Finance: The Return of Liquidity and Risk Assets?

Stock indices have been gradually accumulating new highs since the beginning of the year. The resilience of the US economy has helped restore a certain confidence to investors. In fact, there’s a feeling of déjà vu with regard to riskier stocks, especially with the influx of more liquidity. We will look together at the factors that could influence the return of risk assets.

The US economy, a crucial source of liquidity

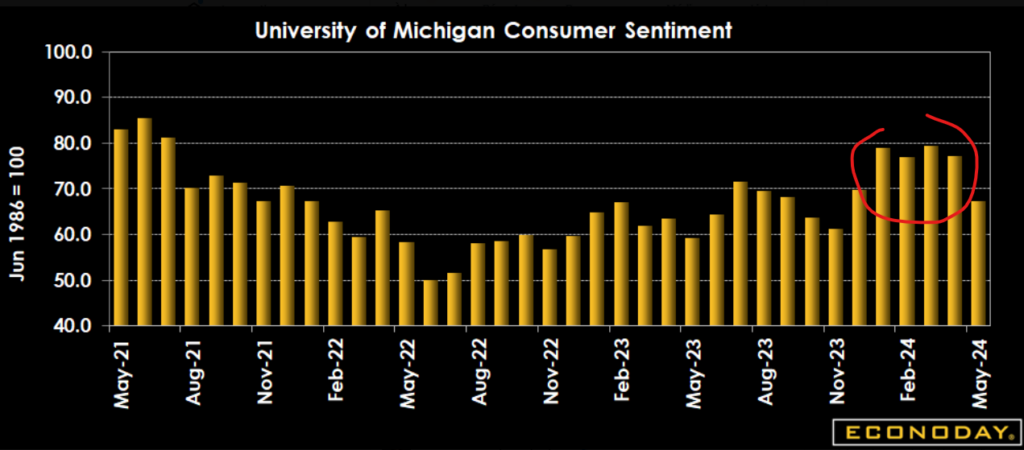

The US has surprised us with its ability to navigate the interest rate hikes between 2022 and 2023. The job market has remained fairly resilient. This is probably because it was necessary to rectify the imbalances caused by the COVID crisis. We are talking here about the labor shortage after the pandemic. These elements have maintained a competitive job market. At the same time, the disinflation process has been a relief for households to regain confidence. This has also eventually had repercussions on the markets. Here’s an example of improved consumer sentiment:

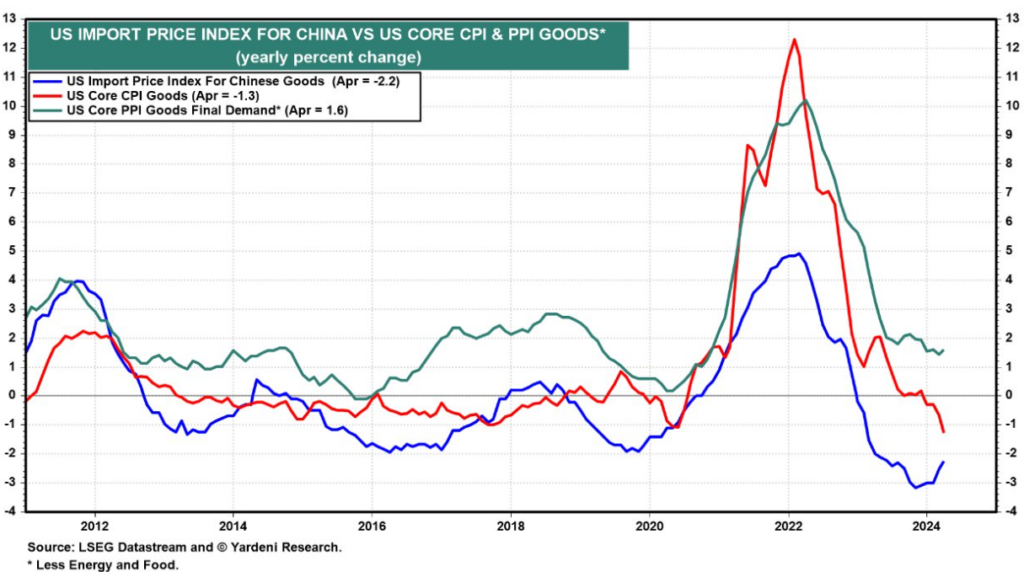

The disinflation process is probably due to the fact that China has gone through a major deflationary crisis. This allowed the US to import deflation, at least since 2023, allowing the US to avoid a recession. Here is an illustration of this:

Decisions of the FED (American central bank), a key factor

Since 2022, the decisions of the FED members have impacted the markets. They have been making and breaking the weather for the last two years. Every speech is carefully listened to in order to demystify if the directives will be more accommodative or restrictive. It was agreed that they would slow the pace of balance sheet reduction during the last FED FOMC meeting. This means that since the start of the implementation of restrictive monetary policy, the FED has not been renewing the maturing bonds it holds in its portfolio. This, therefore, reduces available liquidity. Here is an example of the reduction in the balance sheet since 2022:

However, it has been specified that the FED will slow the pace of balance sheet reduction from 60B to 35B. Even if the balance sheet reduction remains a restrictive principle, slowing the pace is seen as a sort of relief. As a result, markets interpret this as better financial conditions and progress towards ATHs (All-Time Highs).

In another register, we can look at the net liquidity of the FED which takes into account the balance sheet, the repo market, and the treasury account. We can see that it has been improving since the end of 2022, which also coincides with the bottom of US markets.

Calculated and well-synchronized interventions

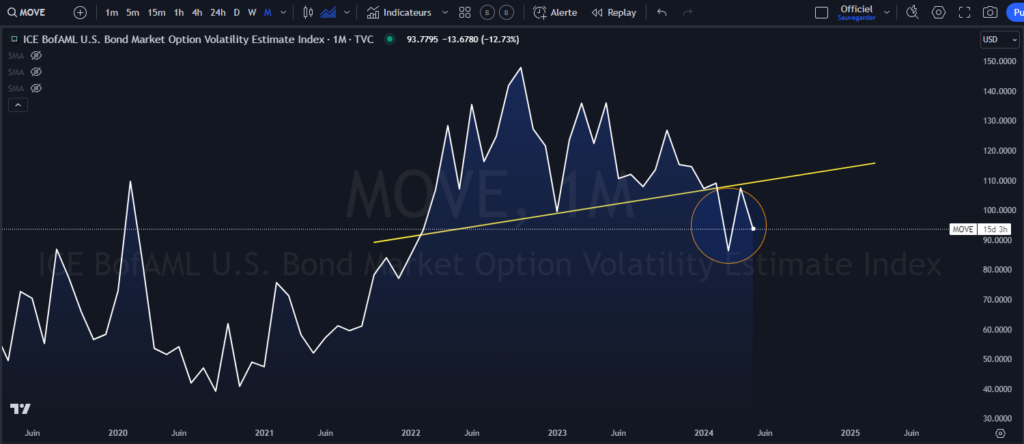

In addition to the recent changes made by the American central bank, there were other interveners like Treasury Secretary Yellen. It was announced in parallel a buyback of US bonds for the coming months to ease the tensions surrounding the high US debt. A buyback is a process of repurchasing securities in order to reduce the available supply. This program is introduced for the first time in 20 years. The aim is to reduce volatility and tensions mainly from the bond market over the past two years. One could say it is to support liquidity. This is also one of the reasons why the volatility index on the bond market has eased a lot in recent weeks.

And in a similar vein and during the same period, we had a synchronized intervention from the Bank of Japan when the USDJPY pair tagged the 160 level. Japan is one of the largest holders of US bonds. This is why synchronized interventions between different central banks are important.

The impact of liquidity on assets

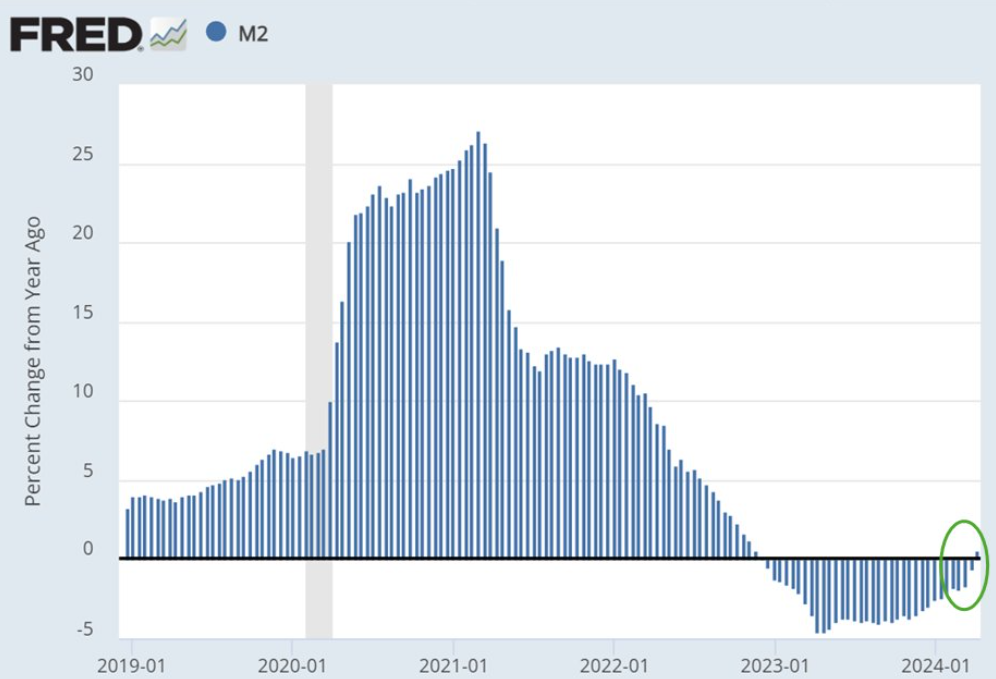

The growth of M2 money supply has returned to positive territory, which hasn’t happened for about a year and a half. In general, this can also be a sign of impending robust economic growth. Liquidity drives risk assets.

For example, Bitcoin is one of the assets that is highly correlated with the money supply. A contraction or reduction in the money supply is often negative for Bitcoin and vice versa. This process is quite logical because the money supply represents the monetary supply which is unlimited. This principle is the opposite of Bitcoin, whose supply is limited to 21 million. Furthermore, Bitcoin production is halved every four years, which is called the halving. As Bitcoin’s inflation rate decreases over the years, this is also why Bitcoin responds positively to an increase in the money supply.

Is the euphoria of risk assets back?

One of the consequences of increased liquidity is obviously euphoria over risk assets. This is especially the case with meme stocks for example (stocks that gain popularity on media or social networks). We saw this with the euphoric return of GAMESTOP and AMC stocks that marked 2021. A brief reminder, the story of Gamestop highlights how a group of novice investors (dumb money) bet against the money from huge investment firms (smart money) to bring them down. Here’s the performance of GAMESTOP after a simple tweet from the protagonist of this story, Roaring Kitty, a few days ago:

When liquidity is abundant, euphoria hits the markets. And this money flows into everything that moves. Consequently, this could also be the case this year since we have both the presence of liquidity and precursor signs of the return of meme stocks.

For example, after the GAMESTOP and AMC affair in 2021, the euphoria transferred to the altcoin market including memecoins. Here’s a chart showing GME in orange and the altcoins, we can see this transfer:

This is why liquidity can be a precursor sign of euphoria in the markets, particularly for riskier assets.

Conclusion

There are several elements pointing to an improvement in liquidity in the coming months. This could lead to both a melt-up (bullish) in financial markets and also give a boost of euphoria to riskier assets. Of course, this kind of situation does not always end well, so it is necessary to remain cautious in such situations.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.