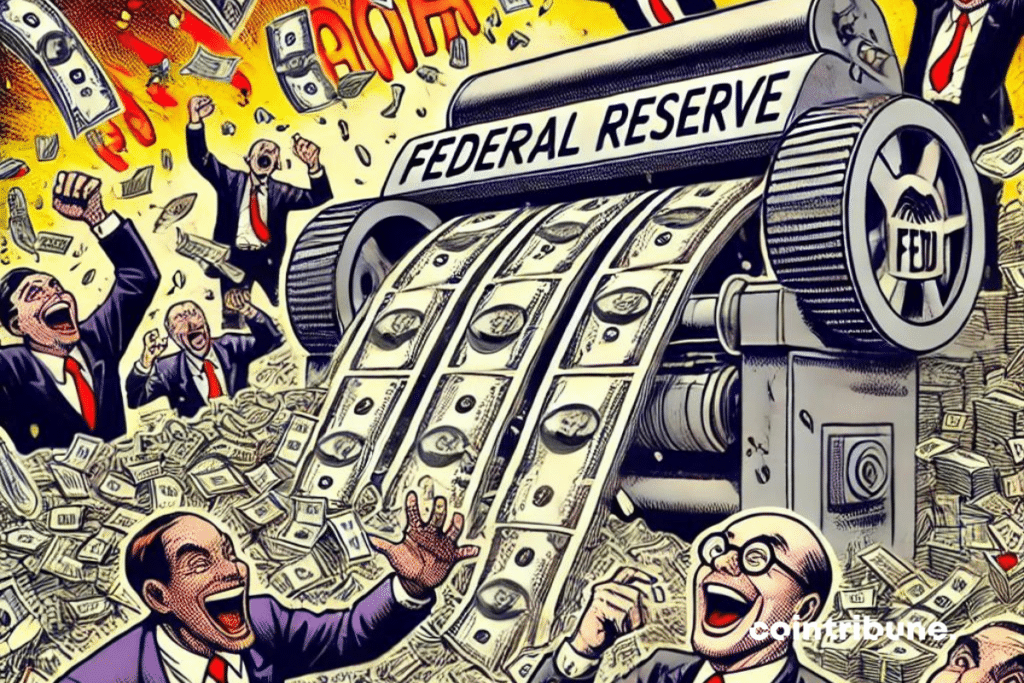

FED: The Unexpected Return Of The Printing Press

The Fed has just made a major shift in its monetary policy. After 17 months of status quo, the central bank decided to cut its key rates by 0.50 percentage points at its September meeting. Are you ready for the return of the printing press?

The Spectacular Reversal of the Fed

The rate cut by the Fed was widely anticipated by markets, but its magnitude surprised many observers. Until the last minute, investors were debating between a 0.25 or 0.50 point cut.

Ultimately, the more aggressive option won out, signaling that the Fed is determined to support the economy.

This spectacular reversal contrasts with the cautious tone adopted by Fed officials just a few weeks ago. Governor Christopher Waller stated in early September that “the time had come” to cut rates, but preferred a gradual approach.

The publication of press articles mentioning the possibility of a 0.50 point cut, however, changed the game. These articles shifted market expectations towards a more pronounced easing.

A Victory for Powell

The decision to cut rates by 0.50 point is seen as a personal victory for Fed Chairman Jerome Powell.

He managed to convince a majority of his colleagues to opt for a more pronounced monetary easing, despite the reluctance of some members of the monetary policy committee.

This decision reinforces Jerome Powell’s credibility, which had sometimes been criticized for his lack of authority within the Fed. It demonstrates his ability to build consensus within the institution and impose his vision of monetary policy.

A Risky Bet for the Fed?

While the rate cut is welcomed by markets, some economists are concerned about the risks it entails.

The Fed is betting that inflation is sustainably under control and that the US economy can withstand monetary easing without overheating inflation.

However, the latest inflation figures remain above the Fed’s 2% target. The PCE index, the Fed’s preferred measure of inflation, was still at 2.7% year-on-year in August. Some fear that a rapid rate cut could revive inflationary pressures.

The Fed justifies its decision by the slowdown observed in the labor market. The unemployment rate rose to 4.2% in August, its highest level in nearly two years. But again, this figure remains historically low and does not indicate a marked deterioration in employment.

Optimistic Projections?

The new economic projections published by the Fed reflect the institution’s optimism. The central bank now anticipates growth of 2.1% this year and 1.5% next year, figures revised upwards from June.

Moreover, the Fed expects inflation to continue to slow to 2.2% by the end of 2024 and 2% in 2025. These projections allow it to consider further rate cuts in the coming months.

The median forecast of the monetary policy committee members indicates key rates at 4.4% by the end of 2024 and 3.4% by the end of 2025, compared to 5.3% currently. This implies a cumulative rate cut of nearly 2 percentage points by the end of 2025.

The Fed Brings Back the Printing Press

Beyond the one-time decision to cut rates, the entire doctrine of the Fed seems to be evolving. The central bank appears to be adopting a more flexible and responsive approach to monetary policy.

While it had long favored a gradual increase in rates to combat inflation, the Fed is now opting for a rapid and marked cut. This shift reflects its willingness to be more proactive in supporting the economy, even if it means taking some risks.

This new approach raises questions about the Fed’s ability to finely steer the economy.

Divisions Within the Fed

The decision to cut rates by 0.50 point was not unanimous within the monetary policy committee. Governor Michelle Bowman opposed this cut, advocating for a more gradual easing.

It’s the first time since 2005 that a Fed governor has formally opposed a monetary policy decision. This dissent illustrates the debates within the institution about the appropriate pace of rate cuts.

Michelle Bowman, appointed by Donald Trump, is concerned about the inflation risks associated with a too rapid easing. Her stance contrasts with the one she defended during the Trump administration, where she supported an accommodative monetary policy.

This reversal raises questions about the Fed’s independence. Some observers see it as the influence of political considerations, with the approaching 2024 presidential election.

Uncertainty…

The impact of this rate cut on the real economy remains uncertain. While it should support investment and consumption, its impact could be limited as rates remain historically high.

Businesses and households have already largely factored in the possibility of a rate cut in their decisions. With limited surprise effect, the economic stimulus might be less significant than in the past.

Some economists also worry about a potential adverse effect of this rate cut. By sending a pessimistic signal about economic prospects, the Fed could paradoxically slow down activity in the short term.

Euphoric Markets

Financial markets, however, enthusiastically welcomed the Fed’s decision. Wall Street ended sharply higher on Wednesday, with the S&P 500 gaining more than 1.5%. Bond yields fell significantly, with the 10-year yield dropping below 3.9%.

This positive reaction reflects investors’ relief at a more accommodative Fed. But it also raises fears of new speculative bubbles forming, as stock valuations are already high.

The drop in the dollar following the Fed’s decision could also revive trade tensions with some US partners, such as Europe or Japan.

Brrrrr!

The Fed has clearly indicated that this first rate cut will be followed by others.

Markets are now anticipating three more 0.25 point cuts by the end of 2024, which would bring key rates around 4.5%.

This scenario, however, remains conditional on the evolution of the economic situation. The Fed stressed that it would remain “data-dependent”, attentive to economic indicators to adjust its policy.

A more marked slowdown in activity than expected could lead the central bank to accelerate the pace of rate cuts. Conversely, a rebound in inflation would likely compel it to pause.

The Fed: The Most Influential Institution in the World?

In the end, the Fed’s decision to cut its rates by 0.50 point appears fraught with implications. It marks a turning point in US monetary policy and will have repercussions far beyond the borders of the United States.

Its success will depend on the Fed’s ability to strike the right balance between supporting the economy and controlling inflation. A tightrope act that promises to be delicate in an uncertain economic and geopolitical context (China, Iran, Israel, Lebanon, Ukraine…).

The credibility of Jerome Powell and the Fed is at stake. Their bet on a soft landing for the US economy will be closely watched in the coming months. Whether this historic shift in monetary policy was justified will become clear. If not, the Fed’s failure would reinforce the argument for its abolition, in favor of a joyous Bitcoin (BTC) standard.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Chaque jour, j’essaie d’enrichir mes connaissances sur cette révolution qui permettra à l’humanité d’avancer dans sa conquête de liberté.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.