Ethereum Supply is Deflationary, Here Are the Two Main Reasons

A major transformation is shaking up Ethereum: validators are leaving the ship, slowing the issuance of new tokens. Coupled with a rise in network activity, this is making the global supply of the cryptocurrency ETH deflationary. Let’s decrypt it!

“Exodus” of Validators on Ethereum

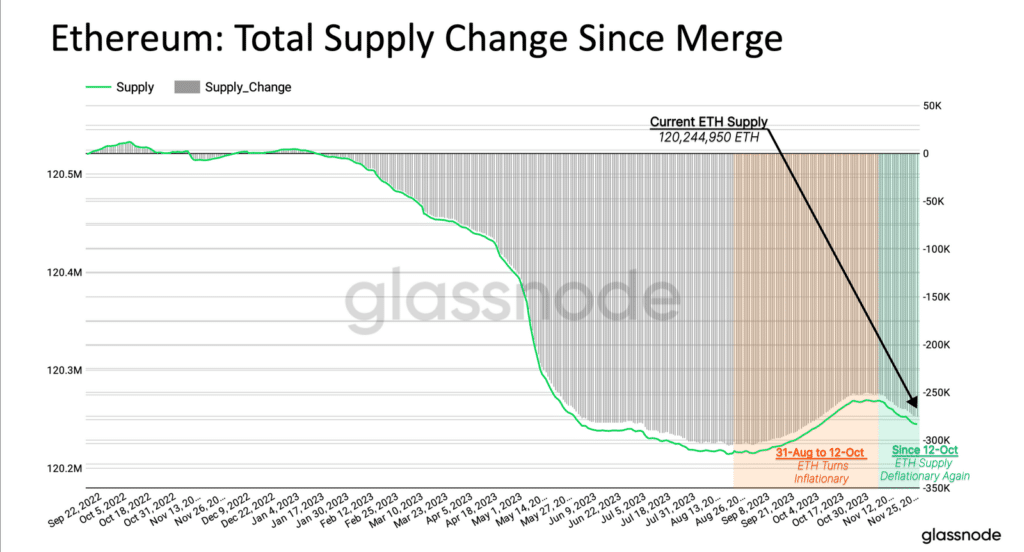

While the price of Ethereum cryptocurrency is stalled around $2000, a significant change is taking place on the network. Indeed, the supply of ETH is undergoing a major shift, becoming deflationary once again.

This deflation results from two key factors. First, there is the slowdown in the number of validators in the staking pools. Then, there is the increase in daily Ethereum cryptocurrency fees burned via EIP1559, fueled by an intensification of network activity

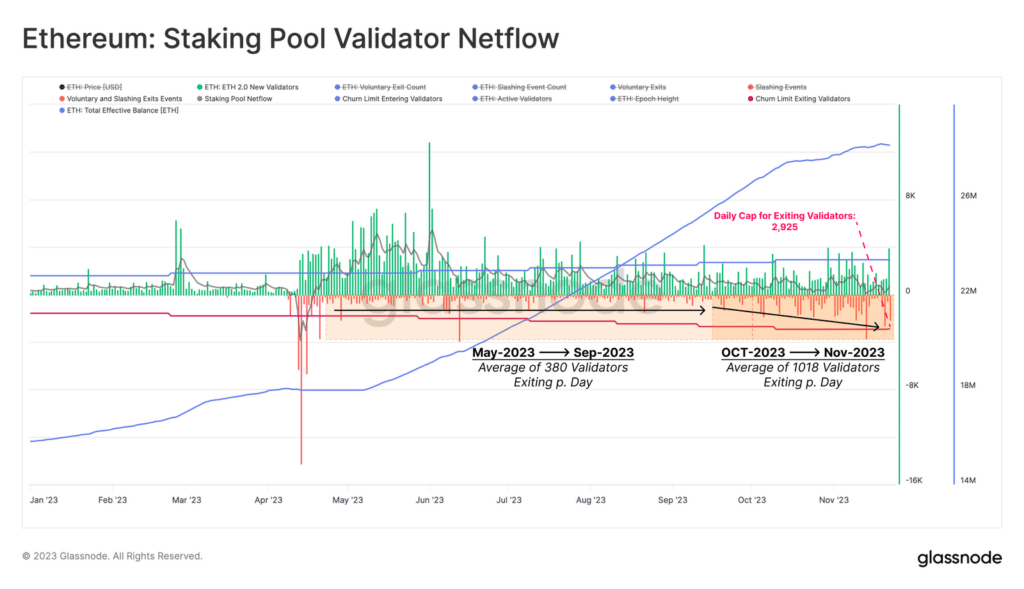

The growing number of validators leaving the pool since October indeed slows down the growth of the network. This leads to a decrease in the issuance of new ETH crypto tokens. According to Glassnode’s analysis, the number of participant exits has seen a notable increase. This has gone from an average of 309 per day in October to an impressive average of 1018 validators per day since early November. This trend aligns with the recent rise in crypto prices.

The massive exits of participants, mostly voluntary, are particularly concentrated among the CEXs such as Kraken and Coinbase. A modest increase in exits at the liquid staking provider, Lido, is also highlighted.

Increased Activity and Pressure on ETH

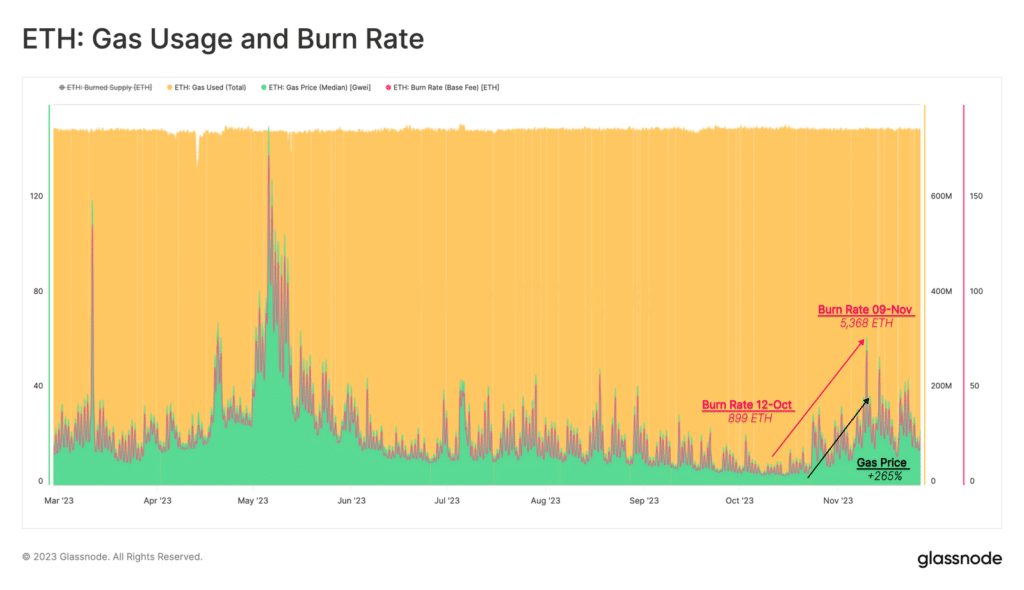

According to Glassnode’s analysis, the network is also experiencing a significant increase in transaction demand, particularly for token transfers and stablecoins. This increased pressure on the network leads to a rise in gas fees, generating a notable growth in Ethereum fees burned via EIP 1559.

In October, the daily amount of Ethereum burned reached 899 ETH, a figure that has climbed to 5,368 ETH in less than a month. These figures reflect a spike in activity, pushing Ethereum to new heights of demand and transactions.

This double pressure translates into a critical situation: ETH is once again becoming a deflationary resource. The reduction in the number of validators leads to a slowdown in the issuance of ETH. While the explosion in network activity exerts upward pressure on gas fees.

The combined effect of these two factors shows that Ethereum is responding to market changes. This creates a situation where the supply of ETH is once again shrinking, moving towards deflation.

How will this new dynamic influence the choices of investors in the weeks to come?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Je suis passionnée par les cryptomonnaies, un monde que j'ai découvert il y a peine 3 ans. Mon seul but est de vous informer de cet univers incroyable à travers mes articles.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.