Does the Money Supply Influence Bitcoin?

We largely know, with significant consistency, the close relationship between the S&P 500 and the level of the money supply. We also know the fairly high long-term correlation between the S&P 500 price and that of bitcoin. Therefore, it is likely to assume the existence of a close link between the money supply on the one hand, and the price of bitcoin on the other. In this paper, we will focus on describing the nature of the relationship between bitcoin (BTC) and the money supply for the United States.

The link between the S&P 500 and the money supply

Major stock indices like the S&P 500 are largely determined by macroeconomic variables. Indeed, the S&P 500 alone represents nearly 80% of the US stock market capitalization. This mass effect allows, independently of individual values, to judge global economic dynamics. Thus, many economists have long observed a close relationship between the amount of money (M2) and the S&P 500 for the United States.

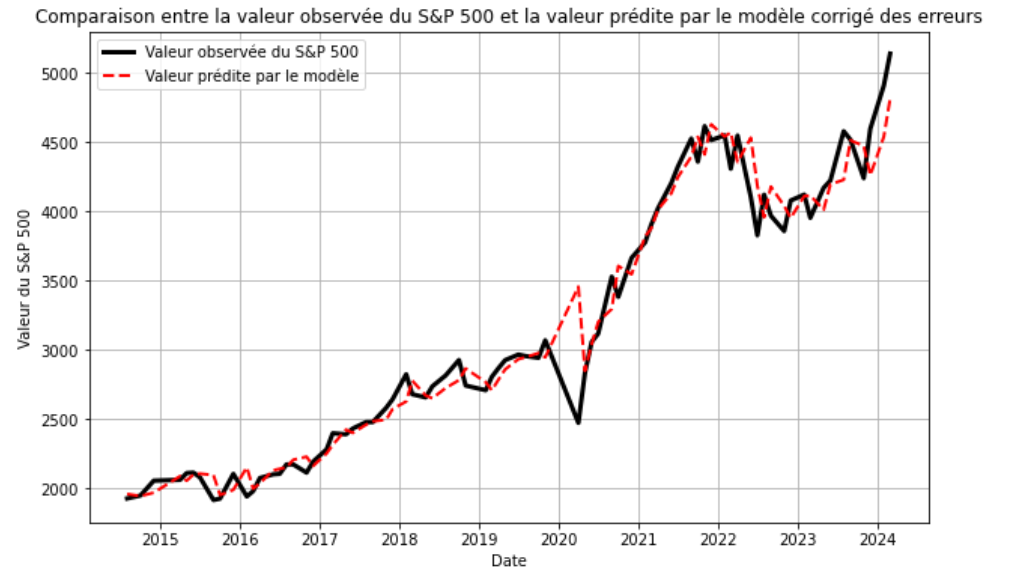

Indeed, an econometric study between 2014 and 2024 shows the existence of a correlation and determination of over 90%, even 95%. The link between the money supply and the S&P 500 is not only considerable, but it is also particularly determining. The graph below shows the S&P 500 price (black curve) and the level of the model based on the money supply and cyclical phenomena. The correspondence between the two curves is extremely strong. This strongly suggests that the S&P 500 is largely determined by the money supply, as well as the bullish or bearish excesses surrounding monetary expectations.

How to explain this phenomenon?

The relationship between the money supply and the S&P 500 can be explained in the short term and the long term. In the short term, a decline in rates can encourage an increase in the growth of the money supply. This first shock leads to an increase in liquidity in the money market, which mechanically favors stocks. In the long term, this relationship can only be valid if the increase in the money supply translates into an increase in companies’ results and/or economic growth.

Therefore, we can assume that the increase in the money supply leads to an increase in agents’ wealth (assets and liabilities). There is a wealth effect in the sense of Milton Friedman, meaning that the anticipated increase in agents’ wealth leads to an increase in growth. Ultimately, company results and stock values increase in the long term. The relationship between the money supply and the S&P 500 is viable.

The causes identified by Milton Friedman

The relationship between stock indices and the money supply has been identified for many decades in the world of finance and economics. In the 1980s, Milton Friedman advanced some elements of explanation for this empirical relationship.

“The inverse relationship between stock prices and monetary velocity (or the direct relationship between stock prices and the level of real money balances per unit of income) can be rationalized in three different ways:

Money and the Stock Market (1988) – Milton Friedman

- (1) An increase in stock prices means an increase in nominal wealth and generally, given the wider fluctuations of stock prices compared to income, also in the wealth-to-income ratio. The higher wealth-to-income ratio can be expected to be reflected in a higher money-to-income ratio or in lower velocity.

- (2) An increase in stock prices reflects an increase in the expected return on risky assets relative to safe assets. Such a change in relative valuation does not necessarily need to be accompanied by a reduced risk aversion or an increased preference for risk. The resulting increase in risk could be compensated by increasing the weight of relatively safe assets in an overall portfolio, for example, by reducing the weight of long-term bonds and increasing the weight of short-term fixed-income securities or more cash.

- (3) An increase in stock prices can be interpreted as implying an increase in the dollar volume of financial transactions, thus increasing the amount of money demanded to facilitate transactions.”

Money Supply (M2) and Bitcoin (BTC)

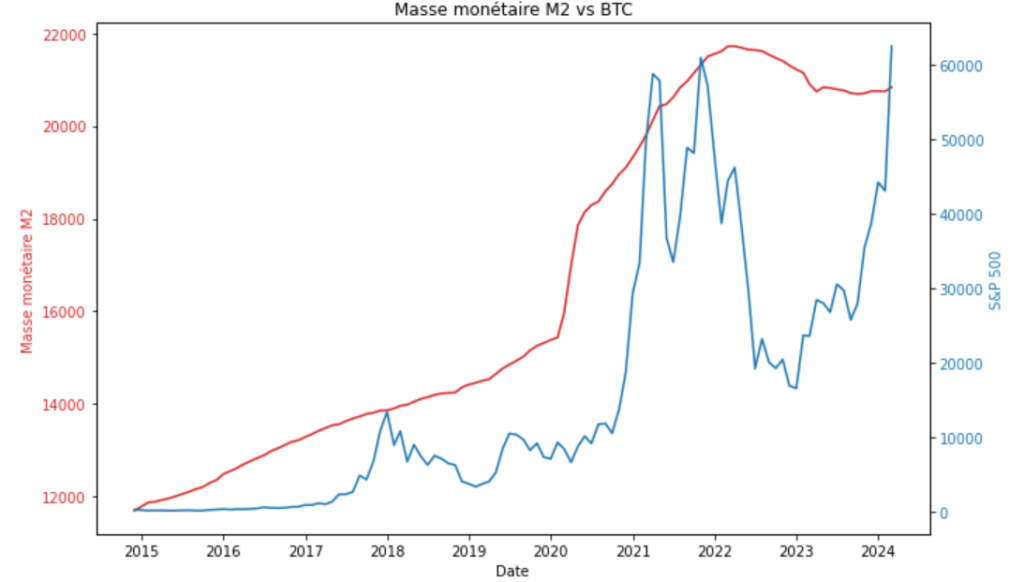

The presence of a significant correlation between the S&P 500 and the bitcoin (BTC) price leads us to consider an influence of the money supply on bitcoin. A simple linear study allows us to identify, between 2015 and 2024, a determination of nearly 72%. That is, more than 70% of the variability in the bitcoin price is explained by the money supply. The graph below shows the level of the money supply and the level of the S&P 500. We can see quite clearly, from the adjustment presented here, that bitcoin’s major highs are more or less framed by the money supply.

However, it may happen that the bitcoin price temporarily exceeds the level suggested by the money supply. This was the case in early 2024, before the correction in March and April 2024. Therefore, exceeding the level suggested by the money supply indicates that markets are optimistic about the future growth rate of the money supply.

Bitcoin and money supply: the model

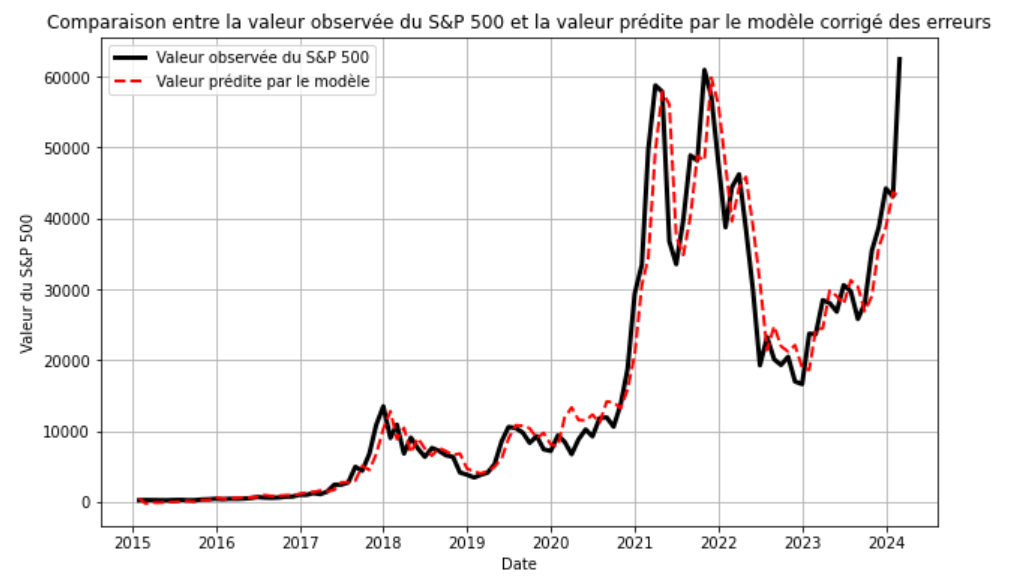

The econometric estimation of the relationship between the money supply and bitcoin allows us to construct a theoretical model. Indeed, such a model allows us to compare the bitcoin price with the level of the money supply. However, the bitcoin price is significantly more volatile than the money supply. As a result, bitcoin experiences cycles of bullish and bearish excesses around the level of the money supply. To improve the model, we thus correct the initial equation for this cyclical phenomenon. Finally, we obtain the following graph.

The graph above thus shows the bitcoin price with the corrected model based on the money supply. The significant symmetry between the two curves suggests that the bitcoin price has two major determinants:

- On the one hand, the level of the money supply which determines the “structural potentialities” of evolution.

- On the other hand, the cyclicity of the bitcoin price which determines the different bullish and bearish phases and their timing of appearance.

We thus note that the coefficient of determination for such a simple model exceeds 92%… The vast majority of bitcoin’s variability is thus covered by these two factors.

Bitcoin Dependence: A Paradox?

In its conception, bitcoin was defined against the dictate of fiat currency. It is therefore seemingly paradoxical to observe such dependence of bitcoin on the money supply. Indeed, we see that a reduction in the money supply would likely result in a decrease in bitcoin’s bullish potential. Therefore, the amount of money capable of being converted into bitcoin thus depends, to a large extent, on the previously issued money.

On the other hand, bitcoin’s dependence on monetary perspectives can be interpreted favorably. Indeed, an increase in the amount of money in circulation leads to a mechanical devaluation of the value of other goods in the economy. Therefore, it seems coherent for bitcoin to benefit from the increase in the money supply. We also note that the amount of money in circulation is strongly correlated with the level of public debt. A rather lax monetary and fiscal policy orientation will thus, in theory, ultimately benefit the stock market and cryptocurrencies.

Conclusion

The money supply appears to be the determining factor for the level of major global stock indices. The influence of the money supply on the stock market has been known for many decades. A major explanation for the dependence between the money supply and the stock market would be a short-term liquidity effect. In the long term, it appears that an increase in the money supply also impacts economic conditions, ensuring the viability of this relationship.

Bitcoin thus shows increased dependence, albeit slightly lower than that of the S&P 500, on the money supply. The money supply thus largely determines bitcoin’s bullish potential. This relationship may evidently question bitcoin’s independence, but a rather lax monetary and fiscal context generally benefits financial assets.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Author of various books, financial and economics editor for many websites, I have been forming a true passion for the analysis and study of markets and the economy.

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.