Is Bitcoin Mining Profitable?

Bitcoin is the first successful attempt at a decentralized digital currency. Created in 2009 by Satoshi Nakamoto, this cryptocurrency has seen a meteoric rise in popularity, reaching a market capitalization exceeding 1,000 billion dollars. When you try to acquire bitcoin (BTC), you have two main options: purchasing on exchanges and mining. The latter is subject to a phenomenon called Bitcoin halving, which halves the block reward every four years. This leads many investors to question the profitability of bitcoin mining. In this article, we attempt to provide a clear and transparent answer to this question.

Bitcoin mining: operation and costs

BTC mining is the process by which transactions are verified and added to the blockchain, which is the public ledger of all transactions made on the Bitcoin network.

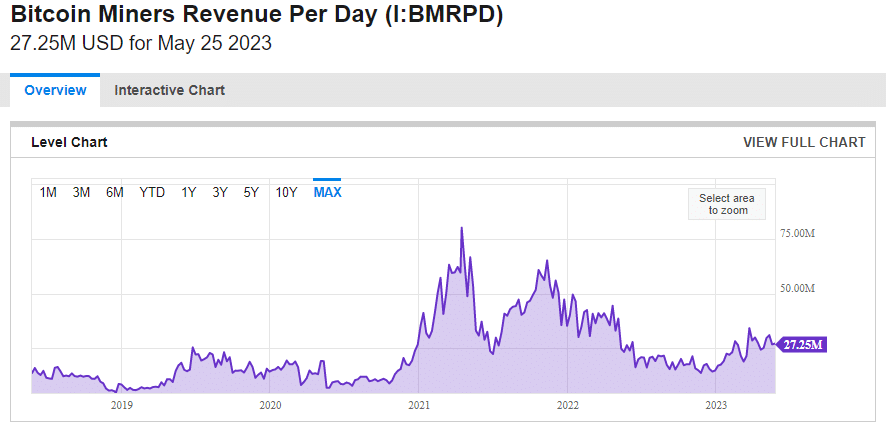

Mining involves solving complex mathematical problems using specialized computers to validate transactions. Miners who successfully solve these problems receive a reward in bitcoins, along with transaction fees for each transaction they have verified.

The cost of BTC mining is linked to equipment fees, electricity, and maintenance.

To equip themselves, miners must purchase specialized computers called ASICs (Application Specific Integrated Circuit) which are designed to solve the mathematical problems related to bitcoin mining. The cost of an ASIC ranges between a few hundred and several thousand dollars.

Miners also have to pay for the electricity costs associated with operating the equipment, which can be very high given the significant energy consumption of the computers.

Finally, miners must regularly perform maintenance tasks to ensure their equipment is functioning properly.

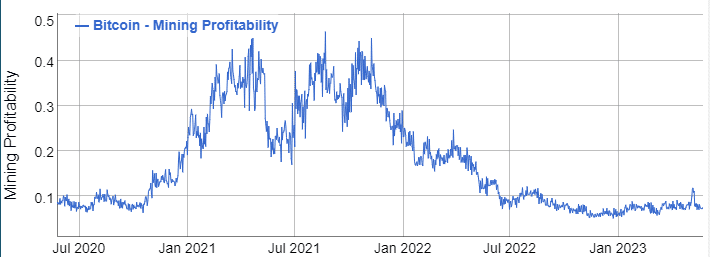

Factors of Bitcoin mining profitability

The mining difficulty is a parameter that is adjusted every two weeks to maintain an average block-solving time of about 10 minutes.

If the computing power of the Bitcoin network increases, the mining difficulty also increases, making it more challenging to solve the mathematical problems necessary for transaction validation. Conversely, if computing power decreases, mining difficulty also reduces.

The mining reward is another important variable that determines the profitability of BTC mining. Currently, the mining reward is 6.25 bitcoins per validated block.

However, this reward is halved every 210,000 blocks, or approximately every four years. This programmed reduction in the mining reward is called “Bitcoin halving” and aims to reduce the supply of BTC in circulation to maintain the currency’s scarcity.

The price of bitcoin is another important factor to consider when determining mining profitability.

A high price for bitcoin can offset the costs of the equipment and electricity needed for mining. However, a low price can affect mining profitability, even rendering the activity unprofitable.

Calculating Bitcoin mining profitability

To calculate the potential profits generated from BTC mining, you need to consider equipment costs, electricity, and maintenance, as well as the mining difficulty and mining reward.

There are several free online calculators that allow you to calculate the profitability of bitcoin mining based on these variables. Suppose you mine with an ASIC Antminer S19 Pro that you purchased for $5,000. Add to that electricity fees at $0.10/kWh. A profitability calculator might tell you that it will take about 308 days to recover your initial investment.

However, the profitability of this activity can vary significantly depending on mining difficulty and bitcoin price.

There are several online calculators for BTC mining that allow you to estimate your costs and potential profits. Here are a few:

- WhatToMine: it’s one of the most popular calculators for crypto mining. It allows you to calculate the profitability of your mining activity based on your equipment, hashrate, electricity costs, and current exchange rates.

- CryptoCompare: this site allows you to compare different mining hardware for cryptocurrencies, taking into account costs, electricity consumption, and potential profits.

- NiceHash: this service allows you to sell or buy hashrate for crypto mining. They also offer a profitability calculator that takes into account costs, profits, and service fees.

Alternatives to Bitcoin mining in terms of profitability

There are other ways to generate BTC that may be more profitable than traditional mining. Here are some examples:

Buying bitcoins

In some cases, the direct purchase of BTC may be a better option than mining. Especially if the goal is merely to invest in the digital currency rather than actively using it. And there are several reasons for this.

First, buying bitcoins directly is a simple and quick method to obtain crypto. Users can simply buy BTC on a crypto-asset exchange platform or through an online broker, without needing the mining equipment or associated maintenance.

This method is often considered more accessible and less expensive than bitcoin mining, which requires a significant initial investment in equipment and energy consumption.

Moreover, the value of bitcoin can increase significantly over time, which can result in substantial gains for users who buy and hold BTC long-term.

Although the price of bitcoin can be volatile, some analysts believe that the value of bitcoin will continue to rise in the long term due to its limited supply and growing demand.

However, it is important to note that direct purchase of bitcoins can also present risks. As with any other form of investment, the value of bitcoin can also decrease, and users may suffer financial losses.

Direct purchase of bitcoins may require some understanding of the technology and the crypto market, as well as knowledge of the associated risks.

Staking

Staking can be an interesting alternative to BTC mining in terms of profitability for several reasons.

First, staking is a method of obtaining cryptocurrencies that does not require the use of mining equipment. Instead, users can participate in transaction validation and network management simply by holding a certain amount of the crypto.

This method is often considered more environmentally friendly and more accessible than traditional mining, which requires significant computing power and high energy consumption.

Yet, staking can offer higher returns than traditional mining for some cryptocurrency projects. Staking rewards are often determined by factors such as supply and demand, user participation, and the value of the crypto. In some cases, staking returns can be higher than the profits made from bitcoin mining.

It should be noted that staking also presents risks. Just like mining alternative cryptocurrencies, the value of staking rewards can fluctuate based on the market’s supply and demand. Staking may require a long-term commitment to the crypto project, which can limit user flexibility.

Alternative mining

Alternative mining, also known as “altcoin mining”, is the process of mining cryptocurrencies other than bitcoin. While BTC is the most well-known and used crypto, there are thousands of digital assets in the market, each with its own technology and community.

Alternative mining can be more profitable than bitcoin mining for several reasons. First, some cryptocurrencies may be easier to mine than bitcoin, which means miners can use cheaper and more readily available equipment to extract the currency.

Some cryptocurrencies may have a higher price than bitcoin, which means miners can realize larger profits even if they extract fewer coins.

However, mining alternative cryptocurrencies can also present risks, as these currencies are often more volatile than bitcoin and may experience significant price fluctuations in a short period. Additionally, it can be challenging to find accurate information on lesser-known cryptocurrencies, which can make choosing alternative mining projects riskier.

Conclusion

Is generating bitcoins profitable? The answer to this question depends on many factors, including the difficulty of mining, the mining reward, the cost of equipment, electricity, and maintenance, as well as the price of bitcoin. Although BTC mining has been profitable in the past, it is becoming increasingly difficult to make profits due to increased competition and rising costs associated with mining. If you are considering mining bitcoins, we recommend using ASIC-based hardware. In general, this equipment has more potential in terms of profitability.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.