Devastating offensive by the SEC: What impacts on Bitcoin HODL?

A week ago, the SEC launched its war against two crypto giants and didn’t forget to shake up around fifty assets classified as “unregistered securities” along the way. Many did not expect such a turn of events. The prices of certain cryptocurrencies plummeted. Even the flagship crypto’s price was affected by this attack from the US regulator. However, according to Glassnode, long-term Bitcoin hodlers are unfazed by this storm.

Unwavering Bitcoin hodlers

Like ADA, SOL, and MATIC, Bitcoin also experienced a severe correction after the SEC sued Binance and Coinbase. Some analysts argue for a “collapse” of the flagship crypto as it descended to $25,000. But with whales making their presence felt again, BTC could bounce back in the near future.

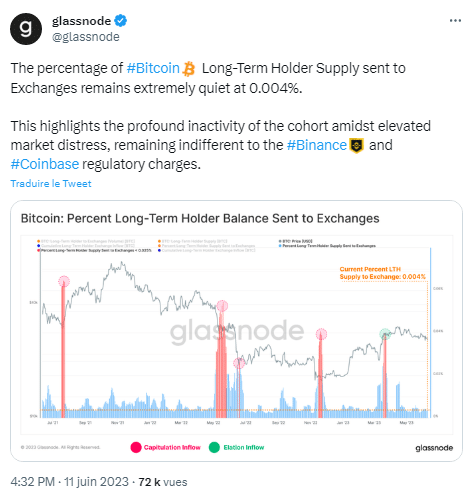

In a recent publication, Bitcoinist reported on an analysis by Glassnode highlighting a certain calmness among long-term Bitcoin holders. This demonstrates the unwavering nature of BTC enthusiasts.

“The percentage of the supply of long-term Bitcoin holders sent to exchanges remains extremely calm at 0.004%.

This highlights the profound inactivity of the population amidst market distress, remaining indifferent to the regulatory charges against Binance and Coinbase.”

In other words, the recent scandals in the crypto sphere have not undermined the faith of BTC hodlers.

At this point, it is worth mentioning that Glassnode attributes the status of long-term Bitcoin hodlers. To those who do not part with their holdings for more than 155 days.

Bitcoin, the next target of the SEC?

It is quite likely that the US financial watchdog wants to go after Bitcoin. The fact that this currency can serve as an alternative for sanctioned countries like Russia and North Korea is concerning to Western nations.

As for the possible classification of Bitcoin as a “financial security” or “security,” Bitcoiners believe that this is almost impossible. The reason: the Howey test considers a security as “an investment of money in a common enterprise with profits solely from the efforts of others.”

In other words, the queen of cryptos, with its unique characteristics, can never satisfy the famous Howey test disapproved by Coinbase. The SEC chairman has already acknowledged his powerlessness in the face of Bitcoin recently.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.