February 28: Bitcoin’s Worst Day Since FTX, Over $1B Lost in 24H

The table is black for Bitcoin. Very black. For several days, the crypto market has been in turmoil, with losses piling up at a hellish pace. Not only are altcoins taking a hit, but even stablecoins are wavering. The carnage intensified on February 28, when Bitcoin fell below 80,000 dollars, recording realized losses of 685 million dollars in a single day. So, who is taking the biggest hits?

Bitcoin: New Traders at the Heart of Massive Liquidations

After a week of significant correction and intense selling pressure, Bitcoin briefly rebounded to over 85,000 dollars, boosted by long positions and margin leverage. However, this recovery is not enough to mask the extent of the losses.

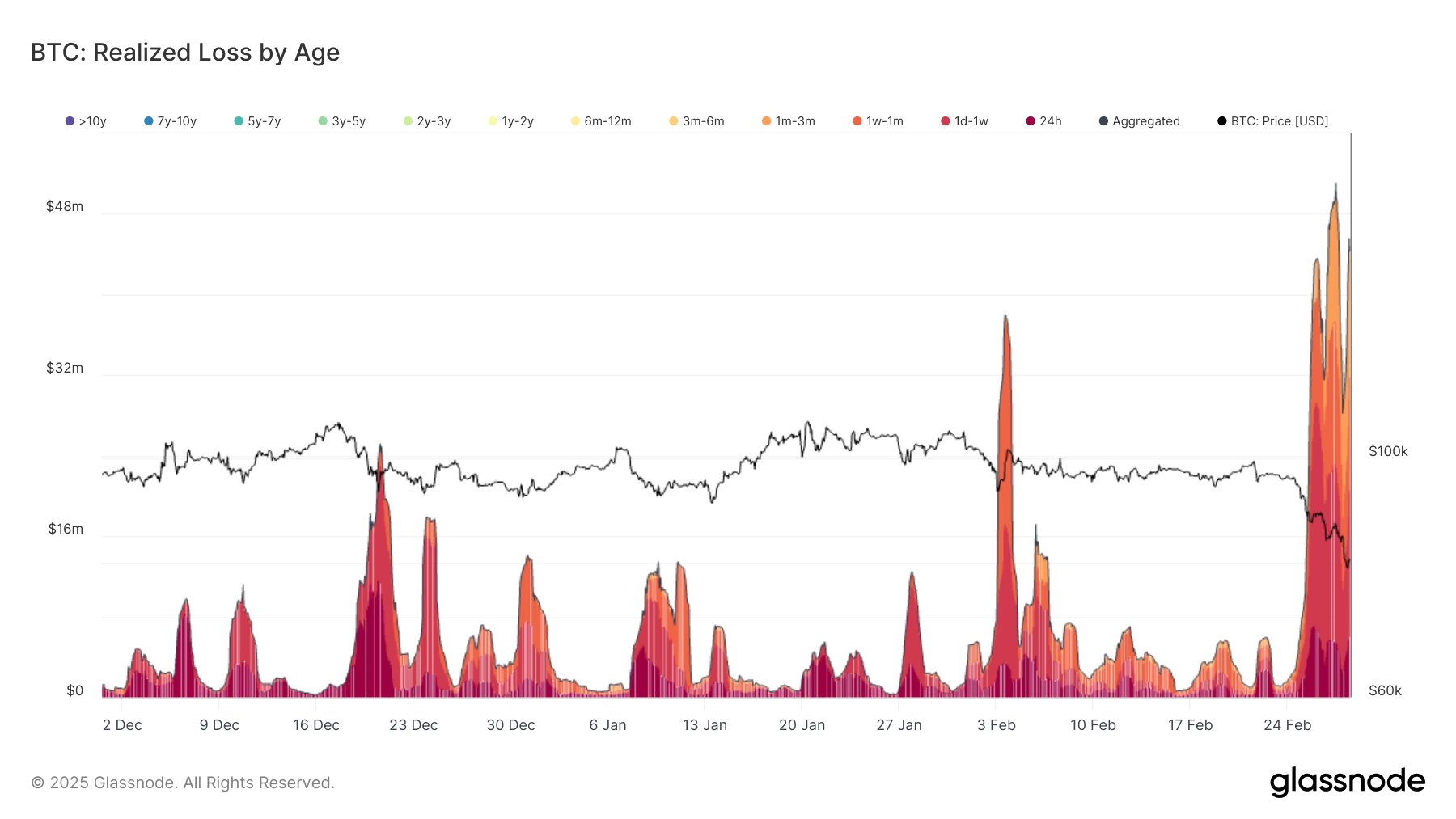

The numbers speak for themselves: it is the recent holders who are taking the hardest hit. Glassnode analyzed the carnage and identified the most impacted groups:

- 1 day to 1 week: 238.8 million dollars in losses;

- 1 week to 1 month: 187.6 million;

- 1 month to 3 months**: 132.4 million;

- Buyers in the last 24h**: 104.9 million;

- 3 to 6 months: an explosion of losses at 12.7 million (+95.4% in one day).

The pace is frightening: the average realized losses reach 57.1 million dollars per hour, with a peak at 19.9 million per hour for the most recent holders. For them, the “HODL” rule seems already forgotten…

A massive capitulation that is reminiscent of the dark hours of the market, like the collapse of FTX.

“You just survived the worst day since FTX, it’s a signal of a bottom!” tries to reassure Crypto Rover.

But is this really the end of the descent into hell?

A BTC price in decline, but the old HODLers hold steady

Despite this tsunami, a group of investors remains unfazed: long-term holders. Data shows that those who have owned BTC for 6 to 12 months remain unperturbed. They are not selling, or very little. A profitable long-term strategy?

For their part, short-term traders continue to rack up liquidations. In just three days (from February 25 to 27), over 2.16 billion dollars in realized losses were recorded. February 26 was even the worst day in months, with 1.13 billion dollars in losses in a single day.

Who dares to say that the crypto market is a long, calm river?

The price of Bitcoin had fallen to 80,000 dollars before bouncing back timidly to 85,200 dollars. But the trend remains uncertain. Technical rebound or just a calm before a new storm? And most importantly, how long will HODLers who have held for 6 to 12 months keep their cool?

However, according to the shocking predictions of River, the bullish potential of Bitcoin remains colossal. If their shocking predictions come true, a BTC will be worth several million dollars in the future, possibly becoming an international reserve currency. Crazy dream or inevitable future?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.