Get ahead of the 2024 Bitcoin Halving now

Every four years, the Bitcoin protocol experiences an event known as the Halving. It is undoubtedly one of the most significant events in the network. This highly anticipated event involves a change in the protocol’s monetary policy by halving block rewards. In April 2024, the block reward will drop to 3.125 BTC. With this crucial deadline approaching, how can you best prepare?

Halving: ticktock every 4 years

When Bitcoin was launched in 2009 by Satoshi Nakamoto, the reward was 50 bitcoins per block. This reward was reduced to 25 BTC in 2012, then to 12.5 BTC in 2016, and finally to 6.25 BTC in May 2020 during the last halving. Since 2020, miners have been receiving the same reward when they add a block to the Bitcoin blockchain.

During the upcoming halving scheduled for April 26, 2024, the reward offered to miners will decrease from 6.25 BTC to 3.125 BTC.

It is coded in the protocol’s computer code that the reward be halved every 210,000 blocks. So far, there have been three halvings. In other words, over time, the Bitcoin protocol generates less and less inflation, until it virtually stops producing any in a few years.

Bitcoin indeed has an important preprogrammed characteristic: the reward that miners receive (on average every 10 minutes) for including transactions in a block is not fixed.

As a reminder, block rewards are the primary incentive for miners to secure the network.

What’s the point of halving?

The halving of the block reward is an essential feature of Bitcoin’s monetary policy. It is implemented to control inflation rates, ensure the scarcity of the digital asset, and increase the value of BTC over time.

Each halving reduces the number of new bitcoins produced per block, leading to a mechanical decrease in supply. More precisely, it slows down the rate of increase in the money supply. This is what is known as continuing to produce inflation, but at an increasingly slower pace.

Bitcoin shares many similarities with a deflationary currency like gold. Satoshi Nakamoto himself admitted to drawing significant inspiration from gold production when defining Bitcoin’s monetary policy.

As BTC becomes scarcer and demand increases, its price is likely to rise, following the elementary principle of supply and demand.

Less and less inflation

The halving of the block reward will eventually cap the total supply of bitcoins at 21 million coins. This fixed supply is one of the fundamental characteristics that differentiate Bitcoin from traditional fiat currencies.

Bitcoin is the currency of limits. The inviolable limit of 21 million. A limit protected by decentralized governance that prevents modifying the protocol at will.

In contrast, government officials and bureaucrats manage national currencies without any possible competition (legal tender policy). A performative act is enough to break the limit. This exposes the population to strong inflationary pressures, leaving them with no escape from this invisible tax.

Government currencies lose value over time due to inflation caused by a growing money supply, which in turn reduces their purchasing power (the same unit of money can buy fewer and fewer goods over time).

Theft.

The limit of 21 million

Governments have always used the printing press, and it is unlikely (especially in Europe) that they will suddenly adopt monetary orthodoxy. The printing press allows them to levy additional taxes without having to justify the misuse of public funds. People don’t understand it, and all they need to be told is that it’s because of the Russians that egg prices are increasing in Dunkirk.

We can see that the mechanism of halving is intimately linked to that of the imperative of digital scarcity. It stems from the cypherpunks’ desire to create a currency detached from government-driven inflationary impulses and restore individual sovereignty over property.

This scarcity-driven price dynamics has historically played a role in the appreciation of the Bitcoin price after each halving. Therefore, it will be interesting to observe the impact of future halvings on BTC prices.

The euphoria before the halving?

Every four years, the period leading up to the halving is a time of anticipation and speculation within the Bitcoin community. As we approach the fateful date, investors closely analyze historical trends and market dynamics to anticipate potential price movements.

Speculations abound: some believe that the halving will drive prices up due to the reduction in supply, while others argue that it is already priced in.

During this period, euphoria often fuels the trading activity of crypto companies and market volatility. Investors try to position themselves for potential gains. It’s an exciting time.

Looking back at the first halving in 2012

The first Bitcoin halving took place on November 28, 2012.

As mentioned, during a halving, the number of new bitcoins produced per mined block is cut in half. Before November 28, 2012, the block reward was set at 50 bitcoins. After the event, the reward was reduced to 25 bitcoins per block.

Here are the details of the exact block where the reward transitioned from 50 BTC to 25 BTC:

- Block number: 210,000

- Block reward: 25 BTC

- BTC created per day: 3,600 BTC

- BTC price before the halving: $12.35

- BTC price one year later: $964

The second halving in 2016

The second halving occurred on July 9, 2016.

Before this halving, the block reward per mined block was 25 BTC. Here are the details of the transition block:

- Block number: 420,000

- Block reward: 12.5 BTC

- BTC created per day: 1,800 BTC

- BTC price before the halving: $663

- BTC price one year later: $2,500

Again, we see the same upward trajectory in price dynamics.

The most recent halving in 2020

The third halving took place on May 11, 2020.

Block reward was reduced from 12.5 BTC to 6.25 BTC.

- Block number: 630,000

- Block reward: 6.25 BTC

- BTC created per day: 900 BTC

- BTC price before the halving: $8,500

- BTC price one year later: $64,000

What will the BTC price be after the halving?

Considering the current trajectory, the halving will repeat every four years (approximately) until the block reward becomes zero. By 2024, nearly 96.5% of all BTC will have been mined. By 2032, we will be close to 99%.

It’s difficult to say what future price trends will look like. Especially since this will be the first halving in a world with 5% interest rates.

Prices tend to appreciate much less when money is no longer free.

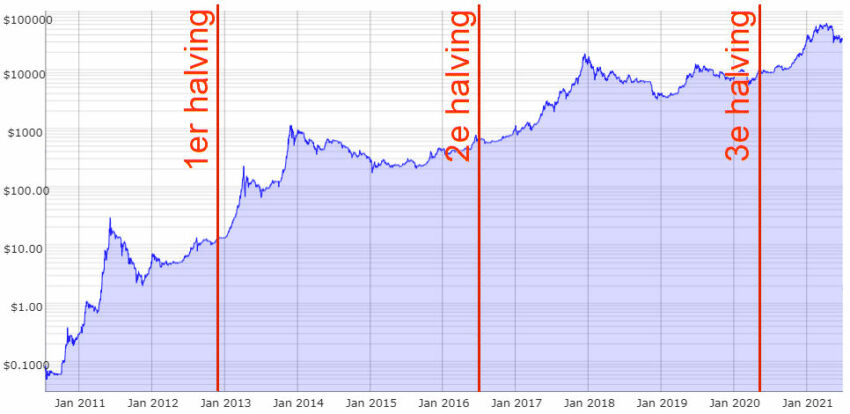

Using a halving chart

A halving chart is a representation of the BTC price history with indications of the halvings that have occurred on the protocol over time.

These charts are often used to analyze historical trends and track the impact of halvings on the price of Bitcoin and market dynamics.

BTC price forecasts are generally based on historical data and are subject to market fluctuations. The effects on the BTC price are speculative and uncertain.

Past performance is not indicative of future results. Especially in a world with 5% interest rates…

When will all 21 million Bitcoins be mined?

According to the current halving schedule, 100% of all bitcoins will be mined by 2041. However, over 98% of the total bitcoin supply is expected to be mined by 2032.

From the 2030s onwards, newly created bitcoins will be insignificant. And as explained earlier, it is highly unlikely that a consensus will emerge to change the sacred limit of 21 million.

What is the impact of halving on miners?

Miners use computational power to solve relatively simple mathematical problems that require time and secure the network. When the block reward is halved, miners receive fewer bitcoins in exchange for their efforts.

This affects the profitability of mining operations as miners need to anticipate the reduced block rewards and adjust their strategies accordingly.

What is the impact of halving on the crypto market?

Halvings often generate a lot of interest and speculation in the crypto market. Anticipation of a decrease in BTC supply and a potential increase in demand can contribute to price volatility.

During previous halvings, the Bitcoin price experienced both increases before the halving and rises in the months and years following the event. However, it is important to remember that the Bitcoin price is influenced by various factors and is not solely determined by events like the halving. Ultimately, the only driver of prices is expectations, i.e., the psychological reaction of investors.

Factors that positively influence the Bitcoin price

Several factors explain why the halving has a significant impact on the Bitcoin price and market dynamics:

- Supply and demand: Halving the rewards reduces the rate of new bitcoin creation, which decreases the supply. With a fixed maximum supply of 21 million coins, the supply reduction can create an imbalance between supply and demand, potentially leading to a price increase.

- Scarcity narrative: Halving reinforces the narrative of Bitcoin’s scarcity, highlighting its deflationary nature and limited supply. This narrative often attracts investors seeking a store of value, which can drive up demand and price. This scarcity contributes to Bitcoin’s value as a store of wealth and its potential as a hedge against inflation.

- Market sentiment: Anticipation of halving can create a positive sentiment in the market as investors expect potential price increases. This sentiment can lead to speculative buying and contribute to short-term price volatility.

Factors that negatively influence the Bitcoin price

- Incentives for miners: Miners play a crucial role in securing the Bitcoin network. Halving reduces their block rewards, making mining less profitable. If the price does not increase sufficiently to compensate for the reward decrease, some miners may exit the network, which could impact network security and stability. A less secure network implies a weaker value proposition, especially for states or large financial companies.

- Halving already priced in: Some argue that the impact of halving on prices is already factored into the market, meaning that the anticipation of reduced supply and increased demand has already been considered. In this case, the halving may not immediately lead to price increases.

The Bitcoin bet

It is important to note that while halving has historically coincided with price increases, it does not guarantee future price appreciation. Various factors beyond halving influence the BTC price, including macroeconomic conditions, regulatory developments, investor sentiment, and market speculation. Therefore, predicting the Bitcoin price based solely on halving is highly risky and subject to uncertainty.

Although halving is often associated with positive price movements, this event does not guarantee an immediate or automatic price increase. Different factors, including market sentiment, overall demand for bitcoins, investor speculation, and macroeconomic events, influence the market’s reaction to halving. While historical trends suggest that halvings have contributed to long-term price appreciation, short-term price movements can be unpredictable. Stack sats and see you in April 2024!

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.