Gen Z Bets On Crypto To Prepare For Retirement

The adoption of crypto by young people is skyrocketing. For many, Bitcoin and Ethereum are not just speculative assets, but an alternative solution for retirement savings. Tired of traditional systems, these generations prefer modern tools that promise more control and transparency. Focus on this radical mindset change and the reasons that drive Gen Z towards decentralized options.

Gen Z redefines retirement with crypto

With 20% of Gen Z, the most scammed by crypto fraudsters, and Alphas ready to receive their pensions in cryptocurrency, according to Bitget Research, a financial revolution is underway. This figure illustrates a generational break: young people no longer believe in old recipes.

Why settle for an imposed retirement when bitcoin offers flexibility and potential growth? Gracy Chen, CEO of Bitget, emphasizes:

” Young people want modern solutions, not uniform systems. “

The figures speak for themselves:

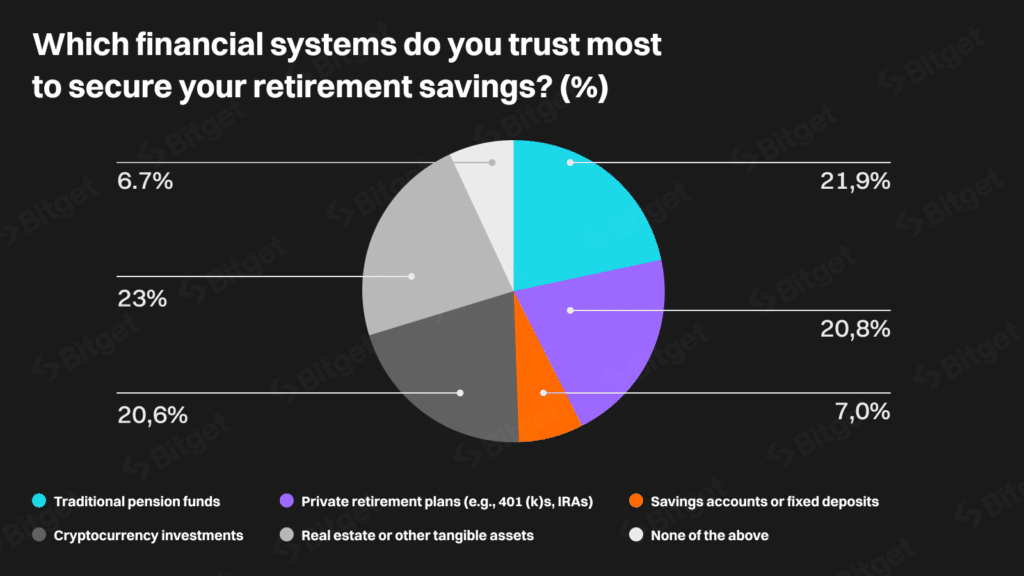

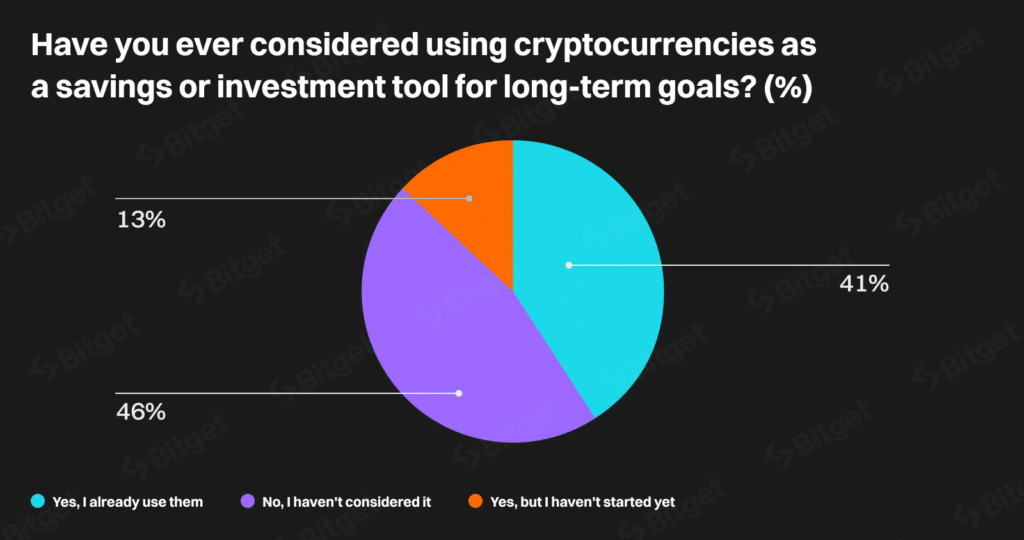

- 40% of young people have already invested in crypto;

- 78% prefer alternative options for their savings;

- The altcoin and major crypto market continues to attract new investors.

Despite the enthusiasm, three major challenges hinder adoption: price volatility, regulatory uncertainty, and cyberattacks.

But, as Fred Krueger highlights on X, ” 10 BTC today might be enough to guarantee a comfortable retirement. “

Why saving differently attracts young people?

Traditional pension funds struggle to convince. Between uncertain returns and lack of flexibility, they no longer inspire dreams. Cryptocurrencies, on the other hand, offer an attractive alternative. Moreover, decentralized finance (DeFi) promises returns superior to those of traditional banking products.

However, the story is not without hurdles. In 2024, hackers stole over 2.3 billion dollars in crypto. Security flaws remain a significant obstacle. Fortunately, solutions like off-chain validation significantly reduce hacking risks.

And what about altcoins, often viewed as the entry ticket for diversified portfolios? Ethereum, Solana, and other assets attract young people who see beyond Bitcoin.

For them, crypto is not just a bet, it’s a strategy.

Crypto and Gen Z: towards massive adoption?

The adoption of crypto is not limited to young individuals. Financial institutions are also hopping on the bandwagon, driven by clearer regulation and record valuations.

For Gen Z, cryptos represent much more than just an asset: they embody a new economic philosophy. Decentralization, transparency, and autonomy are the watchwords.

And this generation does not intend to stop there. The goal? To build a financial future where retirement savings depend more on their choices than on government policies.

Despite the challenges, the enthusiasm is palpable. For proof, Bitcoin retirement projects are increasingly attractive, with savings models projected at several millions over 20 years.

Last August, Bitpanda and YouGov revealed that crypto adoption is exploding among young Europeans: 32% of Millennials and 29% of Generation Z are already on board. A revolution that is reshaping the financial future of the continent.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.