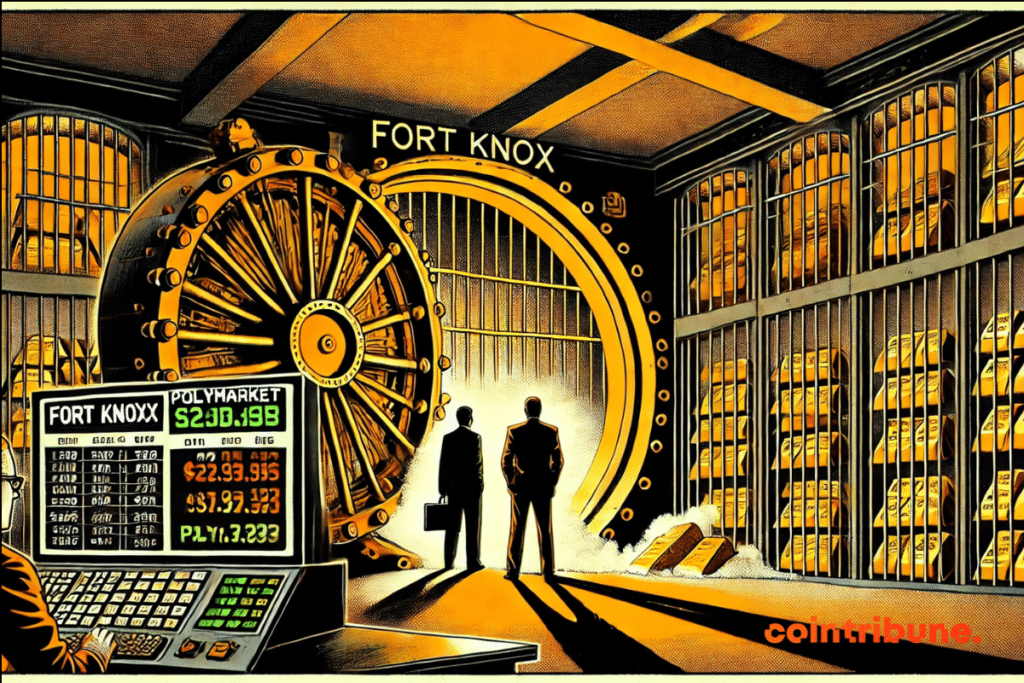

Fort Knox’s Gold: A Mirage? Polymarket Stirs Suspicion!

For decades, Fort Knox has embodied the economic power of the United States. Yet, an insidious question lingers: what if these legendary reserves are just a mirage? The betting platform Polymarket is adding fuel to the fire: a contract speculates at 21% on the actual absence of gold. Between official silence and abundant theories, doubt settles in.

Fort Knox: an invisible treasure that defies transparency

Official figures claim that 4,582 tons of gold lie dormant at Fort Knox. But here’s the catch: no complete audit has been conducted since 1953. At that time, only 6% of the bars had been checked. Since then, there have been partial verifications, “seal inspections”, but nothing tangible. In 1974, a handful of journalists and officials touched on the mystery, without purity tests or a comprehensive inventory. The result? Ambiguity feeds suspicion.

In 2017, Steve Mnuchin, then Secretary of the Treasury, visited the site. The images show smiles, sparkling bars… but no scientific analysis. A public relations exercise, according to critics. The doors remain locked, the protocols secret. Even officials only enter on rare occasions. This opacity, combined with the absence of recent evidence, fuels a paradox: how can such a strong symbol rest on such fragile data?

Today, Polymarket crystallizes this mistrust. Bettors, skeptical, estimate a 21% probability that the vault is empty. A symbolic figure, but revealing. It reflects a distrust toward institutions, amplified by decades of silence. For in the collective mind, the gold of Fort Knox is no longer an asset: it’s a myth.

Trump, Musk, and the theories: when fantasy meets decentralized finance

The interest in Fort Knox has never been purely economic. It is a political narrative, almost cinematic. Donald Trump understood this well. In 2016, he promised to “personally verify the reserves”, implying that the Obama administration had “mismanaged” them. A rhetoric echoed by Elon Musk, whose enigmatic tweet in 2020 reignited conjectures. Their influence transforms an old rumor into a national debate.

Social media amplifies the phenomenon. From YouTube videos to Twitter threads, theories abound: gold may have been discreetly sold, replaced by copies, or even moved to unknown bunkers. Polymarket, by channeling these speculations into financial bets, lends unprecedented legitimacy to these narratives. The risk? That fiction influences reality. For if Trump reignites an audit, as promised, the consequences could be explosive.

Imagine a catastrophic scenario: what if the gold had really vanished? The dollar would lose its symbolic anchor, and markets would tremble. But the opposite is equally fascinating: an official confirmation would reinforce America’s status. In the meantime, doubt benefits some. Cryptocurrencies, often presented as the “digital gold”, gain credibility in light of the opacity of traditional assets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.