Finance: 5 Reasons Why Interest Rates Will Not Decrease in 2024

For the past two years, uncertainty has persisted regarding the evolution of rates. It is the Fed that dictates the mood. Rate movement probabilities change quite regularly and are always postponed. But what about 2024? Here, we will look together at 5 reasons why the Fed might delay a rate cut until 2025.

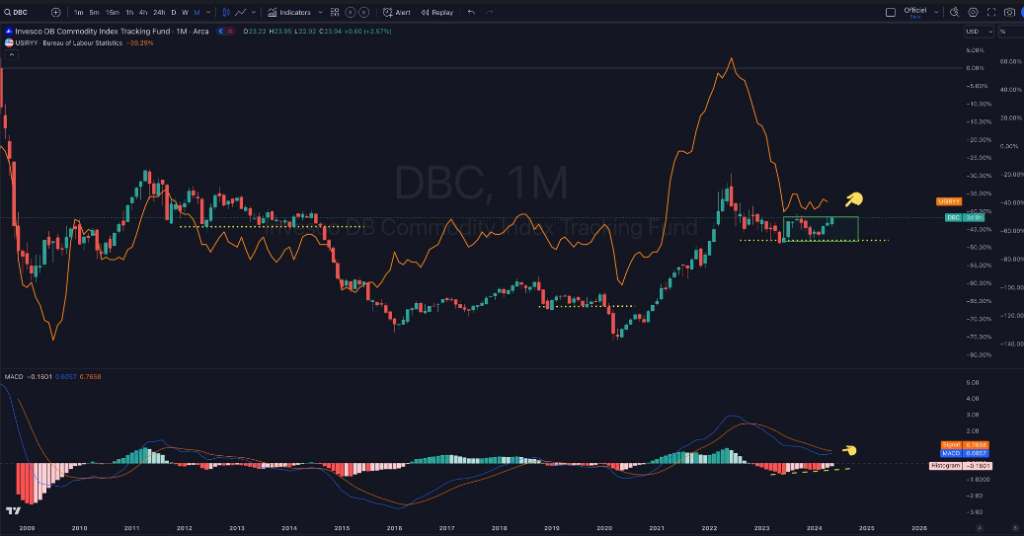

1/ Pressure from Commodities

One of the factors that has significantly contributed to the slowdown in inflation since mid-June is the drop in commodity prices. We can see a positive correlation between the two on the graph below:

Since commodity prices have stabilized, inflation has stabilized between 3 and 3.5%. That’s why there is a limit to inflation dropping below 3% as long as we don’t have a more significant drop in commodity prices. For now, the rebound in the global economy can put pressure on commodity costs (or keep them at the same level) and make the Fed’s task more challenging. Additionally, we are in a decade of energy transition. Therefore, this is likely to remain inflationary over the coming years as demand is expected to be substantial.

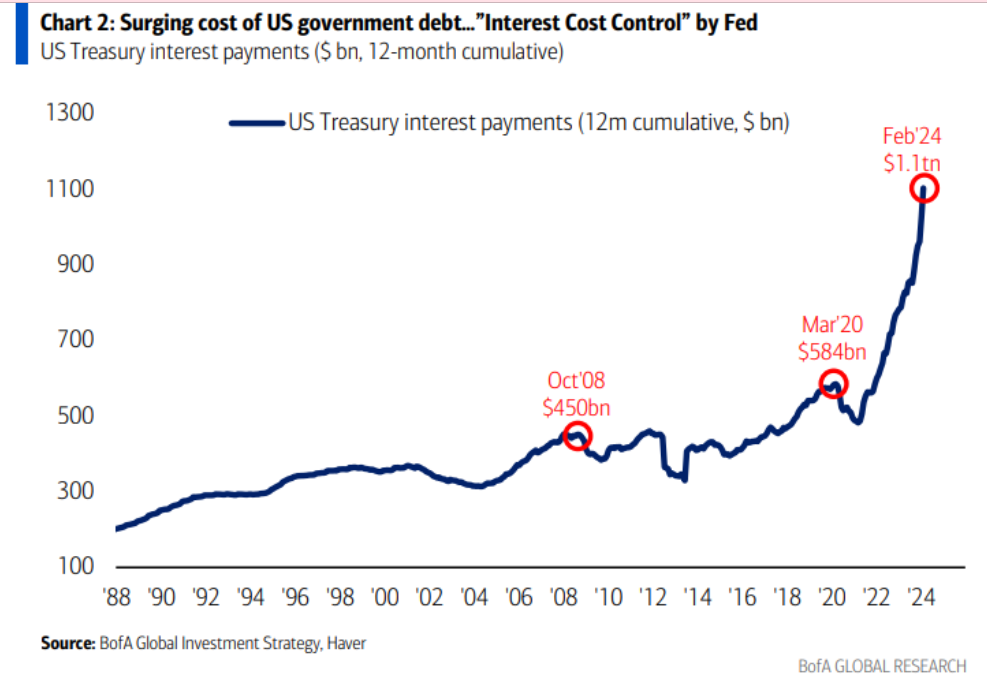

2/ Fiscal Dominance – Problematic High Rates

Fiscal dominance is a less popular concept. It starts from the principle that monetary policy is dependent on fiscal policy. This implies that the larger the debt, the higher the risk of default. Consequently, investors demand higher returns (high rates) to compensate for the risk. This is why interest rates can remain high. Moreover, the fact that high rates are applied to significant debt implies more interest payments from the state.

And as the population ages, taxes are lower to compensate for the expenses to be paid, so more bonds have to be issued to pay the interest. All this remains inflationary because keeping high rates increases mortgage costs and, therefore, rent costs too.

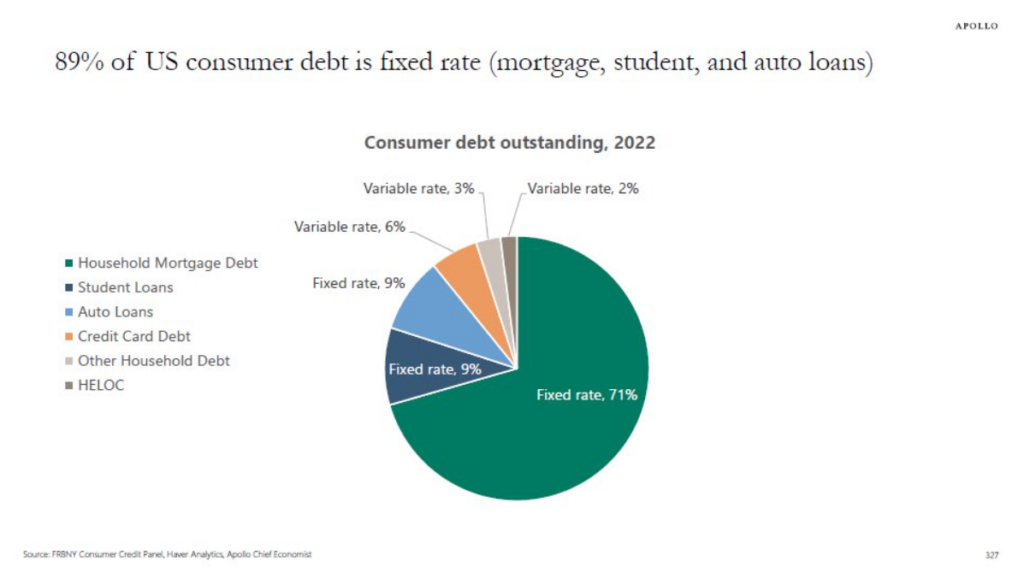

3/ Limited Effects of Monetary Policy

In general, when the central bank raises rates, it implies a slowdown in demand because borrowing costs are higher. But unfortunately, there is a limit to this. This is especially true if a significant portion of already contracted loans are fixed-rate. They are not impacted by the rate increase. For example, those who locked in fixed rates during the pandemic for several years have benefited from low rates and are not impacted by the rate hike. They are only impacted on new loans but not on existing ones. Therefore, it does not affect everyone.

Moreover, as wage growth remains higher than inflation and the job market is quite resilient, it also helps to preserve some purchasing power.

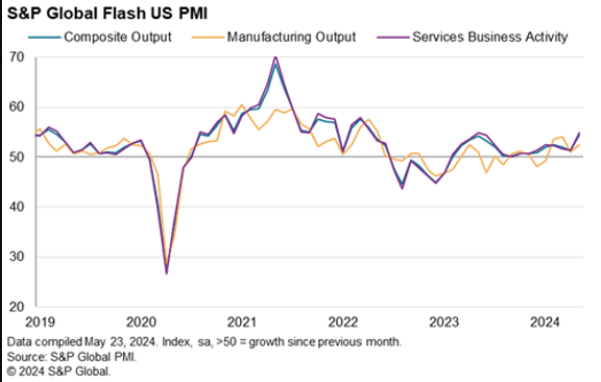

4/ Global Economic Rebound

In recent months, we have seen an acceleration in the global economy. If the economy accelerates, it likely implies a rebound in demand, which can pressure prices.

It is when productivity surpasses demand that it might lower price tensions.

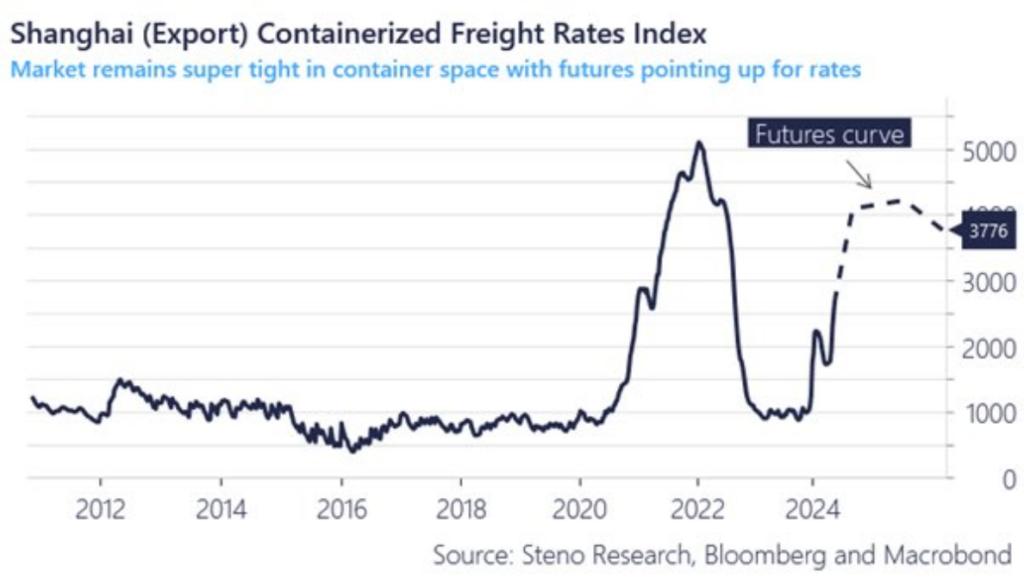

5/ Increase in Freight Container Rates

Futures contracts are pricing a rise in FRED container rates. The projected increase remains close to the last peak of 2021. If these forecasts are accurate, this will not be good for goods inflation.

Is the Target Rate Level of 3% the New 2%?

For now, as we have seen previously, several reasons could keep rates at high levels, and this is likely to be the case for the coming years. This is also why we see some media headlines suggesting changing the inflation target level. It’s a debate to consider, even if the Fed fears losing its credibility by raising its target rate, which has been in place for several decades. However, the environment and context have changed significantly, and some points may need to be revised, this one included.

What Are the Reasons That Will Convince the Fed to Lower Rates?

In the past, the Fed has been more reactive than proactive. This is often why interventions happen after consequences occur. Along this line of thought, we can see under what conditions the Fed might lower rates. Of course, as we cannot predict the future, we will base our assessment on facts.

The Fed’s first mandate is price stability. Consequently, if it observes a sustainable drop in inflation, it will start to lower its key rate. That said, as explained above, the stabilization of commodities in the lateral zone limits the potential for inflation to drop below 3%.

Its second mandate, and the most important, remains the stability of the labor market. If we see a rise in unemployment that becomes alarming, this should convince the Fed to proceed with a rate cut. Moreover, if we look at the attached graph, we can see that there is no acceleration in trend. The 4% level also remains a key level for unemployment.

Conclusion

Based on current facts, several elements could still delay a rate cut to next year. This is why the probabilities gradually decrease. Consequently, a major change in the current situation would be necessary to discuss a rate cut, such as a sustained economic downturn leading to a drop in inflation, a rise in unemployment, or a liquidity crisis.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Après avoir travaillé pendant 7 ans dans une banque canadienne dont 5 ans dans une équipe de gestion de portefeuille comme analyste, j’ai quitté mes fonctions afin de me consacrer pleinement aux marchés financiers. Mon but ici, est de démocratiser l'information des marchés financiers auprès de l'audience Cointribune sur différents aspects, notamment l’analyse macro, l’analyse technique, l’analyse intermarchés…

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.