Guide To Optimize Transaction Fees On Coinbase

Coinbase is a well-established cryptocurrency exchange platform, providing services to millions of users worldwide. However, one of the major challenges for investors and traders with this crypto exchange lies in the applied fees that can significantly reduce profits. This guide explores in detail the strategies to understand and optimize these fees, enabling users to make the most of their transactions.

Understanding Transaction Fees on Coinbase

The fees applied on Coinbase vary and depend on the type of transaction, payment method, and service used. Before optimizing these fees, it is essential to understand their structure well.

The Structure of Fees Applied by Coinbase

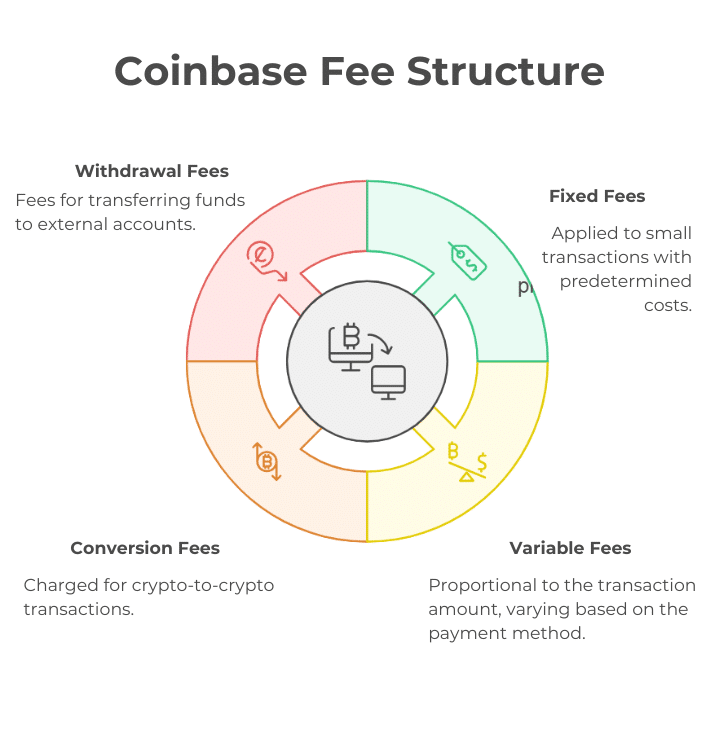

Coinbase applies several types of fees depending on the services and transactions:

- Fixed Fees: these fees, predetermined, often apply to small transactions and vary depending on the method used. For example, credit card payments include high fixed fees;

- Variable Fees: proportional to the transaction amount, these fees apply when buying or selling cryptocurrencies, ranging from 1.49% to 3.99% depending on the payment method;

- Conversion Fees: transactions involving a conversion between two cryptos are charged at a rate of 1%;

- Withdrawal Fees: they concern funds transferred to a bank account or an external wallet. SEPA transfers, for example, charge €0.15, while withdrawals via credit card may include additional percentages.

These fees are communicated before each transaction, allowing users to plan effectively.

The Differences Between Coinbase and Coinbase Advanced

Coinbase and Coinbase Advanced offer distinct services tailored to different profiles. Coinbase, designed for beginners, provides a simple and accessible interface but applies higher fees. Transactions include fixed and variable fees, making this platform convenient but costly for frequent users.

Coinbase Advanced, on the other hand, caters to experienced traders with a more competitive fee structure. The “maker” and “taker” fees vary based on traded volumes. For volumes above $400 million, maker fees can drop to 0%, thus favoring active investors and institutional traders.

How to Reduce Cryptocurrency Purchase Fees on Coinbase?

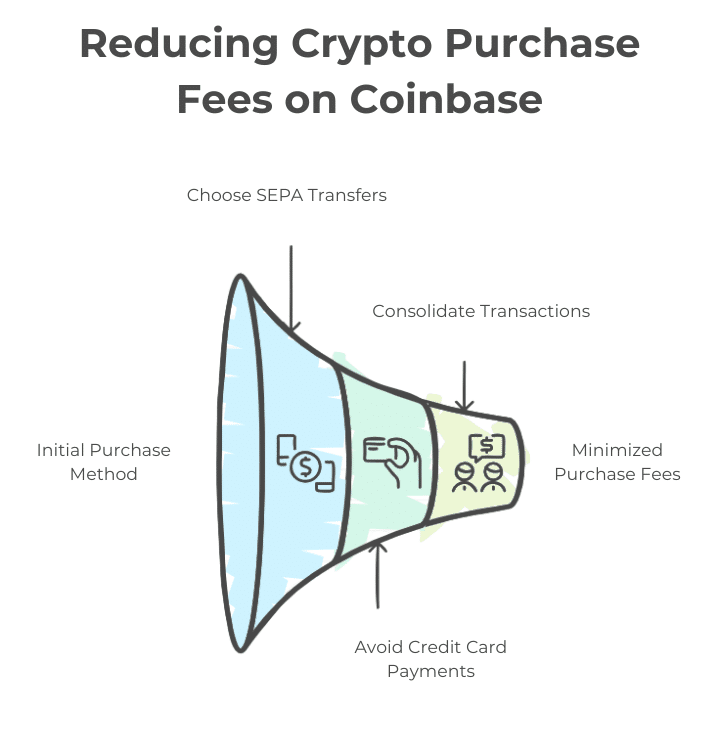

Minimizing fees when purchasing cryptocurrencies on Coinbase requires choosing suitable methods and planning transactions intelligently. Several strategies can reduce these costs and optimize your investments.

Prioritize SEPA Bank Transfers

SEPA transfers are an economical method for funding a Coinbase account. With fixed fees of only €0.15, they are much cheaper than credit card payments. This option is particularly advantageous for European users looking to make large or regular deposits. In addition to reducing costs, it provides a secure alternative compliant with European regulations on financial transactions.

Avoid Credit Card Payments

Credit card payments, while immediate, generate significant fees, reaching 3.99% of the purchase amount. This method suits users seeking speed, but it becomes unprofitable for frequent or large transactions. For serious investors, it is advisable to opt for bank transfers or other less expensive methods to preserve a larger portion of their capital.

Consolidate Your Transactions

Fixed fees impact smaller transactions more significantly, making their effect proportionally higher. By consolidating several small purchases into a larger transaction, you reduce the burden of fixed fees relative to the total amount. This approach is particularly suitable for users planning regular purchases or investing for the long term, as it allows for significant savings on overall costs.

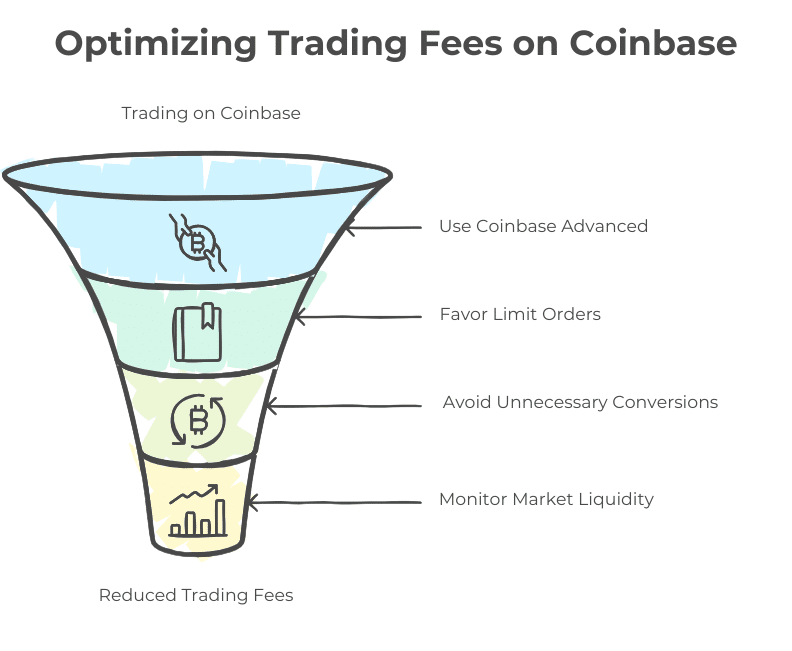

How to Optimize Conversion and Trading Fees on Coinbase?

The fees related to conversions between cryptocurrencies and trading activities can reduce your gains if you do not anticipate them. Adopting suitable strategies helps minimize these costs and maximize the efficiency of your transactions.

Leverage the Advantages of Coinbase Advanced

Coinbase Advanced stands out with a favorable fee structure, designed for active traders. The sliding scale fees based on trading volumes allow substantial savings for those conducting significant transactions.

Limit orders, which are executed when the price reaches a defined threshold, benefit from reduced or even zero fees for makers. In contrast, market orders, executed immediately at the best available price, incur higher costs due to their taker status.

Strategically using Coinbase Advanced by prioritizing limit orders and increasing your volumes can thus significantly reduce your expenses in the long run.

Avoid Unnecessary Conversions

Conversions between cryptos on Coinbase generate fixed fees of about 1% for each operation. These costs can quickly accumulate if the conversions do not meet clear objectives.

To reduce these expenses, it is advisable to evaluate your needs before exchanging your assets. For instance, holding a cryptocurrency long-term avoids multiple conversions. By planning your transactions precisely, you decrease your fees while optimizing your crypto wallet.

Monitor Favorable Trading Moments

The crypto market experiences significant liquidity variations, affecting spreads and fees. Low liquidity can lead to additional costs for substantial transactions. Identifying periods when the market is stable or highly liquid allows for exchanges at lower costs. An analysis of trends and trading volumes helps you choose the right moments to limit your spending while benefiting from favorable conditions for your operations.

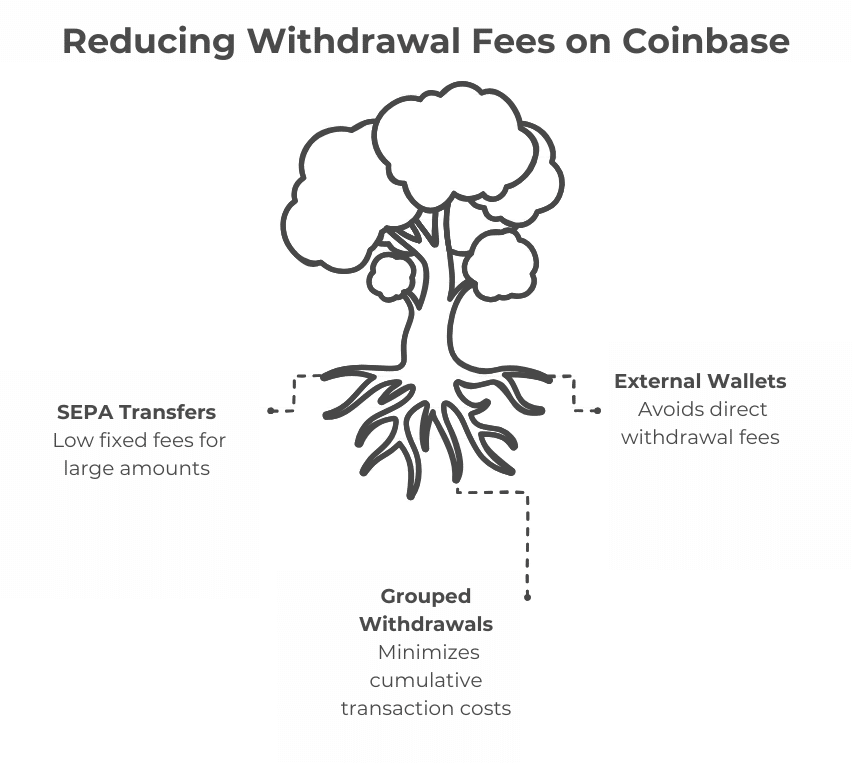

How to Reduce Withdrawal Fees on Coinbase?

Withdrawal fees on Coinbase can represent a significant portion of users’ expenses on Coinbase. By choosing the right methods and planning transactions, it is possible to substantially reduce these costs.

Favor SEPA Transfers

SEPA transfers are among the most economical options for withdrawing funds in euros from Coinbase. With fixed fees of only €0.15, this method proves particularly advantageous for large amounts.

By opting for a SEPA transfer, you limit the costs associated with percentages charged on other types of transactions, such as withdrawals by credit card. This method, suitable for European residents, ensures fast and secure transfers while optimizing your expenses.

Use an External Wallet

Transferring your cryptos to an external wallet before converting them into fiat currency can reduce fees associated with direct withdrawals from Coinbase. Solutions like Metamask, Ledger, or Trezor allow you to store your assets in a secure environment while providing more flexibility for future conversions.

Users who adopt a long-term view on their investments can thus avoid recurring withdrawal fees and choose strategic moments to make their transactions.

Plan Group Withdrawals

Every withdrawal, whether a small or large amount, incurs fixed fees. Making several small withdrawals increases these cumulative costs over time. By consolidating your funds for a single or less frequent withdrawal, you limit the number of transactions and associated fees. This strategy is particularly effective for those who regularly use their Coinbase account, allowing them to save while optimizing their financial management.

Maximizing Benefits with Coinbase One and Other Programs

Coinbase offers several programs and features aimed at reducing costs for users while providing additional benefits. These options maximize the profitability of your transactions while taking advantage of premium services.

The Coinbase One Subscription

The Coinbase One subscription offers exclusive benefits, including a significant reduction in fees for frequent users. With this subscription, certain transactions are fee-free, making it an ideal option for active traders.

In addition to savings, subscribers benefit from priority access to customer support, reducing resolution times for issues. This service also includes coverage for certain unexpected fees, enhancing the attractiveness of the offer for regular investors.

The “Learn & Earn” Educational Programs

The Coinbase “Learn & Earn” program allows users to earn crypto by taking interactive courses on topics related to blockchain and cryptocurrencies. By discovering new projects or deepening their knowledge, participants receive rewards in the form of tokens. These free cryptocurrencies can later be used to cover part of transaction fees, providing a practical and educational solution to reduce costs while enhancing skills.

Referral Rewards

Coinbase offers a referral program that allows you to earn cryptocurrencies by inviting new users to join the platform. For each successful registration and following a first purchase, both referrer and referred receive rewards.

These crypto earnings can be reinvested to reduce transaction fees or to diversify your portfolio. This method, both simple and lucrative, encourages users to expand their network while lowering their expenses related to operations on the platform.

User Reviews on Coinbase Fees

Reviews concerning the fees applied by Coinbase vary based on users’ needs and expectations. While some appreciate the simplicity of the platform, others criticize the high cost of transactions.

Positive Points

- The platform offers ease of use, perfect for beginners looking to familiarize themselves with cryptocurrencies.

- A wide range of cryptocurrencies is available for trading and investment, offering numerous opportunities for diversification.

- Coinbase ensures enhanced security and strict regulatory compliance, enhancing user trust.

Negative Points

- Fees are often perceived as higher compared to competitors like Binance or Kraken.

- Some users regret a lack of clarity in communicating the fee structure for specific services.

- Customer support, although effective, is sometimes criticized for prolonged response times for complex inquiries.

These feedback highlight the importance of comparing platforms before choosing the one that best suits your needs.

Optimizing transaction fees on Coinbase requires careful planning and strategic use of available tools. By leveraging options like Coinbase Advanced, SEPA transfers, or programs such as “Learn & Earn”, you can reduce your costs and maximize your gains. Although Coinbase imposes higher fees than some alternatives, its security, simplicity, and features make it a solid choice, especially for beginners. Using Coinbase Advanced provides access to a tiered fee structure and advanced tools, ideal for active traders. Plan your transactions carefully and explore all available options to enhance your experience on this recognized platform!

FAQ

Yes, stablecoins like USDC can be used to reduce conversion fees. For example, by making payments directly with stablecoins from your Coinbase wallet, you can avoid the conversion fees typically applied to more volatile cryptocurrencies.

Coinbase displays estimated fees before you confirm any transaction. You can also use external tools or online simulators to estimate the total fees based on your transaction preferences (buying, withdrawing, converting)

Yes, users who trade large volumes can benefit from discounts through Coinbase Advanced. Additionally, the Coinbase One subscription offers extra benefits, such as reduced or zero fees for certain transactions.

Coinbase occasionally offers promotions or specific campaigns to reduce certain fees, such as trading discounts or bonuses for using the Coinbase Card. These offers are usually announced via email or through the app.

Yes, transferring your crypto to a non-custodial wallet can help reduce fees associated with custody or certain transactions. Decentralized wallets like MetaMask or Ledger offer more flexible asset management and reduce reliance on centralized services like Coinbase.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The contents and products mentioned on this page are in no way approved by Cointribune and should not be interpreted as falling under its responsibility.

Cointribune strives to communicate all useful information to readers, but cannot guarantee its accuracy and completeness. We invite readers to do their research before taking any action related to the company and to take full responsibility for their decisions. This article should not be considered as investment advice, an offer, or an invitation to purchase any products or services.

Investment in digital financial assets carries risks.

Read more