Does The Exodus Of Ethereum Investors Hide A Bigger Problem?

It’s a total bloodbath in the Ethereum universe. While ETH sinks into the red, its ETFs aren’t faring much better either. In short, investors are abandoning ship, and the flows are evaporating. More than thirteen days of uninterrupted bleeding, hundreds of millions flowing elsewhere, while BTC puffs out its chest. The next chapter? It’s in the strange behavior of these ETFs that it unfolds.

Dry Ethereum ETFs: the downfall of an asset that no longer yields

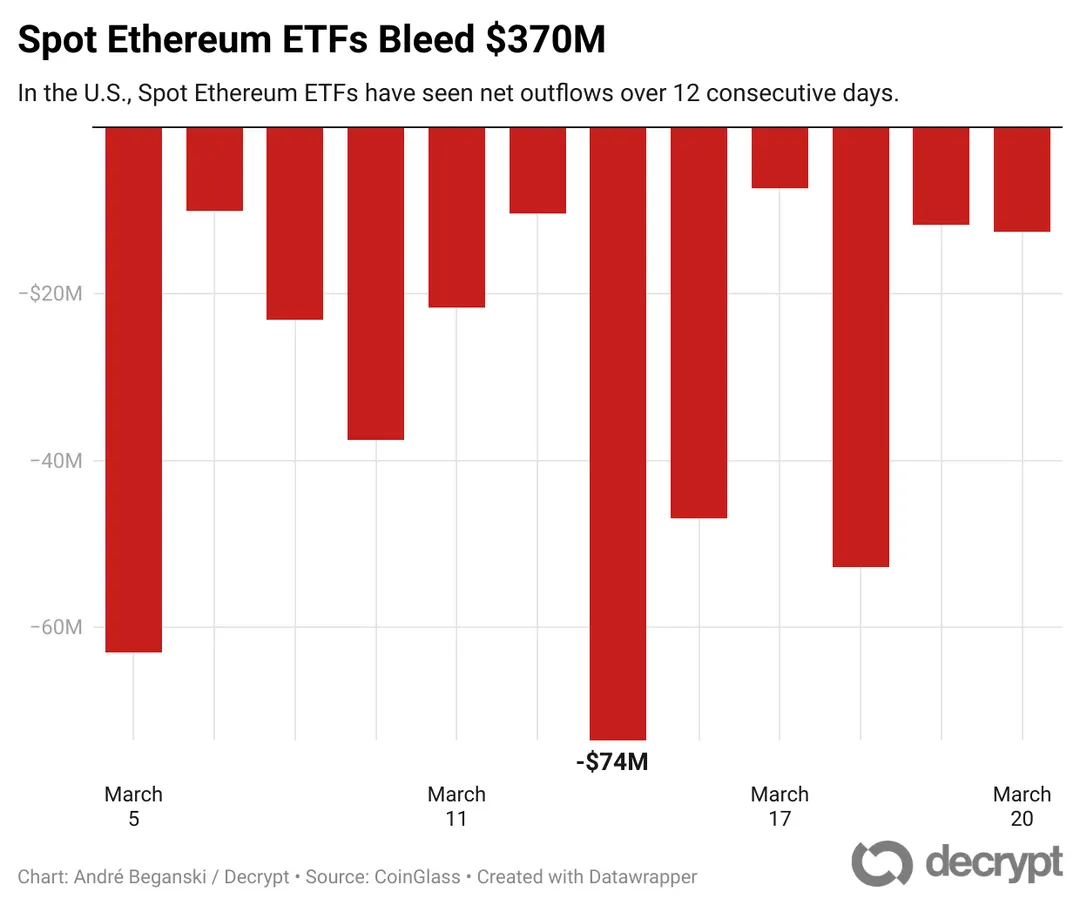

The Ethereum ETFs, benefitting from several inflows of 2.6 billion dollars in December 2024, are currently on a dry spell. For 13 consecutive days, they have not seen a single net influx of capital. We’re talking about a hemorrhage of 370 million dollars going up in smoke. Worse still, it’s the two market giants, iShares and Grayscale, that are bleeding the most: 146 and 106 million in net outflows, respectively.

Meanwhile, staking is rising, staked ETH reaches 33.8 million. Ironic? Not so much. Ethereum ETFs currently do not allow access to the famous staking rewards. Without yield, ETH loses its appeal.

“A staking yield is a significant part of the performance in this sector,” recognized Robert Mitchnick of BlackRock.

As the SEC is considering proposals to allow staking in ETFs, interest is collapsing. Fidelity even recorded zero dollars in inflows for its ETH ETF on March 22. A first that stings.

Key takeaways:

- 370 million $ in outflows over 12 days.

- Grayscale: –106 million $.

- iShares: –146 million $.

- 33.8 million staked ETH.

- 0 $ in inflows for Fidelity on March 22.

But then, are these outflows merely temporary? Or is Ethereum truly becoming the forgotten altcoin of the market?

ETH vs BTC: one stagnates, the other delights

While ETH moans in its corner, BTC is celebrating. The numbers are telling: 274 million dollars flowed into BTC ETFs in a single day, on March 17. And it’s not over: six consecutive days of positive net inflows, 83 million on March 21 according to Kapoor Kshitiz.

Meanwhile, Ethereum continues to sink, with 18.6 million dollars flowing out on the same day, according to @rovercrc. The trend is clear: crypto investors are regaining confidence in Bitcoin, not in Ethereum.

Why? Because Bitcoin reassures. It is perceived as more stable, better understood, easier to regulate. While Ethereum gets bogged down in debates over the efficiency of its blockchain and staking mechanisms, BTC moves forward like a bulldozer.

The BTC ETFs have become the massive capital conquest weapon. Over $35 billion in inflows since their launch. The ETH ones, on the other hand, struggle to gain momentum. Does this mark a turning point? Do investors no longer have faith in the Ethereum project? Or are they waiting for a real signal to return?

The crypto universe of Ethereum is still searching for its second wind

Alongside the brutal numbers, a timid optimism seems to cling to the corners of charts. The technical indicators on Ethereum display a glimmer of hope: a breakout to the upside was observed around $1,955, with a return to $1,985, and bullish signals on the RSI and MACD.

But let’s be clear: this small jump does not compensate for the hemorrhage of confidence. Even with $2.45 billion accumulated since July 2024, ETH ETFs remain in the shadow of the BTC giant.

Investors seem to be hanging on the next jolt of the crypto market. Traders, meanwhile, scrutinize support at $1,960 and resistance at $1,990 as seers would scrutinize coffee grounds.

The near future will depend on the answers to these questions:

-

- Will ETH ETFs finally allow staking?

-

- Is a trend reversal credible without a strong catalyst?

-

- Can Ethereum really take the lead over altcoins?

While the technical signals are encouraging, the underlying situation remains the same: capital is still shunning Ethereum.

2025, the year when the Ethereum ETF could surpass Bitcoin, is it just wishful thinking? Moral of the story: it’s not 7 weeks of continuous net inflows since Christmas that will settle this issue.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.