Is The NEAR Crypto Ready To Bounce Back? Analysis Of November 7, 2024

After experiencing a sharp decline, NEAR has stabilized by demonstrating increasing buyer interest. Let’s examine the future prospects for NEAR together.

Situation of the NEAR Price

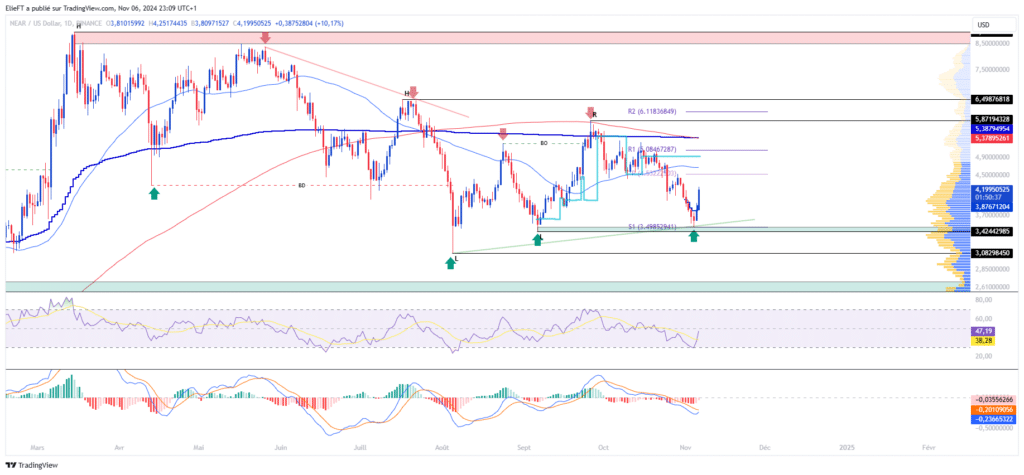

After dropping from $8.4 to $3, the price of NEAR rebounded to reach a resistance zone around $5.2. The crypto then suffered selling pressure, causing a correction down to $3.4. It is from this level that the NEAR price broke its resistance, marking a new peak just below $6. Unfortunately, NEAR has suffered an almost complete retracement of its last increase. Although this may seem negative, it can be emphasized that all of these fluctuations have allowed for higher lows to form, which technically indicates a bullish reversal in progress.

At the time of writing this article, the NEAR price is around $4.2. While a trend reversal for the cryptocurrency is conceivable, it should be noted that NEAR is now below its value zone around $5 and its monthly pivot point. Moreover, the cryptocurrency is below its 50-day and 200-day moving averages, both of which are oriented downward. These elements therefore raise doubts about its true crypto trend. In terms of momentum, a slight rebound is observed, visible in both the recent fluctuations of NEAR and its oscillators.

The current technical analysis has been conducted in collaboration with Elie FT, an investor and passionate trader in the cryptocurrency market. He is currently an instructor at Family Trading, a community of thousands of active proprietary traders since 2017. There, you will find live sessions, educational content, and assistance regarding financial markets in a professional and warm environment.

Focus on Derivatives (NEAR/USDT)

The open interest on NEAR/USDT contracts was revised downward before finally rebounding, just like its underlying asset. This demonstrates a relatively healthy market, with speculators’ interest mostly oriented towards buying. These observations are supported by a positive funding rate. However, on the CVD side, a divergence is observed regarding these recent indicators, indicating persistent selling interest on market orders. On the liquidation side, they remain minimal, thus reflecting a balanced market where buyers and sellers seem to agree on the current direction of the crypto.

The liquidation heat map for NEAR/USDT shows that the crypto has recently entered a notable liquidation zone, situated between $4.2 and $4.5. So far, NEAR seems to be maintaining this price level, demonstrating persistent buyer interest. Currently, notable liquidation zones are mainly found above the current NEAR price. One can note the levels of $4.8, then, just above, the zone of $5.1. Higher still, we find the zone of $5.3, followed by the one just below $5.7. Below the current price, one can identify the subtle zone around $3.5. The approach of the price towards these levels could lead to a massive triggering of orders, thus increasing the risk of heightened volatility for the cryptocurrency. These zones therefore represent crucial points of interest for investors.

Forecasts for the NEAR Price

- As long as the NEAR price remains above $3.5, a progression towards $4.5 remains conceivable. Breaking through this resistance could pave the way towards the $5 threshold. Subsequently, the resistance levels to monitor would be at $5.9 and $6.5, corresponding to a potential increase of over 54%.

- In the event that the NEAR price fails to stabilize above $3.5, support could be found around $3.4. If selling pressure persists, the next support threshold is at $3.1. Lower down, the zone between $2.7 and $2.45 would represent additional support, implying a potential correction of nearly 41%.

Conclusion

Although NEAR has faced obstacles, signs of recovery and the formation of ascending troughs suggest a possible stabilization of the price. If the positive momentum continues to assert itself, a trend reversal could materialize in the medium term for the crypto. Therefore, it will be essential to closely monitor the price reaction at key levels to validate or revise current forecasts. Finally, let’s remember that this analysis is based solely on technical criteria, and the prices of cryptocurrencies can evolve rapidly based on other more fundamental factors.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Family Trading est une Communauté de traders a compte propre active depuis 2017 offrant Lives, contenus éducatifs et entraides autour des marchés financiers dont celui des cryptomonnaies avec à ses côtés Elie FT, investisseur et trader de passion sur le marché crypto.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more