Guide To Understanding Coinbase Listing

The listing of Coinbase on Nasdaq marked a historic advancement for the crypto ecosystem. In 2021, Coinbase Global Inc. became the first major crypto platform to go public, attracting the attention of traditional investors and blockchain enthusiasts. Understanding this listing, its implications, and the tools to analyze its price is fundamental for anyone looking to explore the opportunities offered by this emblematic company.

What is Coinbase Global Inc.?

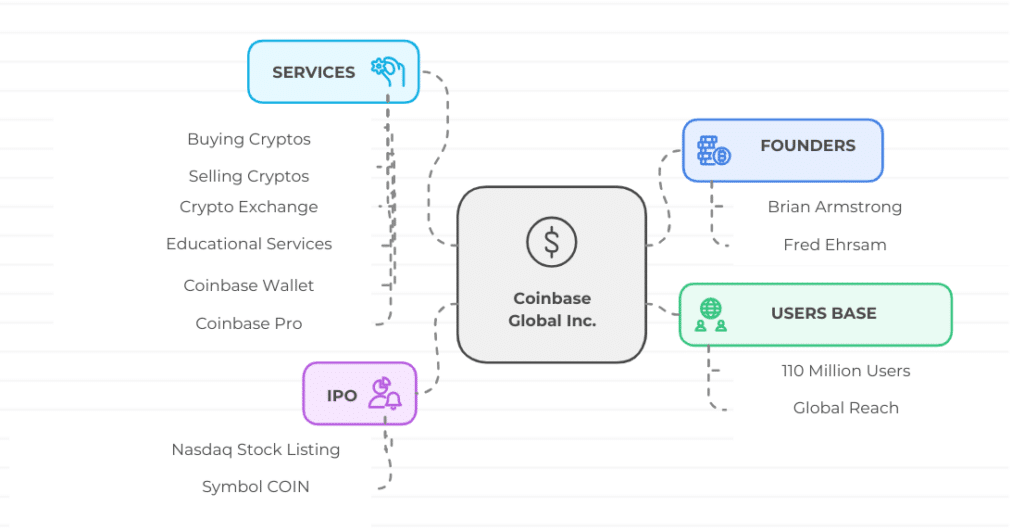

Coinbase Global Inc. is a crypto exchange founded in 2012 by Brian Armstrong and Fred Ehrsam. With over 110 million users worldwide, Coinbase is one of the leading companies in the crypto sector. Its mission is to facilitate access to cryptocurrencies by offering intuitive tools and enhanced security.

The company offers a wide range of services. Users can buy, sell, and exchange over 250 cryptos, including popular assets like bitcoin and ethereum. The platform caters to both beginners and experienced traders. It has educational services, a non-custodial wallet (Coinbase Wallet), and an advanced version for traders (Coinbase Advanced).

In April 2021, Coinbase opted for a direct listing on Nasdaq under the symbol COIN. This IPO highlighted its central role in the adoption of cryptocurrencies while reflecting the challenges and opportunities in the sector.

Understanding the listing on Nasdaq

The listing of Coinbase on Nasdaq symbolizes the entry of cryptocurrencies into the traditional financial sphere. This chapter explores the details of this listing and the mechanisms that govern it.

What is a direct listing?

Coinbase chose a direct listing, a method different from a traditional initial public offering (IPO). In an IPO, new shares are created and sold through intermediaries like investment banks. In contrast, a direct listing allows existing shareholders to sell their shares directly on the public market. This eliminates costs related to financial intermediaries and ensures full transparency.

The direct listing of Coinbase allowed an initial valuation based on actual supply and demand. This provided investors immediate access to objective data on the company’s value, without relying on bank projections.

The initial performance of Coinbase

On the day of its Nasdaq listing, the Coinbase stock was set at $250. Quickly, its price soared to a peak of $429 before closing at $328. These fluctuations reflected the enthusiasm for cryptocurrencies, but also the uncertainties surrounding regulation and the long-term viability of the sector.

Since its listing, the COIN stock has experienced significant fluctuations. These movements are closely linked to trends in the crypto market, the company’s financial performance, and changes in the regulatory environment.

Tools to monitor Coinbase’s listing

For investors, understanding and monitoring the variations in Coinbase’s stock is necessary. Several analysis tools enable a better grasp of trends and the development of investment strategies.

Moving averages and technical indicators

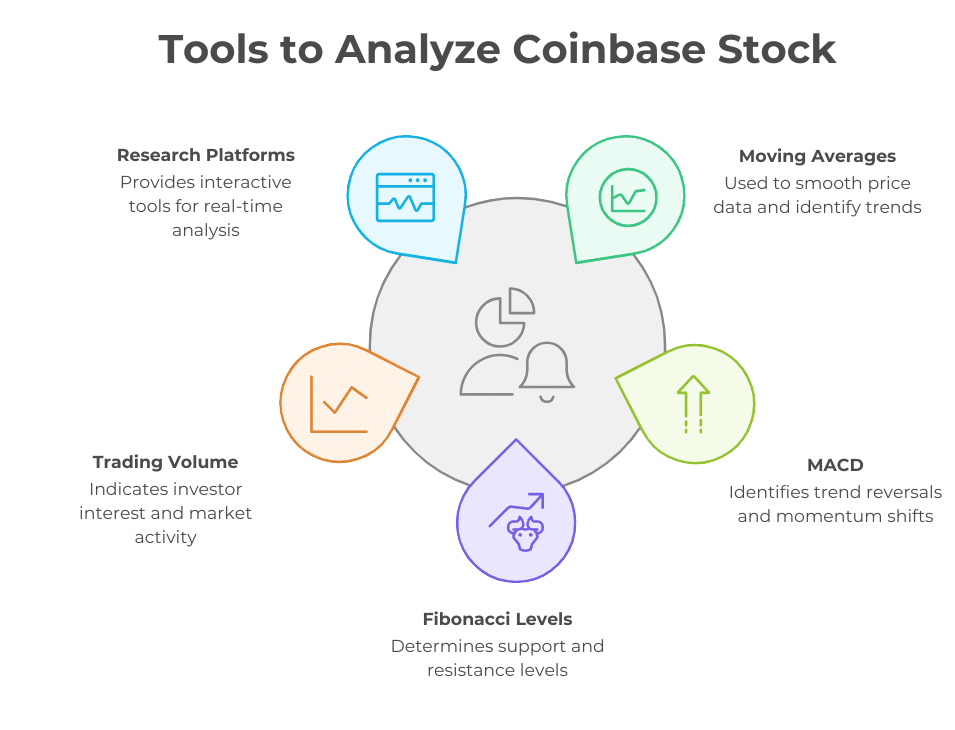

Moving averages are indispensable tools for analyzing a stock’s price. They help observe trends while smoothing out short-term fluctuations. For Coinbase’s stock, simple moving averages (SMA) and exponential moving averages (EMA) are often used.

Indicators like the MACD (Moving Average Convergence Divergence) provide additional analysis by identifying bullish or bearish trend crossings. Fibonacci levels help to determine support and resistance thresholds, thus providing a clearer view of potential movements.

Transaction volume

The transaction volume reflects investor interest in a stock. For Coinbase, a high volume generally indicates increased activity, often linked to major announcements or changes in the crypto market. A combination of volume analysis and price variations helps understand the underlying movements in the market.

Tracking platforms

Platforms like FactSet Research Systems and Boursorama offer interactive tools to track Coinbase’s stock price. These tools include charts, personalized alerts, and comparative analyses, allowing investors to stay informed in real time.

Factors influencing Coinbase’s stock price

The evolution of Coinbase’s stock price depends on several factors, ranging from the dynamics of the cryptocurrency market to internal strategic decisions and external influences. These elements, often interrelated, shape short- and long-term trends.

The link with the crypto market

Coinbase’s price is closely linked to the performance of the crypto market. When bitcoin, ethereum, or other major cryptocurrencies register a rise, Coinbase enjoys an increase in trading volumes on its platform, boosting its revenues.

Conversely, a market crash reduces these volumes, directly affecting its revenue. This link is based on Coinbase’s business model, which is primarily centered on transaction fees. Investors therefore consider the overall evolution of the crypto market as a key indicator for anticipating the value of Coinbase’s stock.

Financial and strategic announcements

Coinbase’s quarterly financial results, play a decisive role in investor perception. Revenue growth, particularly in diversified segments like staking or subscriptions, reinforces confidence in the company. For example, the introduction of the Coinbase One offer, with reduced fees and priority customer support, was well received by the market.

Similarly, strategic announcements, such as acquisitions or the launch of new features, can signal an ability to innovate and resilience in the face of competition, positively influencing the stock price.

Regulations and government policies

Regulations and political decisions represent a major risk factor for Coinbase. As a publicly traded company, it must comply with international financial standards, enhancing its credibility.

However, announcements from organizations such as the SEC in the United States can raise uncertainties. For example, restrictions on trading certain cryptocurrencies or enhanced audits can influence investor confidence. Conversely, clear and favorable regulation can stabilize the sector, providing Coinbase with a conducive framework for its development.

How to Analyze Coinbase’s Listing?

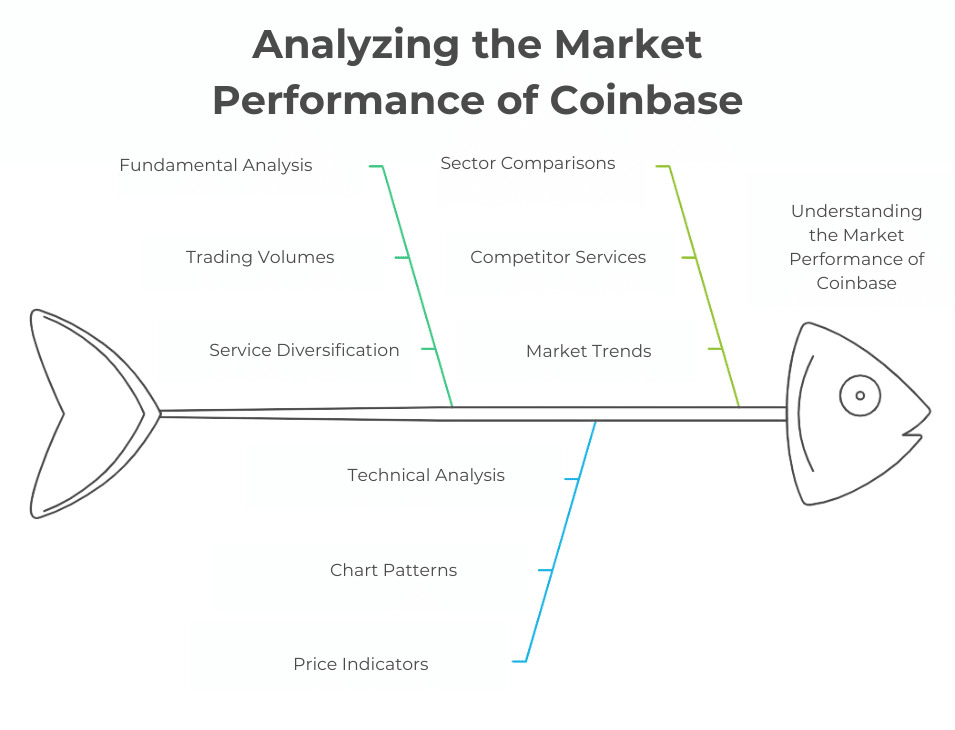

To better understand Coinbase’s performance, it is essential to use a combination of fundamental and technical analyses.

Fundamental Analysis

The fundamental analysis examines the financial aspects of the company to assess its health and prospects. Investors look at quarterly reports, which reveal crucial data such as revenue and net profit.

In the case of Coinbase, it is essential to monitor trading volumes as they constitute a significant part of the revenue. The diversification of services, such as staking or subscriptions, also plays a key role in assessing the company’s stability. Long-term growth forecasts, based on cryptocurrency adoption, also influence investment decisions.

Technical Analysis

The technical analysis relies on the study of charts and indicators to anticipate price movements. Investors use tools like the RSI (Relative Strength Index) to detect overbought or oversold areas. Japanese candlesticks and Kagi lines help visualize trends and potential reversals.

Fibonacci retracements identify support and resistance levels, which are essential for entry or exit decisions. This method is particularly useful for traders looking to profit from short-term fluctuations in Coinbase’s stock price.

Sector Comparisons

Comparing Coinbase to other players in the technology and finance sector allows for a better understanding of its market position. Companies like PayPal or Block, which also integrate cryptocurrency-related services, provide interesting comparison points.

These sector analyses reveal Coinbase’s relative strengths and weaknesses, particularly in terms of innovation or market share. They also help position its performance in relation to the overall evolution of the cryptocurrency industry, thus enhancing the relevance of the analysis.

Coinbase’s listing on the Nasdaq marked a major milestone in the recognition of cryptocurrencies by traditional finance. By mastering its mechanisms, analyzing its performance, and using tools to track its evolution, investors can better grasp the opportunities it offers. Although volatile, COIN stock reflects the dynamics and constant innovation of the crypto ecosystem. Whether you are passionate about blockchain or an experienced trader, remember that this listing can also inspire new strategies for your trading on Coinbase.

FAQ

The direct listing chosen by Coinbase eliminates the costs associated with investment banks, thus promoting transparency. Unlike a traditional IPO, it allows existing shareholders to sell their shares directly without creating new shares, reducing value dilution for existing investors.

By analyzing the company’s quarterly reports, you can examine sales, operating margins, revenue diversification (staking, subscriptions) and the evolution of trading volumes on the platform. This data provides a clear picture of Coinbase’s economic viability.

Regulatory changes, such as restrictions on certain cryptocurrencies or increased compliance requirements, could reduce trading volumes and increase management costs. These factors may affect Coinbase’s profitability in the short to medium term.

Although Coinbase and PayPal operate in different sectors, comparisons are possible. Coinbase focuses on cryptocurrencies, while PayPal integrates traditional payments and digital assets. Both companies can be evaluated on their market share, capacity for innovation and user adoption.

Platforms such as Yahoo Finance, TradingView and Boursorama offer interactive charts, technical analysis and price alerts. These tools help you monitor trends, identify buying and selling opportunities and track external factors influencing Coinbase shares.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more