Gold Surpasses Bitcoin Again, Reaching a Historic High

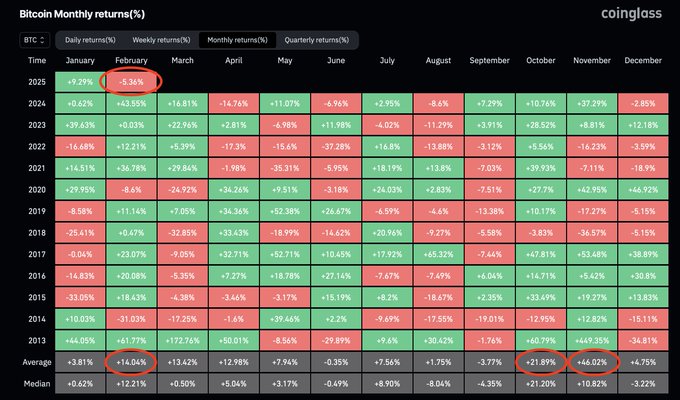

The month of February was not kind to Bitcoin. The fluctuations of BTC oscillated between 93,000 and 98,000 dollars, with a brief escape above 100,000 dollars, before the reality of the market brought everyone back to square one. A disappointment for record fans, while other assets, notably gold, took advantage of the spotlight. A situation that highlights the resilience of BTC in the face of a generally uncertain market.

Bitcoin vs. Gold: a duel at a distance, but with heavy geopolitical stakes

February was marked by persistent geopolitical tensions, concerns regarding the trade tariffs from the United States, and a cryptocurrency market searching for catalysts. Bitcoin struggled to stay above 95,000 dollars, oscillating rather around 97,000 dollars without managing to project itself towards new heights.

The general sentiment? Frustration.

The price stability of bitcoin in this narrow range contrasts with the spectacular performances of gold. Indeed, gold, with its rarity and reputation as a safe haven, has crossed a new psychological threshold by reaching new historical records.

It’s simple, gold seems to dominate safe haven markets, with consecutive increases of +11% in just a few weeks, driven by a series of gains since 2024.

Some interesting figures about gold:

- Gold prices have risen by +27% in 2024, their third-best performance since 1980.

- The trend continued in 2025 with an 11% increase in 5 weeks, whereas it was +27% increase in 2024.

- The prospect of gold reaching 3000 dollars an ounce is becoming increasingly realistic.

In this context, it is not surprising that traders like Roman, on X, qualified the situation as “absolute carnage” on the bitcoin side, with “false signals” in every direction and reduced volatility.

“The BTC market seems to be plagued by a lack of clear direction, with each upward attempt met with stubborn resistances.” — Rekt Capital

The price of BTC: still in a tight range, but a hope for recovery?

Bitcoin continued to stagnate in February. After briefly flirting with 100,000 dollars, the sellers came back strong, pushing BTC once again below this symbolic barrier. Yet, despite this period of latency, some analysts remain optimistic.

The trader Cold Blooded Shiller, for example, mentions a “developing bullish divergence” that could allow BTC to aim for new horizons, provided that a short squeeze occurs.

Weak trading volumes and the difficulty of breaking the 100,000 dollar resistance have created a kind of trap for traders who found themselves fighting in an “endless pain market”.

But, as Daan Crypto Trades points out, the early hours after the US markets opened were particularly challenging, with quick sales that caught many traders off guard. Volatility thus seems to be on the agenda, but without a clear direction.

However, there is still a possibility that bitcoin reaches 101,000 dollars, as Cold Blooded Shiller suggests, if the market starts to change dynamics.

“Each sale seems less violent than before, a sign that the market may be preparing for a rally.” — Cold Blooded Shiller

For maximalists, the real opportunity might lie in selling part of the gold reserve of the United States under Trump, a potential trigger for a BTC rise in 2025. If this event materializes, the dream of a Bitcoin victory over gold could very well become a reality.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.