Bitcoin Private Key Management: Everything You Should Know!

The concept of a key frequently appears in the cryptocurrency world due to its crucial role in managing a crypto wallet. Indeed, a person truly owns bitcoins only when they are the sole holder of their private keys. Therefore, you must keep it secure if you possess one. In this article, we invite you to dive into the fascinating world of Bitcoin private keys and their secure management. Our journey will include understanding fundamental concepts, various types of wallets available, and optimal storage methods. From a broader perspective, we will also provide essential Bitcoin security tips to effectively protect your valuable digital assets.

What is a Bitcoin Private Key?

To manage and secure your cryptocurrencies, you need to understand the concept of a private key through its definition, role, and fundamental differences between different types of keys.

Definition and Role

A private key is a secret and unique string of numbers and letters generated by the blockchain algorithm for each user. It is used to sign Bitcoin transactions and prove that you are the legitimate owner of the funds. It is necessary to access your digital assets, and it must be kept secret and secure. Stored in your wallet, it helps you access your assets at any time.

Private Key vs. Public Key

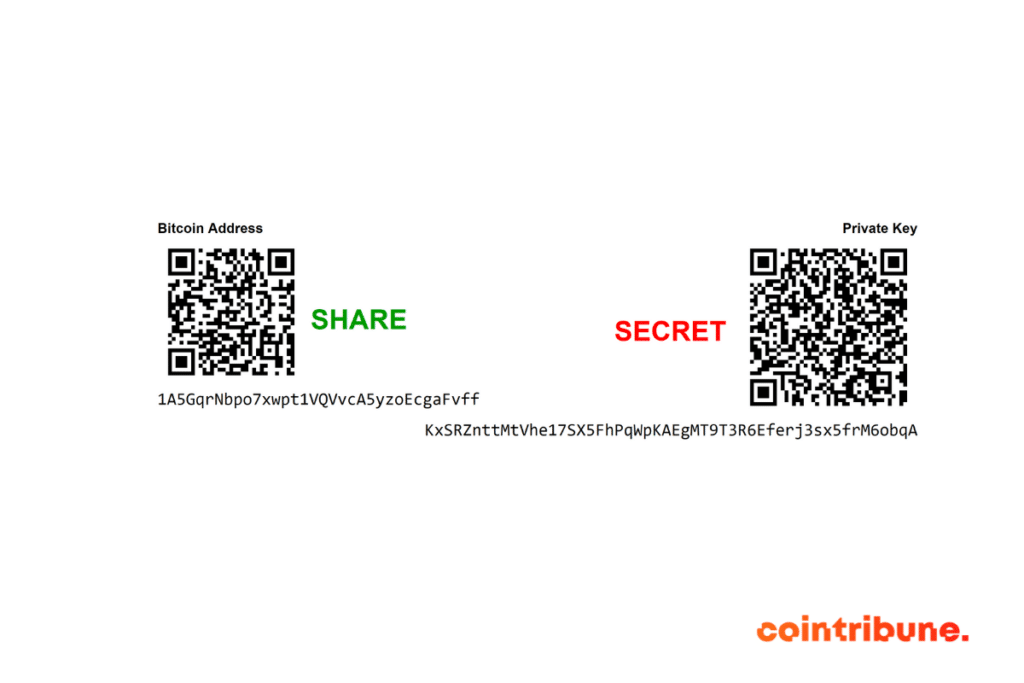

According to asymmetric cryptography, the private key is intrinsically linked to a public key, which serves as a Bitcoin address to which other users can send funds. The public key is generated from the private key and can be disclosed without compromising the security of your assets. In contrast, the private key, which allows you to access and manage the funds associated with the Bitcoin address, must be kept secret at all times. Possession of it equates to control over all the funds associated with it.

Here is a summary table of similarities and differences between private keys and public keys:

| Private Key | Public Key | |

|---|---|---|

| Nature | Secret, confidential | Public, shared |

| Generation | Randomly generated | Derived from private key |

| Function | Allows signing transactions | Allows receiving funds |

| Confidentiality | Must be kept secret | Can be shared publicly |

| Authentication | Used to prove identity | Used to verify identity |

| Security | Extremely critical to protect | Less critical, can be disclosed |

| Size | Typically long and complex | Typically shorter and less complex |

| Representation | Text format (e.g., hexadecimal key) | Text format (e.g., Bitcoin address) |

The security of cryptocurrencies relies on the confidentiality of the private key. Therefore, you must protect it from unauthorized access, as the person who possesses it has full control over the funds associated with the corresponding public key.

Format and Generation

Bitcoin private keys are usually represented as 256-bit strings, which is 64 hexadecimal characters or 51 base-58 characters. They always start with a K, a 5, or an L. They can also be represented as QR codes or seed phrases to facilitate backup and recovery.

How Do Bitcoin Private Keys Work?

Bitcoin private keys leverage asymmetric crypto technology, ensuring transaction security and fund authentication. They are used to digitally sign transactions, while public keys allow for verifying this signature. Thus, only the holders of private keys can move the funds linked to their public keys.

Private keys can be stored on your smartphone, computer, or a hardware wallet like the Ledger Nano S. These wallets generate them deterministically from a recovery phrase consisting of 12 to 24 words. Therefore, it is essential to carefully back up this phrase, which will allow you to restore your funds in case of loss or theft of your device.

It is worth noting that if you hold bitcoins on an exchange platform like Coinbase or Kraken, they are actually held by the platform. In other words, you do not have direct access to your private keys, meaning you do not have full control over your funds.

How to Secure Your Bitcoin Private Key?

Securing your key is crucial to protect your cryptocurrencies from loss, theft, and attacks. Discovering different types of storage wallets and various security techniques for your Bitcoin private keys will help you achieve this.

Offline Storage (Cold Storage)

Offline storage, also known as cold storage, is a method of storing private keys on a medium not connected to the Internet. This significantly reduces the risks of hacking and theft.

Paper Wallet

A paper wallet is a printed document containing your keys, often in the form of QR codes. It must be kept in a safe place, protected from water, fire, and prying eyes.

Hardware Wallet

Hardware wallets are electronic devices specifically designed to securely store your private keys. They are generally immune to cyber attacks and are considered one of the best options for securing your digital assets.

Online Storage (Hot Storage)

Online storage, or hot storage, is a method of keeping private keys on devices connected to the Internet, such as computers, smartphones, or servers. Although less secure than cold storage, it offers more convenience and accessibility.

Among online storage devices, there are soft wallets, which are software installed on the user’s computer. These wallets offer full control over crypto assets but are susceptible to malware. Then, there are mobile wallets, which are apps on smartphones. These wallets are portable and can be used for transactions on the go, but they are also vulnerable if the phone is lost or stolen. Finally, there are online wallets, hosted on a website or exchange. These wallets are the most convenient, as they can be accessed from any Internet-connected device. However, they pose the highest risk, as the user must trust the platform to secure their assets.

Additional Security Measures

In addition to choosing an appropriate storage method, it is necessary to adopt additional security measures to protect your Bitcoin private keys.

Backup and Encryption

Regularly backing up and encrypting your private keys helps prevent loss or theft. You can also split them into several parts and store them separately to reduce risks.

Using Seed Phrases

Seed phrases are sequences of words that can be used to generate or recover your private keys. They are easier to memorize and store than traditional private keys and offer additional protection in case of loss or theft of your storage device.

Using Bitcoin Private Key

Once you have secured your private key, it is necessary to learn how to use it properly to manage your digital assets effectively.

Sending and Receiving Transactions

To send bitcoins, you need to digitally sign the transaction with your private key. Most wallets allow you to do this automatically. To receive bitcoins, you need to provide your public key (Bitcoin address), which can be shared publicly without risk, to the sender.

Recovering Funds in Case of Loss or Theft

If you lose your storage device or your private keys are compromised, you can recover your funds using your seed phrase. Ensure you keep your seed phrase in a safe place, separate from your main storage device.

Mistakes to Avoid and Best Practices

Let’s review some common mistakes to avoid and best practices to adopt for effectively managing and securing your Bitcoin private keys.

Never Share Your Private Key

You should never share your private key with anyone, as this would compromise the security of your funds. If you need to share your public key to receive transactions, ensure you do not confuse the two.

Be Cautious When Importing Private Keys

If you import a private key into a new wallet, ensure you do so securely and check the integrity of the wallet before using it. Avoid importing private keys from untrusted sources.

Check for Updates and Security Alerts

Keep your wallets and security software up to date and monitor security alerts to protect against emerging threats.

Use Community-Recommended Wallets

Choose wallets that have been tested and recommended by the Bitcoin community, as they are more likely to be secure and reliable.

Conclusion

A rigorous management of Bitcoin private keys is essential to effectively protect your digital assets. Understanding the meaning of a private key, how it works, and methods to secure it are crucial skills for safely operating in the crypto world.

The importance of these concepts becomes even more relevant when it comes to Bitcoin account recovery, a process that requires mastering your recovery phrase associated with your private key. Additionally, using Bitcoin two-factor authentication is an extra security measure, providing a higher level of protection for your digital wallet.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.