Grant Engelbart, Carson Group vice president and investment strategist, sees a handful of advisors allocating 3.5% of Bitcoin ETFs on average to client household portfolios.

— Bloomberg TV (@BloombergTV) March 18, 2024

He speaks with Scarlet Fu and Katie Greifeld on Bloomberg ETF IQ https://t.co/OPSAiysQ3Y pic.twitter.com/acikDctTCe

A

A

Grayscale's ETF drags down bitcoin again

Tue 19 Mar 2024 ▪

3

min read ▪ by

Getting informed

▪

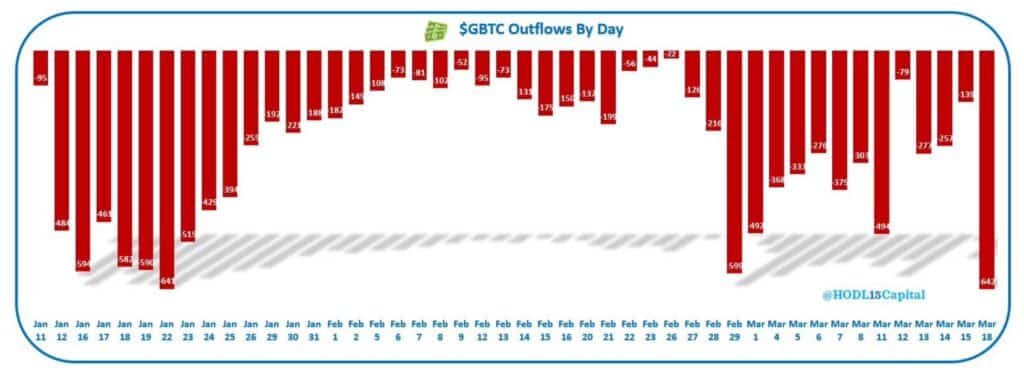

Grayscale’s GBTC ETF once again weighs on bitcoin with capital outflows of several hundred million dollars.

Grayscale’s shadow looms again

Bitcoin has fallen 4% since the start of the week. It is 12% lower than the $73,000 ATH achieved just a few days ago and is currently trading around $64,000.

As has happened before, it’s the outflows from GBTC ETF that are responsible for this pullback. They reached $643 million this Monday. This is the largest capital leakage since its conversion to an ETF on January 11th:

The exodus of Grayscale clients is expected to continue due to its management fees being seven times higher than its competitors’. Moreover, the law prohibits ETFs from directly reimbursing their clients in BTC. They must first be converted into dollars. Hence the downward pressure caused by Grayscale.

Net ETF outflows totaled $154 million this Monday. This hadn’t happened since March 1st. However, BlackRock’s ETF still displays impressive volumes. Its iShare ETF has offset Grayscale’s bleeding with inflows of $451 million.

Here is the number of bitcoins held by various ETFs as of March 18:

- BlackRock: 237,339 BTC

- Fidelity: 134,889 BTC

- ARK: 39,829 BTC

- Bitwise: 29,529 BTC

- Vaneck: 7,721 BTC

The ETFs of Valkyrie, Invesco, Franklin, and Wisdom Tree share the crumbs (15,945 BTC). The GBTC ETF holds 368,600 BTC itself, which is a 40% decrease since January 11th. What proportion of these capital outflows have already rotated to other ETFs? Hard to say.

In total, the new ETFs have already attracted 465,000 BTC, but “only” 214,000 BTC net, due to Grayscale’s scheming.

Regardless, overall demand remains strong. The Vice President of Carson Group stated on Bloomberg that some of his managers are reallocating an average of 3.5% of their portfolio from stocks to bitcoin:

Taking into account that more than 140 trillion dollars are under management globally. We’re talking about 5 trillion dollars. Knowing also that it only took about fifteen billion dollars to double the value of bitcoin…

The Standard Chartered Bank estimates that it will only take 75 billion dollars (currently 15 billion) in ETF investments to reach a valuation of 250,000 dollars for one bitcoin.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

A

A

Bitcoin, geopolitical, economic and energy journalist.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.