not foresee one.

Furthermore, two rate cuts are expected in 2024 instead of the four cuts projected in June. Ten governors expect two rate cuts (or fewer), while nine anticipate three cuts (or more).

It’s worth noting that one governor anticipates two more rate hikes.

In summary, the average of these points suggests only two rate cuts in 2024, down from the four previously anticipated in June.

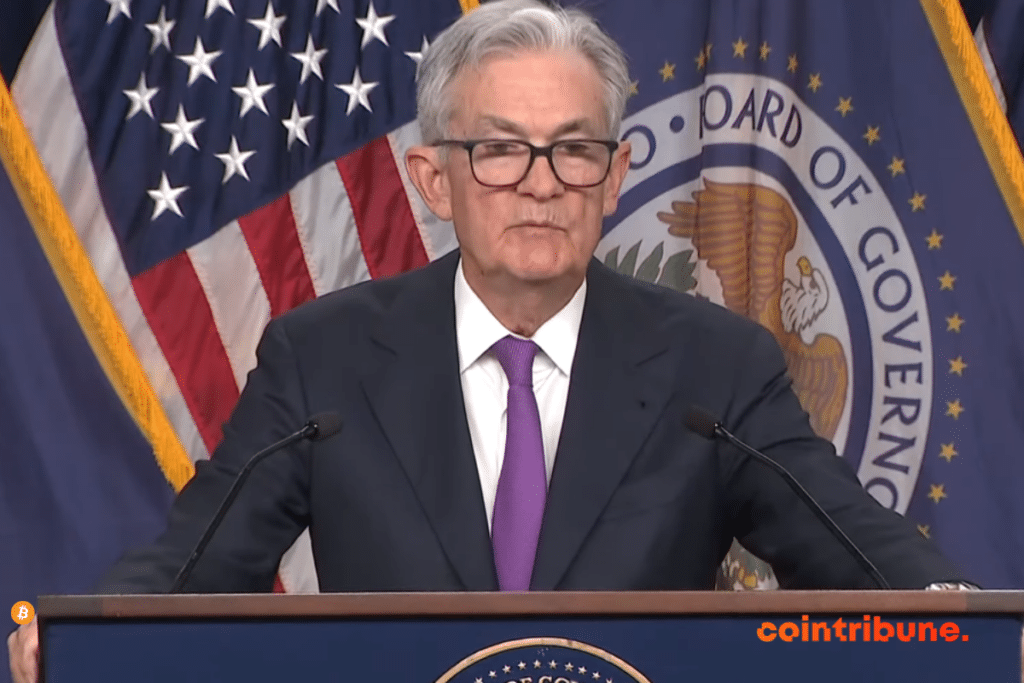

Jerome Powell warned that rates will remain high longer than anticipated, while leaving the door open for more rate hikes:

“We stand ready to raise rates further if necessary. We also intend to keep our policy at a restrictive level until we are convinced that inflation is sustainably approaching our target.”

Another crucial point is that Quantitative Tightening (QT) continues at a rate of $95 billion per month.

QT

QT refers to the Fed reducing its balance sheet by selling Treasury bonds and MBS (mortgage-backed securities).

It’s worth noting that the U.S. government does not pay interest on the $5 trillion worth of Treasury bonds held on the Fed’s balance sheet. In other words, more QT means more interest to be paid by the government.

These monetary tightenings ultimately aim to slow down inflation, although the Fed’s chairman remained cautious:

“Rates have risen significantly. They will rise a bit more, and once they stop rising, we won’t lower them for some time. Inflation has come down significantly from last year’s peak, but it is still much too high. Things are unpredictable.”

Unfortunately for Jerome Powell, the Fed does not control the price of oil. It is approaching $100, which will quickly lead to new inflationary pressures.

Indeed, this is already happening. The Consumer Price Index (CPI) increased by 0.63% in August. This is the largest monthly increase since June 2022.

Raising rates further could paradoxically trigger a severe recession without effectively controlling inflation, which depends more on OPEC and Russia…

Thus, new rate hikes could ironically increase the U.S. government’s debt, which does not seem to want to reduce its spending, quite the opposite. These interest payments now represent over 20% of federal government revenues…

The debt spiral continues, increasingly strengthening the interest of the masses in Bitcoin as a store of value.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.