How far will Ethereum (ETH) go?

Bull markets in cryptocurrencies generally benefit altcoins in a second phase. In the month of May, Ethereum (ETH) performed over 15%, and nearly 65% since the beginning of the year. This resurgence of Ethereum comes after the SEC approved the establishment of ETFs on the world’s second-largest cryptocurrency. While the correlation between Bitcoin and Ethereum remains high, the cyclicity of Ethereum’s price seems to act with as much precision in the structure of this bull market. Decoding the indicators and the dynamics of Ethereum’s price.

Soon an ETF to boost the market?

As with Bitcoin (BTC), the U.S. Securities and Exchange Commission has approved the establishment of an ETF on Ethereum. Thus, this decision will allow major global managers to expand the cryptocurrency offerings to their clients. However, the SEC still needs to approve its commercialization…

“This decision follows the successful introduction of Bitcoin ETFs in January, which quickly attracted $13.3 billion in net inflows, setting performance records for ETFs at their launch. The arrival of Ethereum ETFs could experience similar success, attracting a new influx of capital to the second-largest cryptocurrency.”

Crypto: Ethereum ETFs approved by the SEC! – Cointribune

This same announcement for Bitcoin had particularly favored the price hike to historical highs. The arrival of an ETF on Ethereum thus leaves potential for a return to the November 2021 highs of $4,868. In May 2024, ETH thus represents nearly 17.7% of the market capitalization. This market share is still far behind Bitcoin, with a dominance near 53%.

The approval of Ethereum ETFs could thus instigate a catch-up effect compared to Bitcoin. Moreover, these ETFs could also be used to create ETFs representing a basket of cryptocurrencies in the future.

Taking a look at fractals: the rise persists

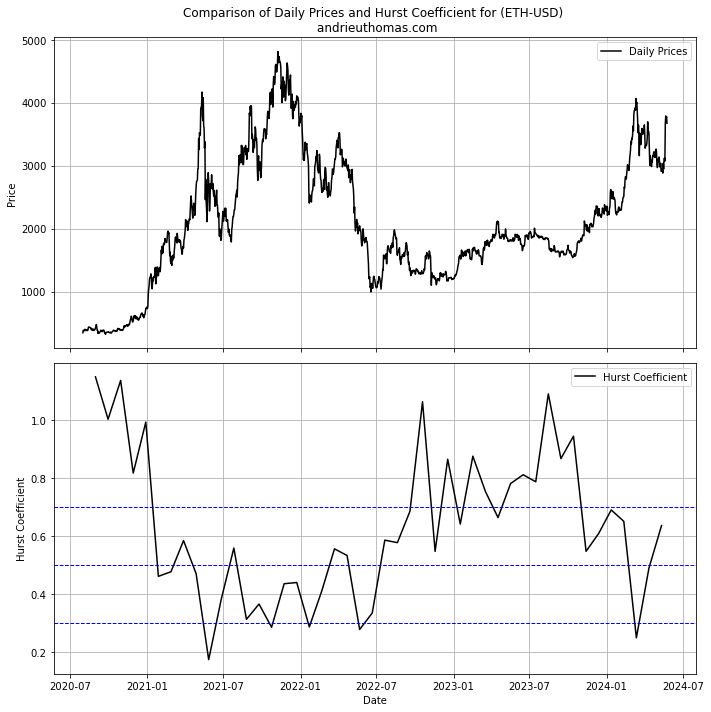

A major indicator for measuring the viability of the trend on ETH is to use fractals. Indeed, the Hurst exponent (read more) allows measuring the degree of trend persistence from one time scale to another. Furthermore, the Hurst exponent is ideally bounded between 0 and 1. With Ethereum, a Hurst exponent close to 1 indicates significant upward potential, and consequently a good symmetry with major lows. Conversely, a Hurst exponent close to 0 will indicate that the trend is anti-persistent and is likely to turn downward.

Graphically, we see that ETH gained significant upward potential in mid-2022, and reconfirmed it in early 2023. The ensuing bull market, in accordance with theory, was accompanied by a decrease in the Hurst exponent, signaling the loss of upward potential. In March 2024, the Hurst exponent was below 30%, indicating a bearish risk, or at least, the absence of upward potential. Nevertheless, the recent rebound in Ethereum seems to reaffirm a renewal of upward potential, thereby limiting the bearish risks observed in spring 2024.

Despite everything, this approach encourages us to be more cautious about the nature of the bull market compared to 2023. Indeed, it appears clear that the bull market has exhausted a significant portion of its overall potential.

The cycles acting on ETH

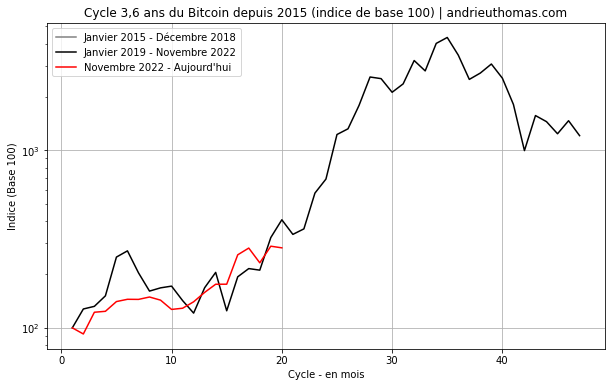

In several papers, we have had the opportunity to highlight a cycle close to 3.6 years on Ethereum. Furthermore, this dominant cycle corresponds to the same dominant cycle as Bitcoin (BTC). The timing of this cycle thus allows us to judge, and compare, the different bull or bear markets. For example, the bull market observed on Bitcoin since 2023 is strongly symmetrical to previous bull markets.

“Indeed, we know that two cycles of 4 months and 22 months synchronized in February 2018. We are now looking for the time period needed to achieve the next constructive interference. By calculating the LCM(4,22), we get 44 months (3.6 years), which strongly correlates with the cyclicity of equities and Bitcoin (Bitcoin Cyclicity (BTC) – Cointribune).”

Technical Indicators: Constructive Interferences and Destructive Interferences – Cointribune

Thus, a little more than 3.6 years separate the major peak of 2018 from that of 2021 on Ethereum. Likewise, 3.6 years separate the major low of early 2019 from that of mid-2022, etc. We see here a clear cyclical dynamic, mainly fueled by the correlation of Ethereum with Bitcoin. In this perspective, which remains admittedly theoretical, we could expect an Ethereum peak around mid-2025. We will finally mention the good symmetry observed so far between the current bull market and the previous bull market.

ETH remains correlated with Bitcoin

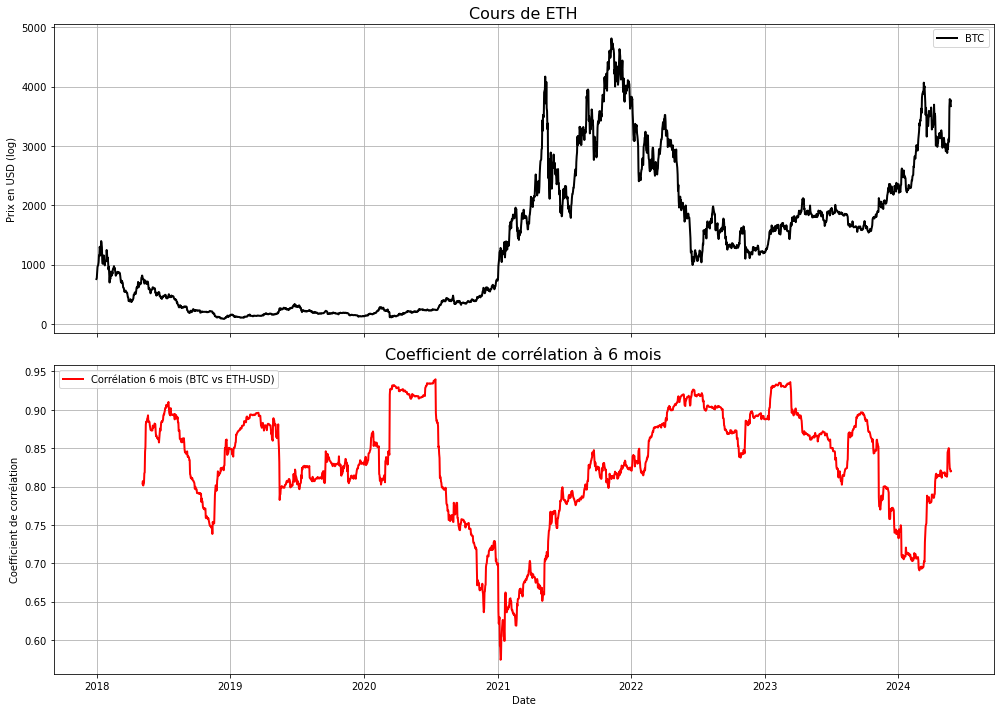

In our previous paper, we highlighted the importance of the correlation between Ethereum and Bitcoin. The lows and the major lows of the cryptocurrency market are indeed linked to the relationship that exists between the two main cryptocurrencies.

“We notice in our case that a high correlation coefficient between Bitcoin and Ethereum is conducive to translating major lows on Bitcoin. Conversely, a low correlation coefficient (prominent low of the coefficient) is likely to translate a sharp weakening of market strength, and major peaks. A major explanation would be that, during bull markets, the dependence of altcoins on Bitcoin decreases.”

Bitcoin (BTC) decorrelates from other assets – Cointribune

Graphically, we can verify that major lows on ETH are linked by a very high correlation with Bitcoin. However, before major bull markets on ETH, we notice that the BTC/ETH correlation is minimal. In March 2024, the 6-month correlation between Bitcoin and Ethereum thus reached a low around 70%. By symmetry, this indeed signaled the likely arrival of an intense bull market on ETH. The study of the correlation between the two assets, however, does not allow us to effectively judge the probable highs on Ethereum.

Despite everything, we see that the correlation between the two assets remains generally high. It is mostly above 80%, which is significant.

Towards $6,000?

The Technical Analysis of Ethereum’s price can provide us with additional elements. Indeed, we notice that the consolidation of March/April 2024 does not undermine the bullish trend initiated since 2023. On the contrary, the recent bullish breakout allows us to set an initial target (almost reached) towards the recent peaks around $4,000.

Then, as we have highlighted, it would be coherent, given the correlation with Bitcoin, to reach the historical peaks at $4,800. In the continuation of this theoretical bullish movement, the next extended target of the consolidation pattern (flag, logarithmic scale) would be near $6,000. This level does not seem graphically and statistically impossible. Conversely, continued difficulties in surpassing recent peaks, or a prolonged drop below $3,000, would signal a probable exit from the bullish trend.

We have also mentioned the good timing of this dynamic, similar to that of Bitcoin. Nevertheless, we see that a continued upward trend would be with less foundation than the rise of 2023 and early 2024. This necessarily encourages greater attention to market strength indicators.

In conclusion

The approval of Ethereum ETFs seems to have triggered a break in the consolidation since March. The upward trend on Ethereum thus continues:

- With an extension of demand to ETFs and the rebound of Bitcoin’s price.

- A weakening of bullish strength in terms of fractals. Nevertheless, the upward potential seems to be maintained in April/May concerning the price rebound.

- Additionally, the market’s timing and cyclicity still seem relevant. So far, a certain symmetry persists between the current bull market and the previous one. The upward dynamic is thus accompanied by the market’s structural cycles.

- The correlation with Bitcoin is maintained despite a decorrelation in March 2024. This signal indicates that the bull market on ETH is likely to continue in line with Bitcoin.

- Finally, Technical Analysis clearly shows a potential for continuation. The target towards previous peaks, then towards historical peaks, would thus be likely in a bull market. If the bullish strength is maintained, some extended targets are around $6,000, and beyond by extension.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Author of various books, financial and economics editor for many websites, I have been forming a true passion for the analysis and study of markets and the economy.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.