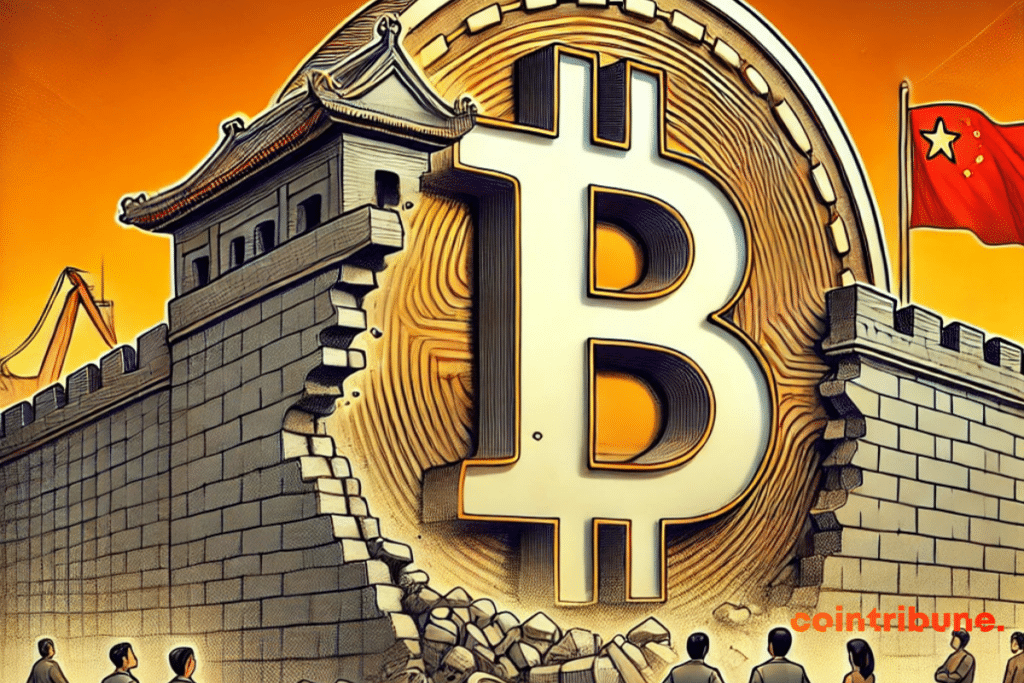

Explosion Of Chinese Debt: Arthur Hayes Reveals Why Bitcoin Could Benefit From It.

As China considers increasing its national debt by more than 1.4 trillion dollars, investors and economists around the world are turning to Bitcoin as a potential refuge against currency collapse. This interest, rekindled by the predictions of Arthur Hayes, co-founder of BitMEX, is reminiscent of the events of 2015, when Bitcoin surged after the brutal devaluation of the yuan. This time, Bitcoin could play an even more strategic role for savvy investors.

Chinese debt: a ticking time bomb

China is facing an unprecedented debt crisis, with plans to inject more than 10 trillion yuan into the economy to help local governments stabilize.

This decision, while ambitious, raises serious concerns in the financial markets. Such an injection increases the risks of inflation and currency devaluation, thereby heightening the yuan’s vulnerability.

For investors in China and elsewhere, this uncertain economic context makes traditional assets less attractive. It is in this framework that Bitcoin appears as a serious alternative. The decentralized nature of bitcoin and its limited supply make it a shield against currency erosion and an attractive option for investors looking to escape currency fluctuations.

Indeed, previous financial crises have already proven that Bitcoin is resilient in the face of economic shocks and expansive monetary policies.

Bitcoin: a unique buying opportunity

Arthur Hayes, a visionary in the crypto space, sees in the current situation a “remarkable buying opportunity.”

According to him, when the affluent middle class in China realizes the urgency of investing in Bitcoin to protect their wealth, massive demand could result, reminiscent of the price surge in 2015.

This dynamic could quickly propel Bitcoin to new heights, especially as pressure is increased by external factors such as the U.S. elections.

The appeal of Bitcoin is bolstered by its status as a hedge against devaluation. For many investors, the global uncertainty surrounding traditional currencies justifies a strategic investment in digital assets.

Moreover, the growing interest from Asian buyers, recently observed, further fuels Bitcoin’s bullish momentum. This situation could thus make Bitcoin not only a tool for speculation but also a true refuge against global economic uncertainties.

Bitcoin, in this context of debt crisis in China, proves to be much more than just a digital asset. It positions itself as a potential shield, a bold and strategic solution for those looking to protect themselves from upcoming economic turbulence. Meanwhile, Musk and Nvidia are stepping up their game.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.