Fork Bitcoin: Explanations And Examples

Bitcoin (BTC) has revolutionized the world of finance by providing a decentralized alternative to traditional online transactions. Since its launch in 2009, it has attracted a large community of users and developers but has also faced debates on how to evolve and grow. To resolve these divergences, some members of the community have chosen to fork the Bitcoin blockchain. What does this term refer to? What are the different types of forks, and how do they work? What are the impacts for users and miners? Let’s explore the universe of forks together to deepen our understanding of how Bitcoin works.

Definition and functioning of a Bitcoin fork

What is a fork in the context of the Bitcoin blockchain?

A fork occurs when a part of the community decides to detach from the original chain to create a new chain with different rules. This detachment can lead to minor or major modifications. Additionally, it can be done to resolve a specific issue or to add new features to the network.

The reasons behind creating a fork

The reasons behind creating a fork can vary. There are two main reasons why forks may occur in the Bitcoin blockchain:

- To resolve technical issues: for example, to increase the network’s processing capacity, to fix bugs, or to improve security;

- For differences in vision or opinion: for instance, regarding how to adopt or not adopt certain features, the speed of network development, the distribution of wealth, etc.

The types of Bitcoin forks

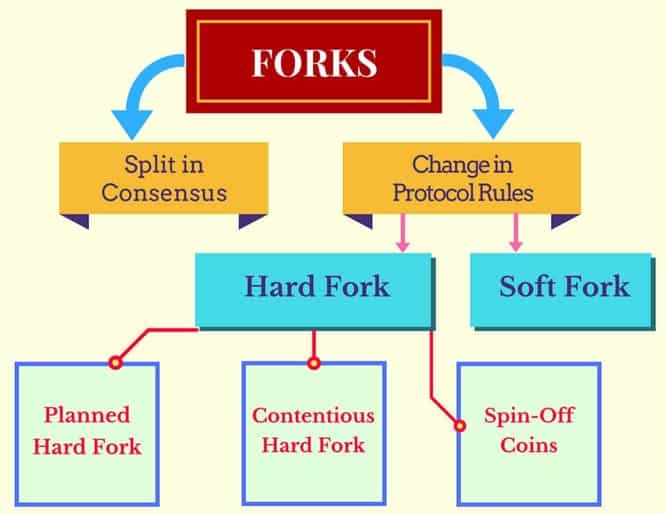

We can distinguish two main types of forks: hard forks and soft forks.

Hard fork Bitcoin

Definition and characteristics of a hard fork

We talk about a hard fork when the rules of the blockchain are changed in a way that is incompatible with the old rules. This results in the creation of a distinct new blockchain.

This means that users must update their software to continue participating in the new blockchain. Otherwise, they will no longer be able to validate transactions or participate in the emerging network.

Hard forks can also lead to the creation of new cryptocurrencies. Transactions made on the new chain are not recognized by nodes remaining on the old chain and vice versa.

It should be noted that hard forks are generally subject to controversy. The downside is that they lead to a fragmentation of the community and dual development.

Example of a Bitcoin hard fork

A famous example of a hard fork is Bitcoin Cash (BCH). Created in 2017, it aimed to increase the block size to allow for a greater number of transactions per second on the network.

Soft fork Bitcoin

Definition and characteristics of a soft fork

Soft forks, on the other hand, involve minor modifications to the rules so that the new version of the protocol remains compatible with the old one. Users do not need to update their software to access the new blockchain.

However, there is a risk that certain transactions made on the new chain with the old software may not be recognized.

In general, soft forks are used when it comes to making minor improvements to the network, such as security patches for example. That said, they can also be used to add new features to the blockchain without causing major disruptions.

Furthermore, soft forks are generally simpler and less controversial than hard forks, as they do not lead to fragmentation of the community.

Examples of Bitcoin soft forks

Among the most popular soft forks of the Bitcoin network, we have:

- Segregated Witness (SegWit): this upgrade aimed to reduce the space required within blocks. Activated in 2017, its ultimate goal was to optimize the scalability of the Bitcoin network;

- CheckSequenceVerify (CSV): this utility allowed introducing advanced features such as smart contracts and time-locked transactions on the Bitcoin protocol;

- Taproot: it was introduced to improve the privacy and flexibility of the network. It allows hiding transaction details behind a unique hash, which can prevent third parties from knowing what has been transferred and how.

The importance of Bitcoin forks

Forks can have a significant impact on the development of the Bitcoin network. They help solve problems such as scalability and security. They also allow for adding new features to improve the user experience.

They also offer some flexibility to the Bitcoin community, which can choose to follow the version of the network that best aligns with its values and beliefs.

Consequences and impacts of a Bitcoin fork

The consequences of a fork can vary depending on the type of fork and the modifications made to the blockchain.

Impact on Bitcoin holders

In the case of a hard fork, users will need to update their software to access their funds on the new version of the network. If users do not take this step, they risk losing access to their funds.

In the case of a soft fork, users generally do not need to do anything to access their crypto-assets on the new version of the network.

Consequences for miners and network security

In the event of a hard fork, miners will need to choose between the two versions of the network and decide which one they want to mine. If a significant part of the community chooses to follow a different version, this can lead to a fragmentation of the computing power of the network and a reduction in security.

In the event of a soft fork, miners will continue to mine the existing version of the network and will not need to make any additional decisions.

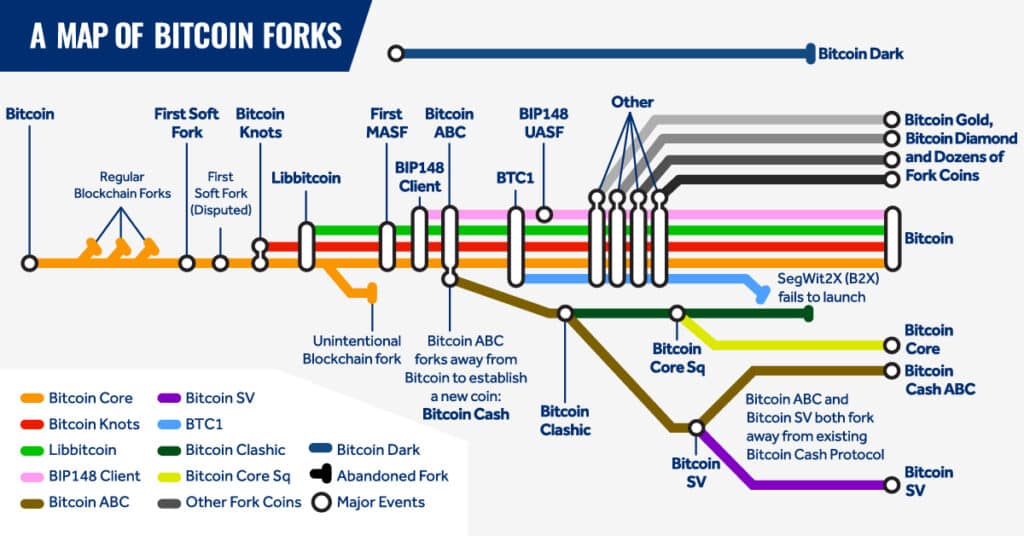

Famous and Controversial Bitcoin Forks

Within the cryptosphere, some Bitcoin forks have been more impactful than others. These include: Bitcoin Cash, Bitcoin Gold, and Bitcoin SV.

Bitcoin Cash (BCH)

Bitcoin Cash is a hard fork of the Bitcoin blockchain that emerged as a response to the scalability challenges of the original network. In reality, this project was born out of a disagreement over increasing block sizes.

The main objective of Bitcoin Cash was to improve transaction capacity and reduce fees for users. To solve this problem, the hard fork increased the block size limit from 1 MB to 8 MB.

Bitcoin Gold (BTG)

The Bitcoin Gold: initiated in 2017, this Bitcoin hard fork aimed to decentralize the mining industry and make it more democratic. BSV modified the mining algorithm to promote a fairer distribution of mining rewards.

Instead of SHA-256, it opted for a Proof-of-Work consensus mechanism (PoW) based on a hashing function called Equihash.

Bitcoin SV (BSV)

The Bitcoin SV is a result of a split from the Bitcoin Cash hard fork. Launched in 2018, it intended to return to the fundamental principles of the Bitcoin blockchain. Indeed, for the founders of BSV, the Bitcoin network created by Satoshi Nakamoto had strayed from its original vision, and it needed to be restored.

To enhance its scalability, Bitcoin SV increased the block size to 4 GB and removed some controversial features from Bitcoin Cash.

Bitcoin Diamond (BCD)

The Bitcoin Diamond is a hard fork of Bitcoin that was created in November 2017. Its main objective was to improve transaction speed and reduce transaction fees by increasing block sizes.

Similar to Bitcoin Cash, Bitcoin Diamond has a block size of 8 MB. This is supposed to allow for a greater number of transactions per block and thus increase the network’s processing capacity.

Conclusion

Forks are a fundamental aspect of the development and evolution of the Bitcoin network. They allow for improvements and new features, bug fixes, and the resolution of technical issues. However, they can also have significant consequences for users and miners. Additionally, their potential impact on the electricity consumption of the network should not be overlooked.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

The Cointribune editorial team unites its voices to address topics related to cryptocurrencies, investment, the metaverse, and NFTs, while striving to answer your questions as best as possible.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.