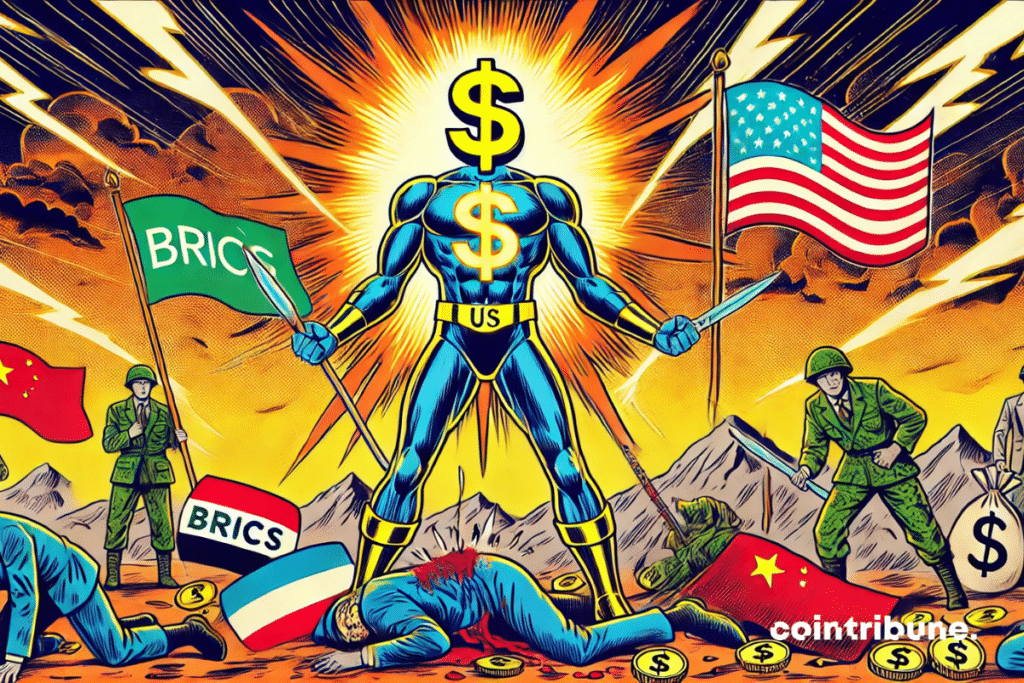

Foreign Banks Boost Dollar Reserves, Challenging BRICS’ Vision

As the world closely observes the BRICS efforts to reshape the global economic order, a new trend seems to undermine their ambitions. Foreign banks, far from aligning with the alliance’s de-dollarization agenda, are instead strengthening their reserves of US dollars. This development, in a context where the local currencies of the BRICS are collapsing, raises further questions about the future of economic multipolarity and the resilience of the global financial system.

The US dollar : an essential safe haven in the economic storm

In the face of increasing volatility in global financial markets, the US dollar is consolidating its role as a safe haven. According to a report from The Economic Times, the DXY index, which measures the strength of the dollar against a basket of global currencies, has currently reached a historic high of 107.06 before stabilizing at 106.55. This rise comes even as the BRICS continue their policy of de-dollarization, aimed at reducing their dependence on the US currency.

The situation is aggravated by the depreciation of the local currencies of BRICS members. For instance, India has seen its rupee reach its lowest historic level of 84.47 INR/USD this week, despite interventions by the Reserve Bank of India. Similarly, the Chinese yuan has fallen to its lowest level in seven months against the dollar. These monetary weaknesses are driving foreign banks to accumulate more dollars to secure their reserves, attracted by the higher yields offered by the American currency.

The BRICS strategy under pressure : between ambitions and economic realities

In this context, the BRICS objectives of creating a new international financial order seem to drift away. While the alliance leaders tout the merits of strengthened collaboration, the inability to stabilize their respective currencies undermines their credibility. Experts observe that this instability fuels an increased dependence on the dollar, even among financial institutions seeking to diversify their holdings.

Moreover, the specter of new protectionist policies in the United States complicates the ambitions of the BRICS even further. Analyst Boris Mezhuyev, a political scientist at the Scientific Information Institute for Social Sciences of the Russian Academy of Sciences, stated that “Donald Trump may seek to fracture the BRICS alliance and annihilate their dream of de-dollarization as soon as he takes office.” This scenario, where trade and political pressures would reinforce the dollar’s dominance, highlights the geopolitical challenges the BRICS must face.

Looking ahead, this dynamic could have profound implications for the global economy. If the BRICS fail to stabilize their currencies and offer a credible alternative to the dollar, their influence on the economic stage could decline. However, this situation could also stimulate closer internal cooperation or accelerate innovative initiatives to circumvent the mechanisms that dominate the current financial system. The future remains uncertain, but the stakes continue to grow.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Diplômé de Sciences Po Toulouse et titulaire d'une certification consultant blockchain délivrée par Alyra, j'ai rejoint l'aventure Cointribune en 2019. Convaincu du potentiel de la blockchain pour transformer de nombreux secteurs de l'économie, j'ai pris l'engagement de sensibiliser et d'informer le grand public sur cet écosystème en constante évolution. Mon objectif est de permettre à chacun de mieux comprendre la blockchain et de saisir les opportunités qu'elle offre. Je m'efforce chaque jour de fournir une analyse objective de l'actualité, de décrypter les tendances du marché, de relayer les dernières innovations technologiques et de mettre en perspective les enjeux économiques et sociétaux de cette révolution en marche.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.