How Much Does BTC Mining Yield? A Complete 2024 Guide

While bitcoin mining plays a fundamental role in securing the network, the rewards it yields remain variable and uncertain. Originally an effective way to verify transactions on the network, mining has become a real professional activity in just a few years.

The profitability of this activity depends on many factors related to BTC cycles, including halving, but also on the external environment. How can you know how much you can earn from BTC mining? Find the answer in this comprehensive guide on bitcoin mining. Before knowing how much bitcoin mining can earn, one must first understand how this activity works.

Understanding Bitcoin Mining

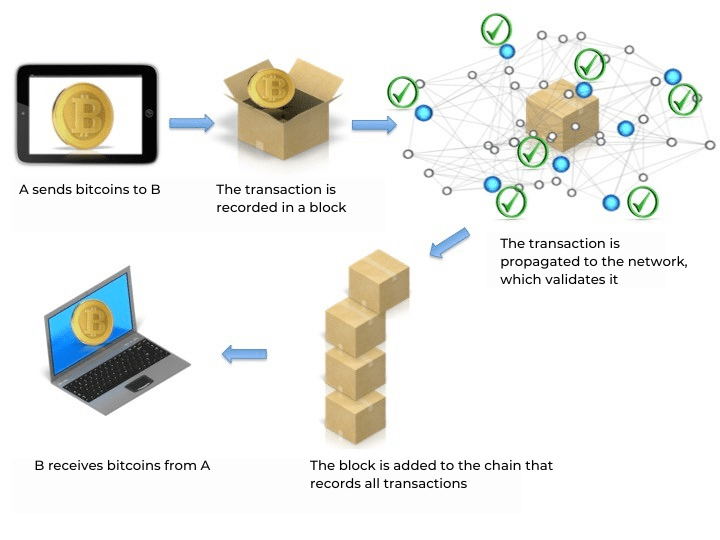

Bitcoin mining is a process by which miners validate transactions on the Bitcoin network in exchange for a reward. It allows new bitcoins to be put into circulation.

This process consists of different steps, starting with recording transactions on the blockchain:

- Transactions: they are grouped in a block by mining nodes;

- Block creation: miners solve complex mathematical problems to add the new block to the chain;

- Miner remuneration: it is granted to the miner who managed to create a new block.

It should be noted that only Proof-of-Work (PoW) blockchains allow mining. Proof of work is a computer protocol that contributes to the consensus algorithm for verifying transactions and adding new blocks to the chain.

Bitcoin was the first blockchain to use it. However, it is now used by others such as Ethereum, Litecoin, Dogecoin, and Zcash.

PoW is a security mechanism for blockchain systems because it makes any attempt to maliciously attack the network difficult and costly.

The Role of Miners

Miners play an important role in securing and operating the network. Their work preserves the blockchain’s immutable nature and protects the neutrality of the bitcoin network. The role of miners is, therefore, firstly, to verify the validity of transactions and to confirm them.

Then, they choose the most recent block header to integrate into the new one as a hash.

To do this, miners solve puzzles through a “nonce”. When the solution is found, the block is added to the chain and published across the entire network.

The miner’s objective is thus to find the solution first in order to obtain the block reward.

Block Reward – How Does It Work?

The mining premium or block reward is awarded to the miner who successfully adds a new block. It is impossible for just one person to receive the payout.

No one has enough computing power to solve the complex mathematical equations required to validate a block.

Originally, the reward was 50 bitcoins. But it is halved every 210,000 blocks, as part of what is called Bitcoin Halving. This occurs approximately every four years, thereby reducing the remuneration.

The next Bitcoin Halving, scheduled for 2024, will reduce the current reward to 3.125 BTC.

Mining Bitcoin – Factors Influencing Earnings

The profitability of mining the queen of cryptos depends on several internal and external factors to the cryptocurrency.

1. The Cost of Electricity

The cost of electricity is one of the largest sources of expense in cryptocurrency mining. When energy costs are higher than the gains obtained from mining, the activity is not profitable. This is why the sector has developed in regions where electricity is cheap.

To claim profitable mining, it is therefore necessary to favor more economical energy sources. The miner can use renewable energy resources such as solar and wind energy, or non-renewable resources such as oil, coal, or natural gas.

2. The Cost of Bitcoin and Block Reward

The price is also a factor that directly affects mining earnings. The price is proportional to the profits made by miners. They, indeed, obtain higher gains when the value of bitcoin is high. This is how the bear market in 2022 reduced the profitability of bitcoin mining.

Earnings also depend on the amount of the block reward. This is the quantity of BTC offered to miners for mining a block on the blockchain.

As mentioned earlier, this remuneration is halved during Halving. Currently, the mining premium is 6.25 BTC per block.

3. Mining Difficulty

Mining difficulty has an impact on the profitability of this activity. The higher the difficulty, the more mining requires additional computing power to verify transactions and validate blocks.

This difficulty continuously increases so as to frequently reach new historical highs.

Nevertheless, the difficulty of bitcoin mining undergoes an adjustment every 2,016 blocks, or approximately every two weeks. This adjustment aims to maintain the target block time of 10 minutes.

4. Mining Equipment

Mining also involves hardware investment. Indeed, potential mining gains also depend on the choice of equipment. Some equipment like ASIC allows faster bitcoin mining. Note that the expenses related to it can also be higher.

Now, you know the factors that affect the profitability of bitcoin cryptocurrency mining. You can then estimate the potential gains to determine if mining can be profitable in 2024.

Calculation of Mining Revenue of this Cryptocurrency

There are different ways to calculate the costs of bitcoin mining:

Let’s take a global example where the average cost of electricity is $0.16/KWh. The bitcoin network consumes about 60% renewable energy and 40% fossil energy. Suppose the average cost of renewable electricity is $0.05/KWh, and the same applies for the use of methane on oil platforms. The total bitcoin network consumes 80.7 TWh.

- 0.05 ✕ 80,700,000,000 ✕ 60% = $2,421,000,000

- 0.16 ✕ 80,700,000,000 ✕ 40% = $5,164,800,000

The total global mining costs for renewable and fossil energy amount to $2,421,000,000 and $5,164,800,000 respectively.

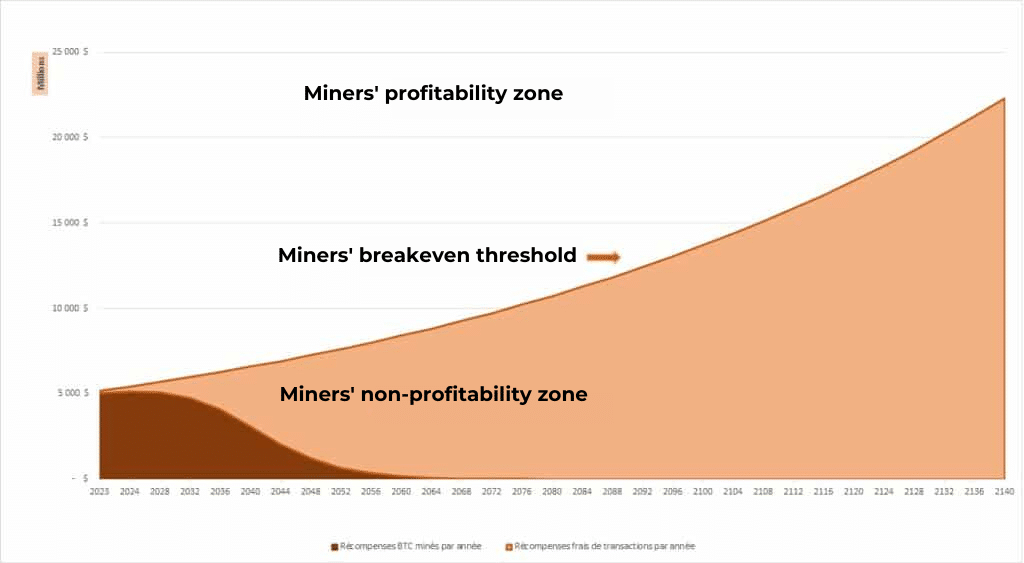

Next, let’s calculate the current global revenues of mining, excluding the total transaction fees. The block reward is 6.25 BTC.

- 6.25 ✕ 6 ✕ 24 ✕ 365 ✕ 60% ✕ BTC Price (renewable)

- 6.25 ✕ 6 ✕ 24 ✕ 365 ✕ 40% ✕ BTC Price (fossil)

The average breakeven price of bitcoin for renewable and fossil resources is $12,283 and $39,306 respectively.

- Breakeven BTC Price = 0.05 ✕ 80,700,000,000 ✕ 60% ÷ 365 ✕ (6.25 ✕ 6 ✕ 24) ✕ 60% (green energy)

- Breakeven BTC Value = 0.16 ✕ 80,700,000,000 ✕ 40% ÷ 365 ✕ (6.25 ✕ 6 ✕ 24) ✕ 40% (fossil energy)

Its current price fluctuates around $24,000. Thus, the type of fossil energy does not currently allow for covering costs with revenues, unlike renewable energy. For more details on potential revenues, you can also use calculators.

Just enter important information like the hardware value, mining difficulty, hashrate, electrical consumption as well as exchange rates, etc.

Configuration Examples

The configuration of your btc mining hardware has a significant impact on potential gains. Performance and fees incurred vary from one mining method to another.

Mining Rig

GPU graphics card mining rigs are one of the most common methods for mining bitcoin. It is a simple regular computer that uses multiple graphics cards. It consumes less electricity, which is economically more advantageous. However, in return, GPU Rigs have a lower computing power.

You should also consider expenses related to GPU Rig equipment such as the motherboard, four risers, power supply, chassis (structure holding the graphics cards), hard drive, and RAM. The total cost of these equipments can amount up to 2530 euros today.

ASIC

ASICS or “Application-Specific Integrated Circuit” are specifically designed to perform a single type of calculation. Although this material is less flexible in the choice of cryptocurrencies to mine, it remains very efficient. It is more suited for professional mining and has a high computing power.

However, energy costs can be very high due to its high electricity consumption. This machine can cost about 900 euros today for 20 TH/s and 1,600 Watts consumed. Additionally, consider energy costs as well as the installation and maintenance fees of the machine.

Cloud Mining

Cloud mining is a more economical and more beginner-friendly method. It does not require purchasing sophisticated hardware or having extensive knowledge of mining.

It involves renting the hash power, or data storage, of a company specialized in cryptocurrency mining. The cloud company then assumes the energy costs by reflecting them in the fixed value of your contract.

Mining Pools

Mining pools are a good option to reduce costs while gaining in performance.

The principle is simple, miners pool their machines’ computing power to increase the chances of mining a block.

Besides, remember that one person alone cannot claim to obtain the block reward in full. It is better to partner with other miners. The gains obtained are then distributed among the members of the mining pool.

This method has many advantages:

- The cryptocurrency mining activity is simplified;

- Better chances of making gains;

- Maintaining the scalability of mining operations;

- Benefits proportional to the mining power that the miner possesses;

- Reduction in equipment and electricity costs.

Optimizing Mining Gains

Reducing costs while remaining efficient is the only way to optimize bitcoin mining gains, even by exploring innovative ways like mining bitcoin for free. Before starting the activity, you must make wise choices about the equipment to use and the techniques to adopt.

Choosing the Right Equipment

The rule is simple: find the best value for money.

When choosing the mining equipment to use, try to take into account the following elements:

- Hashrate: should be higher than that of the most common miners;

- Electricity: high energy efficiency to reduce costs;

- Value: consider the current price of the cryptocurrency to set the budget allocated to equipment;

- Efficiency: ability to perform more hash per second while spending less energy resources.

Joining a Mining Pool

Many miners prefer to join a mining pool to avoid spending a large amount of money on overly expensive mining equipment. To choose the right pool, take its size into account.

The higher its hash power, the greater the chances of obtaining gains. Mining pool fees are generally between 1% to 2%.

Reducing Energy Costs

Various techniques can reduce energy costs. You can prioritize the use of green energy like solar and wind energy to reduce costs. Moreover, renewable energy is today the primary source used by miners.

Modifying the electrical voltage is also a good way to reduce the GPU’s electricity consumption. This could thus reduce the heat it emits. The mining software can allow an optimal setting of the current tensions. But be careful, lowering should not be excessive, otherwise it might cause machine crashes.

Future Prospects

So you will understand that the process of validating blocks in the bitcoin network is becoming increasingly complex. Faced with increased competition in the sector, it is harder to make gains. But that doesn’t mean that bitcoin mining is no longer profitable. On the contrary, you can optimize your gains by making the right choice of mining method and equipment. Despite the challenges hindering mining activity, the industry is not lacking in technological inventiveness to overcome them. Bitcoin mining still has a bright future and remains the fundamental pillar of decentralized finance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.