Ethereum In Free Fall: Dominance Drops To 13.1% Despite Technical Advancements

There was a time when Ethereum shone in the firmament of the crypto sphere. But since the American election, many investors have seen it as a disappointment. Admittedly, the asset has finally crossed the $4,000 mark, but its dominance is eroding in the face of increasingly dynamic altcoins. Between the competition from Solana and divisive updates, Ethereum must now reinvent itself to remain relevant in a bustling ecosystem.

Ethereum: updates that struggle to convince

With the Dencun update, Ethereum hoped to strike big. By drastically reducing fees on Layer 2 (L2) solutions through the introduction of “blobs“, this advancement has particularly revealed a shadow on the horizon: a drop in revenues for Layer 1 (L1). The result? The infamous burn mechanism, the spearhead of the “ultrasound money” argument, takes a hit.

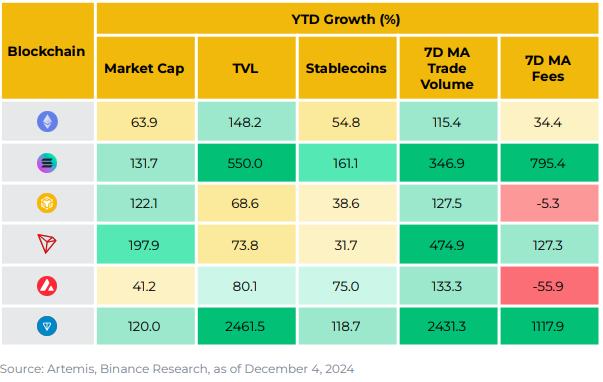

At the same time, Ethereum’s market dominance has reached a historic low of 13.1%, a level not seen since 2021. Meanwhile, Solana is exploding with an impressive growth of 131.7% in 2024, just like more modest projects such as Sui and The Open Network (TON).

The decentralization of fees towards solutions like Celestia and the rise of app-chains, like Uniswap migrating to Unichain, further destabilize the Ethereum ecosystem.

Some numbers to ponder:

- 4 million ETH now “bridged” to L2 solutions;

- 28.2% dominance for altcoins, sharply rising;

- $512.8 million spent in fees by DeFi platforms in 2024.

A quote from the Binance report summarizes the dilemma well:

“ Ethereum navigates multiple competitive arenas at once, between L2, L1, and alt-L1, while needing to preserve value accumulation for ETH.“

ETH Price: Can it still surprise?

In terms of price, ETH seems to be unlucky. The post-election dynamic hasn’t been enough to reignite the massive interest anticipated with the arrival of Spot ETH ETFs in July 2024. Despite $1.7 billion in net flows, trading volume remains timid. Faced with increasingly high-performing alt-L1s, traders hesitate to bet big on Ethereum.

The Pectra upgrade, scheduled for 2025, could, however, reshuffle the cards. By focusing on improving the scalability of L2s and user experience, Ethereum aims to regain ground.

But the crucial question remains: should the focus be on L2s or on preserving the value of L1? A clear answer is required if Ethereum wants to avoid the collapse of its economic model.

Meanwhile, analysts note a positive annualized inflation for the first time in 2024. A development that further tarnishes Ethereum’s image as a deflationary currency. The loss of flagship projects to other ecosystems, such as dYdX, doesn’t help matters.

Thus, Ethereum faces an uncertain future, caught between technological innovations and economic slowdown. This context leads crypto analysts to seriously doubt the likelihood of ETH reaching $5,000 this year.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.